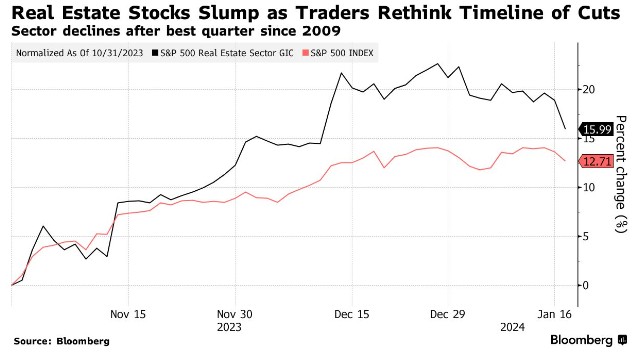

US Real Estate Sector Plunges, Traders Reassess March Rate Cut Bets

房地產類股週三成為拖累標準普爾 500 指數的最大板塊,因交易員撤回了對美聯儲降息的押注。房地產市場勢必會受到衝擊,特別是辦公樓 REITs。房地產類股在 2023 年的大部分時間裏難以恢復穩定,投資者正在拋售股票。房地產投資信託基金 (REIT) 指數正走向去年 11 月以來最差的一週。

智通財經 APP 注意到,房地產類股週三成為拖累標準普爾 500 指數的最大板塊,因交易員撤回了對美聯儲降息的押注。

該行業是去年第四季度降息預期的最大受益者之一,對經濟和市場的整體發展高度敏感。因此,隨着交易員減少對美聯儲在 3 月份會議降息的押注,以及 10 年期美國國債收益率升至去年 12 月 12 日以來的最高水平 4.11%,房地產市場勢必會受到衝擊。

"我們認為,隨着月底美聯儲會議的臨近,第四季的強勁漲勢將得到回報," Integrity Asset Management, LLC 的投資組合經理 Joe Gilbert 表示,"總體而言,所有地產股都將受到影響,但我們對辦公樓 REITs 更為謹慎。"

當然,從更廣泛的角度來看,房地產類股只是回吐了部分漲幅。去年第四季度的強勁反彈推動該行業的一項指標飆升至 2009 年以來的最高水平。該指數週三下跌 1.9%,自年初以來累計下跌 3.7%,成為標準普爾 500 指數中表現第三差的板塊。

房地產類股在 2023 年的大部分時間裏難以恢復穩定,原因是向遠程工作的轉變、對商業房地產的恐慌以及地區銀行業危機給該行業帶來了壓力。投資者現在正在拋售股票,寫字樓房地產投資信託基金 (REIT) 指數正走向去年 11 月以來最差的一週。

信託證券以 Ki Bin Kim為首的分析師在給客户的報告中寫道:“辦公樓的整體基本面顯然很差,2024 年在供應、需求、入住率和租金方面可能會變得更糟。”"我們仍然認為一些股票被低估了,但需要有一個催化劑來引起投資者的興趣,並重新定價股票,"他們補充説,並以 SL Green Realty Corp.和 Vornado Realty Trust 為例。

信託諮詢服務公司首席市場策略師 Keith Lerner 表示,“值得注意的是,包括房地產投資信託基金在內的許多領域都回到了 12 月 13 日的交易水平,即上次聯邦公開市場委員會會議和新聞發佈會,當時美聯儲被認為更加鴿派。”

與此同時,隨着華爾街恐慌指數 VIX 自去年 11 月以來首次攀升至 15 上方,市場波動性再度迴歸。美國 10 年期國債收益率升至 4.1%。

週三公佈的最新零售銷售數據進一步加劇了市場的狂熱,突顯出人們對市場能否預期利率在 3 月份回落的懷疑,因為強於預期的數據顯示,進入新年之際,消費者的韌性有所增強。

Interactive Brokers 首席策略師 Steve Sosnick 表示:“房地產行業容易令人失望。” 他補充説,如果降息的步伐沒有如預期的那樣發揮作用,交易員應該預期,不確定性將反映在該行業的未來走勢中。