HSBC "Suggests Selling, Target Price 146", Tesla Falls 5% Again

非汽車產品將是增長的主要阻力,將於月內交付的 Cybertruck 或令人失望。

特斯拉的增長故事還能説下去嗎?

當地時間 11 月 9 日週四,滙豐銀行分析師 Michael Tyndall 下調特斯拉評級為 “賣出”,設定目標價 146 美元,為當前股價下跌 33%。

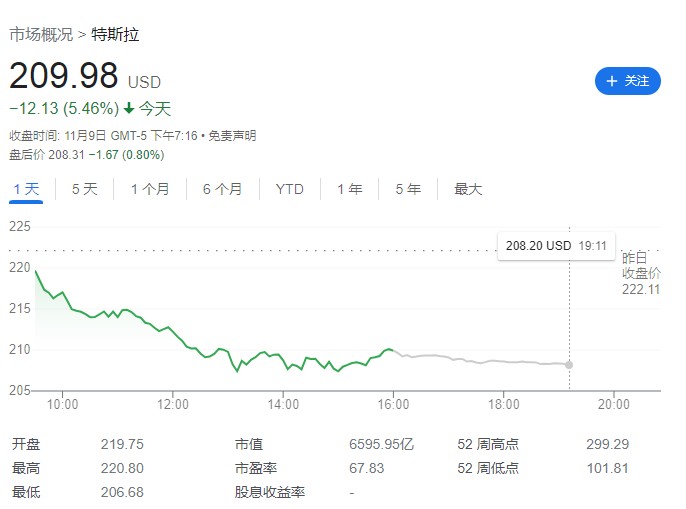

特斯拉股價應聲回落,當天收盤跌近 5.5%。過去一個月以來,特斯拉股價累計下跌 18.9%。

Tyndall 在報告中解釋下調評級的原因為:“我們認為交付時間表可能比市場和估值反映的時間更長,因此降低該評級。”

非汽車產品將是增長的主要阻力

具體而言,Tyndall 認為有三點原因讓他看跌特斯拉。

首先是交付時間。特斯拉此前公佈的 “到 2030 年交付 2000 萬輛汽車” 的目標很雄心壯志,但是鑑於該公司此前兑現承諾的表現,Tyndall 對該目標能否如期實現表示懷疑,2000 萬的數字看起來 “過於樂觀”。Tyndall 在報告中説:

“我們的謹慎源於其各種想法的時間和商業化的不確定性。”

其次是非汽車產品的前景。Tyndall 認為包括 Dojo 計算機、全自動駕駛(FSD)在內的非汽車產品是特斯拉增長故事的主要阻力,因為 “考慮到企業面臨的監管和技術挑戰,它們的預期資本成本遠高於集團平均水平”。

最後,Tyndall 稱,首席執行官埃隆·馬斯克是一個 “風險”。Tyndall 認為馬斯克在全球範圍內的個人聲譽遠超過集團本身,撇開其個人言論和其他追求不談,馬斯克的全球知名度在一定程度上大大節約了營銷和廣告成本,但其個人的突出地位也給特斯拉帶來了 “相當大的 ‘單身’ 風險”。

不過,Tyndall 在報告中承認特斯拉目前在電動汽車市場的領先地位,並且認為其溢價具有合理性,他説:

特斯拉汽車面臨的挑戰比現有汽車公司少,因此值得溢價:我們將傳統汽車製造商視為前增長企業;他們向(很大程度上)飽和的市場銷售產品,並且他們設定更高價格的能力歷來受到限制。

Tyndall 寫到,上行風險包括全球電動汽車轉型速度快於預期、特斯拉市場份額持續增長,以及 FSD 等產品有利的監管環境。

又一個看跌特斯拉的聲音

由於需求下滑,近日來,看跌情緒逐漸蔓延全球電動汽車市場,特斯拉作為龍頭企業首當其衝。

讓特斯拉股價雪上加霜的還有媒體對 Cybertruck 的悲觀報道。

當地時間 11 月 6 日,有媒體近距離參觀特斯拉公開的 Cybertruck 原型機,稱這輛車 “看起來十分可怕”。

據悉,該原型車在表面塗層、構建質量、面板間隙、後方能見度等方面都具有一定程度的缺陷,該報道記者直言:

“我不禁感到一種類似於二手貨的尷尬。”

“我接觸過數百輛原型車,從早期的測試騾子到接近生產的原型車,我從未見過一家汽車製造商自豪地展示質量如此差的東西。”

此前,特斯拉曾承諾 Cybertruck 將於 11 月 30 日內完成交付,但根據目前的聲音,高達 100 多萬個訂單的反饋可能會不盡人意。

就連馬斯克本人,也在特斯拉三季度財報電話會上對 Cybertruck 的增長也持悲觀態度,儘管馬斯克稱 Cybertruck 為特斯拉有史以來最好的產品,但“讓 Cybertruck 的現金流專為正值將會面臨巨大的挑戰”。