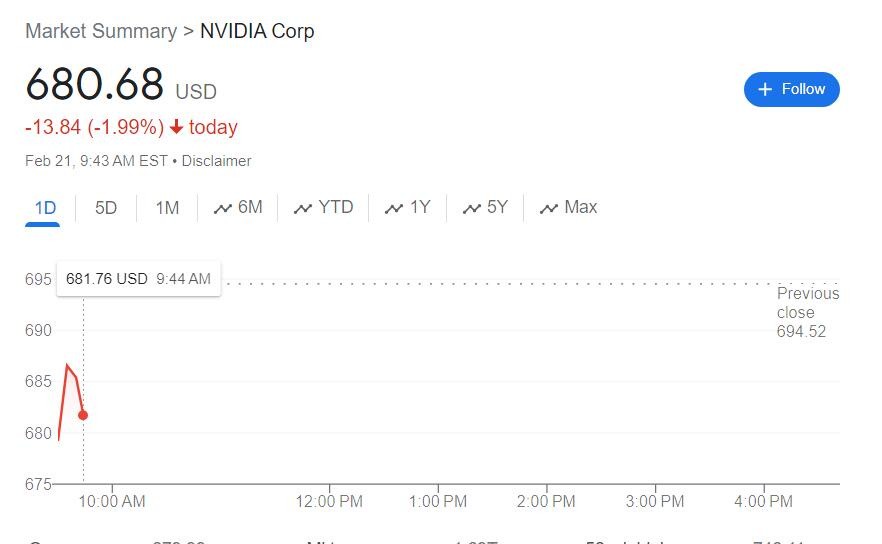

US stock futures are falling, while European indices are mixed. Chinese concept stocks are generally rising, with NVIDIA down nearly 2% in pre-market trading.

芯片股指盤初跌超 1%,兩日跑輸大盤,盤後將發佈財報的英偉達四連跌。特斯拉早盤漲超 2%。盤初中概股指漲超 2%,阿里、京東、理想汽車漲超 4%。更新中

2 月 21 日週三,美聯儲會議紀要以及人工智能巨頭英偉達財報公佈前夕,美股大盤繼續走低,10 年期美債收益率和美元波動不大;受企業財報表現不佳影響,歐指漲跌不一。

備受期待的英偉達財報即將發佈,分析指出,強勁的盈利能力,大幅超預期的營收數據早已不是市場關注的焦點。相比於短期的財報數據,市場更為關注 “未來”:H100 GPU 芯片的需求前景,下一代 GPU 芯片 B100 的更多細節,以及明年計劃的產品路線圖。

今晚美聯儲會議紀要也將發佈,近期數據顯示美國通脹並未像投資者希望的那樣迅速降温後,交易員被迫繼續削減對美聯儲將很快降息的押注,預計首次降息將推遲至 6 月。投資者將從 FOMC 會議紀要進一步瞭解政策投資者對降息路徑的看法。

【22:55 更新】

包括微軟、蘋果、英偉達、谷歌母公司 Alphabet、亞馬遜、Meta、特斯拉在內,七大科技股漲跌不一。

早盤特斯拉漲逾 2%,亞馬遜漲超 1%,連跌六個交易日的蘋果漲不足 1%,而 Alphabet 盤初漲近 0.4% 後曾小幅轉跌,微軟、Meta 跌超 1%。

【22:44 更新】

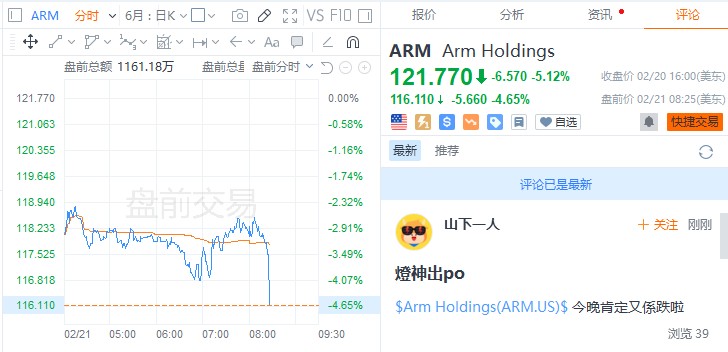

芯片股總體連跌繼續下跌,費城半導體指數盤初跌超 1%,連跌四日,連續兩日跑輸大盤。盤後將發佈財報的英偉達盤初曾跌超 2%,也四連跌,AMD 也曾跌超 2%,Arm 盤初跌超 4%,後跌幅迅速收窄到 3% 以內。

【22:37 更新】

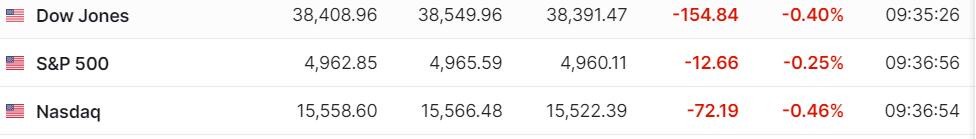

三大美股指集體低開,道指盤初跌超百點,和標普、納指連跌三個交易日。

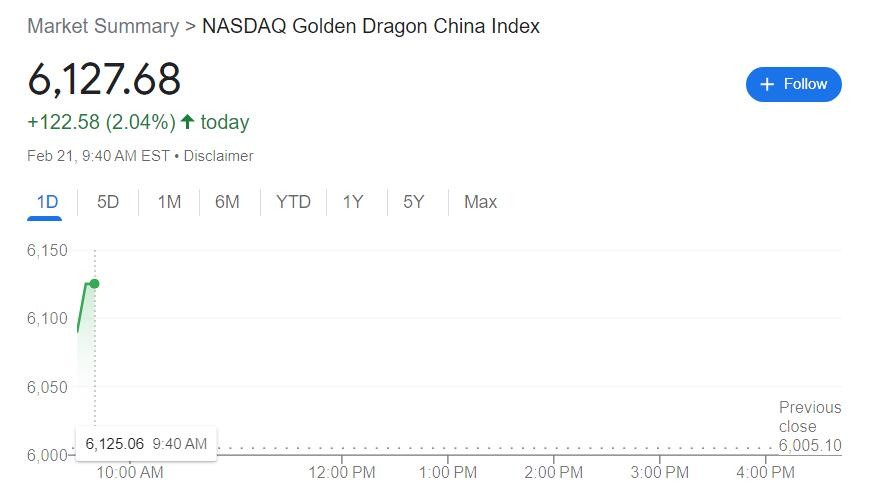

中概股逆市反彈,納斯達克金龍中國指數(HXC)盤初漲逾 2%,中概 ETF KWEB 和 CQQQ 盤初分別漲超 3% 和 2%。盤初阿里巴巴、京東、理想汽車漲超 4%,小鵬汽車漲超 3%,蔚來汽車漲約 3%,百度、拼多多漲超 2%。

【21:50 更新】

ARM 美股盤前下挫,現跌近 5%,台積電公告稱子公司以 1.02 億美元出售 85 萬股 ARM 股份。

美國天然氣期貨延續漲勢,日內漲超 9%。

【18:00 更新】

會議紀要公佈前夕 美股期貨齊走低

美股三大股指期貨延續下跌趨勢,以藍籌股為主的道指期貨跌 0.15%;標普 500 指數期貨跌 0.18%;以科技股為主的納斯達克 100 指數期貨跌 0.39%。前一日納斯達克 100 指數跌近 1%,標普 500 指數跌破 5000 點。

大型科技股普跌,英偉達跌近 2%,AMD 跌超 1%,特斯拉、高通跌近 1%。

美股盤前,中概股普漲,京東、小鵬汽車漲超 3%,騰訊音樂、嗶哩嗶哩漲近 3%,蔚來、微博漲超 2%;

今日港股繼續回暖,恒生指數收漲 1.57%,銀行加大對房企融資支持後,房地產開發商板塊領漲,量化交易監管再出 “組合拳”則減少了對賣空的擔憂。

財報表現不佳 歐股漲跌不一

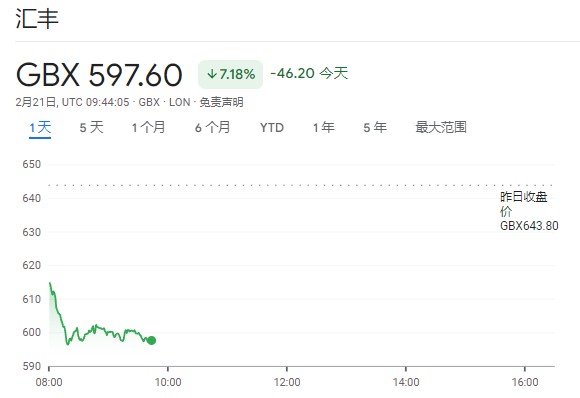

歐指漲跌不一,歐洲斯托克 50 指數漲 0.27%,德國 DAX30 指數漲 0.25%。法國 CAC40 指數上漲 0.27%。英國富時 100 指數下跌 0.78%,歐洲斯托克 600 指跌 0.26%。

銀行股領跌,滙豐控股財報顯示,四季度利潤暴跌 80%,主要為所持交通銀行股份減值 30 億美元,股價跌超 7%。

大宗商品交易商嘉能可財報不及預期,利潤大幅下滑,股價大跌 6.1%。全球最大的鐵礦石開採商力拓因金屬價格疲軟利潤下降,導致股價下挫。法國雜貨商家樂福在宣佈回購股票後上漲,但其季度銷售低於預期。

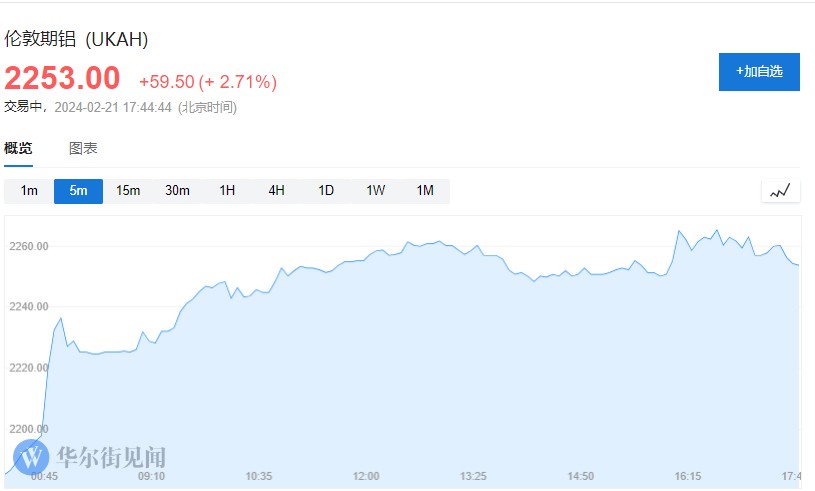

鋁價上漲 黃金走高

大宗商品方面,鋁價漲近 3%。此外黃金也走高。