零跑距跻身一线新势力还有多远?| 见智研究

零跑的下一個目標,還是穩定的實現自我造血

5 月 17 日晚,零跑汽車率先公佈今年第一季度的財報。作為國內二線造車新勢力中的佼佼者,零跑汽車在一季度慘烈的價格戰下,保持住了銷量增長,淨虧損出現收斂。

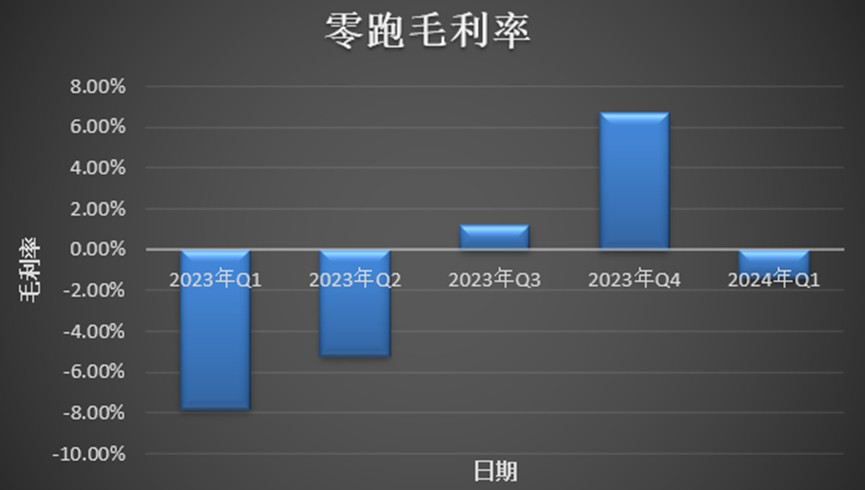

不過負面影響仍然存在,領跑一季度毛利率水平重新轉負。

具體來看,零跑 Q1 在實現營業收入 34.86 億元,同比增長 141.7 %,環比降低 33.9%;毛利率水平重新跌回負數為-1.4%,同比增長 6.4 個百分點,環比降低 8.1 個百分點;淨虧損有所收斂,為 10.1 億元,同比降低 10.6%,環比增長 6%。

1、今年海外市場將提供增量,助力零跑汽車實現全年銷量目標

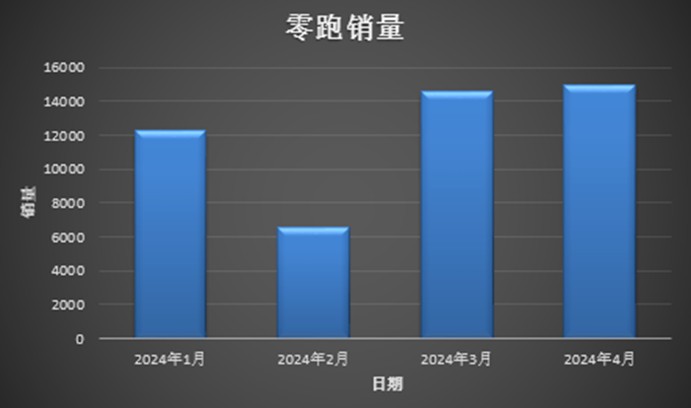

今年第一季度,零跑汽車的總銷量高達 3.34 萬輛,同比增長 217.9%。該銷量不僅在二線造車新勢力行列中名列前茅(哪吒 2.4 萬輛,極氪 3.3 萬輛),還超越了小鵬的 2.2 萬輛和蔚來的 3 萬輛。

零跑汽車全年銷售目標在 25 萬輛-30 萬輛,同比增長 73.6%-108%。

這一目標並不低,零跑要完成目標則需要在接下來 3 個季度環比增速達到 40% 以上。

海外市場有望提供部分增量貢獻。5 月中旬,零跑汽車與 Stellantis 集團宣佈正式成立 Leapmotor International B.V.(零跑國際)合資公司,由零跑汽車提供產品技術,由 Stellantis 集團提供全球市場資源和影響力。

具體來看,作為全球第四大汽車集團,Stellantis 在全球擁有一萬多家經銷商,零跑有望直接利用這些現成的海外經銷商渠道,將零跑汽車旗下首兩款產品 TO3 和 C10 率先帶到海外進行銷售。

目前,零跑汽車的海外市場已經開始進入初期的產品導入階段。零跑汽車預計,將在今年第三季度就全面完成出海產品認證並在歐洲正式開啓銷售,計劃年底前將歐洲銷售網絡拓展至 200 家,並同步進軍印度、亞太、中東、非洲以及南美的新能源汽車市場。

2、毛利率再次由正轉負

零跑汽車在去年三季度首度實現毛利率的轉正,並維持到四季度。但在今年一季度,零跑汽車的毛利率重回負數,環比降低 8.1 個百分點至-1.4%。

在慘烈的價格戰背景下,零跑汽車的毛利率環比下滑超 8 個百分點,超市場預期,華爾街見聞·見智研究認為主要原因有以下幾點:

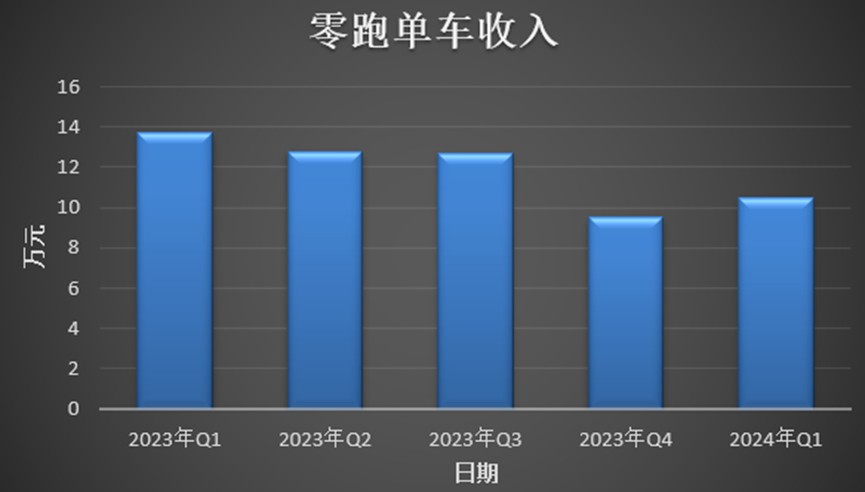

第一,零跑汽車的銷量主力正從 10 萬以下向 20 萬元價格區間轉移,但零跑汽車在今年一季度給出了較大幅度的降價促銷,抑制了單車收入上漲的幅度。

今年一季度,零跑對其全系車型實施了 1.5 至 3.2 萬元的現金優惠,並且新推出的 2024 款車型價格較舊款下降了 1 至 5 萬元。

儘管,零跑汽車通過銷量主力的轉移,從單價區間 5-7 萬元的 T 系列車型轉向 10-20 萬元的 C 系列車型。

具體來看,今年一季度零跑 T03 的交付量為 9433 輛,其銷量佔比較上一季度下降了近 10 個百分點,至 28%。與此同時,C 系列車型如 C11、C01 和 C10 的交付量分別為 12122 輛、3998 輛和 7857 輛,同比分別增長 129% 和 209%,C 系列車型的銷量佔比已經超過了 70%。

這一策略有效抵消了部分由降價帶來的收入下滑,與去年四季度相比,單車收入實際上有所增加,上漲了 0.8 萬元至萬元 10.4 萬元。

第二,今年第一季度,零跑汽車銷量環比有所下滑,使得攤銷和單車製造成本隨之上升。

同時,部分鋰電原材料如電池級碳酸鋰的價格也是在一季度出現回暖,從 9 萬元/噸左右回漲至 11 萬元/噸以上。這也使得零跑汽車的單車成本出現增長,且幅度遠高於單車收入增長。今年一季度,零跑汽車的單車成本為 10.58 萬元,同比降低 4.32 萬元,但環比增長 1.68 萬元。

好在,後續零跑汽車將重心從純電動車型轉移至增程式車型,也將對毛利率有正向作用。

相較純電動版本,C11 增程式版本的電池容量減少一半以上,以目前三元鋰電池電芯(動力型)的平均價格 0.52 元/Wh 來計算,而燃油發動機在 5000 元左右,這將為零跑汽車帶來近 2 萬元的成本下降,但 C11 增程式版本的價格卻只比純電版本便宜 0.3 萬元。

3、研發費用加大投入,短期彈藥不是問題

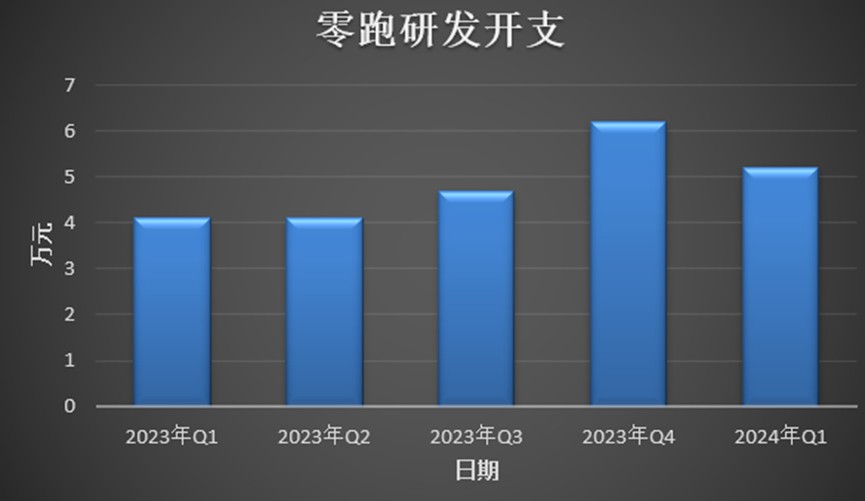

零跑汽車經過 8 年的全域自研,除了三電系統(電池、電機、電控)等核心零部件外,近年來也顯著加大了在智能駕駛技術上的投資,以期迅速趕上行業領先水平。

在 2024 年一季度,零跑汽車標誌性地推出了其首次 OTA(Over-the-Air)升級,引入了包括高速智能領航在內的新功能,顯著提升了車輛的智能化水平。此外,基於高精度地圖的智能駕駛版本也已推向市場,城市 NOA(導航輔助駕駛)功能預計在第二季度正式啓用。同時,基於雲計算的車聯網解決方案的開發也被提上了日程,成為公司研發的新重點。

2024 年第一季度,公司的研發開支已達到 5.2 億元,同比增長 26.1%。這樣的投資雖然短期內難以降低,但對於提升零跑汽車在智能駕駛領域的競爭力及市場地位至關重要。

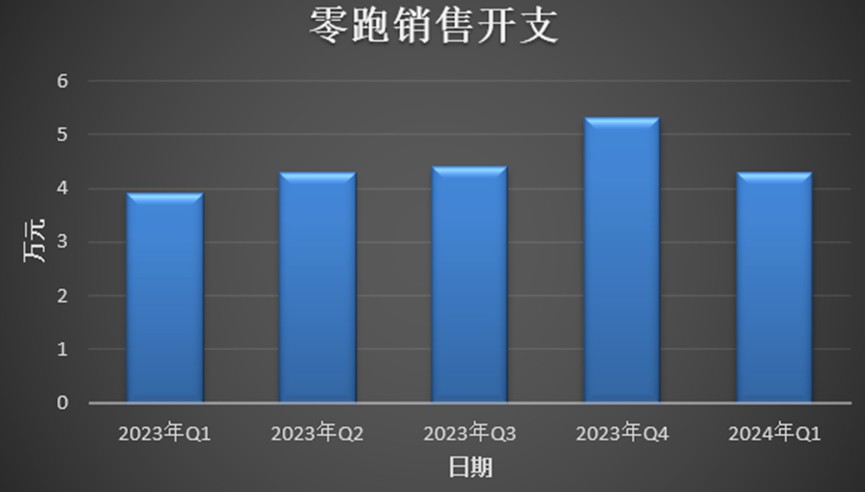

不過在銷售費用上,零跑就有意在控制了。第一季度銷售費用為 4.3 億元,同比僅增長 8.8%,環比降低 19.8%。表現在門店數量環比減少了 50 家至 510 家。

現金流也有所好轉,相比去年同期增長 87 億元,環比降低 18 億元,截至 1 季度末,公司現金及現金等價物、受限制現金和銀行定期存款的金額為 175.8 億元。

領跑汽車離一線越來越近了,但當下新能源市場的競爭仍然激烈,領跑需要儘快盈利。