3 月交付报告:AITO 问界破 3 万冲顶,小米上市开启新转折点

蔚來在 3 月份交付了 1.19 萬輛新車,同比增長 14.34%,環比增長 45.92%。蔚來宣佈推出最高 10 億元的油車置換補貼,油車用户購買蔚來可獲得 1 萬元的選裝補貼。蔚來還發布了 BaaS 新策,月租降價,並且煥新禮金可用於購買蔚來的新車。

對於中國新能源汽車領域而言,沒有一個月是平靜的。

4 月的第一天,理應是爭相發佈交付數據的日子,但車企似乎更青睞於發佈降價新策。

特斯拉先是上漲 Model Y 價格,後又宣佈 Model 3/Y 星空灰車漆免費,隨後是極氪 007、小鵬 G9、問界新 M7 等車型降價。

蔚來的降價方式依舊獨特,宣佈推出最高 10 億元的油車置換補貼,油車用户購買蔚來可獲得 1 萬元的選裝補貼。

一時間,降價潮蓋過了銷量日的熱度,再加上週末各家新能源車型銷量上漲,不少人認為,這是小米 SU7 扇動的蝴蝶翅膀。

一季度在圍繞小米 SU7 的喧囂中結束,二季度以各大車企開啓新一輪價格戰開始。

可以窺見,榜單與血戰將成為 4 月的主旋律,並今日揭開帷幕。

讓我們在愈發動盪的中國新能源汽車領域,看看 3 月的印記。

蔚來

3 月份,蔚來共交付 1.19 萬輛新車,同比增長 14.34%,環比增長 45.92%。

蔚來在 3 月 27 日宣佈下調一季度交付目標,從 3.1-3.3 萬台至 3 萬台。1-3 月份,蔚來累計交付 3 萬台新車,與調整後的預期相符。

瞄準油車用户,蔚來在今天宣佈推出最高 10 億元的油車置換補貼,油車用户換購蔚來 2024 款新車,可額外獲得 1 萬元的選裝基金補貼。

瞄準油車用户,蔚來在今天宣佈推出最高 10 億元的油車置換補貼,油車用户換購蔚來 2024 款新車,可額外獲得 1 萬元的選裝基金補貼。

2024 款新車上市在即,蔚來在 3 月中旬發佈了 BaaS 新策,月租降價、已支付的月租費用重新獲得購買力,且其煥新禮金可用於購買蔚來第二、第三品牌的新車。

與用户溝通完的李斌,還在當晚開啓了抖音直播,回應了 BaaS、過往言論、對理想 MEGA 及高合倒閉等話題傳聞的看法,而 3 月 28 日與雷軍合拍的視頻,進一步加強了蔚來在社交平台的傳播。

蔚來的全域領航輔助測試,也從最開始的僅招募內部員工,到招募百人領航團、千人領航團,拓展到了 招募 2 萬人的規模,萬人領航團的開啓,也是蔚來全域領航輔助功能全量推送準備的重要一步。

在子品牌方面,蔚來公佈了子品牌命名為「樂道」,李斌也在抖音「淺淺」展示了一波樂道 L60 的空間。

對於今年不打算發新車的蔚來而言,樂道將是其實現增量的重要一子,它會帶來怎樣的表現?2024 款新車的推出,會掀起新的火花嗎?

小鵬

X9 成了小鵬的「承重牆」,3 月份,小鵬共交付 9026 台,同比增長 28.91%,環比上升 98.51%,依舊未能過萬,其中,小鵬 X9 交付 3946 台。

按照 X9 的數據來算,小鵬 P5/P7i/G6/G9 四款車型加起來,3 月的交付量是 5080 台。

1-3 月,小鵬累計交付 2.18 萬輛新車,小鵬 X9 上市三個月累計交付 7872 台。從 1 月的 2478 台、2 月的 1448 台來看,節後產能恢復與個別供應鏈瓶頸的解決,讓小鵬正在兑現 X9 的產能提升諾言。

X9 上市的三個月,其在總交付量中的佔比,都在 1/3 左右,成為小鵬的主銷車型之一。

小鵬需要為自己尋找多元的、平衡的增長點,價格調整是其中一個方法。

今天, 2024 款小鵬 G9 全系價格下調 2 萬元,並推出至高 8000 元的選裝摺扣,調整後,其售價區間為 24.39-33.99 萬元。

此外,小鵬 P7i 也在 3 月 25 日迎來了 702 Max 鵬翼版,並推出兩款限定專屬顏色,售價 24.99 萬元,繼續補強 P7i 陣容。

值得注意的是,在其公眾號 3 月交付數據推文中,提到了「4 月,小鵬汽車全新品牌即將亮相北京車展」,也即何小鵬之前在百人會上提到的子品牌 MONA,該品牌將推出 10-15 萬級的 A 級車,並載有高階智能駕駛功能。

在 2024 款 G9 降價、P7i 702 Max 鵬翼版上市、新能源領域獲得新一波關注度時,小鵬 4 月的交付,回温會更快嗎?

理想

於理想而言,3 月可以算得上是「多事之秋」。

3 月份,理想交付 2.9 萬輛新車,同比增長 39.2%,環比增長 43.12%,雖與理想此前在財報會上預計的超 5 萬台相去甚遠,但相較 2 月,訂單恢復表現較佳,且成為首家累計交付七十萬輛的中國新勢力車企。

3 月 27 日, 理想將 2024 年一季度的交付目標從 10-10.3 萬輛,下調為 7.6-7.8 萬輛,下調幅度在 2.4-2.5 萬輛之間。

1-3 月,理想累計交付 8.04 萬輛新車 。

與理想此前的計劃相比,3 月交付量並非預期成績,這或許要從 MEGA 的上市説起。

3 月 1 日,理想舉辦春季發佈會,2024 款 L 系列與 MEGA 正式上市。

只是,絕大部分人都未能預料到,這場發佈會會成為理想陷入輿論泥沼的開始,直到一個月後仍留有餘波。

3 月 21 日,飽受輿論之苦的理想,似乎走出了對 MEGA 的過度狂熱之中,李想在全員內部信中稱 MEGA「讓銷售團隊大幅減少了服務 L 系列用户的時間和精力」,似要「退燒」MEGA,重新將重心放到 L 系列上。

隨後,便是訂單不及預期,理想宣佈下調一季度目標的消息,3 月份的理想奔波在輿論攻勢與戰略調整之間。

首款純電車型面臨「臉先着地」的困境、2024 款 L 系列的訂單未及預期,理想今年還有 L6 和三款純電車型要推出,而問界新 M7,今天也宣佈價格降價,被認為是對 L 系列的追擊與對 L6 的預防戰。

理想的下一步,也許會走得更為謹慎。

極氪

全新極氪 001 的起量還需要時間,3 月份,極氪交付 1.3 萬輛新車,同比增長 95.29%,環比增長 73.26%。

1-3 月,極氪累計交付 3.31 萬輛新車。

旗下兩款主力車型與小米 SU7 存在競爭關係,極氪在 4 月第一天就推出了極氪 007 後驅增強版,售價 20.99 萬元,相較於此前,購車門檻下調 2 萬元。

與其他車型一樣,極氪 007 後驅增強版依舊標配 800V,零百加速 5.4s,CLTC 純電續航里程 870km,對標小米 SU7 的意味明顯。

而在全新極氪 001 方面,新車上市首月大定破 3 萬台,3 月最後一天,全新極氪 001 的大定破 2000 台,仍表現出較為良好的訂單增長勢頭。

與此同時,極氪在 3 月 22 日正式官宣了第五款車命名為「極氪 MIX」。新車定位為五座純電 MPV,長寬高分別為 4688/1995/1755mm,軸距 3008mm,搭載時代吉利的三元鋰電池,以及衢州極電的 310kW 電機,有激光雷達可供選裝。

隨着小米 SU7 的影響,極氪要面臨的問題,除了產能,又多了一個,在全新極氪 001 叫好、極氪 007 降低門檻的情況下,極氪今年的月交付數能破 2 萬嗎?

問界

問界是新勢力中第一個交作業的,底氣自然是高分答卷。

3 月份,問界全系交付 3.17 萬台新車,環比增長 50.07%,其中,問界新 M7 交付 2.46 萬輛,正式開啓交付後的第一個完整月,問界 M9 交付 6243 台,而 M5 僅交付了 886 台。

1-3 月,問界累計交付 8.58 萬輛新車,穩坐新勢力頭把交椅。

上個月,M5+M9 的 2 月交付量是 2663 台,這個月單 M9 一款車型,便飆升到了 6243 台,仍處於產能爬升期,手握超 6 萬份大定訂單的 M9,交付數據或還能再漲。

今天,問界新 M7 宣佈全系降價 1-2 萬元,不帶激光雷達的五/六座後驅版降 2 萬元,但不贈送價值 1.5 萬元的科技包;帶激光雷達的智駕版則降價 1 萬元,依舊有價值 1.5 萬元的科技包;不帶激光雷達的五座四驅版價格保持不變。

調整後,問界新 M7 的起售價為 22.98 萬元。

問界新 M7 的降價更像是在應對即將到來的理想 L6,同為增程 SUV,後者定位 25-30 萬級,雙方才是真正意義上的對手,新 M7 此次降價,也是在向理想 L6 的定價發難。

問界在 3 月份也將全系車型進行了 OTA 升級,問界表示,其旗下全系車型「已具備了全國範圍內的高階智能駕駛能力」,兑現餘承東此前的「全國都能開」智駕諾言。

只是,在光芒萬丈的問界新 M7 與 M9 之外,M5 不到千位的交付數也值得關注。據傳,問界或在北京車展推出 M5 改款版本,二季度的問界,能再上一層樓嗎?

零跑

零跑可以説是「悶聲發財」的代表,在網上聲量不高,但在 3 月交付數據的公眾號推送裏,已經自信地打上了「站穩新勢力頭部位置」的摘要。

3 月份,零跑共交付 1.46 萬輛新車,同比增長 136.02%,環比上升 121.85%。1-3 月,零跑累計交付 3.34 萬輛新車。

緊盯着理想 2024 款 L 系列車型,零跑在 3 月 2 日發佈了其首款全球車型——零跑 C10,售價 12.88-16.88 萬元,零跑全新 C11、全新 C01 及全新 T03 也同時發佈。

與此同時,為了呼應如今車手互聯潮流,零跑在 3 月 15 日宣佈與華為將基於 HarmonyOS NEXT 鴻蒙星河版啓動零跑汽車 APP 的鴻蒙原生應用開發,加強其在生態互聯方面的實力。

從零跑發佈的 2023 年全年財報來看,儘管淨利潤虧損 42.16 億元,但虧損範圍正在收窄,毛利與現金流實現轉正,總體呈向上走的趨勢。

最近也能陸續看到零跑與 Stellantis 合作的傳聞,如外媒 Autonews 報道的零跑 T03 將在 Stellantis 波蘭工廠投產,消息難辨真假,但與 Stellantis 的合作,有助於零跑向外走的步伐。

交付量的站穩新勢力第一陣營固然可喜,下一步的零跑,會不會有更多措施,來提升車型的毛利?

哪吒

3 月份的哪吒還未能完全走出銷量困境,交付 8317 台新車,同比下降 17.55%,環比上升 36.68%。

1-3 月份,哪吒累計交付 2.44 萬新車,2022 年為 2.62 萬輛。

3 月 7 日,有媒體報道稱,哪吒南寧工廠已停工近 20 日,隨後,哪吒 CEO 張勇回應稱,南寧工廠是出口基地,其中今年就會有 5-6 萬套 KD 件的出口任務,暗指該工廠不會長期停擺。

今天的交付量海報上,哪吒還提到了其桐鄉工廠改建擴建工程,會對 3、4 月產量會有「較大影響」,將在 4 月下旬開始逐步拉產能,或在預示着哪吒 4 月交付量難看到大幅度提升。

張勇去年年末曾提到哪吒在營銷方面存在不足,今年將親自帶隊相關工作。

3 月 26 日,哪吒邀請到了投資人之一的周鴻禕一起直播,期間,周鴻禕公開批評哪吒車型命名混亂,並直指直播安排存在問題,表示哪吒不會營銷,不能將好產品介紹出去。

我們難以確定這是否為雙方安排,但可以肯定的是,這個插曲為哪吒帶來了一波流量。

隨後張勇發博:「接受老周批評,營銷向雷軍學習,不丟人!」

對於哪吒而言,即將在 4 月份上市的哪吒 L 是其重振旗鼓的重要車型。哪吒 L 能助力哪吒完成「翻身」嗎?

嵐圖

嵐圖同樣正在從春節後餘韻中恢復過來,3 月份,嵐圖交付 6122 台新車,同比增長 102.24%,環比上升 92.39%。

1-3 月,嵐圖累計交付 1.63 萬輛新車。

嵐圖在 2023 年,嵐圖夢想家、嵐圖追光、嵐圖 FREE 等多款車型上新,並在多款車型上補全了智駕拼圖。

3 月份的嵐圖,其 10 億元的置換補貼對於銷量的增長有一定刺激作用,具體來看,置換夢想家可獲得 3 萬元、FREE 2 萬元、追光插混版 1 萬元、追光純電版 5 萬元。

嵐圖的月交付數據在逐步上升,更重要的是,其所屬東風汽車集團,近期在新能源汽車領域方面的動作不斷。

先是東風奕派 007 上市,然後是東風風神 L7 亮相,後者的綜合續航達到了 1500 公里,東風表示,其目標是今年售出 100 萬輛新能源汽車,到 2025 年,實現自主與合資 1:1 的售車比例。

奕派、風神都出手了,北京車展前,嵐圖會有新動作嗎?

埃安

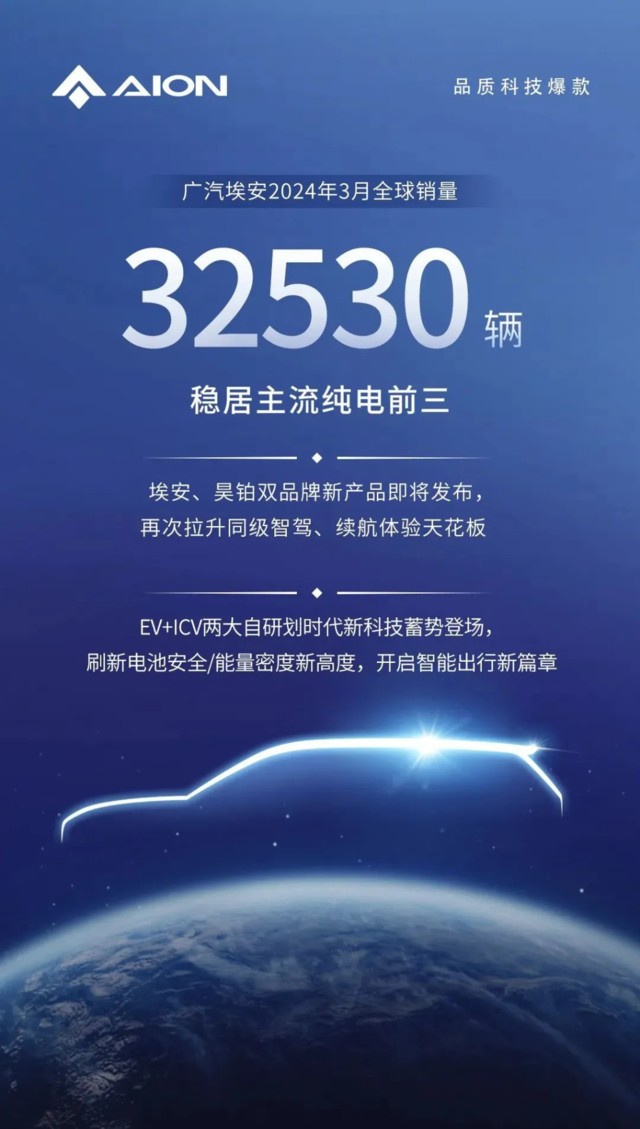

剛接盤廣汽三菱的埃安,3 月份共售出 3.25 萬輛新車,同比下降 18.71%,環比上升 95.07%。

1-3 月份,埃安累計售出 7.42 萬輛新車,2023 年為 7.83 萬輛。

3 月份,埃安對埃安 Y PLUS、埃安 V PLUS 的 80 MAX 版本進行了調整。前者上市了 9.98 萬元的 310 星耀版,響應比亞迪掀起的降價風潮,後者官降 2.3 萬元至 18.69 萬元。

同月 21 日,埃安以 20 億元接盤了退出中國市場的廣汽三菱,廣汽三菱的核心資產將用於廣汽埃安的產能擴充,目前,廣汽埃安產能為 40 萬輛/年,而 2023 年埃安的銷量超過 48 萬輛。

埃安的工廠擴產完成後,其產能將達到 60 萬輛/年。

網約車市場趨於飽和,埃安一直在尋求向上發展,但昊鉑品牌的銷量一直不盡如人意。埃安表示,埃安和昊鉑兩大品牌即將推出新產品,將再次提升智能駕駛和續航體驗水平。

埃安的向上之旅,2024 需要有更新更強的動作。

比亞迪

照例以「老大哥」比亞迪來結尾,3 月份,比亞迪售出 30.25 萬輛新車,其中乘用車售出 30.16 萬輛,環比增長 147.8%。

王朝與海洋共銷售 28.67 萬輛汽車,騰勢銷售 1.03 萬輛,仰望銷售 1090 輛,方程豹銷售 3550 輛。

1-3 月,比亞迪乘用車累計售出 62.44 萬輛。

比亞迪 3 月份銷量的大漲,離不開其榮耀版車型的推出,比亞迪自 2 月份以來,陸續推出了秦 PLUS、驅逐艦 05、漢、唐、宋 PLUS、宋 Pro、海豹、海豚等多款車型的榮耀版,增配降價,3 月份或是消費者在考慮期過後的一次爆發。

也就是在 3 月,比亞迪也迎來了第 700 萬輛新車下線,比亞迪的第 700 萬輛新車,是今天上市新款的騰勢 N7,今晚的新款騰勢 N7,售價區間為 23.18-32.18 萬元,在智駕、外觀、智能座艙上皆有升級。

比亞迪集團 2023 年銷量超 302 萬輛,比亞迪相關負責人曾在受訪時表示,2024 年,其銷量將在 2023 年的基礎上,保持 20% 以上的增長,以此推算,至少為 362.88 萬輛。

「榮耀」加持的比亞迪,能實現這一目標嗎?

結尾

今天對於不少車企而言,似乎發佈購車新政的重要性,比交付數據更為重要。

平心而論,一季度除比亞迪、問界之外,大家的成績都不算理想,大部分還處在找回自己的狀態,小部分甚至還在徘徊。

3 月份的車圈,仍在延續開年以來的詭異現象:一面是像小米 SU7 這樣的大熱產品出現,極度熱鬧,另一方面,卻是部分車企仍在找尋突破之道,暗含冷風。

2024 年是中國新能源車企的轉型之年,這樣的現象難以避免,但即便有心理準備,還是難免覺得唏噓。

無論如何,對在中國新能源車企而言,現在不是急踩剎車的時候,甚至市場不允許放慢一點腳步。

4 月的新能源領域已初見殘酷,這一見血見肉的轉型大年,會如何收尾?到時候再看吧。

本文作者:思為,來源:電動星球 N,原文標題:《3 月交付報告:AITO 問界破 3 萬衝頂,小米上市開啓新轉折點》