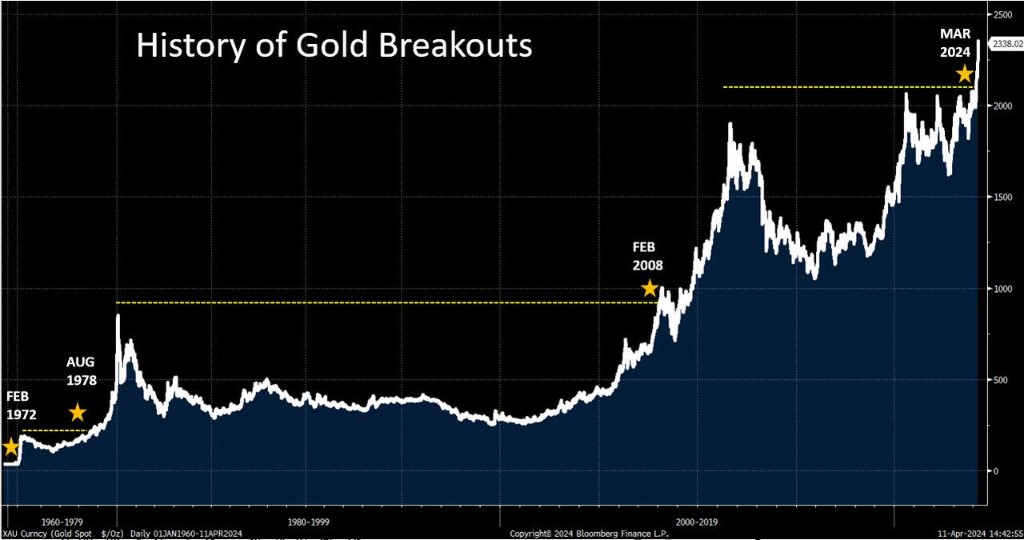

What does it mean when gold breaks through its previous high by more than 10%?

黃金價格突破歷史峯值,達到 2400 美元以上,預計未來可能翻一番至 4000 美元。瑞銀分析師認為,參考歷史數據,黃金價格突破前高超過 10% 後,漲勢將迅猛而激烈。投資者可關注實際利率和衰退情況,以決定是否追漲或迴避。黃金市場警告信號已發出,價格似乎存在錯估。美銀大宗商品策略師預計到 2025 年,金價將升至每盎司 3000 美元。白銀也將受益。

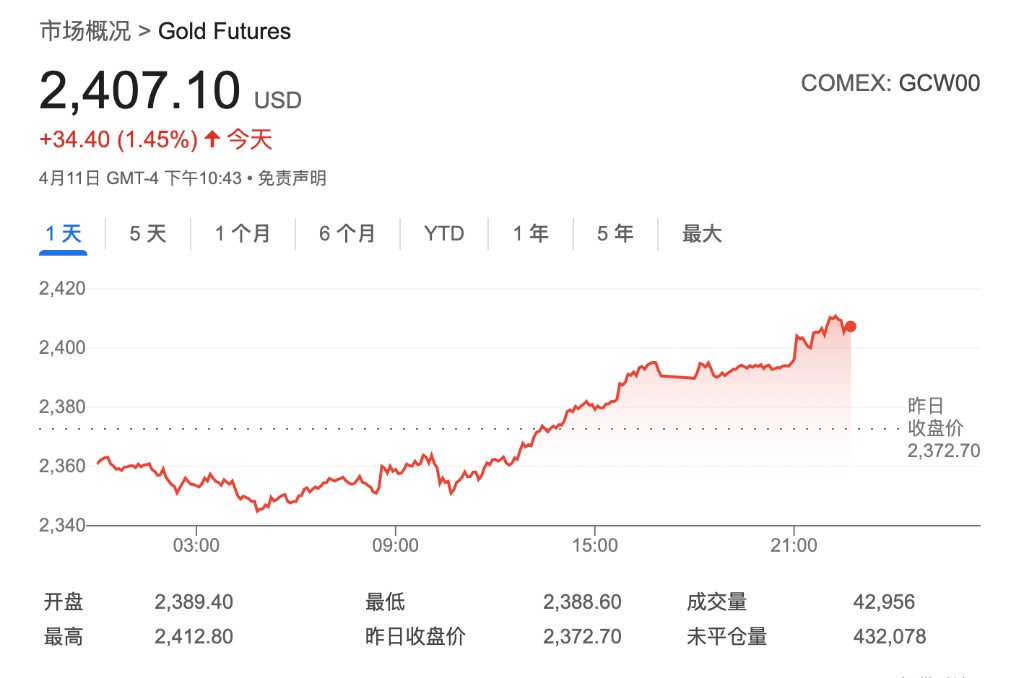

國際金價續創新高。4 月 12 日,國際金價再度上行,COMEX 黃金站上 2400 美元大關,最高達 2412.8 美元/盎司;倫敦現貨黃金則逼近 2400 美元大關,一度達 2395.34 美元/盎司,均創歷史新高。

面對當前強勁的漲勢,瑞銀依然選擇看好金價前景,他們預測金價可能會從現在翻一番:

最近金價的飆升讓我聯想到一句名言:“幾十年什麼都沒有發生,然後是幾周內發生了幾十年的事。” 歷史數據表明,金價可能會長時間處於低迷狀態,但一旦突破,漲勢往往會迅猛而激烈。投資者在決定是否追漲或迴避最近的金價上漲時,可以參考過去的行情來獲得啓發。這裏我將 “突破” 定義為金價比之前歷史峯值高出 10%。

如果歷史重演,那麼現在參與黃金漲勢還為時不晚。持有 2-3 年期的投資者可能會看到金價翻一番,漲至 4000 美元以上。獲利平倉的信號是實際利率轉負和出現全面衰退。展望未來,由於目前實際利率仍處於高位,且衰退似乎遙遙無期,因此現在宣佈金價上漲結束還為時尚早。金價突破可以被視為一個不祥的信號,也不難想象地緣政治風險可能隨之而來。對於市場而言,許多東西的當前價格似乎都存在錯估,例如極低的信用利差、高企的股票估值和温和的波動性。可以説,黃金市場已經發出了警告信號。

美銀大宗商品策略師 Michael Widmer 也在最新報告中看多黃金:

黃金和白銀是我們最青睞的商品之一,在包括加息週期結束在內的宏觀因素的綜合作用下,各國央行、中國投資者以及越來越多的西方買家推高了黃金價格。因此,我們預計到 2025 年,金價將升至每盎司 3000 美元。白銀也將從中受益,價格也將因工業需求加強而上漲,這可能在接下來的 12 個月內將白銀價格推高到每盎司 30 美元以上。

與此同時,金價目前和 10 年期美債實際利率之間出現了背離。對此,美銀首席投資官 Michael Hartnett 上週提出了一種悲觀的預測,他在最新的報告中指出,投資者正在放眼 “當下”,意識到市場或經濟不可能維持 5% 的名義利率和 2% 的實際利率,並且正在對兩件事進行對沖:

一、美聯儲在 CPI 加速上升的情況下降息的風險;

二、更不祥的是,美聯儲利率成本控制 (ICC)、收益率曲線控制 (YCC) 和量化寬鬆 (QE) 停止支持美國政府支出這一 “終局遊戲”。

簡而言之,即將發生重大突破,如果黃金的飆升導致收益率飆升,那麼就要開始倒計時,等待以下兩者之一:量化寬鬆 (QE) 和/或收益率曲線控制 (YCC)。

因為如果債券市場嗅出黃金目前正在嗅到的 “終局遊戲”,那麼鮑威爾將再次承擔防止災難性金融崩潰的重任。