Next week, will inflation data surprise again? Standard Chartered: US April CPI may bring a "pleasant" cool down surprise

截至 3 月,美國 CPI 已連續五個月環比增速高於預期,而 4 月可能增速低於預期。上週鮑威爾樂觀預計,未來住房成本下降可能降低核心通脹。渣打分析師稱,這種樂觀可能是合理的,迴歸分析發現,CPI 中的住房通脹指標 OER 未來幾個月將急劇下降。

上月公佈的美國 3 月 CPI同比超預期加快增長,環比連續五個月增速高於預期,核心 CPI 三個月增速高於預期,重創了市場的降息預期。上週會後美聯儲主席鮑威爾否認下一步很可能加息,但傳遞的信號顯示降息時間更不確定。有 “新美聯儲通訊社” 之稱的記者Nick Timiraos 此後撰文稱,市場認定美聯儲的傾向已經沒有那麼重要,更關鍵的是經濟和通脹數據。

美聯儲會後,下週三將公佈的 4 月 CPI 就是打頭炮的重磅通脹數據。CPI 會不會再次超預期增長,打擊市場的降息信心?渣打銀行的首席外匯策略師 Steven Englander 新近報告指出,如果密切觀察住房成本,特別是 CPI 中的住房通脹相關指標——自住房業主等價租金(OER),就會發現,有理由樂觀地預計,住房通脹可能很快下行,並且拉動核心通脹下行。

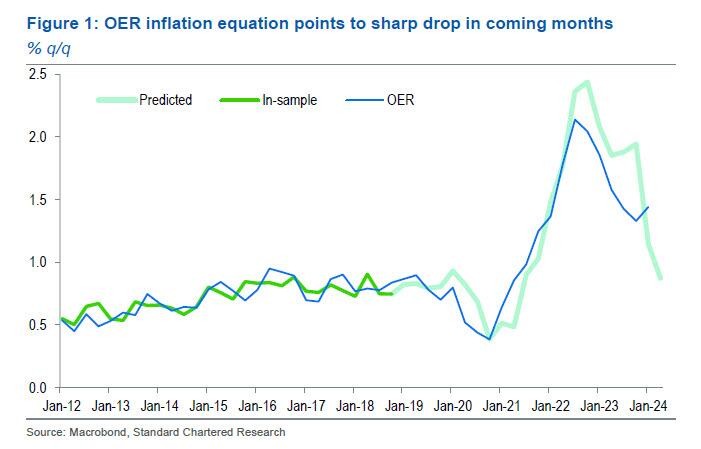

上週鮑威爾會後表現得對未來住房成本下降可能降低核心通脹有信心。如下圖所示,Englander 對實際和預測的 OER 進行了迴歸分析,發現 “鮑威爾的樂觀情緒可能是合理的”,因為分析顯示,“基於近年來已證明穩定的迴歸,未來幾個月 OER 將急劇下降”。

Englander 的分析基於美聯儲和美國工統計局(BLS)研究人員構建的新租户租金和所有租户租金實驗系列,即使在 2012 年到 19 年間估算,迴歸也能給出良好的 OER 樣本外預測。從圖表中可以看出,迴歸結果表明,今年第一季度的 OER 上漲是一種異常現象,未來幾個月將恢復下行壓力,而且下行壓力 “可能急劇”。

Englander 預測的第二季度平均 OER 通脹僅環比增長 0.29%,和 2015 年到 2019 年的普遍幅度相差不遠,較今年一季度的 OER 環比增速 0.48% 放緩。這是很重要的變化,因為 OER 在核心 CPI 中的權重達到 33%,所以 OER 這種預測幅度的增速放緩將會讓核心 CPI 環比下降 0.06 個百分點,這意味着,如果有更多的 CPI 組成部分通脹降温,核心 CPI 增速將可能比預期水平 0.3% 低,增速放緩至 0.2%,甚至可能更低。

Englander 分析 OER 追蹤的是滯後的私人部門市場租金數據,該領域的數據最近已經下降。他認為,OER 通脹未來幾個季度將繼續疲軟。他的結論是,這種 OER 放緩將激勵人們預期通脹會重啓下行,且降幅足以讓美聯儲開始降息。

同時,Englander 指出,他的結論有兩大失誤的風險。一是 BLS 和美聯儲關於新租户和所有租户租金的實驗數據是按季度發佈的,因此,他對季度變化的判斷可能是正確的,但對月度變化的判斷可能有誤。去年 BLS 改動了測算方法,這意味着,OER 目前依據單户出租房屋的小樣板進行估算,這帶來了 OER 數據隨機波動的可能。二是,對單户住宅的大量需求可能導致租金不成比例地上漲,並將持續這樣上漲。不過,大多數業主會鎖定較低的抵押貸款利率,不會面臨住房成本增加。

Englander 提及,他注意到上週鮑威爾説了這樣一句話:考慮到目前市場租金的情況,我仍然預計,這些租金將隨着時間推移體現在可衡量的住房服務通脹中。Englander 指出,鑑於一季度的 OER 通脹較高,鮑威爾這種對住房通脹的信心讓他吃驚。而且,鮑威爾看來不再專注於所謂的超級核心通脹——剔除食品、能源和住房租金的服務,轉而關注降低的租金通脹作為降息的充分理由,這一點也讓他吃驚。