当市场叙事从 “AI 内存” 转向 “整体内存复苏” 时,三星的机会就来了?

摩根大通表示,HBM 执行进展和 DRAM 利润率与同业之间的差距缩小,是三星电子股价表现超越同业的关键前提。

摩根大通在最新发布的研报中,详细解析了关于三星在半导体领域的各项关键问题,包括三星高带宽存储器(HBM)业务的最新进展、DRAM 和 NAND 市场的前景、资本支出策略的变化,以及美国芯片法案对三星在美国晶圆厂投资的潜在影响。

分析师认为,尽管三星电子年初至今表现不佳,但其核心业务的盈利能力以及半导体市场的长期趋势,仍为其股票增值提供了有力支撑。而当市场叙事从 “AI 内存” 转向 “整体内存周期复苏” 时,股票可能会更积极地反应。

HBM 业务的资格认证与生产现状

三星电子在 HBM 领域的进展备受关注。对此,摩根大通在研报表示,截至 2023 年底,三星已完成与三大 GPU 客户的 HBM3 资格认证,并进入大规模生产阶段。HBM3E 12-Hi 的样品测试正在进行中,预计 2024 年第二季度开始晶圆贴片,第三季度起将大规模增产。

摩根大通估计,到 2024 年底,三星的 HBM 产能将从 2023 年底的 60k 提升至 130k/月。

2024/2025 年 HBM 业务对三星的影响

摩根大通在 2024 年 2 月的全球内存市场更新中预测,三星的 HBM 收入将在 2024 年至 2025 年达到 56 亿至 95 亿美元,较去年的 19 亿美元大幅增长。随着 HBM 芯片级密度的增加和更高高度混合比例,存在合理的上行风险。

DRAM 利润率何时接近 HBM

根据摩根大通的估计,HBM 今年的运营利润率(OPM)超过 40%,随着工艺产量的提高,有进一步改善的潜力。随着 DRAM 平均销售价格(ASP)的增长势头略强于最初的预期,预计到年底,普通 DRAM 的利润率可能会与 HBM 相似甚至更高。

DRAM 升级周期及 NAND 价格趋势

投资者还对 DRAM 上行周期能否持续到 2025 年以后表示关注。摩根大通认为,只要普通 DRAM 的比特增长率在未来两年内继续以低至中位数百分比增长,上行周期的持续时间可能会比通常更长。

摩根大通表示,NAND 价格近期上涨的原因与 DRAM 不同,NAND 价格上涨似乎更多地受到供应控制的影响,而非需求端的推动。尽管预计从 2024 年第二季度开始利用率将有所提高,但这主要是由于内存制造商的库存积累。除非企业服务器恢复早于预期,否则价格上升的可见性相对较低。

资本支出更新

研报显示,市场对资本支出的预期自年初以来有所改善,随着 DRAM 行业进入上行周期。

摩根大通预计,由于更高的晶圆厂设备采购对比基础设施资本支出,当前对内存资本支出的假设(24 财年预计为 31 万亿韩元)存在上行风险。

美国芯片法案的潜在影响

根据当地新闻报道,三星晶圆厂可能会根据芯片法案获得超过 60 亿美元的税收抵免,用于泰勒市晶圆厂的投资,三星自 2021 年以来已投资 170 亿美元。

摩根大通认为,这一潜在的税收激励占总投资的约 35%,高于台积电在亚利桑那州晶圆厂的税收激励(50 亿美元,占总投资的 13%)。

OLED 业务和移动业务的展望

摩根大通在研报中还写道,在关键客户的疲软季节性之后,柔性 OLED 的建设势头与去年相比有所减弱。由于混合比例不利(相对更多的刚性而非柔性),整体盈利影响对 2024 年上半年不利。

摩根大通预计,尽管智能手机销量下降(预计下降中个位数百分比),但由于 ASP 提高和混合比例改善(主要是由于 AI 手机销售混合比例的提高),MX 部门的盈利将保持平稳。

估值折扣趋势与同业比较

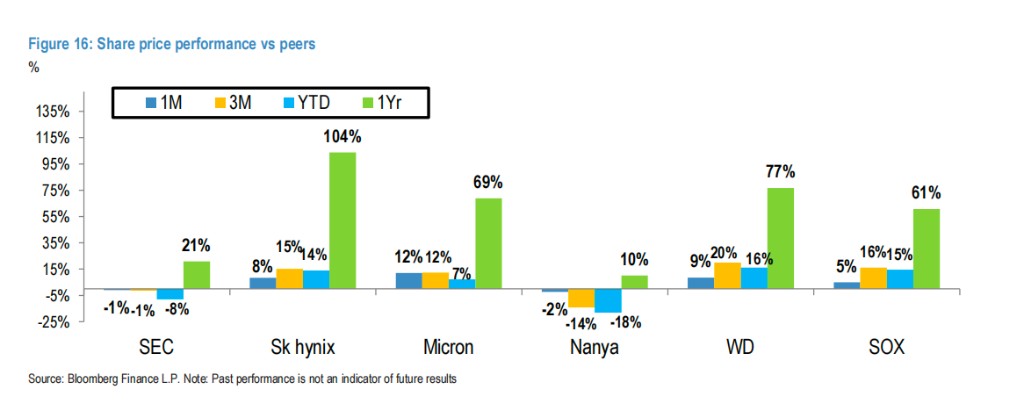

数据显示,三星电子相对于 SK 海力士的估值差距已扩大至 36% 的折扣,而 Micron 目前的交易价格约为未来 12 个月市净率的 2.2 倍,与三星电子的 1.1 倍市净率相比存在显著溢价。摩根大通认为,这种低估主要是由于市场对三星 HBM 进展的预期低迷所致。

摩根大通最后表示,HBM 执行进展和 DRAM 利润率与同业之间的差距缩小,是三星电子股价表现超越同业的关键前提。随着预计三星的普通 DRAM 利润率到年底可能与 HBM 相当甚至更高,当市场叙事从 “AI 内存” 转向 “整体内存周期复苏” 时,股票可能会更积极地反应。