Can the US stock market continue to rise? JPMorgan: Yes, it can.

摩根大通認為,從資金流入的力度判斷,美股的反彈能夠持續,但需要關注美債收益率回升和波動加劇的風險。

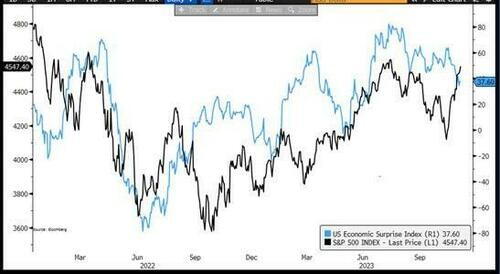

最近幾周,接連出爐的經濟數據表明美國泄通脹進程順利、聯儲加息臨近終點,市場在軟着陸預期之下開啓狂歡模式。早先飆升的美債收益率大幅下行,美股也在小盤股和成長股帶動下強勢反彈。

不過,此前已有多家機構警告稱,美國經濟未來增長動能不足,宏觀前景不確定的情況下,美股的漲勢還能持續嗎?

在上週的路演中,摩根大通市場情報團隊負責人 Andrew Tyler 和 John Schlegel 表示,從資金流入的力度判斷,美股的反彈能夠持續,但需要關注美債收益率回升和波動加劇的風險。

美股還能接着漲嗎?可以!

Tyler 認為,美股反彈能夠持續,近期上漲的催化劑主要與宏觀經濟和 TMT 相關。

從目前的數據來看,宏觀經濟呈現 “無通脹增長” 的 “不着陸” 情景;而 TMT 催化劑可能會重新點燃人工智能主題和夏季反彈。自 5 月 24 日英偉達 FY24Q1 財報發佈到 7 月 31 日,標普 500 指數上漲了 11.5%。納指 100 指數上漲了 15.8%,羅素 2000 指數上漲了 13.4%,木頭姐旗下以科技成長股為主的旗艦基金 ARKK 上漲了 27.9%。

此外,兩位分析師還稱,美國經濟的表現比市場預期的要好:

“如果通縮的趨勢得到控制,我們將看到高於趨勢的增長。第三季度實際國內生產總值(GDP)增長 5% 超出了任何合理的預測,但由於 27 萬億美元的經濟名義上增長了 8%,我認為經濟增長放緩的時間可能比市場預期的要晚。”

此前,摩根大通銀行經濟學家 Michael Feroli 已經上調了他對 23Q4 和 24H1 的 GDP 增長預期,分別從 1.5% 和 2.0% 上調至 2.0% 和 0.5% 和 0.9%)。

名義 GDP 增長率的提高也會促進企業利潤的增長。如果美國保持生產率增長,失業率可能不會飆升,而失業率飆升不會導致通脹。Feroli 還認為 2024 年下半年將降息 100 個基點,他認為核心 PCE 將低於 2.5%,增長放緩將導致美聯儲踩下剎車。

最大風險還是美債

回顧最近幾周的市場表現,分析師指出:

” 儘管出現了反彈,但並不清楚投資者從根本上 “買入” 了多少股票。總體而言,我們看到的大部分買入都來自指數期貨、ETF 和期權實現的。相比之下,在全球範圍內,由於我們繼續看到多頭賣盤(可能是由於獲利了結),高頻基金在股票方面的淨流入一直很低迷。“

從短期來看,市場近期仍然會有些波動。不過,由於本週股票淨流入仍相當中性(過去一個月為負值),因此反彈尚未結束。

在美國市場,過去兩週資金流入最大的是 ETF,其次是能源、銀行和房地產。 TMT 賣出最多,但主要限於傳媒和娛樂行業。

分析師還表示,近期最有可能出現的風險是債券收益率和債券波動的回升:

“儘管 20 年期美債標售的強勁表現可能會緩解部分擔憂,尤其是在美元近期走軟的情況下。但收益率上升和美元走強的驅動因素在近期的反彈中並未消失,因此這種負面催化劑可能會捲土重來。”