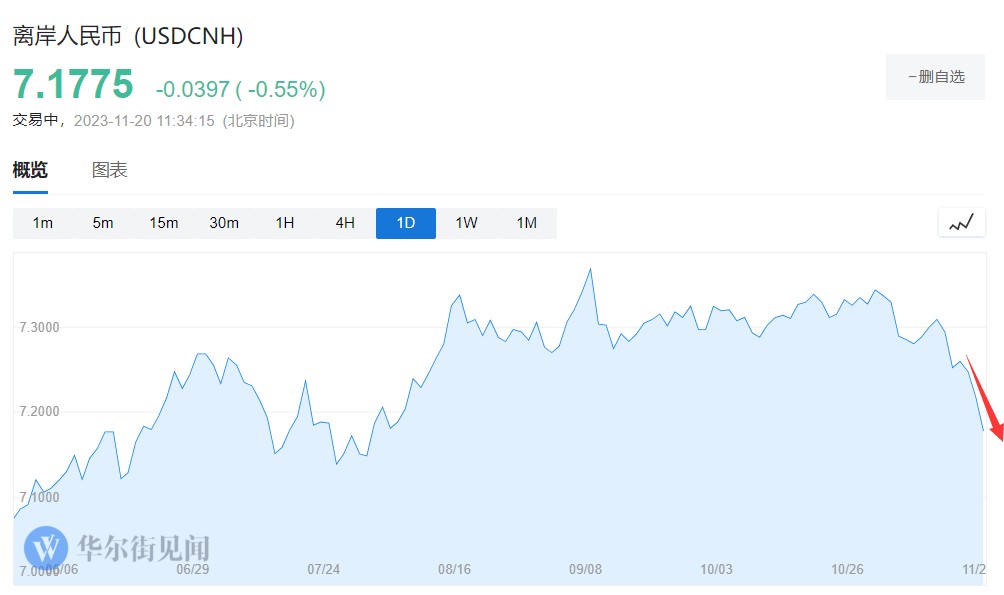

Jumped 200 points! Offshore RMB breaks through the 7.2 level

分析認為,中間價終於脱離 9 月以來在 7.17 附近的平台區域,明顯是希望利用美國數據不達預期後美元走弱的時間窗口,在年底前推動人民幣升至 7 元一線。

11 月 20 日週一,人民幣突然掀起狂歡。

離岸人民幣兑美元持續走高,現已升破 7.18 關口,刷新 8 月份來高點,日內漲近 400 點。在岸人民幣也在不斷走高。

稍早前,中國外匯交易中心數據顯示,人民幣兑美元中間價上調 116 點至 7.1612,創 8 月以來最高紀錄。

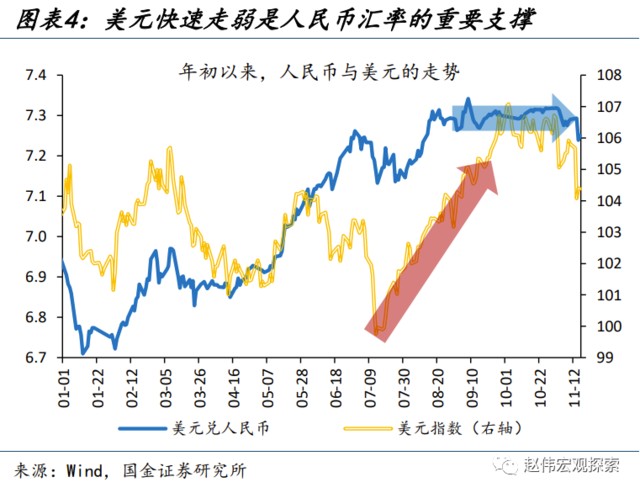

國金證券認為,美元的快速走弱是人民幣匯率升值的直接推手。美元指數自 10 月下旬以來大幅回落,正在逼近 100 大關。

而美元回落,是美債供給側衝擊邊際緩和、經濟數據走弱、投機擾動緩和三方面因素共同作用的結果。國金證券在報告中寫道:

第一,美債供給側衝擊邊際緩和;四季度再融資會議上,財政部預計淨髮債規模降至 7760 億美元、較 7 月預期值下降 760 億美元。

第二,經濟數據走弱、美聯儲態度偏鴿;11 月陸續公佈的 PMI、非農、CPI 等數據均低於市場預期,市場對明年降息的預期逐步升温。

第三,投機擾動也有緩和,美債非商業空頭持倉明顯回落。

國君證券認為,人民幣升值的背後,除了有美聯儲加息週期結束預期的外部因素支撐,還有有中間價的功勞,中間價作為匯市 “穩定器”,在做空離岸人民幣成本下降的背景下,對人民幣形成強勁支撐。

國君宏觀周浩、孫英超在上週公佈的研報中指出,

離岸人民幣的融資成本開始明顯走低,這意味着做空人民幣的成本也同步下滑,但離岸人民幣並沒有出現部分投資者擔憂的貶值,反而藉着近期的美元走弱出現了一波強力的升值。

中間價扮演了 “穩定器” 的作用,由於人民幣兑美元的中間價一直相對穩定,空頭仍然對政策意圖較為忌憚,沒有輕易在這一區域下注,而是希望等待更加清晰的信號。

也有分析認為,中間價調升或顯示出監管層對近期弱勢美元下人民幣即期出現的反彈予以確認。截止上週五時,境內外人民幣本月累計漲幅分別達約 1.4% 和 1.7%。10 月份時在岸人民幣持續運行在日內波動區間 2% 的貶值下限附近,週一在岸較中間價最大偏弱幅度縮窄至僅約 0.65%。

“央行可能樂見境內外即期與中間價在今年底之前、尤其是美元下一波反彈之前實現三價合一,” 外匯與利率策略師趙志軒在媒體採訪中説,中間價終於脱離 9 月以來在 7.17 附近的平台區域,明顯是希望利用美國數據不達預期後美元走弱的時間窗口,在年底前推動人民幣升至 7 元一線。