Tech stocks dragged down the market, with the Nasdaq falling more than 2% at one point. NVIDIA narrowly hit a new high, NIO-SW saw a big turnaround during trading, and Bitcoin plummeted nearly $10,000 after reaching a historic high.

三大美股指至少收跌 1%,納指創近兩週新低,道指兩週新低。特斯拉收跌近 4%,繼續領跌科技 “七姐妹”,蘋果跌近 3%、五連跌;英偉達盤中跌超 2% 後轉漲;AMD 盤中跌 3% 後抹平多數跌幅,台積電美股跌超 2%,均跌落歷史高位;AI 概念股 SoundHound 跌超 10%,超微(SMCI)跌超 9% 後轉漲;地區銀行 NYCB 漲近 19%,上週五暴雷以來首漲;財報後 Target 漲 12%。中概股指跌 1.5%,兩連跌,蔚來汽車盤初跌 10% 後收漲近 3%。歐股 ASML 跌 1.5%,諾和諾德跌 2.5%,均跌落紀錄高位。美 ISM 指數公佈後,十年期美債收益率創逾三週新低,一度降超 10 個基點;美元指數迅速轉跌並創逾一週新低;離岸人民幣短線轉漲並收復 7.21。比特幣盤中漲破 6.9 萬美元創歷史新高,後一度回落超 9000 美元、超 10%。美油兩連跌至一週低位,布油兩日跌離近四個月高位,美 ISM 後短線轉漲。黃金期貨三日連創歷史新高,盤中漲超 1%。倫銅止步三連陽,倫鎳跌 1%,告別近四個月高位。

美聯儲主席鮑威爾本週國會作證前,藍籌科技股一再打擊美股大盤:在德國工廠疑似遭縱火襲擊而被迫斷電停產後,特斯拉繼續領跌科技巨頭 “七姐妹”;機構估算今年前六週 iPhone 在華銷量劇減 24%後,蘋果進一步下探四個月低位。

連日跑贏大盤的芯片股總體漲勢熄火,人工智能(AI)概念股普跌。環球網援引報道稱,AMD 對華銷售 “定製版 AI 芯片” 遭美國政府阻礙,美官員認為其性能 “過於強大”。AMD 跌落連日所創的歷史高位,其勁敵英偉達盤中抹平 2% 以上跌幅,驚險續創收盤歷史新高。

熱門中概股總體繼續回落,但公佈財報的蔚來汽車上演大反轉,盤初大跌 10% 後轉漲。蔚來盤前公佈四季度營收高於預期但毛利率低於預期、營業虧損遠超預期,此後業績電話會上,蔚來 CEO 李斌稱,阿爾卑斯子品牌今年第三季度將推出首款車型,子品牌將將專注於家庭市場,首款車與 Model Y 直接競爭,蔚來今年將重押軟件能力,公司有信心單月交付量回到 2 萬台水平。

AI 熱潮助長的芯片股漲勢暫歇,狂歡的比特幣也遭遇坎坷。上週突破 6 萬美元后,比特幣本週進一步衝擊 7 萬美元大關,週二盤中曾漲破 6.9 萬美元,兩年多來首次創歷史新高,不過此後迅速回吐日內漲幅崩跌,一度跌破 6 萬美元。

週二公佈的美國 2 月 ISM 非製造業指數超預期回落,體現貢獻美國大多數 GDP 的服務業企業擴張速度超預期放緩。遜色的經濟數據助長美聯儲降息的預期,數據公佈後,美國國債價格加速反彈,收益率至少刷新日低,基準十年期美債收益率一度較日內高位回落超過 10 個基點;美元指數迅速轉跌並跌至一週多來低位,離岸人民幣兑美元短線轉漲並收復 7.21。

大宗商品中,美元和美債收益率下行的推動下,黃金重演盤中轉漲,週一首次收盤漲破 2100 美元的紐約期金繼續刷新收盤最高紀錄。有分析師認為,最近金價創新高源於投機性的押注增加,無論是現貨還是期貨黃金都還沒有出現淘金熱潮。

美國 ISM 數據公佈後,國際原油曾短線轉漲並刷新日高,但最終未能成功反彈,繼續跌離將近四個月來高位。有評論稱,市場對美聯儲到今年年中才會開始降息的預期支持美元走強,不利於原油出口,施加油價下行壓力,同時週二市場的避險情緒打擊油價,而週二美油 200 日均線的技術位支持幫助限制了油價跌幅。

三大美股指至少收跌 1% 特斯拉繼續領跌科技 “七姐妹” 蘋果五連跌 芯片股總體熄火 地區銀行反彈

三大美國股指總體低開低走。午盤刷新日低時,納斯達克綜合指數連續兩日領跌,午盤曾跌 2.1%,標普 500 指數跌超 1.4%,道瓊斯工業平均指數早盤尾聲時跌逾 530 點、跌近 1.4%。最終連續兩日集體收跌,均創 2 月 13 日美國公佈 1 月 CPI 超預期增長日以來最大跌幅。

納指收跌 1.65%,報 15939.59 點,刷新 2 月 21 日以來收盤低位。道指收跌 404.64 點,跌幅 1.04%,報 38585.19 點,刷新 2 月 20 日以來收盤低位。標普收跌 1.02%,報 5078.65 點,繼續跌離上週五所創的收盤歷史高位。

價值股為主的小盤股指羅素 2000 收跌 0.99%,連續兩日跌離至 2022 年 4 月以來收盤高位;科技股為重的納斯達克 100 指數收跌 1.8%,創 1 月 31 日以來最大日跌幅,在上週五收創歷史新高後連跌兩日;衡量納斯達克 100 指數中科技業成份股表現的納斯達克科技市值加權指數(NDXTMC)收跌 1.87%,在三日連創歷史新高後回落。

包括微軟、蘋果、英偉達、谷歌母公司 Alphabet、亞馬遜、Facebook 母公司 Meta、特斯拉在內,七大科技股盤中齊跌。尚未確定德國工廠何時能恢復生產的特斯拉早盤曾跌 5.6%,收跌近 4%,在週一重挫逾 7% 後,刷新 2023 年 5 月以來收盤低位。特斯拉 CEO 馬斯克的個人身家被亞馬遜創始人貝佐斯超越,失去全球首富地位。

FAANMG 六大科技股中,蘋果早盤曾跌超 3%,收跌 2.8%,連跌五個交易日,將刷新 2023 年 10 月末以來收盤低位;微軟收跌近 3%,連跌兩日至 2 月 21 日以來低位;Meta 收跌 1.6%、亞馬遜收跌近 2%,分別繼續跌離上週五各自刷新的收盤歷史高位和 2021 年 11 月以來高位;Alphabet 收跌 0.5%,連跌三日至 2023 年 12 月 14 日以來低位;奈飛收跌 2.8%,在上週五刷新2021 年 12 月以來高位後兩連跌。

芯片股在總體連漲三個交易日後回落。費城半導體指數和半導體行業 ETF SOXX 分別收跌略超過 2% 和將近 2%,跌離連續三日所創的收盤最高紀錄。芯片股中,英偉達盤初轉漲後又轉跌,早盤曾跌超 2%,尾盤轉漲,收漲近 0.9%,連續四個交易日創收盤歷史新高,AMD 盤初曾跌 3%,收跌 0.1%,暫別連續三日刷新的收盤歷史高位;週一也創歷史新高的台積電美股收跌超 2%;收盤時,英特爾跌超 5%,Arm 跌近 3%,蘋果供應鏈中的博通、思佳訊跌超 4%、高通跌超 3%、美光科技跌超 1%。

週一漲跌各異的 AI 概念股盤中齊跌。收盤時,週一收漲 25% 的 SoundHound.ai(SOUN)跌近 12%,C3.ai(AI)跌超 8%, BigBear.ai(BBAI)跌逾 13%,Adobe(ADBE)跌超 4%,Palantir(PLTR)跌近 1%;而週一逆市收漲近 19% 的超微電腦(SMCI)早盤曾跌超 9%,尾盤轉漲,收漲 1.5%。

熱門中概股總體繼續回落。納斯達克金龍中國指數(HXC)盤初曾跌超 2%,收跌 1.5%,連跌兩日,刷新 2 月 13 日以來收盤低位,中概 ETF KWEB 和 CQQQ 分別收跌超 2% 和 1%。三家造車新勢力表現不一,蔚來汽車盤初曾跌 10.3%,開盤不到半小時後轉漲,早盤曾漲 5.4%,收漲 2.8%,小鵬汽車盤初跌 2.6% 後收平,理想汽車早盤曾漲超 2%,收漲 0.4%。其他個股中,到收盤,叮咚買菜跌近 4%,網易跌近 3%,百度跌超 2%,京東、B 站跌 2%,騰訊粉單跌近 2%,拼多多跌逾 0.6%,而早盤轉漲的阿里巴巴漲 0.1%。

銀行股指數盤初轉漲,跑贏大盤,地區銀行大反彈。整體銀行業指標 KBW 銀行指數(BKX)收漲近 1.4%,連漲兩日,將繼續刷新 2023 年 3 月 8 日以來收盤高位,抹平去年硅谷銀行倒閉以來跌幅;地區銀行指數 KBW Nasdaq Regional Banking Index(KRX)和地區銀行股 ETF SPDR 標普地區銀行 ETF(KRE)分別收漲 4.3% 和 4%,在連跌兩日後反彈。

地區銀行中,上週五暴雷後連續兩個交易日跌超 20% 的紐約社區銀行(NYCB)反彈,收漲 18.6%,到收盤,阿萊恩斯西部銀行(WAL)漲超 7%, Zions Bancorporation(ZION)漲 4.5%,Keycorp(KEY)漲 3%。

公佈財報的個股中,預計今年銷售疲軟但公佈四季度營收和盈利高於預期後,零售巨頭 Target(TGT)收漲 12.1%;四季度營收和盈利高於預期的支付技術公司 Paymentus Holdings(PAY)收漲 20.2%;第三財季業績及全年指引高於預期的軍工股 AeroVironment(AVAV)收漲 27.9%;而四季度業績優於預期但一季度和全年指引遜色的軟件公司 GitLab(GTLB)收跌 21%;下調全年營收指引的個人造型服務公司 Stitch Fix(SFIX)收跌 21%;公佈四季度淨利潤超預期下降 10% 且下調 2024 年利潤指引後,線上票務平台 Vivid Seats(SEAT)收跌 10.4%。

波動較大的個股中,宣佈將私募發行可轉債 6 億美元、募資旨在購買更多比特幣及滿足一般企業需求後,持有比特幣最多的上市公司 Microstrategy(MSTR)收跌 21.2%;開始出售價值 17.5 億美元存托股票、募資部分用於在中國和澳大利亞的業務擴張後,鋰礦企業 Albemarle(ALB)收跌 17.8%;發行 7.5 億美元可轉債的金融服務公司 SoFi Technologies(SOFI)收跌 15.3%。

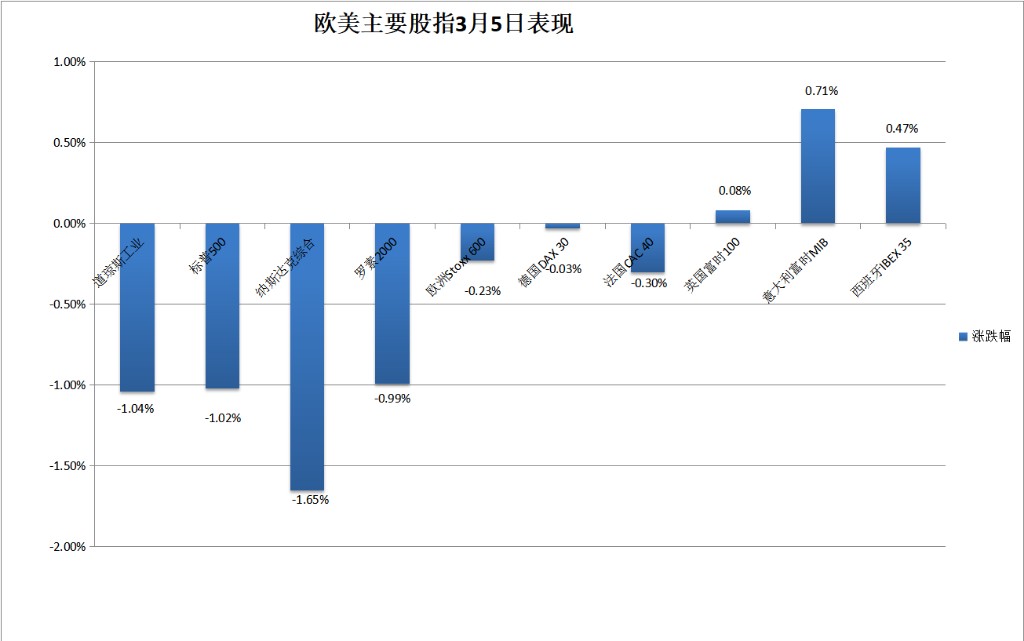

歐股方面,泛歐股指齊跌。週一微幅收跌的歐洲斯托克 600 指數繼續跌離上週五所創的收盤歷史高位主要歐洲國家股指繼續表現不一,德股連續兩日微幅收跌,仍接近上週五連續第八個交易日所創的收盤歷史高位,連漲兩日的法股回落,而西班牙股指連漲三日,週一回落的英股和意股反彈。

各板塊中,週一領漲的科技收跌 1.6%,追隨美國科技股下行,成分股中,荷蘭上市的歐洲最高市值芯片股 ASML 收跌 1.5%,跌落連續兩日所創的收盤最高紀錄;投資者關注中國今年經濟增長目標,礦業股所在板塊基礎資源跌近 0.9%,奢侈品巨頭所在的個人與家庭用品跌超 0.7%,成分股 LVMH 和愛馬仕均跌超 1%。

其他個股中,儘管公佈臨牀試驗結果顯示,旗下治療糖尿病藥物 Ozempic 可將病人罹患嚴重心臟病病及死亡的風險降低 24%,丹麥上市的歐洲最高市值藥企諾和諾德仍收跌 2.5%,跌落週一所創的收盤歷史高位,在盤初創盤中歷史新高後早盤轉跌;2 月銷售低於預期的瑞典車企沃爾沃跌 7.6%;將拆分集團計劃推遲長達三年的德國化工和製藥巨頭拜耳也跌 7.6%。

ISM 後 十年期美債收益率創逾三週新低 一度降超 10 個基點

歐洲國債價格齊漲,收益率追隨美債盤中下行。到債市尾盤,英國 10 年期基準國債收益率約為 4.01%,日內降約 11 個基點;2 年期英債收益率約為 4.27%,日內降約 3 個基點;基準 10 年期德國國債收益率約為 2.32%,日內降約 7 個基點;2 年期德債收益率約為 2.84%,日內降約 5 個基點。

美國 10 年期基準國債收益率在亞市早盤曾升破 4.22% 刷新日高,歐股盤前下破 4.20%,歐美交易時段保持下行,美股早盤美國 ISM 服務業指數公佈後,迅速下破 4.11%,刷新 2 月 8 日以來低位,較日高回落約 11 個基點,到債市尾盤時約為 4.15%,日內降約 6 個基點,在週一止住兩連降後回落。

對利率前景更敏感的 2 年期美債收益率在亞市早盤曾上測 4.61% 刷新日高,美國 ISM 指數公佈後下破 4.53% 刷新日低,逼近上週五刷新的 2 月 15 日以來低位,較日高回落超 8 個基點,到債市尾盤時約為 4.56%,日內降約 4 個基點,回吐週一反彈的部分升幅,最近六個交易日內第五日下降。

ISM 後美元指數迅速轉跌 比特幣漲破 6.9 萬美元后曾回落超 9000 美元

追蹤美元兑歐元等六種主要貨幣一籃子匯價的 ICE 美元指數(DXY)在歐股盤前曾逼近 104.00 刷新日高,日內漲約 0.1%,美股盤前曾微幅轉跌,美股早盤美國 ISM 服務業指數公佈後迅速轉跌並跌破 103.60,刷新 2 月 22 日以來低位,日內跌超 0.2%。

到週二美股收盤時,美元指數處於 103.80 下方,日內微跌,三連跌;追蹤美元兑其他十種貨幣匯率的彭博美元現貨指數日內跌不足 0.1%,連跌三日,刷新 2 月 2 日以來同時段低位。

非美貨幣中,美國 ISM 指數公佈後,歐元和英鎊迅速轉漲,歐元兑美元曾靠近 1.0880,連續兩日刷新 2 月 22 日上上週四以來高位,日內漲 0.2%,英鎊兑美元漲破 1.2730,刷新 2 月 2 日以來高位,日內漲逾 0.3%;兩連跌的日元反彈,美元兑日元在美國 ISM 指數公佈後逼近 149.70 刷新日低,日內跌超 0.5%,和上週四下測 149.20 刷新的 2 月 12 日以來低位仍有距離。

離岸人民幣(CNH)兑美元連續兩日小幅波動,在週二亞市早盤轉漲後曾刷新日高至 7.2059,歐股盤前轉跌後失守 7.21,歐股盤中刷新日低至 7.2137,較日高回落 78 點,美國 ISM 指數公佈後曾短線轉漲並收復 7.21,北京時間 3 月 5 日 5 點 59 分,離岸人民幣兑美元報 7.2121 元,較週一紐約尾盤跌 20 點,在週一反彈後回落,最近九個交易日內第七日下跌。

比特幣(BTC)在美股早盤曾漲破 6.9 萬美元,刷新 2021 年 11 月所創的歷史新高,部分平台漲至 6.92 萬美元上方,後很快跳水,美股午盤曾跌破 6.0 萬美元,較日內高位跌超 9000 美元、跌超 10%,美股收盤時徘徊 6.2 萬美元一線,最近 24 小時跌超 8%。

美油兩連跌至一週低位 布油兩日跌離近四個月高位 ISM 後短線轉漲

國際原油期貨週二大多處於跌勢,美股早盤美國 ISM 指數公佈後曾轉漲、並刷新日高,當時美國 WTI 原油逼近 79.50 美元,日內漲超 0.9%, 布倫特原油漲破 83.10 美元,日內漲 0.4%,早盤轉跌後,午盤跌幅擴大,刷新日低時,美油接近 77.50 美元,日內跌超 1.5%,布油接近 81.70 美元,日內跌 1.3%。

最終,原油連續兩日收跌。WTI 4 月原油期貨收跌近 0.75%,報 78.15 美元/桶,刷新 2 月 26 日上週一以來低位;布倫特 5 月原油期貨收跌近 0.92%,報 82.04 美元/桶,繼續跌離上週五刷新 2023 年 11 月 6 日以來收盤高位。

美國汽油和天然氣期貨繼續漲跌各異。NYMEX 4 月汽油期貨收跌約 2%,報 2.5328 美元/加侖,連跌兩日,刷新 2 月 23 日以來低位;NYMEX 4 月天然氣期貨收漲 2.14%,報 1.9570 美元/百萬英熱單位,刷新 2 月 7 日以來高位,連漲兩日。

倫銅止步三連陽 倫鎳告別近四個月高位 黃金期貨三日連創歷史新高

倫敦基本金屬期貨週二多數下跌。領跌的倫鎳跌約 1%,回吐週一領漲的大多數漲幅,和倫錫均在週一反彈後跌落各自週一所創的將近四個月來和兩週多來高位。連漲三日的倫銅也回落,告別一週多來高位。週一走出兩週多來低位的倫鉛小幅回落。而週一反彈的倫鋅小幅收漲,連續兩日創一個月來新高。

週一漲破 2100 美元的紐約黃金期貨全天處於 2100 美元上方,在週二亞市盤中刷新日低至 2118.5 美元,日內跌近 0.4%,歐股盤前轉漲後保持漲勢,美股盤前刷新日高至 2150.5 美元,日內漲 1.1%。

最終,COMEX 4 月黃金期貨收漲 0.73%,報 2141.9 美元/盎司,連漲四個交易日,連續三日創收盤歷史新高。

現貨黃金在美股盤前曾接近 2142 美元,繼續靠近創 2023 年 12 月 4 日所創的盤中歷史新高,日內漲 1.3%,美股收盤時處於 2130 美元上方,日內漲逾 0.7%。