Duan Yongping shorting NVIDIA, has NVIDIA reached its peak?

3 月 8 日晚,段永平賣出 101 張 3 月 8 日到期,行權價為 1000 的看多期權,盈利估計在 80% 以上。

上週五,英偉達劇震 11.7%,從大漲 5% 到大跌 5.5%,成交額超 1000 億美元。引發市場擔憂英偉達上漲終結,進而導致美股上漲終結。

3 月 8 日晚,段永平曬出了賣空英偉達的期權交易單。賣出 101 張 3 月 8 日到期行權價為 1000 的看多期權(即做空,總資金在 1.3 萬美元左右),該期權為末日期權(該期權最後歸零),盈利估計在 80% 以上。

段永平做空英偉達期權,是否代表不看好英偉達呢?

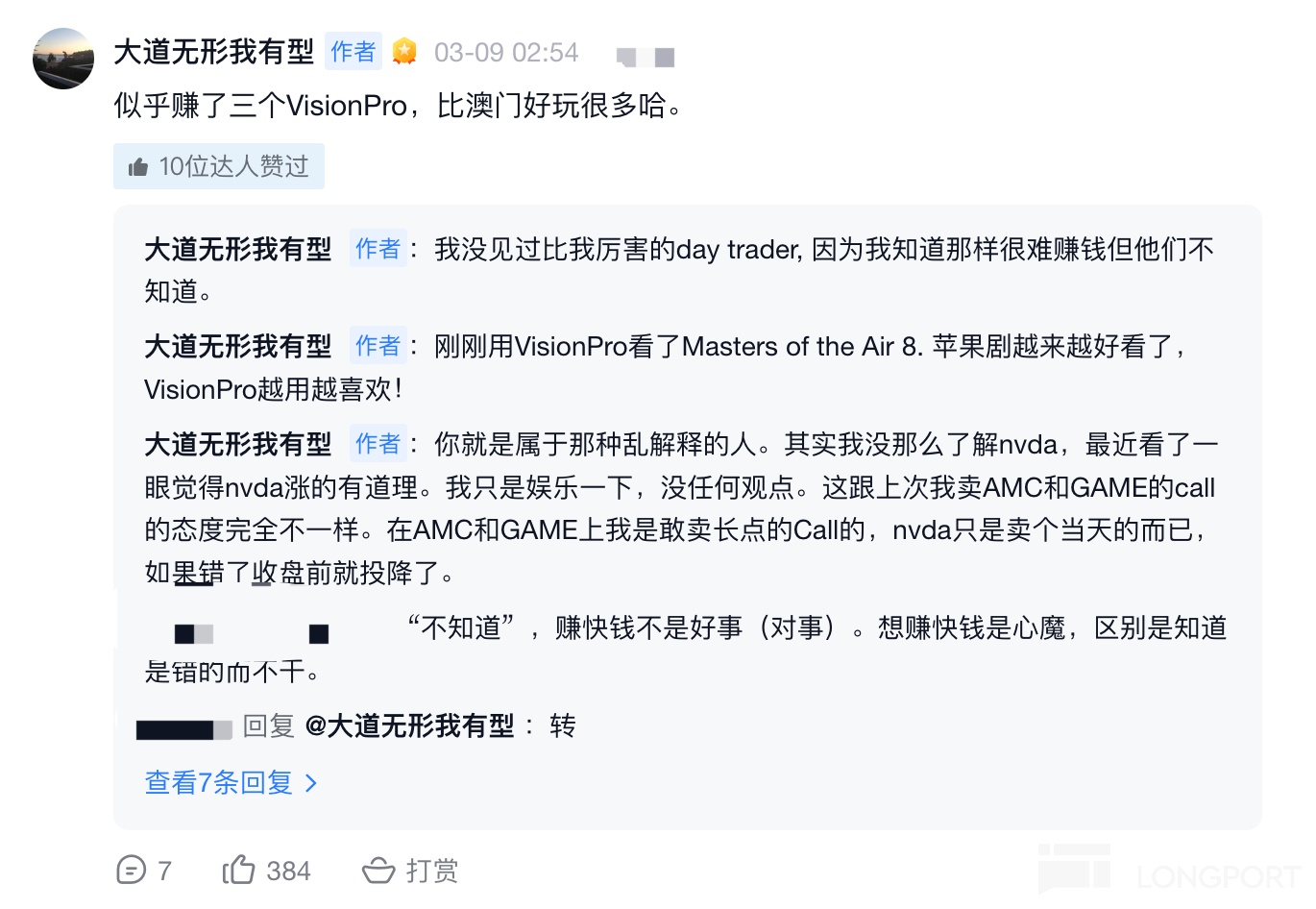

其實不然,段永平一直喜歡做短線,就算其持倉最多的蘋果,也會經常輕倉玩期權。其在社交軟件上,經常發表買賣 Call 期權、Put 期權的觀點。

段永平在隨後的回覆網友中表示:

只是娛樂一下,沒任何觀點;做空英偉達只是當天日內的交易;英偉達漲幅這麼大,有漲的道理。

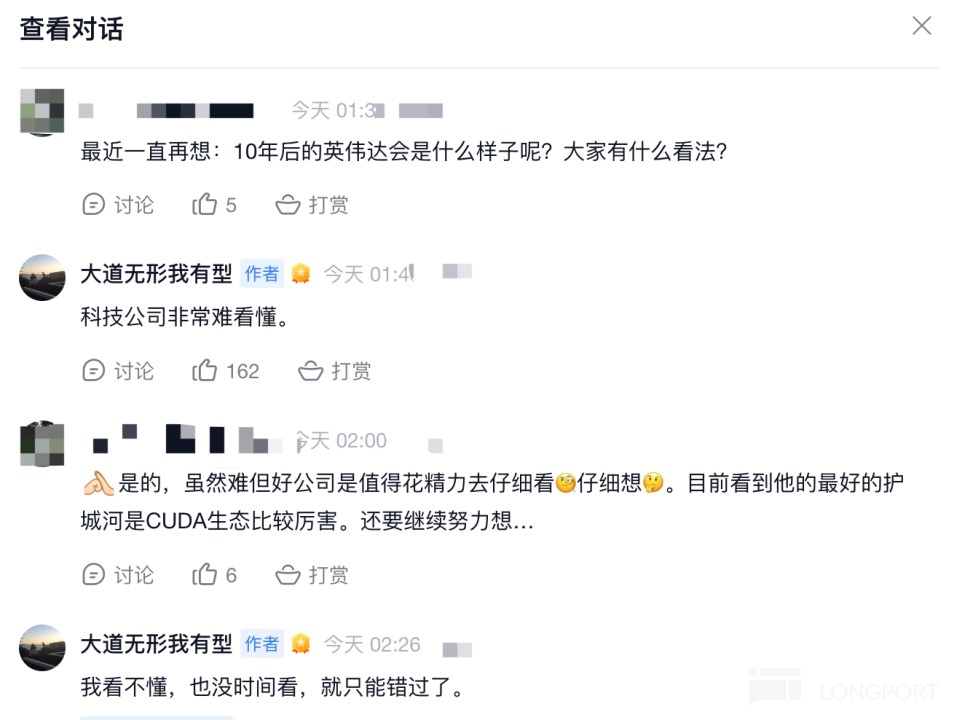

在和網友的聊天過程中,也表示了其看不懂英偉達,也沒時間看,只能錯過了。

英偉達為何下跌?

1)解釋原因之一是,大量英偉達看漲期權在上週五行權。

有分析指出,隨着週末臨近,交易員開始行使英偉達的實值看漲期權,這隨後促使期權交易商通過出售英偉達股票來解除對沖,從而導致了週五的拋售。

期權做市商在賣出看漲期權的時候,會同時買入英偉達股票來進行風險對沖。看漲期權行權後通過賣出股票解除對沖。

隨着人工智能熱情高漲,大量投資者通過期權市場押注英偉達股價上漲。有數據顯示,交易員在 2 月份的最後一週在英偉達的期權上投入了高達 200 億美元的資金,遠遠超過了 “Magnificent 7” 中其他公司。過去一個月,英偉達期權交易佔單票期權市場的 1/4。

2)由於英偉達 2 月 21 日發佈財報以來,短期最大漲幅高達 44%,導致眾多獲利盤出貨。類似於在發佈財報前,連續跌了三天,獲利盤出貨。

後市如何看?

分析認為,結合英偉達數據中心及大廠的資本開支情況,預期 2024 年(自然年)淨利潤在 550 億 +,至 2025 年(自然年)的利潤增長至 700 億 +,當前股價對應 40、 30 倍 PE 左右,還未考慮牛市帶來的估值變動,因此並不算貴。短期股價走勢影響因素太多,無法確定,但長期走勢不變。