上市以来首次季报亮红灯!Arm 四季度指引逊于预期,盘后一度跌超 8%

Arm 三季度营收同比超预期增长 28% 创历史新高,EPS 盈利翻倍,企业客户增加 AI 投资,助推许可费收入同比激增 106%;但三季度 Arm 芯片发货量同比下滑 6%,版税收入下降 5%。四季度 Arm 指引均较三季度超预期放缓,四季度营收指引中值环比降近 6%、EPS 中值降超 30%。CFO 称,指引逊色源于,一笔授权许可的大单较预期迟一个季度落地。Arm 称,未来许可协议的收入确认可能有变。

人工智能(AI)热潮的推动下,英国芯片设计巨头 Arm 今年第三季度销售超预期强劲,但四季度的指引超预期回落,上市以来首次发布的季度财报就拉响了此后一季度业绩逊色的警报。

Arm 的首席财务官(CFO)Jason Child 表示,四季度指引低于预期、全财年指引却高于预期是因为,目前 Arm 预计,有一笔授权许可的大单较公司最初预期迟一个季度落地。

有分析师评论称,对 Arm 是否属于可持续性增长还存疑,三季度业绩看起来不错,四季度指引又不行,并没有真正了解 Arm 的客户周期是怎样的。

财报公布前,在纳斯达克上市的 Arm 股价周三收跌近 1.6%,财报公布后跌幅迅速扩大,盘后跌幅曾超过 8%。

三季度营收同比超预期增长 28% 创历史新高 EPS 翻倍

美东时间 11 月 8 日周三美股盘后,Arm 公布,在截至自然年 2023 年 9 月 30 日的公司 2024 财年第二财季(下称三季度),营业收入、非 GAAP 口径下调整每股收益(EPS)均高于预期,但本季度、即自然年第四季度的指引均逊于预期。

三季度业绩指标中:

- 营收同比增长 28% 至 8.06 亿美元,公司史上首次单季突破 8 亿美元,高于分析师预期 7.469 亿美元。

- 调整后 EPS 为 0.36 美元,同比增 112%,分析师预期 0.26 美元;

- 调整后营业利润同比增长 92% 至 3.81 亿美元;调整后营业利润率 47.3%,同比上升 15.9 个百分点。

Arm 公布,三季度报告的基于 Arm 的芯片发货量为 71 亿片,同比下滑 6%,芯片累计发货量达到 2.725 亿。

企业客户增加 AI 投资 助推许可费收入同比激增 106%

华尔街见闻曾介绍,Arm 的收入有两大来源,一是授权许可费,二是版税。招股书披露的数据显示,许可费在收入中约占四成,版税收入约占六成。授权收入是指,采用 Arm 架构设计的公司支付给 Arm 的一笔授权费。版税收入则是来自,Arm 对售出芯片的芯片厂商抽成。

本次发布财报时,Arm 表示,三季度营收之所以优于预期,源于公司同业界领先的科技公司签署了多项高价值的长期许可协议,以及市场份额增加和版税收费上涨带动了版权收入增长。

Arm 指出,企业客户迫切需要在所有终端市场增加对 AI 的投资,这有助于公司的授权许可收入同比增长翻倍。

Arm 提到,谷歌、Meta、Nvidia、瑞萨电子、小米等公司都宣布退出基于 Arm 的新型节能 AI 技术支持产品,还有更多公司也在行动,Arm 正在让 AI 无处不在。

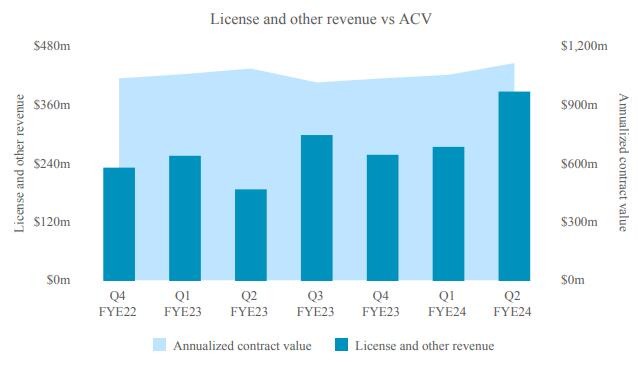

财报显示,三季度 Arm 的版税收入同比下降 5% 至 4.18 亿美元,而许可等业务的收入同比增长 106% 至 3.88 亿美元。版税收入体现了芯片出货下滑的影响。

四季度营收指引中值超预期环比降近 6%、EPS 中值超预期降超 30%

业绩指引方面,Arm 提供的四季度预期均低于三季度水平。

其中,四季度营收指引范围在 7.20 亿至 8.00 亿美元,中值 7.6 亿美元,相当于较三季度环比下降 5.7%,低于分析师预期的 7.73 亿美元。

四季度调整后 EPS 指引方面在 0.21 至 0.28 美元,中值不到 0.25 美元,相当于环比下降近 32%,也低于分析师预期的 0.27 美元。

Arm 还预计,本财年全年的调整后 EPS 为 1.00 至 1.10 美元,全年营收料将为 29.6 亿至 30.8 亿美元,中值均高于分析师预期,分析师预计分别为 1.04 美元和 29.6 亿美元。

上市以来股价回落 四季度指引恐持续打击股价

Arm 是创造今年美股三大 IPO 的新股之一。本周稍早评论称,Arm、Klaviyo、Instacart 这三家公司的财报关系到,在他们的股票上市以来表现疲软之后,投资者能否恢复信心。

今年 9 月 14 日上市首日,Arm 大幅收涨约 24.7%,但此后总体回落。到本周三,Arm 的收盘价已较上市首日收盘 63.59 美元累计跌超 14%。

通常,新上市的公司都会给投行提供可靠的指引,帮助设定公平的估值,并留出业绩发挥的空间制造让人深刻的印象,但考虑到投资者一旦觉得该公司是输家就会考虑抛售,若业绩逊于预期,可能就重创他们的股价。

Rainmaker Securities 的联合创始人 Greg Martin 评论称,新股如果不能保证上市后首次和第二次发布的季度业绩优于预期,就可能碰到麻烦,会在相当长一段时间受到市场的惩罚。

在 Arm 之前公布财报的营销自动化平台 Klaviyo 发布,三季度营收高于预期,但净亏损远超预期,且四季度营收指引中值低于预期,周三 Klaviyo 股价大跌,收跌 15.3%。

未来许可协议的收入确认可能有变

有评论称,Arm 正面对新财会规定的影响,新规影响到该司如何确认来自长期且大规模的许可协议的收入。

一些分析师认为,Arm 确认收入的不可预测性引发了人们对该司高估值的质疑。通过 IPO,Arm 估值超过了 650 亿美元,和公司年收入的差距超过了其他芯片公司。

Arm 在本周三公布三季度业绩的股东信中表示:“未来协议的收入确认情况可能有变化。”