财报前瞻 | HBM 吸金能力拉满! 最新业绩将为美光股价涨势 “添把火?”

華爾街大行花旗將美光科技的評級從 “買入” 調高至目標價 150 美元,預計其最新業績將為股價帶來上漲勢頭。分析師們普遍認為,美光的 DRAM 存儲芯片和 HBM 存儲系統的營收增長將有助於公司大幅縮小虧損。此外,美光還將公佈與英偉達合作的綁定新款 AI 硬件系統的 HBM 存儲細節。根據華爾街分析師預測,美光 2024 財年第二季度的收入預計將達到 53.3 億美元,淨虧損將大幅收窄。花旗分析師 Christopher Danely 預計美光未來 12 個月的潛在上行空間高達 60%。

智通財經 APP 獲悉,來自美國的存儲芯片巨頭美光科技 (MU.US) 將於美東時間 3 月 20 日發佈 2024 財年第二季度財報,華爾街分析師們普遍預計美光 DRAM 存儲芯片以及 HBM 存儲系統營收的增長速度將有助於美光大幅縮小虧損,同時還將公佈該芯片公司為全球 AI 芯片霸主英偉達 (NVDA.US) 所供應的綁定新款 AI 硬件系統的 HBM 存儲的更詳細細節。在美光公佈業績前夕,華爾街大行花旗重申對美光 “買入” 的評級,並將目標價從 95 美元大幅調高至 150 美元。美光一年來漲幅高達 70%,上週收於 93.25 美元。

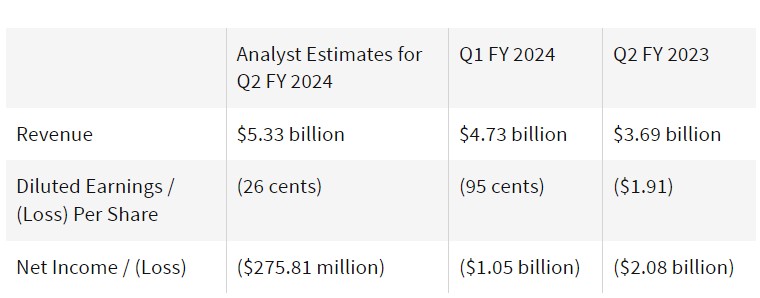

據瞭解,根據 Visible Alpha 彙編的華爾街分析師預期,分析師們普遍預計美光 2024 財年第二季度的收入將達到 53.3 億美元,高於上一季度以及 2023 年同期。數據加上預期的營收增長,該公司預計將錄得 2.76 億美元 (攤薄後大約每股虧損 26 美分) 左右的淨虧損,較上年同期高達 20.8 億美元 (合每股虧損 1.91 美元) 的虧損明顯收窄。這兩項數據都符合美光提供的季度指引。

來自花旗的知名分析師 Christopher Danely 上週在一份投資者報告中寫道:“鑑於消費電子端的 DRAM 價格強勁上漲,以及綁定英偉達新款 AI 芯片的 HBM 存儲系統售價更高、利潤率則遠高於 DRAM,我們預計該公司將公佈高於市場預期的業績,並將大幅上調 2024 財年第三季度的業績預期。”

Christopher Danely 重申該機構對於美光的 “買入” 評級,並將目標價從 95 美元大幅調高至 150 美元,意味着未來 12 個月的潛在上行空間高達 60%。此外,分析師 Danely 預計美光 2024 財年第三財季的總營收將高達 60 億美元,並且環比由虧損轉為獲利,預計 Q3 的每股收益約為 0.26 美元,主要基於 HBM 存儲系統需求激增以及 DRAM 銷售額大幅增加。

Danely 目前預計,美光 2024 財年的每股虧損約為 0.58 美元,2025 財年的每股收益有望高達 6.65 美元,而此前的預測分別為每股虧損 1.29 美元和每股收益 6.38 美元。

美光關鍵指標之一:DRAM 帶來的營收

知名研究機構 TrendForce 近日發佈報告稱,在 2023 年第四季度,整個 DRAM 存儲行業的營收規模都處於增長趨勢。“這是受美光、三星以及 SK 海力士等領先全球的製造商恢復庫存常態化的努力和戰略生產控制行為的推動。” TrendForce 在報告中寫道。

TrendForce 預計,由於價格和銷量的持續上漲趨勢,全球 DRAM 行業在第四季度的整體營收增長速度將接近 30%。該機構估計,美光在此期間佔據了 19.2% 的市場份額,成為僅次於三星和 SK 海力士的全球第三大 DRAM 製造商。

據 TrendForce 研究,展望 2024 年第一季度,全球 DRAM 行業銷售額規模預計將增長。針對第一季度的價格預期,TrendForce 集邦諮詢維持先前預測,DRAM 合約價季漲幅約 13~18%;NAND Flash 則是 18-23%。雖然目前市場對第二季整體需求看法仍屬保守,但 DRAM 與 NAND Flash 供應商已分別在 2023 年第四季下旬,以及 2024 年第一季調升產能利用率,加上 NAND Flash 買方也早在第一季將陸續完成庫存回補,因此,DRAM、NAND Flash 第二季合約價季漲幅皆收斂至 3~8%。

TrendForce 預計,第三季進入傳統旺季,需求端預期來自北美雲端服務業者 (CSP) 的補貨動能較強,在預期 DRAM 及 NAND Flash 產能利用率均尚未恢復至滿載的前提下,兩者合約價季漲幅有機會同步擴大至 8~13%。其中,DRAM 方面,因 DDR5 及 HBM 滲透率提升,受惠於平均單價提高,帶動 DRAM 漲幅擴大。第四季在供應商能夠維持有效的控產策略的前提下,漲勢應能延續,預估 DRAM 合約價季漲幅約 8~13%。

此外,需要留意的是,TrendForce 所預期的 DRAM 合約價漲幅擴大的大部分邏輯來自 DDR5 與 HBM 產品市場滲透率上升,若僅觀察單一產品,例如 DDR5,仍可能出現季跌,意即今年度的 DRAM 合約價上漲並非所有顆粒類別全面上揚,而是產品類別逐漸轉移之故。NAND Flash 合約價季漲幅則預估 0~5%。

華爾街知名投資機構 Wedbush 的分析師們則預計,美光 2024 財年第二季度的 DRAM 營收規模將達到 39 億美元,高於上一季度的 34.3 億美元和 2023 年第二季度的 27.2 億美元。鑑於美光超過 75% 營收來自 DRAM(其中包括 HBM 帶來的營收),因此 DRAM 營收規模激增將有助於大幅縮小公司虧損。

來自韓國的存儲巨頭 SK 海力士預計存儲芯片市場狀況已經從第三季度已經開始明顯改善,預計 2024 年價格與銷量將大幅改善,與三星電子的樂觀預期相呼應。

HBM——有望成為美光的 “創收新引擎”

華爾街分析師們普遍預期,美光預計將提供更多有關其為英偉達 AI 硬件系統生產的 HBM 存儲系統的更多細節。分析師們普遍預期 HBM 至少在未來三年內將成為美光營收規模增長最快的細分業務,並且其規模在未來三年左右時間裏,有望與 DRAM 以及 NAND 這兩項美光傳統業務相提並論。

美光計劃於 2024 年初 (大概 2 月份) 開始大批量生產並 HBM3E 新型存儲產品,並開始陸續交付,同時還透露英偉達是其新型 HBM 存儲產品的主要客户之一。此外,該公司強調其全新 HBM 產品受到了整個行業的極大興趣,這暗示英偉達可能不是唯一最終使用美光 HBM3E 的大型客户。美光顯然對 HBM3E 寄予厚望,因為這可能使其能夠領從 SK 海力士以及三星電子手中不斷贏得市場份額,以全面提高公司營收和利潤。

根據一些業內人士爆料,美光的 HBM3E 將支持英偉達搭載 HBM3E 的新款 AI 硬件體系——Grace Hopper GH200 超級算力體系 (該算力體系配備基於 H100 計算 GPU 和 Grace CPU),這表明美光在 HBM 領域的最新進展不僅是技術上的全面突破,也是其與英偉達合作深化的體現。據業內人士透露,英偉達即將發佈的基於 B100 以及 H200 GPU 的超級算力體系可能也將搭載美光 HBM3E。

在此前的財報電話會議上,美光首席執行官 Sanjay Mehrotra 表示,公司預計 “在 2024 財年將產生數億美元級別的 HBM 營收”,並預計強勁的增幅將持續至 2025 年。

隨着美光陸續向英偉達交付 HBM3E 存儲系統,高盛的分析師們表示,該公司可能將擴展到包括 AMD 在內的其他客户。高盛的分析師們寫道:“相信美光在深化與英偉達的合作——即在未來的 GPU 平台上獲得更高的市場份額,以及擴大英偉達以外的客户羣方面還有非常大的空間。”

HBM 是一種高帶寬、低能耗的存儲技術,專門用於高性能計算和圖形處理領域。HBM 堆疊的多個 DRAM 芯片連接在一起,通過微細的 Through-Silicon Vias(TSVs) 進行數據傳輸,從而實現高速高帶寬的數據傳輸。HBM 主要用於高性能圖形卡、AI 加速、高性能計算和數據中心服務器等領域,其高帶寬特性,以及極低延遲和高能效比使得處理器能夠更快地訪問存儲空間,大幅提高計算性能和效率。在 AI 基礎設施領域,HBM 存儲系統搭配英偉達 H100 AI 服務器系統,以及即將問世的 B100 和 H200 等 AI 服務器系統使用。

美光 HBM3E 模塊基於八個堆疊 24Gbit 存儲芯片,採用該公司的 1β (1-beta) 製造工藝製造。這些模塊的數據速率高達 9.2 GT/秒,使每個堆棧的峯值帶寬達到 1.2 TB/s,比目前最快的 HBM3 模塊提高了 44%。與此同時,該公司不會停止其基於 8-Hi 24 Gbit 的 HBM3E 組件。該公司宣佈,繼開始量產 8-Hi 24GB 堆棧後,計劃於 2024 年推出超大容量 36 GB 12-Hi HBM3E 堆棧。

知名研究機構 Mordor Intelligence 預測數據顯示,HBM 存儲產品的市場規模預計將從 2024 年的約 25.2 億美元激增至 2029 年的 79.5 億美元,預測期內 (2024-2029 年) 複合年增長率高達 25.86%。

今年以來,美光股價上漲超 13%,截至上週五收盤,過去 12 個月的漲幅超過 70%。本月早些時候,隨着分析師們強調該存儲巨頭在人工智能熱潮中的重要地位,該公司股價在今年達到創紀錄的歷史高點,花旗表示,美光在該機構美股半導體板塊的首選標的,主要因該公司受益於 AI 芯片需求激增帶來的無比強勁的 HBM 存儲需求。