The top three officials of the Federal Reserve are suppressing expectations of interest rate cuts, causing a "flash drop" in US bonds. Super central banks have seen a significant increase this week, while the upward momentum of US stocks has slowed down, but still maintained a seven-week streak of gains.

道指跌超百點後轉漲,續創歷史新高,和納指連漲七日。標普微跌止步六連陽,和納指均創 2017 年來最長周漲。芯片股指再創新高,英特爾漲超 2%,博通漲超 2%、全周漲近 20%、創最高紀錄;微軟、亞馬遜反彈,漲超 1%。中概股指結束四連漲,京東漲超 4%,小鵬汽車跌超 7%。美聯儲三把手講話後,美債收益率迅速刷新日高,兩年期收益率一度回升超 10 個基點,但此後回吐多數升幅,十年期收益率上逼 4.0%,後轉降;美元指數拉昇、刷新日高,脱離四個月低位。英債收益率一週降超 30 個基點。離岸人民幣半年來首次盤中漲破 7.10,後一度回落近 400 點,全周仍漲超 500 點。馬士基暫停紅海航運,原油盤中跌近 2% 後抹平多數跌幅,收盤仍跌落一週高位,但終結四年最長的七週連跌。黃金盤中轉跌,告別一週高位, 全周仍反彈。倫鋁四連漲,和倫鋅一週漲超 5%。

美聯儲釋放鴿派大轉向的信號才過去不到兩天,聯儲 “三把手”、紐約聯儲主席威廉姆斯就 “放鷹”:不但表示考慮明年 3 月降息 “為時過早”,而且直接和美聯儲主席鮑威爾唱反調,説 “我們並沒有真正在討論降息”,並暗示市場的反應可能過度,稱市場的反應可能比聯儲自身預測顯示的更強烈。

威廉姆斯認為,需要做好進一步收緊貨幣的準備,必須準備有需要時進一步加息,還認為聯儲需要專注於目標,而非市場觀點。有 “新美聯儲通訊社” 之稱的記者 Nick Timiraos 評論稱,威廉姆斯説,美聯儲的重點是,有沒有采取了足夠的措施加息,這種説法顯然是對鮑威爾週三發佈會上一些降息氛圍的回擊。

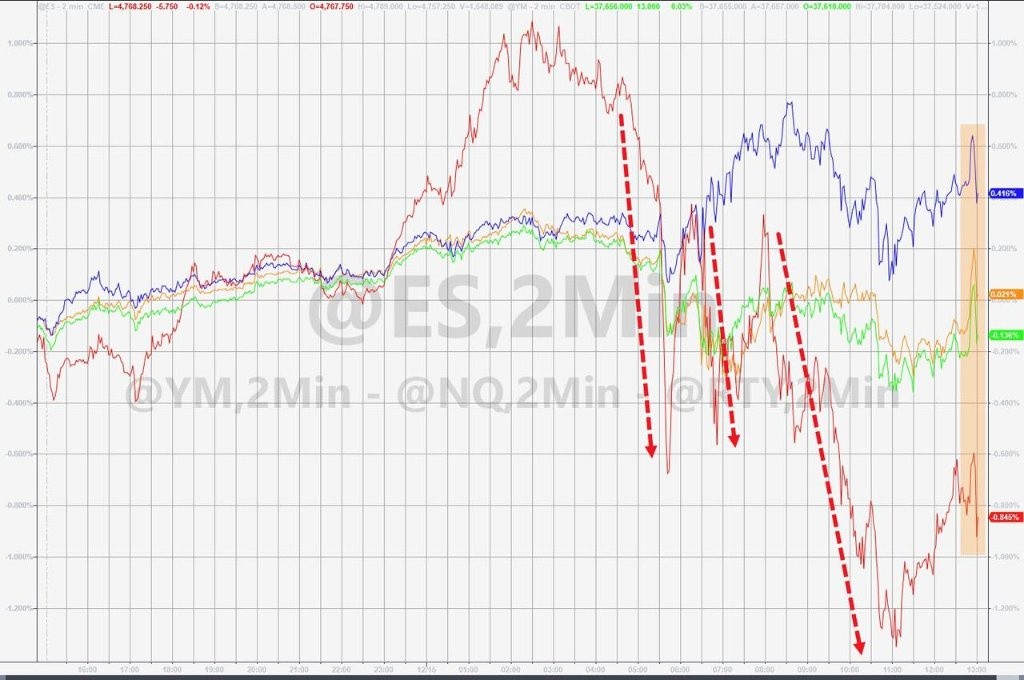

威廉姆斯給明年初美聯儲降息的前景潑冷水。他講話後,美國國債價格盤中 “閃跌”、收益率刷新日高,對利率敏感的兩年期美債收益率一度較日內低位回升超過 10 個基點,基準十年期美債收益率曾上逼 4.0% 關口;美元指數漲幅迅速擴大,刷新日高,繼續脱離週四所創的四個月低位;主要美股指部分回落,標普和道指低開。

而威廉姆斯打壓降息預期的影響並未持續,兩年期美債收益率在美股開盤後回吐多數升幅,十年期收益率重回降勢,又逼近週四擊穿 4.0% 後所創的四個月低位;美元漲幅收窄;道指盤中轉漲,標普一度轉漲,微軟等多隻藍籌科技股反彈,芯片股總體繼續走高,均力挺大盤迴升。

此後,另兩名美聯儲官員博斯蒂克和古爾斯比也給近期降息的預期潑冷水。前者稱明年料將降息兩次,可能從三季度開始,後者稱他預計明年會比現在低,但差距不是很大。他們的講話並未改變長短期美債收益率各異的走勢,道指和納指最終保住漲勢。不過,市場對 3 月降息的預期 “退燒”,預計屆時降息的概率回落到約 66%,

總體而言,美聯儲會議暗示明年多次降息掀起的股債狂歡到週五趨於緩和。但由於前兩日的高漲,全周股債齊漲,主要股指延續一個多月來周連漲勢頭,美債價格大反彈、收益率在上週回升後大幅回落。有評論指出,在美聯儲三把手講話前,市場曾預計明年聯儲降息合計 168 個基點,相當於將近七次 25 個基點的降息。

匯市方面,美聯儲轉鴿預期施壓,美元指數週五即便反彈也未能扭轉全周跌勢。非美貨幣週五盤中轉跌,歐元和英鎊跌離週四歐洲央行和英國央行打擊降息預期後所創的高位,離岸人民幣半年來首度漲破 7.10 後一度回落近 400 點,但因美元前兩日走軟推動,全周這些非美貨幣都累漲。

美元反彈之際,黃金和國際原油都盤中轉跌,丹麥航運巨頭馬士基宣佈暫停旗下所有集裝箱途徑紅海的航運,支持原油抹平盤中多數跌幅。因週四大漲,金價和油價週五回落均無礙全周漲勢。原油終結四年來最長連跌周,有賴於美聯儲會後轉鴿預期高漲,美元走軟,同時,本週國際能源署(IEA)上調明年油需預期、也門胡塞武裝襲擊紅海水域油輪引發中東供油安全擔憂,也有助油價反彈。從這個角度看,美聯儲實現了連 OPEC+ 國家加碼減產都沒能做到的扭轉原油單週跌勢。

納指七連陽 和標普創 2017 年來最長周漲 芯片股指再創新高 中概股指結束四連漲

三大美國股指開盤僅納斯達克綜合指數上漲,全天基本保持漲勢,僅午盤曾短線轉跌。道瓊斯工業平均指數跌離盤中歷史高位,早盤曾跌超 150 點、跌逾 0.4%,午盤轉漲後曾又轉跌,尾盤轉漲鎖定漲勢。標普 500 指數早盤微幅轉漲,午盤轉跌後刷新日低時跌逾 0.3%,尾盤曾轉漲。

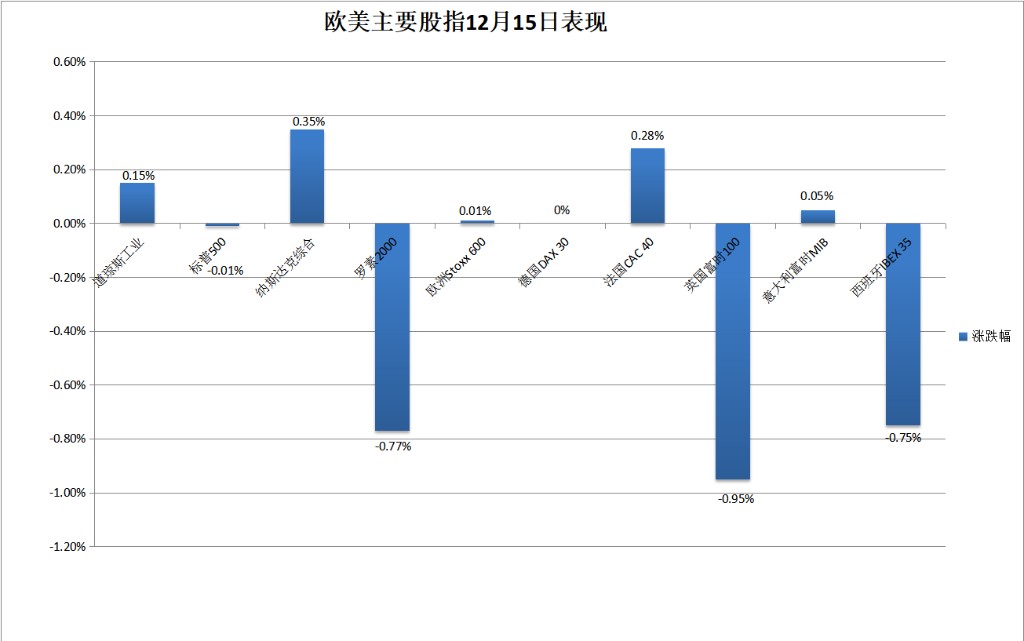

最終,三大指數未能集體收漲。標普收跌 0.01%,報 4719.19 點,仍接近截至週四連續兩日所創的去年 1 月 12 日以來收盤高位。納指和道指連漲七日。納指收漲 0.35%,報 14813.92 點,連續三日刷新去年 1 月 14 日以來高位。道指收漲 0.15%,報 37305.16 點,連續三日創收盤歷史新高。

價值股為主的小盤股指羅素 2000 盤初轉跌,收跌 0.77%,跌落連漲兩日刷新的去年 4 月 20 日以來高位。科技股為重的納斯達克 100 指數收漲 0.52%,收創歷史新高;衡量納斯達克 100 指數中科技業成份股表現的納斯達克科技市值加權指數(NDXTMC)收漲 0.78%,本週累漲 3.44%,均將在週四結束五連漲後反彈。

本週主要美股指繼續集體累漲。標普累漲 2.49%,道指漲 2.92%,納指漲 2.85%,納斯達克 100 漲 3.35%,都連漲七週,其中道指將繼續創 2019 年來最長連漲,其他股指將創 2017 年來最長單週連漲,羅素 2000 累漲 5.55%,連漲五週。

週四回落的多隻龍頭科技股反彈。週四大漲近 5% 的特斯拉收漲近 1%,本週累漲近 4%。FAANMG 六大科技股中,週四跌超 2% 的微軟收漲 1.3%,週四跌近 1% 的亞馬遜收漲 1.7%,週四跌近 0.5% 的 Facebook 母公司 Meta 收漲逾 0.5%,週四跌超 2% 的奈飛收漲近 0.5%,谷歌母公司 Alphabet 收漲 0.5%,抹平週四跌幅,而週四勉強收漲的蘋果收跌近 0.3%。

本週這些科技股多數累漲,奈飛漲 4%,亞麻漲 1.7%,蘋果漲近 1%,Meta 漲近 0.7%,而 Alphabet 跌近 1.8%,微軟跌 0.6%。

芯片股總體連漲七日,費城半導體指數和半導體行業 ETF SOXX 早盤都漲超 1%,分別收漲近 0.5% 和 0.4%,均連續三日收創歷史新高,本週均累漲約 9.1%。個股中,到收盤,博通漲超 2%,本週累漲近 20%,創上市以來最大周漲幅,部分源於被花旗給予買入評級後周一大漲 9%,此後持續走高;英偉達、高通漲超 1%,,被美銀上調評級的三隻芯片股中,英特爾收漲超 2%、AMD 漲 0.8%,而美光科技盤初漲近 1% 後轉跌,收跌近 1%。

AI 概念股總體回落。C3.ai(AI)早盤轉跌後收跌 0.6%,SoundHound.ai(SOUN)收跌超 2%,Palantir(PLTR)收跌不足 0.1%,公佈明年指引遜色後周四跌超 6% 的 Adobe(ADBE)午盤轉跌後幾乎收平,而 BigBear.ai(BBAI)收漲超 2%。

總體連日上漲的熱門中概股部分回落。納斯達克金龍中國指數(HXC)早盤曾漲超 1%,午盤轉跌,收跌逾 0.3%,跌離連漲四日所創的 12 月 1 日以來高位,本週累漲近 2%。中概 ETF KWEB 和 CQQQ 分別收平和收跌超 1%。造車新勢力表現不一,蔚來汽車收漲超 1%,而小鵬汽車收跌超 7%,理想汽車漲近 3% 後轉跌,收跌近 0.4%。其他個股中,儘管董宇輝否認加盟京東的傳聞,京東仍收漲超 4%,到收盤,大全新能源漲 3%,阿里巴巴、晶科能源漲超 2%,宣佈採取進一步行動打擊潛在非法賣空後,法拉第未來漲近 2%,百度、拼多多漲超 1%,騰訊粉單漲 0.1%,而網易跌超 1%,B 站跌 0.4%,此前消息稱高途佳品抖音官號四天漲粉超 99 萬、週四股價收漲近 30% 的高途教育盤初轉跌後早盤曾跌超 9%,收跌近 3%。

重點個股中,在航運巨頭馬士基要求其所有集裝箱船暫停在紅海航行後,歐美多家貨輪股上漲,ZIM Integrated Shipping Services(ZIM)收漲 18%;媒體稱其正與多家顧問研究出售事宜後,提供電子簽名解決方案的 DocuSign(DOCU)收漲 12.5%;在美國密歇根兩個工廠裁員超 1300 人的通用汽車盤初轉跌,收跌 1.4%。

歐股方面,歐元區 12 月綜合 PMI 初值連續七個月萎縮,地區最大經濟體德國的 12 月綜合 PMI 連降六個月、和第二大經濟體法國的 PMI 均超預期下降,發出衰退的警報。法國央行行長 Francois Villeroy de Galhau 暗示降息不會很快到來。但華爾街仍預計明年春季有望降息。巴克萊預計歐央行明年 4 月降息 25 個基點,此後每次會議都會降息,直到後年 1 月。泛歐股指午盤轉跌,收盤時勉強抹平跌幅。

歐洲斯托克 600 指數微幅收漲,兩日刷新週一所創的去年 2 月 2 日以來收盤高位。主要歐洲國家股指週五表現各異,連漲兩日的英股回落,週四反彈的西班牙股指回落,而連跌三日的德股幾乎收平,法股和意股連漲兩日。

各板塊中,礦業股所在的基礎資源和科技都漲超 1%,而電信和房產都跌近 1%。個股中,在歐盟監管機構啓動對其治療血癌藥物的調查後,倫敦上市的葛蘭素史克收跌 2.9%,拖累醫療板塊跌約 0.5%、英國股指在歐洲各國中表現最差;二季度銷售同比猛增超 40%、創單季新高的瑞典科技公司 Sectra 大漲 8.3%,領漲斯托克 600 成分股,丹麥上市的馬士基收漲近 7.9%,在成分股中漲幅僅次於 Sectra。

本週斯托克 600 指數連漲第五週。各國股指未能繼續集體累漲,西股連漲七週,法股連漲五週,英股連漲三週,而連漲六週的德股微幅累跌,連漲兩週的意股回落。各板塊中,在歐債收益率下行的支持下,對利率敏感的房產板塊累漲超 5%,表現最佳,部分受益於週五走高,科技漲近 3%,上週跌超 3% 領跌的基礎資源漲近 2%;而電信跌超 3% 領跌,油氣跌超 1%,繼續逆市累跌。

英債收益率一週降超 30 個基點 美聯儲三把手講話後 兩年期收益率一度回升超 10 個基點 後有所回落

暗示經濟衰退危險的歐元區 PMI 公佈後,歐洲國債價格進一步上漲,收益率繼續下行。儘管歐洲央行行長拉加德週四會後稱根本沒討論降息,目前貨幣市場仍預計,歐洲央行約有 80% 的概率明年 3 月首次降息;衍生品合約價格顯示,市場預計,明年一年歐央行合計降息 155 個基點,較週三美聯儲公佈決議前預計的水平升約 15 個基點。

到債市尾盤,英國 10 年期基準國債收益率收報 3.68%,日內降約 10 個基點,盤中曾下破 3.67%,連續兩日刷新七個月來低位 ;2 年期英債收益率收報 4.24%,日內降約 5 個基點,尚未逼近週四下逼 4.21% 所創的半年多新低;基準 10 年期德國國債收益率收報 2.01%,日內降 9 個基點,盤中曾下破 2.01%,連續兩日刷新將近九個月來低位;2 年期德債收益率收報 2.49%,日內降 4 個基點,繼續刷新八個多月低位。

本週歐債收益率集體下行,上週回升的短債收益率回落,長債收益率連降三週,降幅遠超上週,英債收益率降幅居前,體現薪資增速放緩等數據強化降息預期的影響。上週降約 9 個基點的 10 年期英債收益率本週累計降約 36 個基點,2 年期英債收益率降約 31 個基點;上週降約 9 個基點的 10 年期德債收益率本週累計降約 26 個基點,2 年期德債收益率降約 19 個基點。

美國 10 年期基準國債收益率在歐股盤中曾下破 3.90% 刷新日低,逼近週四下破 3.89%% 刷新的 8 月 10 日以來低位,日內降近 3 個基點,美股盤前美聯儲三把手威廉姆斯講話後,抹平降幅轉升並一度接近 3.98% 刷新日高,日內升 5 個基點、較日低迴升近 8 個基點,美股早盤迴落到 3.90% 一線,又逼近四個月低位,午盤略有回升,到債市尾盤時約為 3.91%,日內降約 1 個基點,連降四日,本週累計降約 32 個基點,在上週小幅反彈後大幅回落。

對利率前景更敏感的 2 年期美債收益率在歐股盤前曾下破 4.36% 刷新日低,日內降近 4 個基點,後逐步抹平降幅轉升,美股盤前威廉姆斯講話後,升幅迅速擴大並升破 4.48% 刷新日高,較日內低位回升近 13 個基點,日內升約 9 個基點,遠離週四下破 4.28%% 而連續兩日刷新的半年來低位,後又回落,到美股早盤徘徊 4.40%,回吐多數升幅,午盤有所回升,到債市尾盤時約為 4.44%,日內升約 5 個基點,在連降兩日後反彈,本週仍累計降約 28 個基點,抹平上週約 18 個基點的回升幅度,但還未超過降約 41 個基點、創 3 月銀行危機以來最大周降幅的上上週。

美聯儲三把手講話後 美元指數拉昇 脱離四個月低位 離岸人民幣漲破 7.10 創半年新高 後回落 全周仍漲

追蹤美元兑歐元等六種主要貨幣一籃子匯價的 ICE 美元指數(DXY)在亞市盤中曾跌破 101.90 刷新日低,日內跌逾 0.1% ,歐股盤初轉漲後保持漲勢,美股盤前美聯儲威廉姆斯講話後盤中拉昇,一度接近 102.60,後有所回落,美股早盤跌至 102.40 下方,美股午盤漲幅擴大,漲破 102.60 刷新日高至 102.643,日內漲近 0.7%,脱離週四跌穿 101.80 刷新的 8 月 4 日以來低位。

到週五美股收盤時,美元指數處於 102.50 上方,日內漲近 0.6%,本週跌 1.4%;追蹤美元兑其他十種貨幣匯率的彭博美元現貨指數漲近 0.4%,本週跌約 1.2%,和美元指數都在連跌三日後反彈、但都在上週止住三週連跌後回落。

非美貨幣中,歐元兑美元在歐美交易時段加速回落,美股午盤曾跌破 1.0890 刷新日低,日內跌逾 0.9%,跌離週四漲破 1.1000 刷新的 11 月 29 日以來高位,美股收盤時略低於 1.900,本週漲約 1.2%;英鎊兑美元在美股午盤曾跌破 1.2670 刷新日低,日內跌近 0.8%,跌離週四逼近 1.2800 刷新的 8 月 22 日以來高位,美股收盤時處於 1.2670 上方,本週漲約 1%;連漲三日的日元回落,美元兑日元盤中不止一次轉跌,美股早盤曾跌破 141.50 刷新日低,午盤又轉漲,美股收盤時處於 142.20 上方,日內漲逾 0.2% 未接近週四跌破 141.00 至 140.95 所創的 7 月 31 日以來低位。

連日上漲的人民幣盤中轉跌。在岸人民幣(CNY)兑美元在歐股盤初曾連續第二日漲破 7.10,逼近週四所創的半年來高位,但美股盤前轉跌。

離岸人民幣(CNH)兑美元在歐股盤初曾漲至 7.0976,自 6 月 2 日以來首次盤中漲破 7.10,連續兩日創半年來新高,日內漲 260 點,此後持續回落,美股盤前轉跌後一度跌至 7.1371 刷新日低,較日高回落 395 點、日內跌 135 點。北京時間 12 月 16 日 5 點 59 分,離岸人民幣兑美元報 7.1346 元,較週四紐約尾盤跌 110 點,止步三連漲,本週仍累漲 526 點,在上週跌超 600 點後反彈,最近五週內第四周累漲。

比特幣(BTC)在亞市早盤處於 4.32 萬美元上方刷新日高,歐股開盤後持續回落,美股早盤曾跌穿 4.2 萬美元至 4.18 萬美元下方,較日高跌近 1500 美元、跌超 3%,午盤重上 4.2 萬美元,美股收盤時處於 4.22 萬美元上方,最近 24 小時跌近 2%,最近七日跌超 5%。

馬士基暫停紅海航運 原油抹平盤中多數跌幅 收盤跌落一週高位 但終結四年最長的七週連跌

國際原油期貨盤中轉跌,在美股盤前轉跌後,早盤刷新日低時,美國 WTI 原油跌至 70.3 美元,日內跌近 1.8%,布倫特原油跌至 75.29 美元,日內跌逾 1.7%,午盤都曾轉漲。

最終,WTI 1 月原油期貨收跌 0.21%,報 71.43 美元/桶;布倫特 2 月原油期貨收跌 0.08%,報 76.55 美元/桶和美油均跌落週四大漲所創的上週二以來高位。

本週美油累漲 0.28%,布油累漲 0.94%,終結創 2018 年來最長連跌週期的七週連跌,主要歸功於週四漲超 3%,創 11 月 17 日市場預期 OPEC+ 加碼減產以來最大日漲幅。巴以衝突以來,除了衝突剛爆發的前兩週外,本週是原油第三週累漲。

美國汽油和天然氣期貨齊漲。NYMEX 1 月汽油期貨收漲 0.9%,報 2.137 美元/加侖,刷新 11 月 30 日以來高位,本週累漲近 4.3%,在連跌七週後反彈;NYMEX 1 月天然氣期貨收漲 4.14%,報 2.4910 美元/百萬英熱單位,刷新一週來高位,但和上週五水平仍有距離,本週累跌 3.5%,連跌六週。天然氣本週前兩日因氣象預報暖冬天氣而分別大跌近 6% 和 5%,此後持續反彈,全周跌幅遠不及跌超 8% 的上週。

倫鋁四連漲 和倫鋅一週漲超 5% 黃金盤中轉跌 告別一週高位 本週仍反彈

倫敦基本金屬期貨週五多數繼續上漲。倫鋁、倫鋅、倫鎳都漲超 1%,倫鋁連漲四日至 11 月下旬以來高位,倫鋅和倫鎳兩連漲,分別創 11 月末和 11 月中以來新高。倫鉛也兩連漲,創將近兩週來新高。而週四五個月來首次一日漲超 2% 的倫銅小幅回落,暫別 12 月初以來高位,連漲三日的倫錫跌落將近兩個月來高位。

本週基本金屬都累漲,領漲的倫鋅和倫鋁都漲超 5%,和漲超 2% 的倫鉛分別結束四周、兩週和三週連跌,倫銅漲超 1%,在上週止步三週連漲後反彈,上週回落的倫鎳反彈超 2%,上週獨漲的倫錫漲超 2%,連漲兩週。

連日上漲的紐約黃金期貨盤中轉跌,在歐股盤中曾上逼 2060 美元刷新日高,日內漲逾 0.7%,美股盤前短線轉跌,午盤轉跌後持續下行。

現貨黃金在歐股盤中曾上逼 2045 美元刷新日高,日內漲逾 0.4%,也在美股盤前轉跌,午盤曾跌至 2016 美元下方刷新日低,日內跌 1%,跌離週四盤中逼近 2048 美元刷新的 12 月 4 日以來高位。

最終,COMEX 2 月黃金期貨收跌 0.45%,報 2035.7 美元/盎司,跌落週四漲破 2040 美元所創的上週四以來收盤高位。

本週期金累漲 1.05%,在上週結束三週連跌後反彈,巴以衝突以來十週內第八週累漲,主要得益於美聯儲會後週四一日漲超 2%,創 10 月 13 日以來最大日漲幅。