SoftBank's net loss for the 23rd fiscal year decreased by 76.5% year-on-year, achieving profitability for two consecutive quarters!

人工智能投資熱潮下,軟銀 2023 財年虧損大幅收窄,得益於去年中旬上市的 Arm,軟銀淨資產創下歷史最高紀錄。

人工智能的滾滾浪潮,正在把軟銀從科技股投資泥潭中拉出來——連續兩個季度實現盈利,去年全年虧損大幅收窄。

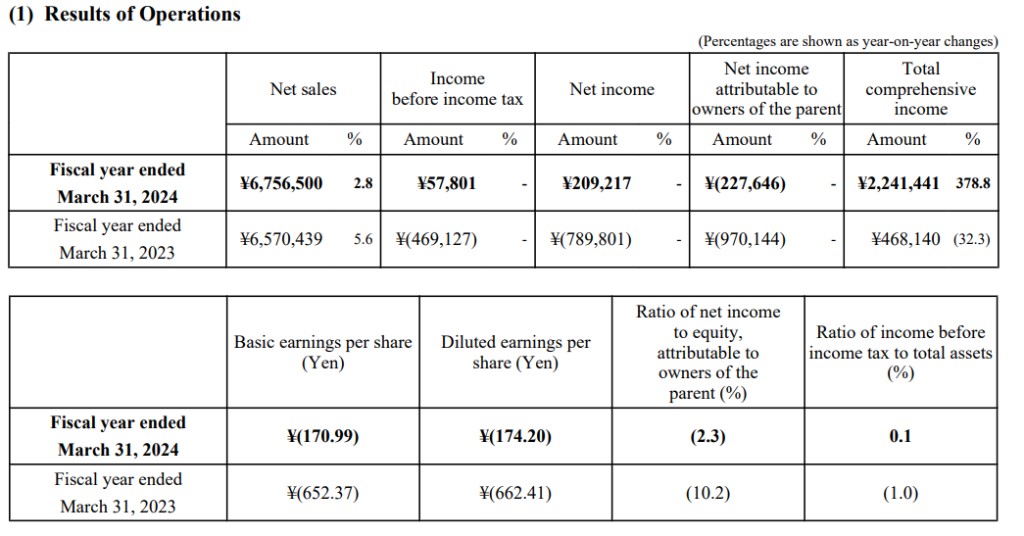

軟銀週一公佈財報顯示,軟銀 2023 財年(截至 2024 年 3 月 31 日)全年銷售淨額同比增長 2.8% 至 6.76 萬億日元(約合 433.8 億美元),但不及市場預估的 6.81 萬億日元;全年歸屬母公司股東淨虧損 2276.5 億日元,同比減少 76.5%,且好於市場預估虧損 2830.9 億日元。稀釋後的每股虧損為 174.2 日元,去年每股虧損為 662.41 日元。全年股息 44 日元,符合市場預期。

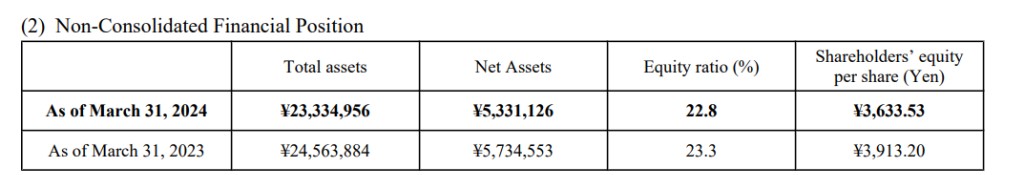

截至 2024 年 3 月 31 日,軟銀淨資產達到 5331.1 億日元,創下歷史最高紀錄。據軟銀 CFO 後藤芳光在財報發佈會上表示,這主要得益於去年中旬上市的 Arm。

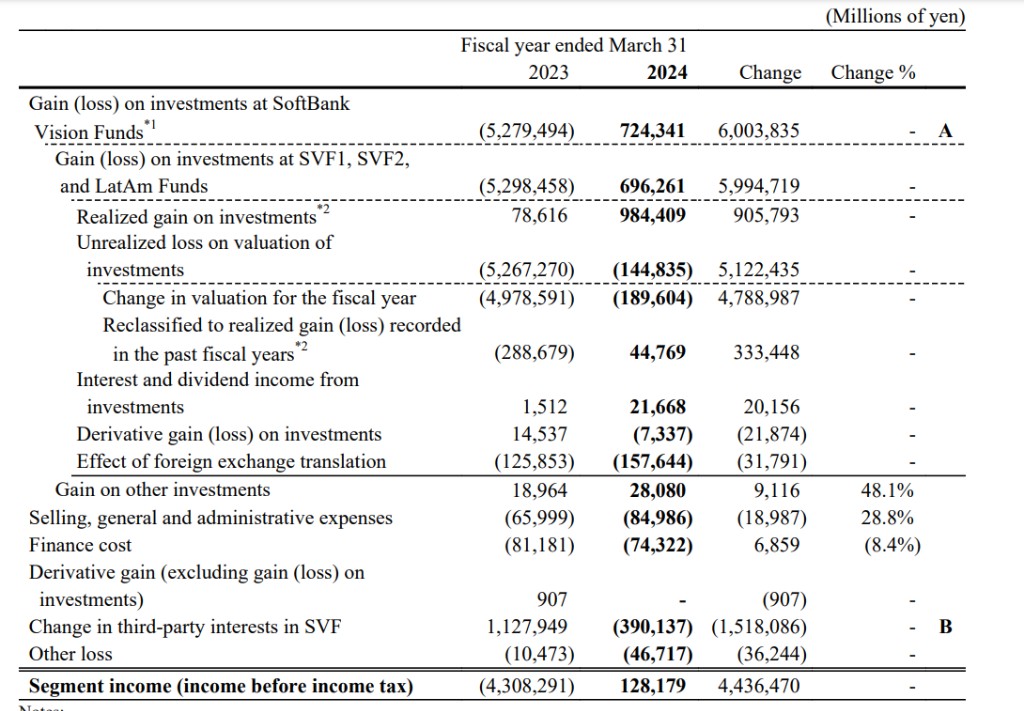

軟銀願景基金部門全年投資利潤(包括投資 Arm)為 7243.4 億日元,去年虧損 5.28 萬億日元;部門全年利潤 1281.8 億日元,去年虧損 4.3 萬億日元,但不及市場預估 3620 億日元。

從單季度來看,軟銀第四季度銷售額為 1754.6 億日元,同比增長 3.5%,歸屬母公司股東淨利潤 2310.8 億日元,為連續第二個季度盈利,2022 年同期虧損 576.3 億日元。

其中,軟銀願景基金部門第四季度投資虧損 575.3 億日元,同比下降 76%,此前已連續三個季度實現盈利;第四季度願景基金虧損 967.4 億日元,不及市場預估的盈利 1851.4 億日元,2022 年同期虧損 2975.4 億日元。

Arm,軟銀的希望

多年以來,軟銀創始人孫正義一直在談論 AI 和機器人技術的潛力,但軟銀仍然踏空了生成式 AI 的投資,沒有成為 OpenAI 等當紅初創 AI 公司的創始人。不過,生成式 AI 的積極前景推動軟銀旗下設計公司 Arm 的市值飆升至 1100 億美元。

Arm 於 2023 年 9 月 4 日在美股納斯達克全球精選市場上市。此次 IPO 中,Arm 出售了 1.03 億股美國存托股 (ADS),相當於已發行普通股的 10%,並獲得了 51.2 億美元收益,出售收益並未計入集團綜合損益表。

財報還顯示,2023 財年,軟銀通過使用阿里巴巴股票的預付遠期合約籌集了 43.9 億美元。

軟銀投資阿里巴巴股票已實現和未實現的估值損失為 9599 億日元,被衍生收益 15174 億日元所抵消,該衍生收益來自使用阿里巴巴股票的預付遠期合約,單獨記錄為 “衍生收益(不包括投資損益)”。

軟銀第四季度的淨利潤有所改善,主要是因為軟銀通過阿里巴巴籌集的資金緩解了願景基金價值減記的一些影響。