NVIDIA faces headwinds in AI, Q3 performance continues to crush expectations, but warns of Q4 sales in China, stock drops more than 6% after hours.

三季度英偉達總營收同比增兩倍、EPS 盈利增近六倍,分別較分析師預期高近 13% 和 20%;AI 芯片所在業務數據中心收入同比增近兩倍,再創單季新高;主要業務中僅汽車收入低於預期。英偉達稱,關注以色列相關地緣政治局勢對運營影響;四季度營收指引同比增 230% 至 200 億美元,較預期均值高近 12%,但較最高端預期低近 5%。CFO 稱,最近幾個季度,中國等受出口限制影響地區貢獻 20% 到 25% 的數據中心收入;四季度在中國銷售料將 “大幅下滑”,下滑足以被其他地區銷售增長抵消;在與客户共同研究不觸發限制的解決方案。

人工智能(AI)應用的熱潮繼續推動英偉達創造業績碾壓市場預期的季度佳績,但面對四季度生效的美國新出口限制,這家 AI 芯片巨頭迎來 “逆風”,拉響了在華銷售大幅下滑的警報。

有分析師指出,在華銷售近期內不會成為擔憂,但可能是投資者未來關注的領域。除了出口限制的影響,有評論稱,英偉達的四季度營收指引雖然高於市場預期均值,但低於部分期望較高的華爾街人士預期,他們預計最高 210 億美元。這相當於,英偉達的指引較高端預期低 4.8%

財報公佈後,收跌 0.9% 的英偉達股價盤後巨震,股價盤後先曾漲超 1%,後迅速跳水,盤後跌幅曾超過 6%,後一度小幅轉漲,目前盤後重回跌勢。

三季度營收超預期同比增兩倍、EPS 盈利增近六倍 關注以色列相關地緣政治局勢對運營影響

美東時間 11 月 21 日週二美股盤後,英偉達公佈,截至自然年 2023 年 10 月 29 日的 2024 財年第三財季(下稱 “三季度”),營業收入和每股收益(EPS)均較華爾街預期更迅猛增長:

- 三季度營收 181.2 億美元,同比增長 206%,分析師預期增長 171% 至 160.9 億美元,較預期高近 13%,也遠超英偉達自身指引範圍 156.8 億到 163.2 億美元,前一季度二季度營收同比增長 101%。

- 三季度非 GAAP 口徑下調整後 EPS 為 4.02 美元,同比增長 593%,分析師預期增長 479% 至 3.36 美元、較預期高近 20%,二季度同比增長 429%。

- 三季度非 GAAP 口徑下調整後毛利率為 75.0%,同比提升 18.9 個百分點,高於分析師預期的 72.5%,也高於英偉達指引區間 72% 到 73%,環比二季度升高 3.8 個百分點。

至此,英偉達連續兩個季度營收同比正增長,且延續了五年來多個季度業績高於預期的佳績。在三季報公佈前,FactSet 數據顯示,此前 20 個季度,英偉達有 19 個季度的業績都優於市場預期。

三季度英偉達非 GAAP 口徑下營業費用同比增長 13%,環比增長 10%,主要反映了員工和薪酬增加。

同時英偉達指出,在密切關注以色列及周邊地緣政治衝突對公司運營的影響,包括約 3400 名在當地員工的和安全和健康,三季度營業費用中包括,支持這些受影響員工及慈善活動的相關費用。

AI 芯片所在業務數據中心收入同比增近兩倍 再創單季新高 主要業務中僅汽車收入低於預期

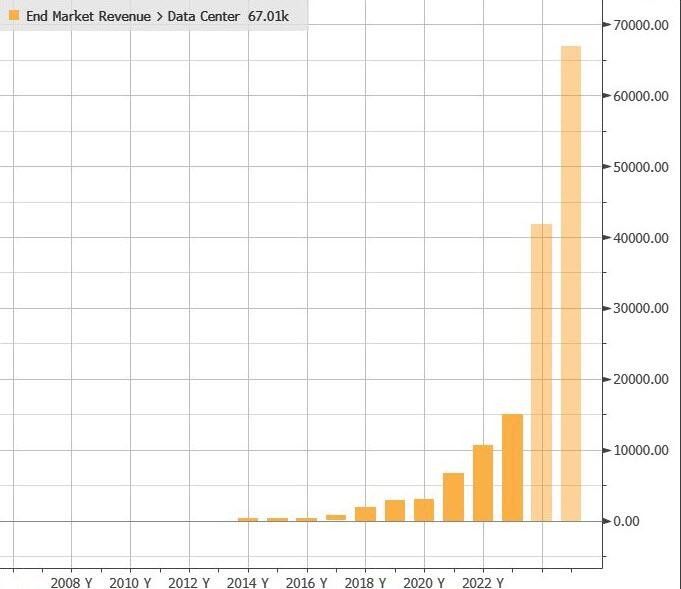

分業務看,AI 需求繼續強力推動英偉達的收入增長。包括 AI 顯卡在內的英偉達核心業務數據中心收入保持翻倍激增的勢頭,今年內一再刷新單季最高收入紀錄,和遊戲業務的收入增速均遠超預期。

三季度數據中心營收 145.14 億美元,同比增長 279%、環比增長 38%,分析師預期 128.2 億美元,二季度同比增長 171%。英偉達稱,三季度增長強勁主要反映了,基於 Hopper 和 Ampere 架構 GPU 的英偉達 HGX 平台需求強勁,主要源於雲服務商和大型消費類互聯網公司。

其他業務中,遊戲業務增速遠超前季,三季度遊戲營收同比增長 81% 至 28.56 億美元,環比增長 15%,分析師預期 27 億美元,二季度同比增長 22%。

英偉達稱,遊戲業務同比猛增源於,在渠道庫存水平正常化後,對合作夥伴的銷量增加,環比增長反映了,在學生返校開學期間和假日季初期對 GeForce RTX 40 系列 GPU 的強勁需求。

三季度專業可視化業務收入 4.16 億美元,同比增長 108%,環比增長 10%,分析師預期 4.092 億美元,二季度同比下降 24%。

英偉達認為,這塊業務同比由降轉增反映了,在渠道庫存水平正常化後,對合作夥伴的銷量增加,環比增長繼續受到企業工作站的需求強勁影響,同時,基於 Ada Lovelace GPU 架構的筆記本工作站產量增長。

汽車業務三季度收入 2.61 億美元,同比增長 4%,環比增長 3%,低於分析師預期的 2.669 億美元,二季度同比增長 15%、環比下降 15%。英偉達稱,同比增長主要反映汽車座艙解決方案和自動駕駛平台銷售的增長,環比增長由由自動駕駛平台的銷售推動。

四季度營收指引超預期增 230% CFO 稱四季度在華銷售料將 “大幅下滑”

業績指引方面,英偉達預計,本季度、即 2024 財年第四財季(“四季度”)營業收入為 200 億美元,正負浮動 2%,相當於指引範圍在 196 億到 204 億美元之間。

以 200 億美元計算,英偉達預期三季度營收將同比增長近 231%,連續三個季度翻倍增長,較分析師預期均值高 11.7%。分析師預計四季度營收均值為 179 億美元,同比增長約 196%。

英偉達還預計,四季度非 GAAP 口徑下的調整後毛利率為 75.5%、上下浮動 50 個基點,即 75% 到 76% 之間,較一年前同比提高 9.4 個百分點;三季度的營業費用料將為 22 億美元,同比增長近 24%。

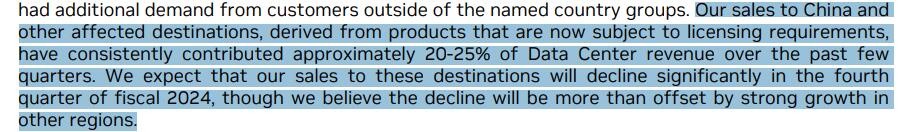

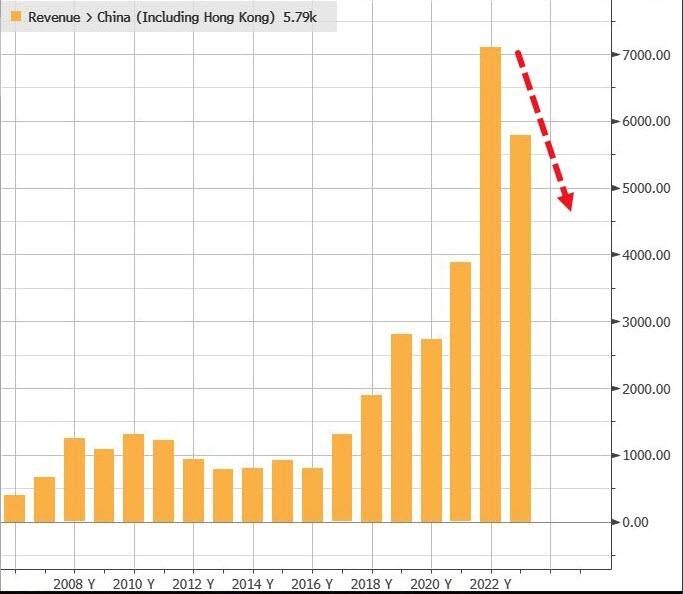

但英偉達首席財務官(CFO)Colette Kress 在發佈財報的同時警告,四季度,在中國和其他受美國政府 10 月新出口限制影響的地區,英偉達的銷售料將大幅下滑。

Kress 表示,英偉達相信,中國等部分地區的銷售下降將足以被四季度其他地區的強勁增長所抵消。不過,對於中國等受出口許可證要求影響的地區,Kress 指出,最近幾個季度,這些地區持續貢獻了 20% 到 25% 的數據中心業務收入。

Kress 還説,英偉達在與中國等受影響地區的客户合作,試圖獲得交付英偉達部分產品的出口許可,以及共同研究不觸發出口限制的 “解決方案”。

黃仁勳:生成式 AI 時代在起飛 英偉達強勁增長反應廣泛的行業平台轉型

在三季度財報中,英偉達 CEO 黃仁勳表示,該公司的強勁增長反映了從通用計算向加速計算和生成式 AI 的廣泛行業平台轉型。他説:

“大語言模型(LLM)初創公司、消費互聯網公司和全球雲服務商是先行者,下一波浪潮正在開始形成。國家和地區的雲解決方案供應商(CSP)正在為滿足當地需求而投資 AI 雲,企業軟件公司正在向其平台添加 AI 駕駛助手和助理,企業正在創建定製 AI,從而實現那些全球最大規模行業的自動化。

英偉達的 GPU、CPU、網絡、AI 代工服務和英偉達 AI Enterprise 軟件都是全速增長的引擎。生成式 AI 時代正在起飛。”