Morgan Stanley reduces holdings in Microsoft and NVIDIA, while increasing holdings in Meta and Eli Lilly in Q3.

根據美國證券交易委員會披露,摩根士丹利遞交了截至 2023 年 9 月 30 日的第三季度持倉報告。

智通財經 APP 獲悉,根據美國證券交易委員會 (SEC) 披露,摩根士丹利 (MS.US) 遞交了截至 2023 年 9 月 30 日的第三季度持倉報告 (13F)。

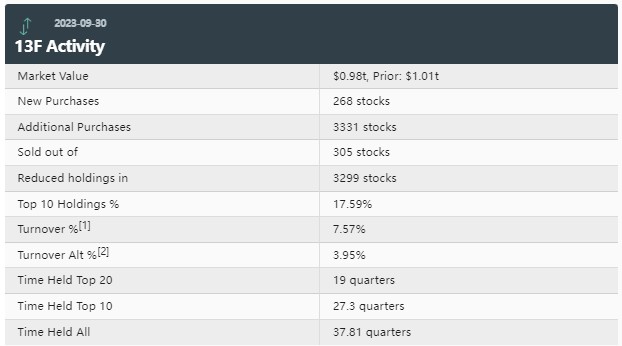

據統計,大摩三季度持倉總市值達 9800 億美元,上一季度總市值為 1.01 萬億美元,環比減少 3.0%。大摩在三季度的持倉組合中新增了 268 只個股,增持了 3331 只個股;清倉了 305 只個股,減持了 3299 只個股。其中前十大持倉標的佔總市值的 17.59%。

在前五大重倉股中,微軟 (MSFT.US) 位列第一,持倉約 1.23 億股,持倉市值約 388.8 億美元,佔投資組合比例為 3.95%,持倉數量較上季度下降 0.30%。

蘋果 (AAPL.US) 位列第二,持倉約 2.07 億股,持倉市值約 353.9 億美元,佔投資組合比例為 3.60%,持倉數量較上季度增加 0.99%。

亞馬遜 (AMZN.US) 位列第三,持倉約 1.50 億股,持倉市值約 190.1 億美元,佔投資組合比例為 1.93%,持倉數量較上季度下降 0.04%。

谷歌-A(GOOGL.US) 位列第四,持倉約 1.11 億股,持倉市值約 145.6 億美元,佔投資組合比例為 1.48%,持倉數量較上季度減少 1.67%。

英偉達 (NVDA.US) 位列第五,持倉約 3270.5 萬股,持倉市值約 142.3 億美元,佔投資組合比例為 1.45%,持倉數量較上季度減少 1.67%。

前十大重倉股中,大摩的第六到第十大重倉股分別為 Visa(V.US)、Meta(META.US)、SPDR 標普 500 指數 ETF(SPY.US)、谷歌-C(GOOG.US) 以及摩根大通 (JPM.US)。

從持倉比例變化來看,前五大買入標的分別是:標普 500 指數 ETF-iShares(IVV.US)、Meta、禮來 (LLY.US)、愛彼迎 (ABNB.US)、羅素 1000 成長指數 ETF-iShares(IWF.US)。

前五大賣出標的分別是:SPDR 標普 500 指數 ETF、微軟、雷神技術 (RTX.US)、Illumina(ILMN.US)、Shopify(SHOP.US)。