Bitcoin falls below $69,000, speculation on the bubble theory intensifies.

I'm PortAI, I can summarize articles.

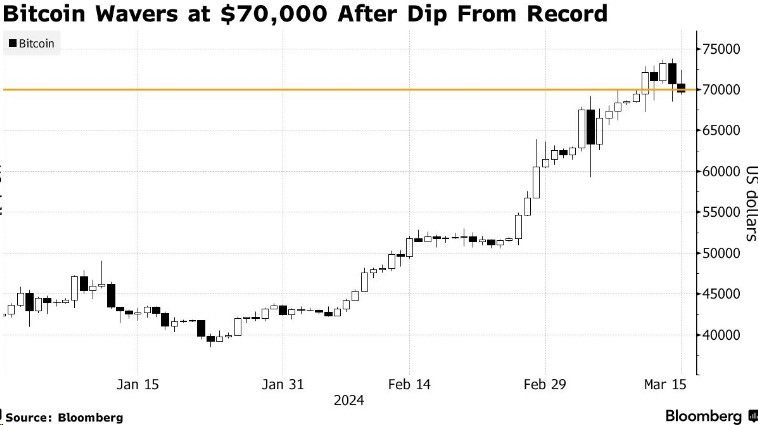

比特幣從最近的歷史高點回落,引發了關於投機泡沫的爭論。比特幣下跌約 3%,至 68631 美元,一天前創下了近 73798 美元的歷史峯值。過去幾個月,投資者對美聯儲降息的押注推動了全球股票、債券和加密貨幣的反彈,但最近的通脹壓力導致投資者重新評估這種押注。市場顯示出泡沫的特徵,引發了關於市場回調的辯論。比特幣支持者表示,淨流入交易基金和比特幣供應增長放緩將支撐比特幣價格。

智通財經 APP 獲悉,比特幣從最近的歷史高點回落,目前有關加密貨幣最新一輪牛市是否證明全球市場存在投機泡沫的爭論愈演愈烈。截至發稿,比特幣下跌約 3%,至 68631 美元,一天前創下了近 73798 美元的歷史峯值。

今年迄今,比特幣和追蹤包括以太坊在內的前 100 名代幣的指標都上漲了約 60%。

過去幾個月,對美聯儲降息的押注幫助推動全球股票、債券和加密貨幣強勁反彈,但在最近有證據顯示美國通脹壓力持續存在後,投資者正在重新評估這種押注。

美國銀行首席投資策略師 Michael Hartnett 表示,在科技 “七巨頭” 股票創紀錄飆升和加密貨幣的歷史新高中,市場正顯示出泡沫的特徵。

此番言論引發了華爾街關於許多市場是否容易受到回調影響的辯論。比特幣支持者表示,大約 116 億美元淨流入相關美國交易所交易基金 (ETF),以及比特幣供應增長即將放緩,這些因素將支撐比特幣價格。

週四公佈的一份報告顯示,美國生產者價格大幅上漲,這引發了人們的擔憂,即美聯儲控制通脹的努力遠未結束。

IG Australia Pty 的市場分析師 Tony Sycamore 在一份報告中寫道,比特幣 “受到了美國國債收益率和美元上漲的影響,而這些上漲是火熱的生產者價格通脹數據造成的。”