Citigroup's Outlook for India in 2024: "Crazy" Stock Market or Continued Performance Depends on This Result

花旗指出,受全球经济逆风影响,印度 2025 财年 GDP 可能会从 2024 财年的 6.7% 降至 6.2%;维持对印度股市建设性看法,预计 NIFTY 指数 2024 年 12 月目标价为 22500 点,远期市盈率为 19 倍。

印度成为今年全球投资的 “宠儿”,经济增长好于预期,股市涨势 “势如破竹”,市值突破 4 万亿美元,Nifty 50 今年迄今涨近 18%,迈向史无前例的八年连涨。进入 2024 年,印度经济能否扛住市场的 “厚爱”,创了新高的印度股市还能继续涨吗?

12 月上旬,花旗印度经济团队、股票和固定收益策略团队发布报告《印度 2024 展望——在选举迷雾中闪耀》,对 2024 年印度大类资产走势进行了展望:

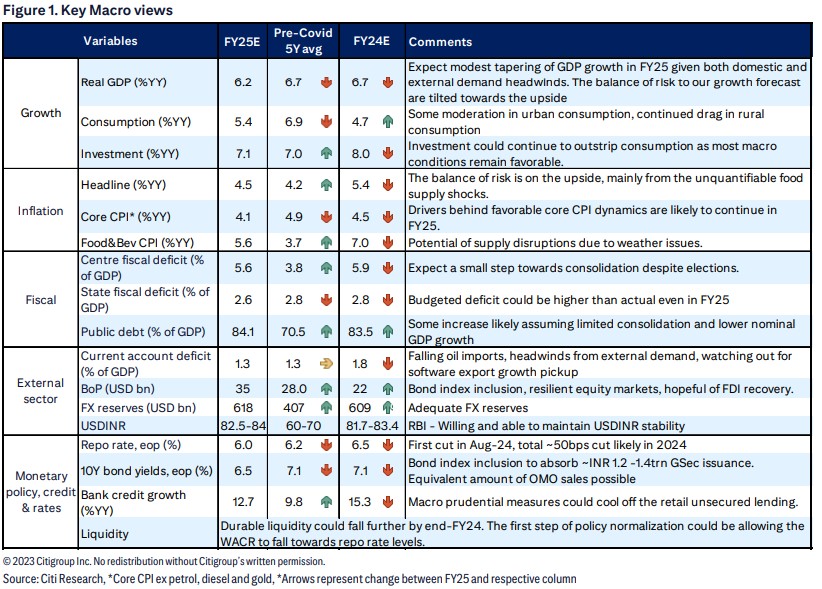

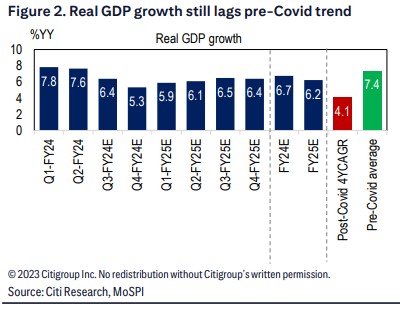

基本面:随着全球利率上升、美元升值和油价上涨等不利因素的消退,印度经济将继续保持强劲增长,印度 2024 财年 GDP 或达 6.7%,受全球经济放缓影响 2025 财年将放缓至 6.2%。

印度股市:对于 2024 年,我们预计有强劲的盈利增长前景,同时维持对印度市场的建设性看法。NIFTY2024 年 12 月目标价为 22500 点,远期市盈率为 19 倍,较目前有大约 5% 上涨空间。虽然今年外资疯狂流入印度股市,但花旗指数显示印度在投资者新兴市场投资组合中的超配程度已下降。

印度债市和卢比:全球名义利率可能下降,美国经济衰退迫在眉睫。印度政策很可能保护印度资产免受避险/去杠杆化逆风的影响,开始逐步降息。我们预计收益率最终将走低,而印度卢比将保持稳定。

值得一提的是,2024 年为印度大选之年,选举结果将对印股等各类资产走势产生影响,不过目前花旗预期现任总理莫迪的政党在获胜的可能性较大,将维持所谓的政治连续性,给市场带来的风险较小。

基本面:受全球经济逆风影响 印度 2025 财年 GDP 或降至 6.2%

花旗指出,随着全球债券收益率上升、美元升值和油价上涨等不利因素的消退,印度将继续保持强劲的表现。通胀的缓和会为宽松货币政策提供空间。然而,随着外部和国内需求环境出现周期性走软,2025 财年经济增速将小幅放缓。

尽管面临外部不利因素,但印度 2023 年的经济增长超出了预期,2024 年全国大选结果带来的风险似乎也相当低,这重新点燃了资本流动改善和私人资本支出复苏的希望。正在出现的全球逆风可能会令全球经济增长率下降 70 个基点至 1.9%,同时美国经济即将陷入衰退。

对于印度,我们预计其 GDP 增长率将从 2024 财年的 6.7% 适度放缓至 2025 财年(2024 年 4 月 1 日持续到 2025 年 3 月 31 日)的 6.2%,印度国内和外部需求存在逆风,但仍对资本支出复苏抱有希望。同时,印度可能会将 2025 财年的财政赤字目标降低到 5.6%,但中期目标 4.5% 仍然具有挑战性。

通胀压力的普遍缓解以及美元走强压力下降将允许印度从 2024 年中期开始逐步降低政策利率,印度央行可能会逐步放宽货币政策,在 24 年 6 月进行首次降息。如果 2025 财年整体 CPI 平均下降至 4.5%,应该足以让印度央行从 2024 年年中开始降息 50 个基点。

关于大选对经济的影响,花旗指出:

在最近结束的邦选举中现任总理莫迪的执政党表现强劲,增加了其在 2024 年大选中获胜的可能性。这加强了市场对政策连续性的预期,也可能有助于股市积极情绪和私人部门投资增长。

印股:盈利增长前景向好 维持建设性看法

对于印度股市,花旗指出,预计 2024 年有强劲的盈利增长前景,同时维持对印度市场的建设性看法。NIFTY 指数 2024 年 12 月目标价为 22500 点,远期市盈率为 19 倍,较目前还有约 5% 的上涨空间。

从相对和绝对估值来看,花旗指出,印度股市的估值高于长期平均水平,但考虑到新兴市场其他国家的相对增长弹性和挑战,这是合理的。花旗/共识预期对 NIFTY 指数 2024 财年每股收益增长预期为 17%/20%,2025 财年每股收益增长预期为 14%/15%。

从细分行业来看,花旗对各行业的立场保持不变:

重点超配: 国有公用事业/国防,工业和银行/保险;重点低配:消费品,IT 服务,金属。

大盘股 vs 中盘股:首选大盘股而不是中盘股。不过资金开始更多地流向了中小型企业,这种情况可能会继续下去。

从资金流来看,印度国内资金流入在 2023 年保持强劲,并且定期投资计划(SIP)的资金流入增速在 2022 年减速后有所提升。而外资在 2023 年上半年流入约 140 亿美元,而在 2022 年流出了约 170 亿美元。花旗指出:

过去我们强调过,该国国内资金大量流入降低了印度市场的波动性,并导致过去十年的估值重估。

在 2023 年 3 月至 7 月间,总计约 350 亿美元资金流入新兴市场,印度吸引了超 50% 以上;而在 2023 年 8 月至 10 月间,500 亿美元资金流出新兴市场,其中印度占比约 6%。这表明外资对印度有相对偏好。

尽管印度在新兴市场基金中的配置增加了,但根据我们地区团队的数据显示,印度在新兴市场组合中的超配情况逐渐减少,现在接近中性。同时印度在基准指数中的权重进一步上升。

展望印度市场明年走势,花旗指出,有以下五个方面需要注意:

a) 消费:短期内可能继续呈 k 形增长,关注消费增长基础是否广泛。

b) 资本支出:鉴于企业资产负债表强劲、现金流产生和有利的政策环境,公共资本支出将保持增长势头,而私人资本支出应逐步改善;

c) 选举:大选结果将受到密切关注,州选举结果降低了意外发生的尾部风险;

d) 信贷增长:未来预计将有所放缓,需要密切关注无担保贷款的趋势。

e) 资金流:印度在新兴市场中处于有利地位,国内资金流入令人惊讶。

印度国债收益率将走低、卢比可能保持稳定

关于印度国债和外汇,花旗指出,随着印度大选开始和纳入关键的债券指数,印度国债收益率最终将走低,印度卢比可能保持稳定。

全球名义收益率可能放缓,美国经济衰退迫在眉睫。印度政策机制和外部缓冲能力增强将在很大程度上保护印度资产免受避险/去杠杆化逆风的影响,再加上印度可能开始逐步放松政策,我们预计收益率最终将走低,而印度卢比可能保持相对稳定。

进一步来看,花旗指出,紧缩的财政政策和宽松的货币政策为收益率下降提供了条件,

超过 250 亿美元的外国直接投资流入有助于收益率下降,到年底印度 10 年期国债收益率可能会逼近 6.5%。

而印度卢比可能会保持稳定,花旗指出:

几个月来,市场力量和印度央行的行动已经将汇率限制在一个超窄的范围内,可能的补救措施是防止商品价格偶尔飙升带来的传导性通胀,以及防范拥有未对冲外国债务的企业的金融风险。但是,抑制货币波动的更典型和结构性的因素是印度央行对美元积累的偏好转变,以及可能更加倾向于贬值的卢比。

花旗提醒称,有两个重要事件可能影响卢比走势:

1)纳入关键债券指数后的资金流入:预计印度央行可能会利用这些资金流入来增强外汇储备,特别是考虑到整体政策对固定收益流入持怀疑态度。这可能意味着当资金流入时,印度可能会采取措施增强外汇储备以稳定卢比汇率。

2) 大选结果:如果在大选期间政策稳定会引发卢比短暂反弹,这可能反映出市场对政策稳定性的乐观态度。考虑到这一情况,我们将探索印度卢比与一篮子货币 (如新元等) 的相对价值交易机会。