美股期权 | 辉瑞、英特尔、Uber 成交暴涨!苹果、Palantir 成交腰斩

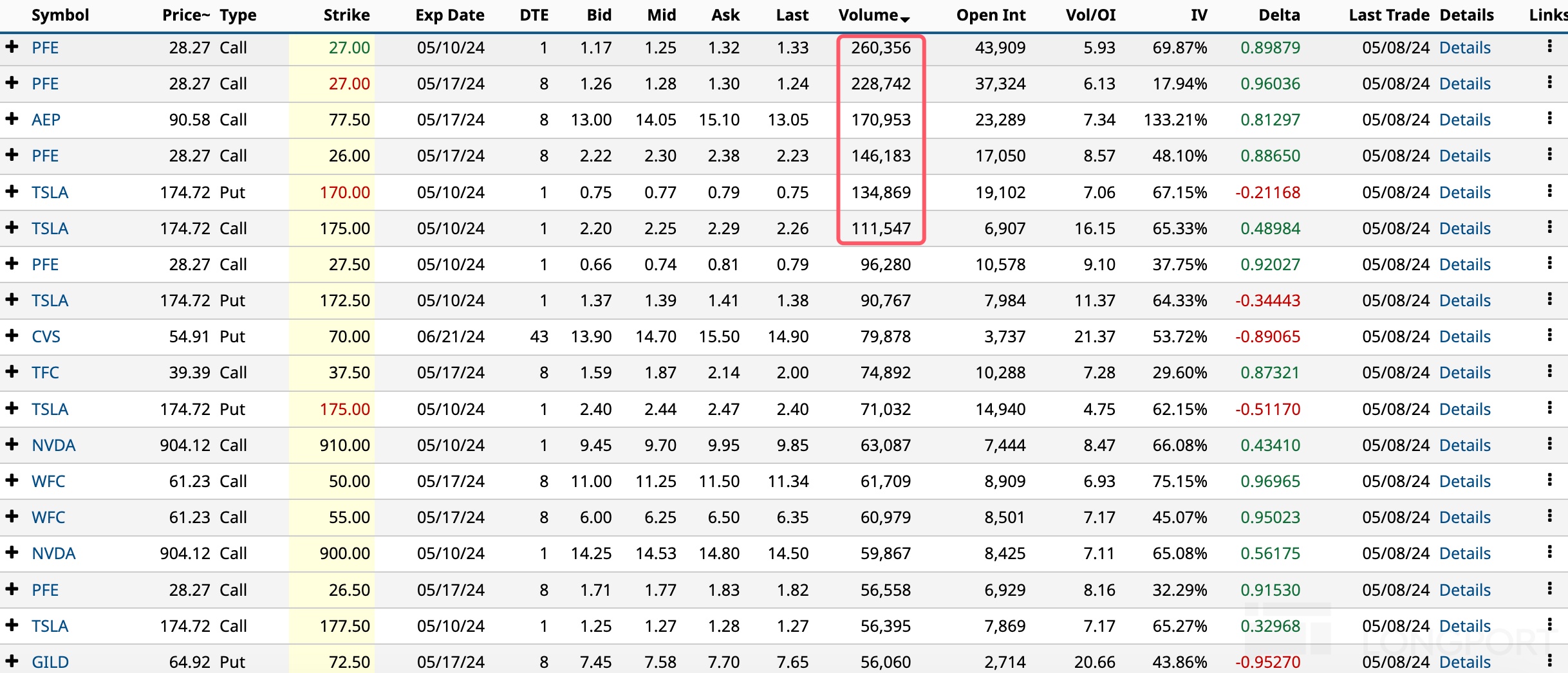

輝瑞股價漲近 2%,期權成交暴漲至 129 萬張,看漲期權佔比 96.8%。5 月 10 日到期、執行價 27 美元的輝瑞 call 成交 26 萬張,為隔夜最火合約。5 月 17 日到期、執行價 27 美元的輝瑞 call 成交 23 萬張,執行價 26 美元的輝瑞 call 成交 15 萬張。

隔夜,科技股再次拖累大盤,熱門中概股繼續下挫。

美股期權成交概覽

隔夜前十大美股期權成交:特斯拉、輝瑞、英偉達、英特爾、Palantir、蘋果、Uber、富國銀行、美國電力 AEP、Shopify。

其中:

特斯拉跌近 2%,期權成交回升至 175 萬張,看跌期權佔比 55%。5 月 10 日到期、執行價 170 美元的看跌期權成交 13 萬張,執行價 175 美元的看漲期權成交 11 萬張。

輝瑞漲近 2%,期權成交暴漲至 129 萬張,看漲期權佔比 96.8%。5 月 10 日到期、執行價 27 美元的看漲期權成交 26 萬張,為隔夜最火合約。5 月 17 日到期、執行價 27 美元的看漲期權成交 23 萬張,執行價 26 美元的看漲期權成交 15 萬張。

英偉達微跌,期權成交跌至 93 萬張,看漲期權佔比 62%。5 月 10 日到期、執行價 900 美元的看漲期權成交 6 萬張。

英特爾跌超 2%,期權成交翻倍至 65 萬張,看跌期權佔比 72.8%。

Palantir 漲近 1%,期權成交腰斬至 54 萬張,看漲期權佔比 65%。

蘋果微漲,期權成交腰斬至 53 萬張,看漲期權佔比 61.7%。

Uber 跌近 6%,期權成交暴漲至 44 萬張,看漲期權、看跌期權佔比五五開。

富國銀行漲近 2%,期權成交暴漲至 43 萬張,看漲期權佔比 95.6%。5 月 17 日到期、執行價 50 美元和 55 美元的看漲期權均成交超 6 萬張。

美國電力 AEP 漲近 1%,期權成交暴漲至 42 萬張,看漲期權佔比 99.8%。5 月 17 日到期、執行價 77.5 美元的看漲期權成交 17 萬張。

Shopify 大跌近 19%,期權成交暴漲至 41 萬張,看漲期權佔比 51.3%。

CVS 合約異動,6 月 21 日到期、執行價 70 美元的看跌期權成交 8 萬張。

TFC 合約異動,5 月 17 日到期、執行價 37.5 美元的看漲期權成交超 7 萬張。

吉利德科學合約異動,5 月 17 日到期、執行價 72.5 美元的看跌期權成交超 5 萬張。