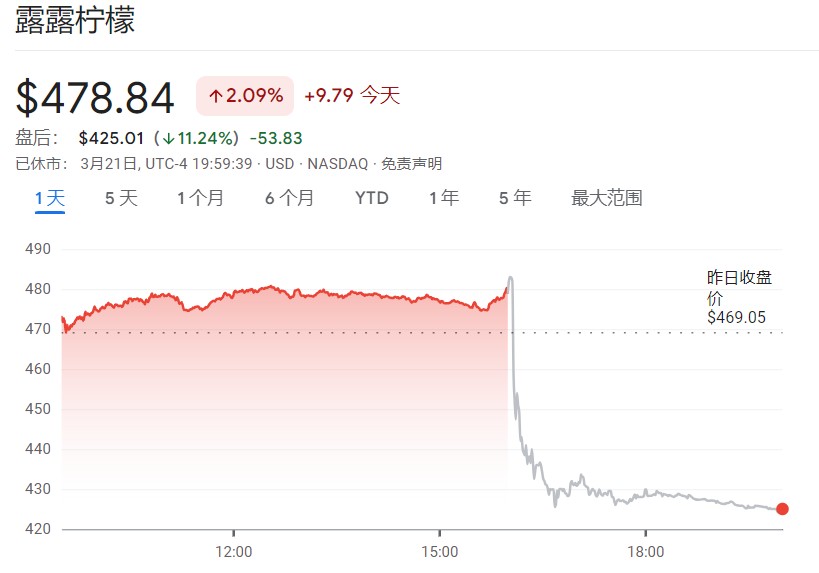

The U.S. market demand is sluggish, sales guidance falls short of expectations, Lululemon's stock price plunges by 11%

I'm PortAI, I can summarize articles.

Lululemon 預計本財年收入將達到 107 億至 108 億美元,同比增長 11% 至 12%,這一增長幅度大大低於去年的 19%。

輕奢瑜伽褲品牌 Lululemon 最新披露稱,今年伊始其美國門店銷售出現下滑,導致公司對第一季度及全年銷售指引不及預期。

消息公佈後,Lululemon 股價美股盤後暴跌 11%。

Lululemon 首席執行官 Calvin McDonald 在週四的分析師電話會議中表示,與去年同期相比,美國門店的顧客購買量全面出現下滑。

他進一步指出,美國市場今年的消費熱情相比較之下顯得有些減退,相比之下,包括加拿大在內的所有國際市場都保持了強勁的增長勢頭。

Lululemon 預計本財年收入將達到 107 億至 108 億美元,同比增長 11% 至 12%,這一增長幅度大大低於去年的 19%。攤薄後每股收益在 14.00 美元至 14.20 美元之間。

但值得注意的是,儘管面對疫情後市場的波動,Lululemon 仍然交出了亮眼的業績,持續保持兩位數的銷售增長,表現顯著優於許多美國服裝公司。

在截至 2024 年 1 月 28 日的第四財季,Lululemon 淨營收同比增長 16% 至 32 億美元;毛利率上升 430 個基點至 59.4%;攤薄後每股收益為 5.29 美元。2023 財年淨營收同比增長 19% 至 96 億美元;攤薄後每股收益為 12.20 美元。

此外,Lululemon 通常會給出較為保守的業績預測,但實際結果往往會超出預期。

分析師 Poonam Goyal 表示:“Lululemon 很可能會超出其謹慎設定的預期。” 她同時指出,特別是在海外市場與男裝產品方面,Lululemon 有很大的發展潛力。