AI server "one-stop" capability is unique! Morgan Stanley: The market still underestimates Foxconn

大摩認為,鴻海獨特的 CMMS 模式有望提升 AI 服務器業務利潤,預計 2025 年的 AI 服務器收入和利潤將分別同比增長 30% 和 126%,此外 iPhone 組裝業務也持續性好於預期。

代工龍頭鴻海(富士康母公司),或將成為 AI 浪潮中下一個脱穎而出的明星。

儘管鴻海台股股價今年以來大漲 62%,但摩根士丹利指出,其 AI 服務器相關的潛力未被市場充分認識,表現遜於緯創資通、廣達電腦、技嘉科技等 AI 服務器 ODM 同行。

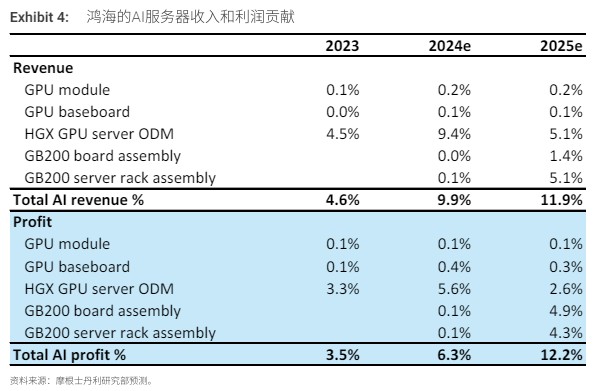

大摩指出,鴻海近期憑藉獨創的 CMMS 模式贏得 AI 服務器項目,預計 2025 年該項目將貢獻 12% 的利潤,利潤總額同比增長 20%。

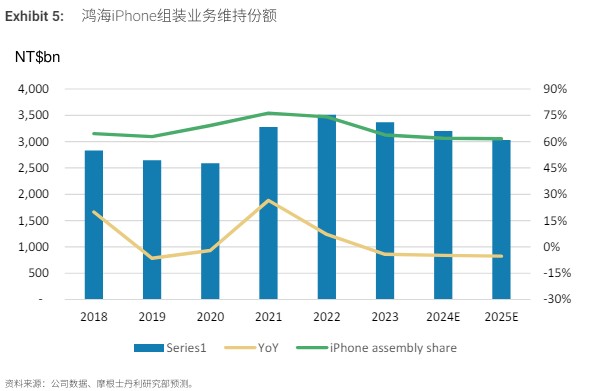

另一方面,iPhone 組裝業務持續性好於預期,即將推出的新款 iPhone 中可能加入 AI 功能,有望因置換需求而帶來出貨量增長,大摩預計鴻海今明兩年的 iPhone 組裝份額將保持在 60% 左右。

鑑於鴻海 2025 年盈利同比增長前景更為強勁,大摩重申對鴻海的超配評級,並將目標價上調至新台幣 210 元,較目前有 23.5% 上漲空間,對應 15.6 倍 2025 年前瞻 PE,目前鴻海 12 個月前瞻 PE 為 12.6 倍,低於同行 15-20 倍的 PE。

CMMS 模式有望提升 AI 服務器業務利潤

大摩認為,鴻海利用其 CMMS(零組件模塊化快速出貨與服務)經營模式,贏得了英偉達 GB200DGX/MGXNVL72/36 旗艦項目的電路板組裝項目和服務器機架集成工作。

鴻海提供的差異化 CMMS(零組件模塊化快速出貨與服務)經營模式,除了服務器組裝/機架集成外,還負責 GB200NVL72/36 服務器機架的主要電路板組裝(計算板、交換機托盤、智能網卡、DPU 等)。

這將使鴻海能夠通過提供各種類型的電路板組裝產生增量利潤,在處理 GB200 服務器機架組裝工作方面,鴻海擁有更強的技術訣竅和組裝專業能力,從而在 AI 服務器 ODM 同行中脱穎而出,這也有助於增加相關的利潤貢獻。

大摩預計,隨着 GB200 相關服務器機架出貨量攀升(DGX 將於 2025 年上半年出貨,MGX 將於 2025 年中期出貨),鴻海 2025 年的 AI 服務器收入和利潤將分別同比增長 30% 和 126%。

我們預計鴻海明年的 AI 業務收入將達到 256 億美元(同比增長 30%),其中 46% 來自英偉達 HGXGPU 服務器,54% 來自 GB200NVL72/36 服務器機架解決方案。

得益於其 CMMS 模式,我們預計鴻海明年的 AI 業務利潤將同比增長 126%,達到 18 億美元,其中 40% 來自高附加值的電路板組裝,35% 來自大規模的 GB200 機架集成工作。

根據大摩測算,2025 年鴻海將從 AI 服務器業務中獲得 18.33 億美元的利潤,佔總利潤的 12%。其中,由於附加值較高,與 GB200 相關的電路板組裝將佔相關利潤的 40%,其次是與 GB200 相關的機架組裝工作,佔 35%(得益於收入規模的擴大)。

iPhone 組裝業務持續性好於預期

另一方面,大摩認為,即將推出的新款 iPhone 中可能加入 AI 功能,有望因置換需求而帶來出貨量增長,今明兩年鴻海的供應份額將維持在 60% 左右。

從 2023 年 1 月到 2024 年 2 月,與服務器 ODM 同行相比,鴻海股價表現不佳,其中一個重要原因是市場擔心其 iPhone 組裝業務會因立訊精密的份額增長和 iPhone 出貨量飽和而失去動力。

基於鴻海今年保持了 iPhone 組裝份額和整體 iPhone 出貨量前景,管理層最近表示,其消費品業務今年同比有望持平,這比市場擔心的同比可能下降 10-15% 要好得多。

我們現在預計鴻海今明兩年的 iPhone 組裝份額將保持在 60% 左右⸺立訊精密的份額增長主要來自於和碩相關資產的轉讓。我們的 iPhone 出貨量預期與覆蓋蘋果的分析師 ErikWoodring 的預測一致,即今年同比下降 6%,2025 年同比增長 9%。因此,iPhone 組裝收入將相當穩定,今年預計為新台幣 32010 億元,明年為新台幣 30320 億元,同比降幅分別為 4.9% 和 5.3%。

此外,大摩還提醒關於近期股價催化因素:1) 5 月 14 日的 2024 年一季度業績電話會議上報告 AI 服務器業務最新動態;2) 6 月 4-7 日的中國台北國際電腦展,英偉達 GB200 服務器機架演示;3) 6 月 10-14 日的蘋果全球開發者大會,潛在的 AI 功能介紹。