The history of PetroChina's daily limit: Either in a bull market or in a market rescue

8 年後中石油再度漲停意味着什麼?

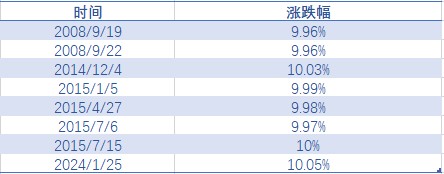

今日午後石油板塊震盪走高,中石油衝擊漲停。這是中石油 2015 年 7 月以來首次漲停,也是中石油上市以來的第 8 個漲停。

中石油於 2007 年上市,與中國石化,並稱為 “兩桶油”。由於當時中石油的市值在 A 股中舉足輕重,一度被老股民視為護盤工具。

雖然中石油在上證指數中的權重已經下滑。但每次中石油的漲停似乎總是在市場心中代表了一些不尋常的意義。而中石油漲停之後,市場究竟又是如何表現?

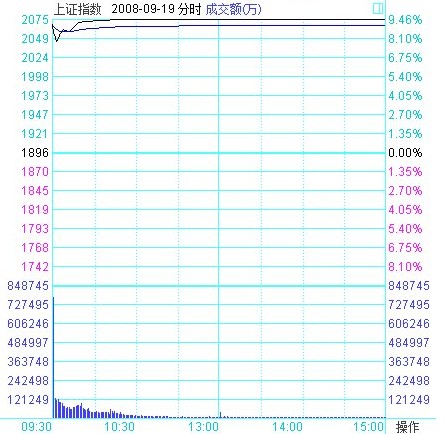

2008 年 9 月 19、22 日 不止中石油,整個 A 股都漲停了

時間回到 2008 年 9 月 19 日前 3 天,為了對沖美國金融風暴帶來的全球性股票市場大跌,央行宣佈了降息的政策。但此時股市似乎並不領情,毫無抵抗地跌破 2000 點整數關口。

9 月 18 日晚間,財政部、中央匯金公司、國資委罕見地聯手出擊,在同一時間祭出三大利好:印花税實行單邊徵收;中央匯金公司通過二級市場增持工商銀行、建設銀行、中國銀行三大行的股份;與此同時,當時的國資委主任李榮融也通過答記者問的形式首次明確表態:國資委支持中央企業在二級市場回購其控股公司的股份,以穩定市場。

三大政策出來後,市場大漲兩天,中石油也是連續兩天漲停。不過政策底領先市場底,A 股市場直到 10 月 28 日見底,此後開啓了一年的牛市,上證指數漲幅達到 90%。

2014 年 12 月 4 日 券商股拉開的權重逼空行情

2014 年下半年,在央行轉向寬鬆以及滬港通推出後,券商股是該輪行情的引領者。11 月 21 日央行晚間宣佈降息,打破了市場温和上漲態勢,逼空行情開啓。

12 月 4 日中石油和中石化在短期藍籌板塊輪動中雙雙漲停,券商也集體漲停,但於此同時也出現了其他股票情緒低迷的局面,市場顯得冰火兩重天。

中石油的漲停作為大盤牛市上漲的中繼,此後,A 股延續上漲半年,漲幅達到 75.8%。

在這段行情中,2015 年 1 月 5 日石油特別收益金起徵點上調利好三大油企業績,中石油漲停。2015 年 4 月 27 日受媒體報道關於中石油與中石化可能進行重組整合的影響,中石油和中石化雙雙漲停,中石油和中石化分別發澄清公告。

2015 年 7 月 6 日、2015 年 7 月 15 日中石油護盤再起

2015 年隨着股市過熱,場外配資盤和槓桿撤離,6 月起股市開啓下跌。7 月 6 日前三天累計下跌 14.4%。

證監會於 7 月 5 日公告,要充分發揮中國證券金融股份有限公司的作用,多渠道籌集資金,維護市場穩定。央行也將給與流動性支持,同時中央匯金發佈公告已於二級市場買入 ETF,並將繼續相關市場操作。

當日中石油護盤漲停,帶動 A 股上漲 2.41%。

7 月 15 日兩市再度全線走低,滬指跳空低開失守 3900 點,全天震盪下行,午後一度下挫近 5% 至 3741.25 點,尾盤中國石油封漲停板強勢護盤,使滬指跌幅收窄,重上 3800 點。

但該日,僅中石油與銀保板塊獨力支撐,中小創板塊龍頭股盡數跌停,個股層面普跌再現,1221 股跌停;中證 500 期貨主力合約跌 7.51%、其餘三合約跌停。

而由於當時經濟基本面和企業利潤均處於下行週期,與此同時股市積累的槓桿也過高,因此,股市處於熊市中期,此後經過半年的下探才見底,開啓新一輪行情,其後的跌幅達到 25%。

8 年後中石油再度漲停,滬指收復 2900

今日中石油再度漲停,消息面上是國新辦 24 日召開新聞發佈會。國務院國有資產監督管理委員會產權管理局負責人謝小兵會上強調,下一步重點圍繞上市格局、規範運作、市值管理納入考核三個方面提高上市公司質量。

尤其是推動央企把上市公司的價值實現相關指標納入到上市公司的績效評價體系中,及時通過應用市場化增持、回購等手段傳遞信心、穩定預期,加大現金分紅力度,更好地回報投資者。

從中石油前七次漲停史來看,有牛市、有底部,也有繼續回調。

其漲停,不是在牛市,就是在救市。

那麼今天中石油的漲停又預示着什麼?