Pre-market trading in US stocks | Bilibili leads the way as Chinese concept stocks rise across the board! BABA-SWR introduces a new "long-term cash" incentive policy.

B 站盤前大漲超 7% 領漲,小鵬、拼多多漲超 4%;上週五大跌的英偉達漲近 2%。萬國數據一度漲超 20%,金山雲一度漲超 17%,Coinbase 漲逾 6%。比特幣站上 71000 美元,以太坊突破 4000 美元。

美股要聞

1、中國國家金融監督管理總局局長李雲澤表示,正在研究降低乘用車貸款首付比,同時進一步優化新能源車險的定價機制。

2、阿里正在升級員工激勵政策:自 2024 年 4 月 1 日起新授予員工的績效、晉升的股權激勵有兩項新變化,一是純股權激勵將調整為 “股權 + 長期現金” 的激勵組合;二是加快股權歸屬和發放頻率,由原來的年度歸屬縮短為季度歸屬。

3、摩根大通表示,鑑於最新的業績表現,“科技七巨頭” 的估值相對於其他股票的偏低程度要比五年前更甚。領漲美股的這些美國科技股在相對值層面並沒有變得更貴,儘管從絕對值上來講它們可能有些過高。

4、特斯拉德國工廠最快有望週一晚恢復供電。

5、據《華爾街日報》,美國最大的天然氣生產商 EQT 公司將以每股 12.50 美元的價格收購美國天然氣採集公司 Equitrans Midstream。

6、Marvell 宣佈,與台積電的長期合作關係將擴大至 2nm,並將開發業界首款針對加速基礎設施優化的 2nm 芯片生產平台。

7、“美國貼吧” Reddit 尋求通過美國 IPO 至多募資約 7.5 億美元,據悉公司計劃將 2200 萬股股票的發行價指導區間設在每股 31-34 美元,尋求通過美國 IPO 獲得高達 65 億美元估值。

盤前異動

美股盤前,三大股指期貨下跌,恐慌指數上漲。

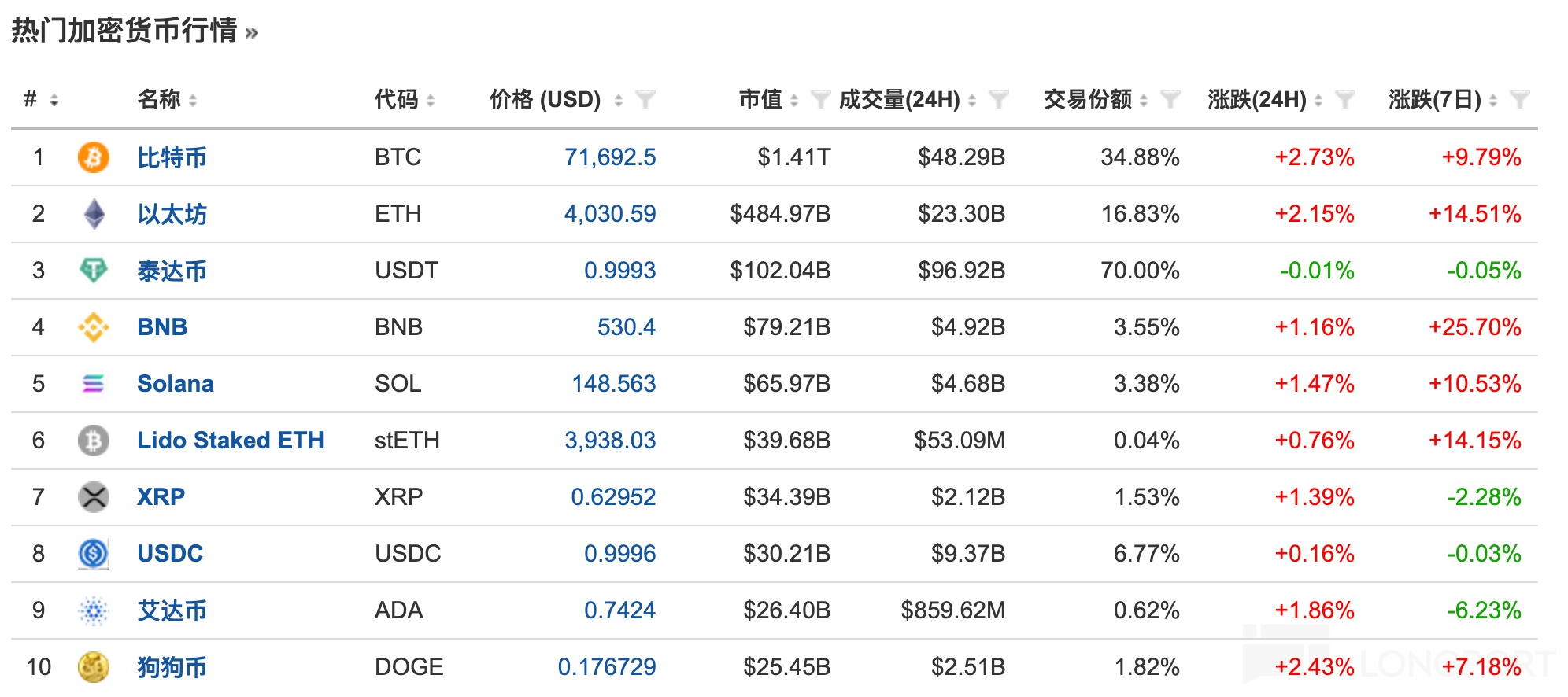

比特幣現報 71692 美元,24 小時漲近 3%;以太坊現報 4030 美元,24 小時漲超 2%。

明星科技股漲跌不一,上週五大跌的英偉達盤前漲近 2%,AMD、特斯拉、蘋果上漲,亞馬遜、微軟、Meta 下跌。

中概股大漲,嗶哩嗶哩大漲超 7% 領漲,小鵬、拼多多漲超 4%,蔚來漲近 3%,京東漲超 2%、阿里、百度、網易漲超 1%,理想汽車漲 1%。

個股方面,萬國數據盤前一度漲超 20%,高瓴等傳有意投資萬國數據亞洲數據中心。

Coinbase 盤前漲逾 6%,高盛上調其目標價至 282 美元。

金山雲一度漲超 17%,小摩上調其評級至超配。

策略回顧

1、如何理解阿里員工激勵新政策?

“增加長期現金、加快股權歸屬”,翻譯一下就是:拿到手的錢更確定了;股票到手的速度更快了。股權變成按季度歸屬,極大增強了廠友收入的流動性,拿在手裏自己再去決定出售還是繼續持有,也更有主動性。

2、本輪牛市週期關鍵時刻:平衡成長和價值投資時機到了?

如果投資者只關注科技股勢頭的減弱,你可能會預計今年晚些時候會出現回調或熊市,但這種轉向小盤股的趨勢表明情況並非如此。

3、美股真的有泡沫風險嗎?

有跡象表明,美股這種主要基於經濟韌性和強勁企業盈利的強勁勢頭並沒有轉變為投機狂熱。在所謂的美股 “七巨頭” 中,有幾隻股票的價格出現了大幅下降,這表明投資者並沒有肆意向市場投入資金。