摩根士丹利:2024 年可能影响全球市场的 “十大意外”

大摩盤點 2024 年最大看點:美國經濟硬着陸 “雖遲但到” 還是美聯儲降息 8 次鎖定經濟 “軟着陸”?

2023 年,金融市場暗流湧動,歐美各國被高利率、高通脹率、高債務率席捲,而動盪持續存在,2024 年又會有哪些 “意外” 發生?

摩根士丹利策略師 Matthew Hornbach 及其團隊如期在 12 月 16 日發佈報告《2024 年的十大 “意外”》,沒有 “意外” 的一年才是 “意外”,在大摩看來 2024 年下列 10 大事件的發生都可能會對全球宏觀經濟產生深遠影響:

意外 1:美國經濟的 “驚嚇”——硬着陸 “雖遲但到”,美國財政擴張支撐消費與經濟韌性使得 2023 年美國經濟避免衰退,但美國的寬財政政策在 2024 年難以維持,經濟增速將明顯下滑,美國政府所面臨的高昂利息及高債務水平與美聯儲加息造成的滯後性影響,可能會對經濟增長產生負面影響。

意外 2:美國經濟的 “驚喜”——美聯儲 8 次降息,美國經濟 “軟着陸”,美聯儲關注的重點是通脹下降時保持實際利率穩定在較低水平,這將使收益率曲線趨於平緩,對長期國債的強勁需求。

意外 3:美聯儲在 6 月首次降息前結束量化緊縮(QT),QT 的結束可能是為了緩解金融市場的壓力,金融機構資產負債表惡化、對儲備金的結構性需求增加,或銀行持續的流動性需求。

意外 4:意大利政府債券(BTP)相對於德國政府債券(Bund)的利減小,由於兩國的財政政策或經濟條件發生了變化,市場對兩國財政和經濟風險差異看法隨之改變。

意外 5:歐元區 10 年期和 30 年期國債間利差縮窄,因歐洲宏觀形勢急劇惡化,30 年期的收益率可能會比 10 年期的收益率低 50 個基點。

意外 6:英國央行早於預期降息,雖然普遍預期英國央行寬鬆週期較為滯後,但近期通脹和經濟數據的勢頭可能支持英國央行早於預期降息。

意外 7:日本國債收益率曲線趨陡非趨平。市場一致預期日本央行貨幣政策將逐步正常化,但如果正常化開啓的信號晚於預期,曲線可能會變陡(短期利率並不會快速上升)。

意外 8:英鎊進入上漲區間,2023 年超低的經濟數據基數、低廉的資產估值以及英國與歐盟加強經濟合作的可能性,為英鎊的潛在看漲奠定了基礎。

意外 9:澳大利亞和加拿大 r*(中性利率)定價下降:由於生產率疲軟以及大宗商品價格風險,中期利率預期降至近期平均水平以下。

意外 10:美國通脹保值債券(TIPS)收益率回到 2019 年前水平,5 年期 TIPS 和 30 年期 TIPS 之間的利差將回歸到 2013-2019 年間的平均水平,即 20 個基點。

2024 年最大的 “驚嚇”:美國經濟硬着陸 “雖遲但到”

大摩直言,2024 年多數投資者押注 “軟着陸”,默認此次緊縮週期"不一樣",但這種預期忽視了財政政策對經濟的重要作用,財政政策加劇了貨幣政策的長期影響和滯後效應,2024 年的衰退可能更加嚴重,美聯儲因此被迫快速調整政策讓利率儘快恢復中性水平:

軟着陸的説法總是讓投資者覺得"這次不一樣",這是金融界最危險的字眼,2024 年最大的 “意外” 可能是,難以捉摸的硬着陸終於到來了。

財政政策和貨幣政策的結合可以解釋 2023 年美國經濟沒有着陸的原因,這也可以解釋為什麼 2024 年會出現經濟硬着陸。進入到 2024 年,美國的寬財政政策料難以維持,經濟增速將明顯下滑,美聯儲可能不會出現明顯的刺激政策,而預期的落空或使經濟持續陷入低增長環境。

大摩解釋道,美國這次的財政政策和貨幣政策組合與以往不同,這種組合可能加劇了經濟週期的波動:

儘管美聯儲的基準利率比 2019 年高出 120%,但美聯儲在儲備餘額上支付的利息增加了 364%,美國財政部支付的國債利息增加了 406%。

美國國債的利息每年佔名義 GDP 的 1% 以上,綜合來看,美聯儲和美國財政部目前至少向經濟中注入了相當於 GDP 的 1.75% 的利息。

為了彌補這天量的赤字,美國當局可能會借入越來越多的債務,從而令債務大山更加龐大,因在高利率水平下,聯邦公共債務利息支出飆升,這可能會進一步加劇赤字問題,從而令美國財政陷入惡性循環。

大摩分析稱,這種由財政政策引發的順週期刺激與貨幣政策的大體中性立場結合在一起對經濟產生了刺激,但貨幣政策立場在 2023 年 9 月轉向了限制性區域。因此,儘管美聯儲不會進一步加息,但 2024 年的政策環境可能更加嚴格,全球範圍內政策限制的增加、美國聯邦政府財政政策支持的減少,以及與美國大選相關的不確定性加劇,將經濟推向硬着陸:

美聯儲在 2023 年 12 月 FOMC 會議上對經濟和貨幣政策的預測表明,自沃爾克以來最嚴格的政策立場即將到來。美聯儲清楚地意識到 2024 美國大選如何影響企業和消費者的信心,進而影響相關的投資決策。

隨着申請失業救濟金人數飆升,收入和支出增長雙雙放緩至停滯,消費者信心急劇下降,這降低了剩餘儲蓄的邊際消費傾向。核心 PCE 已經在 2023 年下半年同比接近 2%,隨着貨幣政策進入限制性區間,財政政策支持逐漸減弱,預計 2024 年上半年同比增速將低於 2%。

由於核心 PCE 通脹率同比可能在明年上半年跌破 2%,比 FOMC 預測至少提前了 18 個月,預計美聯儲在 3 月 22 日的會議上降息 25 個基點,緊接着在 5 月 3 日的會議上又降息 25 個基點。隨着經數據進一步顯示出經濟衰退的信號,美聯儲將在 2024 年餘下的每次會議上以 50 個基點的幅度降息。

2024 年美國經濟 “驚喜”:降息 8 次,經濟軟着陸

大摩認為,市場目前預計 2024 年美國經濟或許會保持適度正增長,但如果美聯儲在 2024 年進行了 8 次共計 200 個基點的降息,使基準利率接近 “中性” 水平,這將確保美國經濟實現 “軟着陸”:

"軟着陸"終於在 2024 年到來,核心 PCE 將穩定在 2% 左右,並實現温和增長(這與我們美國經濟團隊的觀點一致)。雖然美聯儲已在 12 月議息會議上為降息敞開大門,但美聯儲最終將在 2024 年完成 8 次降息(遠高於最新的點陣圖 3 次降息),甚至高於市場目前的預期的大約 6 次降息幅度。

大摩指出,理論上市場對美聯儲 8 次降息的反應應該是債券收益率曲線呈現 “牛陡” 狀態,那麼 2024 年基於美聯儲降息 8 次的另一個 “意外” 是,收益率曲線反而會走平:

債券收益率呈現 “牛平” 可能由多種因素導致——(1)收益率曲線趨陡交易成為高度共識的策略,(2)養老基金和保險公司等為了迅速彌補配置不足,增加超長期債券配比,(3)零售投資者尋求收益,選擇 “鎖定” 長期國債的高收益率。

此外,由於市場已經定價了美聯儲 6 次降息,因此短期國債回報率較低,不利於投資者獲得較高的總回報,而長期國債的持有成本更低,更有吸引力。

預計來自美國的銀行、海外央行以及對沖基金對美國長債的需求將在明年恢復,這使得長端利率相較於短端利率下滑更多,從而使收益率曲線的整體斜率變緩,即呈現 “牛市趨平”。

美聯儲的意外:在首次降息前結束量化緊縮(QT)

摩根士丹利指出,對於美聯儲而言,2024 年的意外將是資金壓力使他們不得不在 6 月首次降息前結束量化緊縮(QT),QT 的結束可能是為了緩解金融市場的壓力、金融機構資產負債表惡化、對儲備金的結構性需求增加,或銀行持續的流動性需求:

我們的基本假設是美聯儲在 9 月開始逐步開始退出 QT,並在 2025 年初停止縮表,但資金條件和市場運作出現尾部風險,可能導致美聯儲在 6 月降息之前退出 QT。

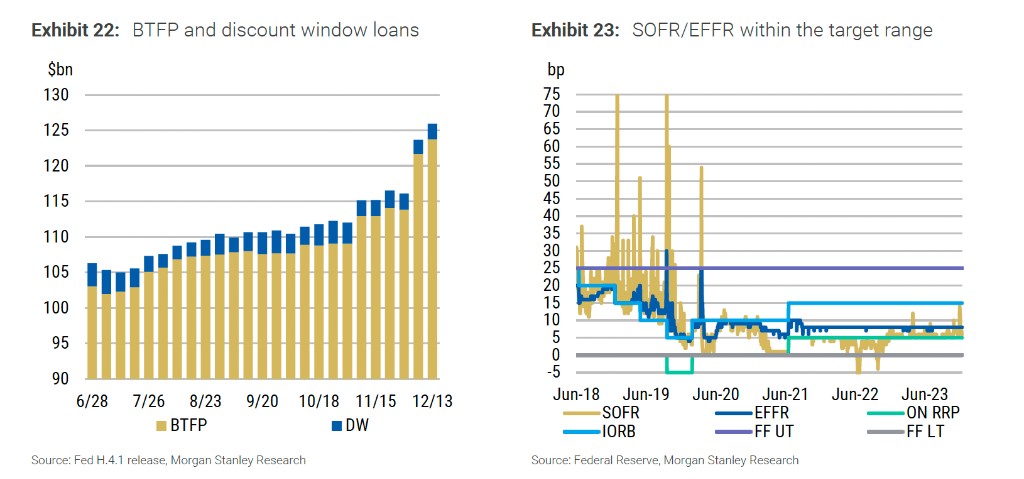

首先,由於隔夜逆回購協議(RRP)的作用,SOFR(隔夜拆借利率)仍然處在上升區間,RRP 對更高的回購利率非常敏感,這限制了 SOFR 上升的幅度。

然而,由於美國國債供應的重新加速,從 2024 年第一季度中期開始,經紀商在回購市場的中介能力(在 RRP 中借入現金再借給投資者)受到干擾。

隨着國債供應的增加,經紀商可能需要持有更多的國債以滿足交易需求。同時,如果回購市場的需求增加,他們可能需要借入更多資金來幫助購買國債。這些操作會增加他們的資產負債表負擔。

這導致一般擔保融資(GCF)和美國國庫現金資源報告(TGCR)之間的利差增加到 25 個基點以上,使 SOFR 的波動在未來幾個月變得更加顯著。這些資產負債表的壓力和由此產生的更高融資成本隨後促使槓桿投資者解除現金 - 期貨基差交易,加劇了回購市場的壓力。

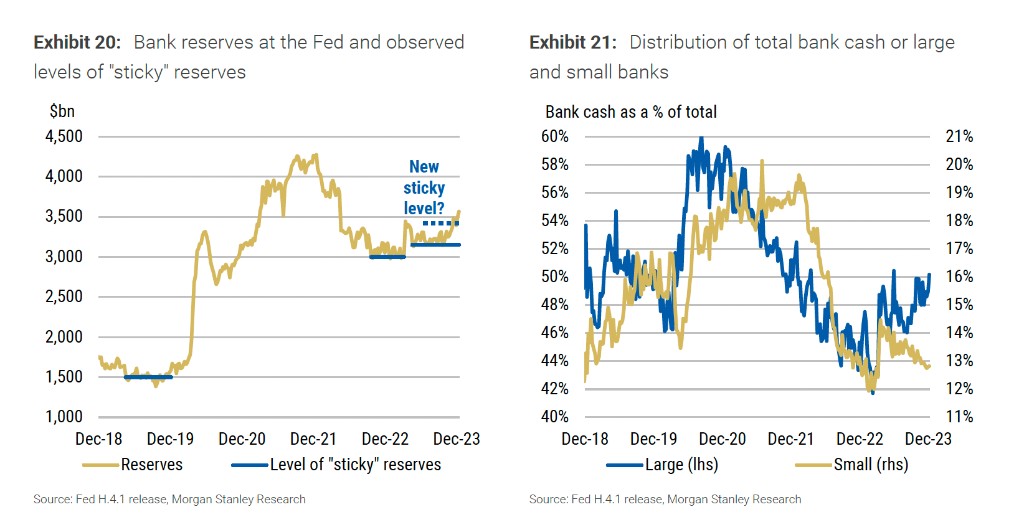

其次,由於銀行繼續失去無息存款,銀行對準備金的結構性需求在 2024 年上半年進一步增加,這可能會促使銀行保留更多流動性,使準備金保持在更高的水平(約 3.5 萬億美元)。

這將導致 RRP 在我們基本情景的 2024 年第三季度(3 月至 5 月)之前被耗盡,銀行將比預期更早成為回購市場的貸款方。同時,對準備金更高的結構性需求將限制銀行向美聯儲貸出現金的意願和能力,這將導致 SOFR 的波動和隨之而來的融資壓力。

此外,準備金的不均勻分佈進一步惡化,將放大融資的邊際風險,小銀行也增加了對準備金的需求,推動 SOFR 和有效聯邦基金利率(EFFR)上升。

第三,美聯儲的量化緊縮(QT)計劃在回購市場之外也面臨威脅,因為美聯儲在 3 月之後無法證明延長緊急貸款計劃 BTFP 的合理性,而銀行流動性壓力持續增加,導致 2024 年第二季度出現新一輪的銀行壓力。過去 6 周,BTFP 增加了 140 億美元,創下 1260 億美元的新高。

大摩認為,為了應對 2024 年上半年出現的意外融資壓力以及美聯儲退出 QT 的計劃,投資者可以將目光轉向 2 年期-10 年期 SOFR(隔夜拆借利率)互換利差趨陡頭寸(利用利率互換合約來投資的策略,投資者預計 2 年期利率相對於 10 年期利率會變得更低:

QT 的突然結束應該會促進投資者對美國長債的需求,使得 10 年期互換利差相對於 2 年期擴大。這種交易相比於直接做空 2 年期互換利差來説,具有更好的持有成本,特別是考慮到明年 1 個月 SOFR/聯邦基金利率期貨(FF)中已經定價的部分。