AMD's first-quarter report and guidance are not bad, but the sales outlook for AI chips does not meet the market's high expectations, leading to a 9% drop after hours | Financial Report Insights

AMD 一季報好於預期,營收同比增 2%,毛利率進一步擴大,包含 AI 芯片銷售的數據中心收入、以及與 PC 市場改善緊密相連的客户端收入都同比激增 80%,而且數據中心收入創新高,但對二季度的營收指引 “沒有製造興奮度”,對 AI 加速器芯片的年銷量預期上調後僅為 40 億美元,遠遜競爭對手英偉達,盤後股價跌幅加深。

4 月 30 日週二美股盤後,在 AI 芯片領域奮起直追英偉達、在 CPU 領域不斷從英特爾手中攻城略地的半導體巨頭 AMD 發佈了 2024 年第一季度財報。

儘管公司一季報好於預期,包含 AI 芯片銷售的數據中心收入、以及與 PC 市場改善緊密相連的客户端收入都同比激增 80%,但其對二季度的營收指引符合預期 “沒有製造興奮度”,對 AI 加速器芯片的年銷量預期上調後僅為 40 億美元,遠遜競爭對手英偉達,盤後股價跌幅加深至 9%。

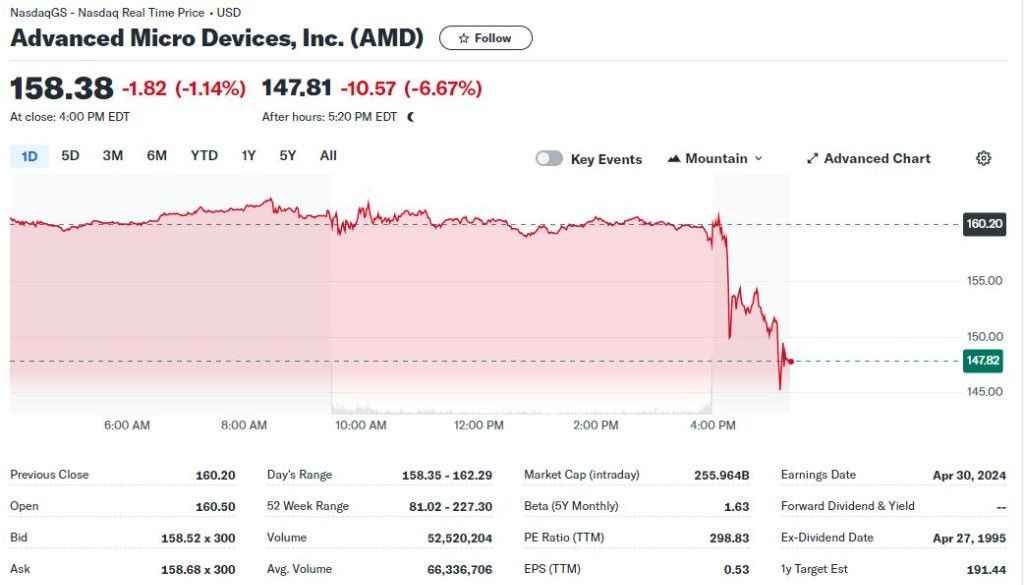

週二 AMD 收跌超 1%,止步四日連漲並脱離兩週高位,今年以來累漲 7.4%,小幅跑贏納指的累漲超 4%,但遜於費城半導體指數的年內累漲近 12%。

在人工智能增長的前景推動下,過去一年 AMD 累漲超 76%,而競爭對手英偉達則大漲近 200%。由於市場擔心 MI300 AI 芯片的年銷售額,AMD 已較 3 月初的峯值 211.38 美元回落了 25%。

在近期 32 位覆蓋該股的分析師中,有 25 人評級 “買入”,7 人評級 “持有”,無人建議 “賣出”,代表華爾街依舊態度樂觀,平均目標價 204.15 美元暗示還有近 29% 的漲幅空間。

AMD一季度營收同比增 2%,毛利率進一步擴大,上調 AI芯片年度銷售預測

得益於人工智能和個人電腦 PC 的銷量增長,AMD 的收入和盈利都同比擴張。

財報顯示,AMD 一季度營收較上年同期的 53.5 億美元增 2% 至 54.7 億美元,略高於市場預期的 54.5 億美元,但環比低於去年四季度的 61.7 億美元。

調整後 EPS 為每股收益 0.62 美元,高於市場預期的 0.61 美元和去年一季度的 0.60 美元。在 GAAP 項下,一季度淨利潤 1.23 億美元或每股收益 0.07 美元,去年同期為淨虧損 1.39 億美元或每股虧損 0.09 美元。

不過,有網友對 AI 芯片銷售給 AMD 淨利潤提供的助力並不覺得滿意。

公司一季度 GAAP 項下的毛利率同比上升 3 個百分點至 47%,非 GAAP 的毛利率上升 2 個百分點至 52%,非 GAAP 的運營利潤為 11 億美元,淨利潤為 10 億美元,盈利能力繼續加強。

業績指引方面,AMD 預計今年二季度營收約為 57 億美元,上下浮動 3 億美元,區間中點等於同比增長約 6%、環比增約 4%,持平市場預期的 57.2 億美元,非 GAAP 的毛利率將進一步增至 53%。

公司首席財務官稱將繼續推動收入增長和利潤率提高,同時投資未來的巨大人工智能機會。

但有分析指出,僅僅發佈一份略超預期的財報以及符合預期的營收指引,對期待AI迅速提供業績助力的投資者來説是不夠的,這才令 AMD 盤後股價跌幅不斷擴大。

AMD 董事長兼首席執行官蘇姿豐(Lisa Su)將今年 MI300 AI 加速器芯片的年銷售額預測從年初的 35 億美元上調至 40 億美元,而此前市場認為 60 億美元都是保守數字,失望情緒可能也參與加速盤後股價下挫。相比之下,英偉達一季度數據中心銷售額達到 184 億美元。

蘇姿豐稱,一季度 AMD 贏得了服務器 CPU 芯片的市場份額,“由於人工智能服務器的蓬勃發展,AMD 看到了對其 CPU 的需求改善跡象”。

今年一季度還是 MI300 AI 加速器推出後的首個完整銷售季度,“供應緊俏且產品供不應求”。這款 AI 芯片已被微軟、Meta 和甲骨文等超過 100 家企業和人工智能客户採用,自 2023 年四季度推出以來,該 AI 芯片的銷量已超過 10 億美元:

“對於整個行業來説,這是一個令人難以置信又激動人心的時刻,因為人工智能的廣泛部署正在推動更為廣泛市場對更多計算的需求。我們在擴大數據中心業務、以及在我們的產品組合中啓用人工智能功能等方面執行得都非常好。”

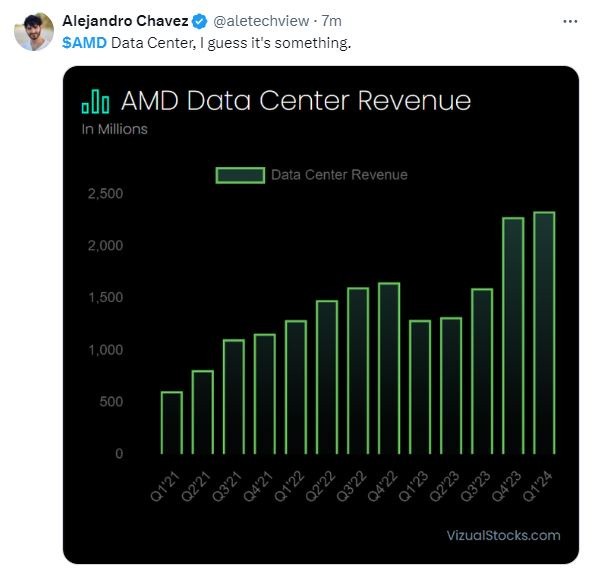

數據中心和 PC客户端收入都同比激增 80%,數據中心營收創新高且加速增長

蘇姿豐評價稱:“第一季度業績強勁,在 MI300 AI 加速器出貨量增長以及鋭龍 Ryzen 和 EPYC 處理器的採用等推動下,公司的數據中心逾客户端業務均實現了同比增長超過 80%。”

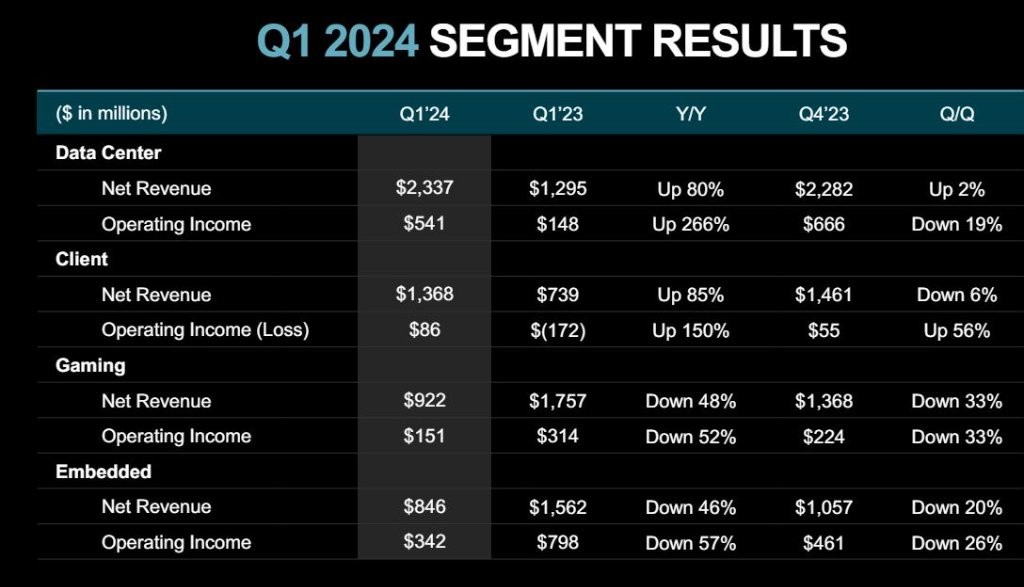

分業務來看,包含全新 AI 芯片的數據中心事業部一季度收入較上年同期的 13 億美元大幅增長 80% 至 23 億美元,創下該業務部門的歷史最高紀錄,高於市場預期的 22.7 億美元,也明顯好於去年四季度的收入同比增速 38%,代表去年底推出的人工智能 MI300 芯片功勞卓著。

有分析稱,去年四季度和今年一季度的 AMD 數據中心收入增長得 “相當可觀”。

公司稱,在 AMD Instinct™ GPU 和第四代 EPYC™ CPU 增長的推動下,數據中心收入不僅創新高且同比大漲,環比也增長了 2%,好於市場預期的環比持平,主要受益於 AMD Instinct GPU 的銷售推動。不過,該部門的收入部分被服務器 CPU 銷售的季節性下降所抵消。

包括個人電腦 PC 銷售的客户端事業部一季度收入同比增長 85% 至 14 億美元,高於預期的 12.9 億美元,主要得益於鋭龍 8000 系列 CPU 的銷售,但收入環比下降 6%。

去年四季度的客户端事業部收入曾同比增長 62% 至 15 億美元。今年一季度 PC 市場開始復甦,據 IDC 統計,全球 PC 出貨量當季增長了 1.5%,是經歷兩年下滑後首次實現增長。

但 AMD 的遊戲事業部收入同比驟降 48%、環比下滑 33% 至 9.22 億美元,顯著低於市場預期的 9.64 億美元,主要由於半定製收入減少和 AMD Radeon™ GPU 銷量下降。客户繼續管理庫存水平,令嵌入式事業部的收入同比下降 46%、環比下降 20% 至 8.46 億美元,遜於預期的 9.41 億美元。

為什麼重要和關注什麼?

瑞穗分析師 Jordan Klein 表示,AMD 擁有通過財報重塑芯片行業投資情緒的 “最大機會”,此前其股價較 3 月份的峯值處於 “絕對自由落體” 頹勢中,財報可能帶動其他芯片股反彈。

投資者最關注的兩個關鍵指標是:人工智能加速器 MI300等 AI芯片的銷量指引與 PC市場表現。AMD 和英特爾還推出了 AI 電腦,即在本地而非通過網絡便可運行生成式人工智能應用程序。

除了基於 AI 的資本支出之外,華爾街還希望 AMD 能提供進軍數據中心人工智能市場的戰略圖景。年初 AMD 曾將 2024 年 MI300 芯片的收入預期從 20 億美元上調至略超 35 億美元,但低於市場普遍預期的 60 億美元。AMD 曾稱 MI300 芯片直接對標英偉達最暢銷的 H100 系列加速器。

華爾街怎麼看?

有分析稱,AMD 企圖利用 MI300 GPU 芯片來顛覆英偉達在數據中心 AI 市場的主導地位,但在英偉達推出下一代最強 Blackwell 平台且定價低於市場預期之後,AMD 的戰略面臨較大阻礙。

不過,憑藉 Zen 4 架構和 MI300 芯片的強大護城河,華爾街對 AMD 不乏信心。瑞銀認為今年 MI300 的銷量在 50 億至 60 億美元都屬於保守估計。Susquehanna 也認為今年銷量會突破 50 億美元,“我們相信 AMD 已經積累了足夠的 MI300 預定和積壓訂單來支持其收入指引上調”。

美國銀行表示,“仍然看好服務於雲基礎設施市場的供應商”,並稱 AMD 將與英偉達、博通、邁威爾科技(Marvell Technology)和美光科技一道成為 “人工智能受益五巨頭”:

“AMD 在今年下半年復甦的故事完好無損,人工智能和非 AI 服務器的數據中心增長都是催化劑。經過長期庫存消化後,嵌入式業務也會從今年上半年的低谷中崛起。非人工智能領域將出現廣泛的週期性復甦,服務器 CPU 庫存將在去年出貨量驟降 33% 後恢復正常。”

Bernstein 認為,AMD 年初展望的今年 MI300 銷量顯著弱於市場預期,可能是客户訂單因高帶寬內存供應問題被推遲引發的,但這不能反映最終需求不振,也不會是結構性的問題,MI300 作為英偉達強大替代品的能力沒有變化:

“去年底的很多討論都集中於 AMD 在人工智能硬件市場上僅次於英偉達的潛力。市場機會看起來很廣闊,但 AMD 必須迅速行動才能將這個利好趨勢資本化,因為英偉達沒有停滯不前。MI300 勉強能與 H100 競爭,但英偉達正在推出 H200,下半年還將推出 Blackwell 芯片。”