Dow Jones Industrial Average closes above 40,000 points for the first time, gold and copper hit new highs, silver and nickel surge, GME plunges again

降息預期回升,道指創新高且連漲五週,標普和納指連漲四周創三個月最長,納指科技指數本週漲超 3%。谷歌三日連創新高,與 OpenAI 合作的 Reddit 一度漲 17% 至歷史第二高,遊戲驛站大跌 20% 令散户抱團股承壓。中概股指跑贏美股大盤,房多多跳漲 311% 盤中熔斷,海底撈美股 IPO 首日漲 53% 後收漲 14%。歐美國債收益率本週後期 V 型翻轉,週五齊漲脱離一個月低位。美油月內首次升破 80 美元,布油上逼 84 美元且三週來首次單週累漲。美元周跌 0.8% 徘徊一個月低位。期金首次收高於 2400 美元,白銀盤中漲超 6%,周內倫鎳漲超 11%、銅錫漲 6%。

美國諮商會領先經濟指標在 4 月環比下滑 0.6%,弱於預期和前值的回落 0.3%。有分析稱,這是該指數連續兩個月回落,表明 “美國經濟增長面臨嚴重阻力”。消費者對商業狀況的前景惡化、新訂單疲軟以及新屋建造許可減少等因素都加劇了降幅。

歐元區 4 月通脹同比增長 2.4%,與 3 月持平,增強了歐洲央行最早 6 月開始降息的市場預期。有分析稱,今年歐洲通脹降幅將快於此前預估,因紅海衝突造成的影響比預期要小。歐盟委員會稱明年下半年通脹重返 2% 的目標,多位央行票委讚揚通脹緩解進程。

美聯儲理事、票委鮑曼重申,如果美國通脹降温停滯或走勢反轉,將願意支持加息,由於其對重新加息持開放態度,推動美債收益率漲幅迅速擴大至日高。

道指新高且收盤首次升破 4萬點,谷歌三日新高,房多多大漲 311%,海底撈盤中漲 53%

5 月 17 日週五,美股三大指數集體小幅高開,但開盤半小時,科技股居多的納指率先轉跌。標普 500 指數大盤無法持續站穩 5300 點上方,在開盤 40 分鐘轉跌。

午盤前,除道指外的主要指數均在漲跌之間徘徊,尾盤時標普重新轉漲,納指接近收復全部跌幅,藍籌股匯聚的道指尾盤漲幅擴大,史上首次收高於 4 萬點,但小盤股轉跌無緣 2100 點。

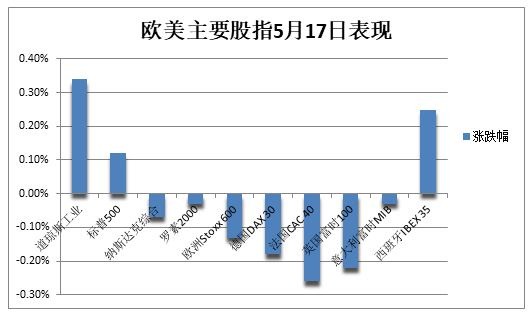

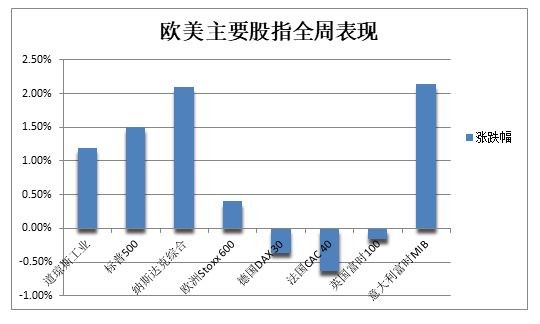

截至收盤,道指創歷史新高,全周累漲 1.2% 且連漲五週。標普和納指均逼近週三所創的歷史新高,全周分別累漲 1.5% 和 2.1%,且均自 2 月份以來首次連漲四周:

標普 500 指數收漲 6.17 點,漲幅 0.12%,報 5303.27 點。道指收漲 134.21 點,漲幅 0.34%,報 40003.59 點。納指收跌 12.35 點,跌幅 0.07%,報 16685.97 點。

納指 100 微跌,衡量納指 100 科技業成份股表現的納斯達克科技市值加權指數(NDXTMC)跌 0.27%,從歷史最高連跌兩日,但本週分別累漲 2.1% 和 3.1%。

羅素 2000 小盤股指數跌 0.03%,本週累漲 1.7%,“恐慌指數” VIX 跌 3.5% 不足 12,逼近 2019 年 11 月 27 日收盤位 11.75,本週累跌 4.54%。

美股指數單週累漲,道指週五創新高且收盤首次升破 4 萬點 本週信息技術和房地產板塊領漲大盤,分別累漲 3% 和 2.5%。緊隨其後是分別累漲 1.8% 和 1.7% 的醫療保健和通訊服務板塊。非必需消費品和工業板塊最差。不過,週五科技板塊跌 0.5%。

工業板塊在本週唯一收跌,科技和金融股表現亮眼

摩根士丹利認為美國經濟軟着陸仍是最可能實現的場景,但將發生概率從 80% 降至 50%,預期標普大盤到年底下跌 15% 至 4500 點。該行與貝萊德都預計美聯儲將在 9 月開啓降息,今年或降息三次。巴克萊預警潛在的滯脹和地緣政治風險或令投資者措手不及。

明星科技股多數上漲。“元宇宙” Meta 跌 0.3%,亞馬遜漲 0.6% 仍徘徊月內低位,蘋果轉漲至近四個月高位,微軟轉跌 0.2% 從一個月新高連跌兩日。奈飛漲 1.7% 至一個月新高。谷歌 A 漲超 1%,連漲五日且連續三天創歷史收盤新高。特斯拉漲 1.5%。

芯片股多數下挫,但 AMD 漲超 1%,連漲四日至一個月最高。費城半導體指數高開低走,轉跌 0.7% 並失守 5000 點關口,從兩個月高位連跌兩日,但離 3 月上旬所創歷史新高不遠,且本週累漲 3.6%。英偉達跌約 2%,繼續脱離約兩個月高位,但本週漲 2.9% 並連漲四周;英偉達兩倍做多 ETF 跌約 4%;英特爾跌 0.6% 脱離三週高位;Arm 跌超 3%,利好財報後應用材料高開 2.5% 但轉跌近 1%。

AI概念股漲跌各異。Palantir 和 C3.ai 漲近 1%,SoundHound.ai 轉跌 1%,甲骨文漲超 1%,連漲四日至近六週最高,BigBear.ai 跌超 3%,超微電腦和 Snowflake 跌近 2%,硅谷人工智能基礎設施硬件獨角獸 Astera Labs 跌 0.7%,阿里巴巴 ADR 最高漲超 4%,延續昨日漲 7% 的表現。

消息面上,有報道稱 Snowflake 洽談以超過 10 億美元收購谷歌和 Meta 研究員們創辦的大語言模型初創公司 Reka AI。英偉達支持的 AI 雲供應初創公司 Coreweave 從黑石、凱雷集團和貝萊德等投資者中籌集 75 億美元以推動人工智能計算。蘋果或計劃明年推出明顯更薄且更貴的 iPhone。

微軟計劃下個月將《使命召喚》最新遊戲納入訂閲服務,對視頻遊戲銷售策略進行重大調整。英國反壟斷機構不再調查微軟與法國初創公司 Mistral AI 的合作,但歐盟要求微軟在月底前提供 Bing 搜索引擎生成式 AI 功能所產生風險的充分信息。

中概股指跑贏美股大盤,但尾盤漲幅收窄。ETF KWEB 漲 0.3%,CQQQ 漲 0.2%,納斯達克金龍中國指數(HXC)漲 1.7% 後收漲 0.4%,盤中曾升破 7000 點,至去年 9 月以來的八個月最高。

熱門個股中,京東漲近 3%,百度跌近 2%,拼多多和阿里巴巴漲約 2%;騰訊 ADR 跌 0.4%,B 站漲 2.5%,蔚來漲 0.3%,理想汽車跌超 1%,計劃 2026 年推出首款飛行汽車的小鵬汽車漲 0.4%。海底撈旗下特海國際(HDL)美國 IPO 首日盤中最高漲 53%,收漲 14%。法拉第未來漲 136% 後暴跌並觸發熔斷,收跌超 38%,本週仍累漲超 2100%。

中國人民銀行出台三項房地產金融政策穩樓市,令貝殼美股盤前一度漲超 9%、房多多漲超 450%。開盤後,貝殼漲 7% 後收漲近 2%,連漲七日至 14 個月最高;房多多一度大漲 412% 並觸發熔斷,創 2020 年 6 月以來最大漲幅,最終收漲 311% 至八個月最高。

其他變動較大的個股包括:

散户集中的 “美國貼吧” Reddit 漲超 17% 後收超 10%,創 3 月下旬上市後的第三高紀錄,與 OpenAI 達成合作協議,內容將被引入 ChatGPT 等產品中,後者可利用論壇數據訓練 AI 模型。

散户抱團概念股熱情消退,遊戲驛站跌近 20%,本週漲幅從 271% 大幅收窄至 27%,計劃增發最多 4500 萬股 A 類股,稱財務狀況未出現重大變化,但一季度初步銷售額下滑且不及預期。AMC 院線週五跌超 5%,單週漲幅也從 308% 收窄至 51%。

主打鄉村風和懷舊商品的美國餐廳 Cracker Barrel Old Country Store 跌超 14%,至 2012 年初以來的十二年新低,將大幅削減 80% 的股息分紅以支持轉型計劃。

企業技術堆棧 IT 公司 DXC Technology Company 低開 21% 後收跌 17%,創 2020 年 9 月以來的近四年新低,儘管財年四季度的業績超預期,但下季度盈利和收入指引不佳。

美國最大零售商沃爾瑪漲超 1%至歷史最高,昨日曾因財報利好而大漲 7%,作為成分股支撐道指上漲。網紅互聯網券商 Robinhood 漲 12%,美銀轉而看漲、將評級提升兩檔至買入。

安達保險漲 3.6%,連續兩日創歷史新高,最近兩日累漲 8.4%,在 “股神” 巴菲特旗下伯克希爾哈撒韋披露持倉的情況下,創 2020 年以來最大兩天漲幅。

歐股週五普跌,泛歐 Stoxx 600 指數從歷史新高連跌兩日,受工業和科技股拖累,週三曾結束九日連漲,但本週累漲 0.4% 且連漲兩週。瑞士奢侈品集團厲峯漲超 5%,全年銷售額創新高。

德國股指全周累跌 0.4%,脱離週三所創的盤中歷史最高。法國股指全周跌 0.6%,英國股指全周跌 0.2%,但負債較深的歐元區外圍國家意大利與西班牙的股指全周均漲 2%。

歐美國債收益率本週後期 V型走勢,週五齊漲並脱離一個月低位

美聯儲理事鷹派發言,令對貨幣政策更敏感的兩年期美債收益率在美股午盤漲幅擴大至日高,升 4 個基點至 4.83%,重返 4.80% 上方,收復週三以來跌幅。10 年期基債收益率升 5 個基點至 4.42%,升破 4.40% 關口,收復週三來過半跌幅,與短債收益率均脱離一個半月低位。

全周,兩年期美債收益率累計下行 4.4 個基點,10 年期基債收益率累計下行 8.4 個基點,在過去三週中有兩週累跌。30 年期長債收益率全周累計下行 8.5 個基點並連跌三週,期間跌去 22 個基點。有分析稱,這是因為美國經濟領先指標暗示增長面臨嚴重阻力。

最近幾周,美聯儲官員對開啓降息態度謹慎,稱仍在等待更多表明通脹持續放緩的證據。金融市場普遍認為夏季結束前不會降息,首次降息將發生在 9 月且今年多次降息。巴克萊資本等華爾街最大的一羣債券空頭建議,逢高賣出 10 年期美國國債。

歐債收益率週五走高,擺脱週三所創的一個月低點,本週在發佈美國 CPI 通脹後與美債收益率均出現 V 型走勢,基本抹去週三以來跌幅。歐元區基準的 2 年期與 10 年期德債收益率尾盤均升約 6 個基點。10 年期英債收益率升 5 個基點,與意債一道在本週累跌 4 個基點。

美油月內首次升破 80美元,布油上逼 84美元且三週來首個單週累漲,天然氣躍升

美國和中國等消費大國的經濟指標增強了需求端改善的希望,國際油價日內漲幅擴大:

WTI 6 月原油期貨收漲 0.83 美元,漲幅 1.05%,報 80.06 美元/桶至 4 月 30 日來最高,月內首次站上 80 美元整數位心理關口,全周累漲 2.3% 且連漲兩週。

布倫特 7 月原油期貨收漲 0.71 美元,漲幅 0.85%,報 83.98 美元/桶至 4 月 30 日來最高,全周累漲 1.4%,為三週來首次單週累漲。

美油月內首次升破 80 美元至兩週高位

有分析稱,中國經濟數據和刺激措施、美國商用石油庫存連降兩週,以及俄羅斯的石油基礎設施又一次遇襲,均有助於提振短期油價。後續重點關注 6 月 1 日的 OPEC+ 產量會議。

而美國通脹數據放緩,強化了美聯儲在不久將來開始降息的理由,導致美元兑其他主要貨幣貶值,也有利於油價。摩根士丹利還認為,今年全球石油需求的增長速度將高於歷史趨勢。

此外,在夏季需求高峰之前的庫存緊張支撐了天然氣價格。美國 6 月天然氣期貨週五漲超 5%、全周累漲超 16%。歐洲基準的 TTF 荷蘭天然氣期貨週五漲近 2% 且連漲四日、全周漲超 3%。

美元抹去日內漲幅,單週跌 0.8%徘徊一個月低位,日元與人民幣小幅走低

衡量兑六種主要貨幣的一籃子美元指數 DXY 在歐股時段漲 0.3% 至 104.80,美股尾盤轉跌並重返 104.45,接近昨日所創的一個月最低,本週累跌 0.8%,5 月已累跌 1.7%。

有分析稱,這是因為在通脹降温和美國經濟疲軟的跡象下,市場對美聯儲從 9 月起降息的押注升温,年內或降息 47 個基點。

歐元和英鎊兑美元小幅抬升,均徘徊在近兩個月高位。日本央行維持購債規模不變,日元兑美元小幅走低至 155.66,脱離一週多高位,維持 1990 年日本資產泡沫破裂以來的低位水平。離岸人民幣兑美元下跌百點並失守 7.23 元,抹去週三以來大部分升幅。

主流加密貨幣普漲。市值最大的龍頭比特幣漲 2% 並升破 6.64 萬美元,至 4 月 22 日以來的近四周最高。第二大的以太坊漲超 4% 並重返 3000 美元關口上方,創兩週高位。

期金與紐約銅創收盤歷史最高,白銀創十一年高位站上 31美元,倫鎳單週漲超 11%

由於歐美央行的降息預期改善,金價連漲兩週且本週累漲近 2%,銀價本週大漲 11%,面臨持續結構型供應赤字的鉑金本週漲近 9% 並觸及一年高點。

COMEX 6 月期金週五收漲 31.90 美元,漲幅 1.3%,收報 2417.40 美元/盎司,創歷史收盤最高。7 月期銀收漲 1.38 美元,漲幅 4.6%,收報 31.26 美元/盎司,創 2013 年 2 月 8 日來收盤最高。

週五現貨白銀最高漲 6.4% 至 31.51 美元/盎司,期銀最高漲 6.3% 至 31.77 美元/盎司,均為十多年來首次突破每盎司 30 美元,日內不斷突破 2013 年 2 月以來最高,帶動 iShares 白銀 ETF 漲 6.4% 同創十一年最高。夜盤中,滬銀期貨主力合約突破 8000 元/千克,漲超 5%。

現貨黃金最高漲 1.8% 或漲超 42 美元,不僅升破 2400 美元整數位心理關口,還上逼 2420 美元,創 4 月 12 日以來的一個月盤中新高,當時金價曾以逾 2431 美元創下歷史最高。

在避險需求、供應鏈干擾,以及金融和工業需求旺盛的背景下,銀價漲勢比黃金還要迅猛。年初至今白銀累漲超 31%,超過累漲 17% 的黃金,成為今年表現最佳的主要大宗商品之一。

倫敦工業基本金屬普漲:

經濟風向標 “銅博士” 週五收漲 2.3%,站穩 1 萬美元整數位心理關口上方,全周累漲 6.6%。7 月 COMEX 紐約期銅收漲 3.6% 至 5.05 美元/磅,創歷史收盤最高。

由於全球第三大鎳產地發生騷亂影響產量,倫鎳週五漲近 1300 美元或漲 6.5%,接連升破 2 萬和 2.1 萬美元兩道關口,全周漲超 11%。

倫鋁漲 1% 並升破 2600 美元,全周漲 3.2%。倫鋅漲 2.4% 並升破 3000 美元,全周漲 3.5%。週五微跌的倫鉛全周漲 2.8%。倫錫漲 1.6% 升破 3.4 萬美元,全周漲 6.7%。

此外,國內期貨主力合約在夜盤多數上漲,純鹼收漲約 4.8%,LPG 漲約 2.4%,苯乙烯漲約 2.2%,鐵礦石漲 0.4%。氧化鋁夜盤漲超 4.2%,滬鎳漲超 3.4%,滬銀收漲超 6%,滬金漲 1.6%。