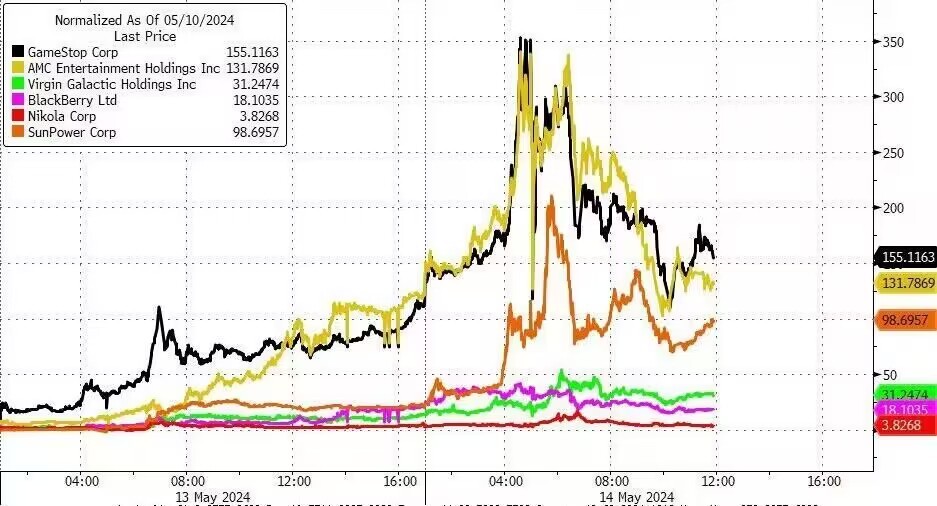

"The Return of the King"! GME and AMC surged for the second consecutive day, everything seems to be repeating the events of 2021

GME 和 AMC 隔夜暴漲 60% 和 32%,均創 2021 年以來新高。耳機制造商 Koss 上漲 40%,黑莓手機上漲 12%,特百惠上漲 17%,“美股散户大本營” Reddit 上漲 7%,網紅券商 Robinhood 上漲近 7%。

美股 “散户的王” Keith Gill 高調回歸、重返社交平台 X的第二天,散户朝着 meme 股再度發起猛攻,逼空行情持續高調上演。

其中視頻遊戲零售商 GameStop(GME)和電影集團 AMC Entertainment(AMC)股價繼續飆漲。在週一分別斬獲 73% 和 77% 的驚人漲幅後,隔夜 GME 和 AMC 各自繼續暴漲 60% 和 32%,創下 2021 年 6 月和 2021 年 1 月以來最大漲幅。

此外多隻散户抱團股隔夜紛紛大漲。耳機制造商 Koss 股價上漲 40%,黑莓手機股價上漲 12%,特百惠上漲 17%,“美股散户大本營” Reddit 股價上漲 7%,網紅券商 Robinhood 股價上漲近 7%。

自上週五收盤以來,GME 股價幾乎上漲了兩倍,市值躍升至約 180 億美元。週一 GME 和 AMC 的交易量分別達到其 20 天平均水平的 15 倍和 20 倍。

這種驚人對空頭的暴擊不可謂不大。分析公司 Ortex Technologies 表示,週二空頭的賬面損失高達 16 億美元,自週一以來的總損失已經達到 24 億美元。

S3 Partners 預測分析董事總經理 Ihor Dusaniwsky 表示:

週二的損失將使許多空頭情緒失控,他們會通過買入回補將 GME 的股價推得更高。

對於這種癲狂的市場走向,有空頭表示十分困惑。香櫞創始人 AndrewLeft 就表示:

這很荒謬,但都是自由市場的一部分。

也有分析師認為這種投機行為主導的市場行情不太可能持續太久,如今的形勢和 2021 年不同,比如利率就已經顯著提升。

值得注意的是,PIMCO 前首席投資官、老債王 Bill Gross 開始選擇一種更加 “躺賺” 的方式。他的策略核心是賣出"年化波動率 400%"的股票,因此在週二賣出了 GME 和 AMC 的看漲和看跌期權,組成跨式期權(straddle),押注 GME 和 AMC 在一定期限內保持區間震盪,不會走出單邊行情,這樣他就能從每份 straddle 裏 “白嫖” 22 美元的期權費。

“散户暴打華爾街” 已經進入 next level 了嗎?