NASDAQ hits a new all-time high intraday, with GameStop up 24%, Nvidia up over 5%, Chinese concept stocks generally rising, and US oil up 2%

在芯片股持續拉昇的推動下,納指盤中創歷史新高。芯片股中,英偉達刷新盤中高位,早盤 Arm 漲超 8%。早盤蔚來和小鵬汽車漲超 2%。

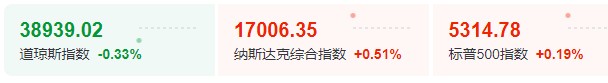

5 月 28 日週二,美股三大指數開盤起漲跌不一,標普和納指高開,納指早盤觸及歷史新高,低開的道指早盤延續跌勢。

上週創去年銀行業危機以來最大周跌幅的道指週二早盤曾跌近 180 點、跌近 0.5%;上週創歷史新高的納指早盤繼續保持漲勢,盤中觸及歷史新高時日內漲近 0.6%;已累漲五週的標普 500 指數盤初曾漲逾 0.2%,盤中幾度轉跌,曾轉跌至跌約 0.09%,後小幅轉漲。

包括微軟、蘋果、英偉達、谷歌母公司 Alphabet、亞馬遜、Facebook 母公司 Meta、特斯拉在內,科技巨頭 “七姐妹” 並未齊漲,上週五領漲的特斯拉早盤表現最差,早盤曾跌超 3%。

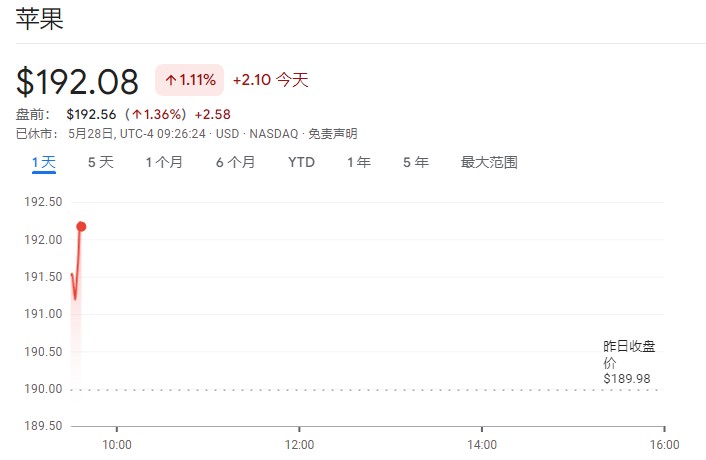

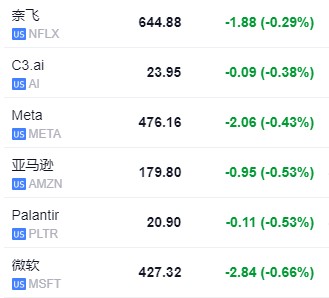

FAANMG 六大科技股中,微軟曾一次轉漲後維持跌勢,早盤曾跌逾 0.81%;上週五收漲近 1.7% 的蘋果繼續維持漲勢,早盤曾漲逾 1.45%,數據顯示 4 月份蘋果中國 iPhone 出貨量增長 52%;Alphabet 早盤曾漲近 1.09%,幾度轉跌後反彈,繼續維持漲勢;亞馬遜盤初跌逾 0.58%,後幾度轉漲,曾漲逾 0.54%;奈飛早盤轉跌至 0.54% 後微幅轉漲,而 Meta 早盤小幅上漲後轉跌,曾跌逾 0.69%。

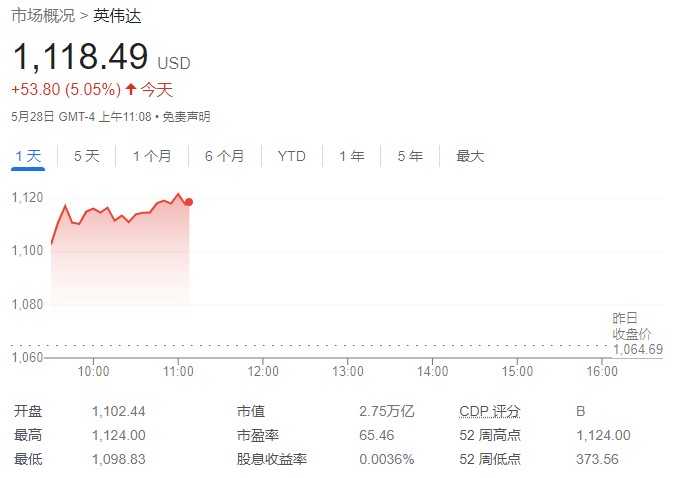

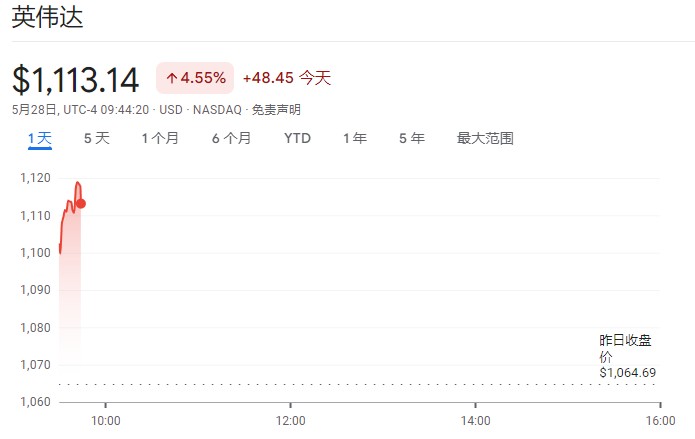

芯片股早盤持續拉昇。費城半導體指數早盤曾漲超 1.7%,半導體行業 ETF SOXX 早盤曾漲逾 1.6%,均盤中刷新歷史收盤高位。芯片股中,英偉達早盤曾漲逾 5.2%,刷新歷史收盤高位,上週末有報道稱馬斯克的 xAI 計劃和甲骨文開發超算支持其 Grok AI 聊天機器人,預計超算連接的芯片組將是當今最大 GPU 集羣的四倍;美光科技早盤曾漲近 2.6% 後回吐部分漲幅,有報道指出美光將在日本廣島新建 DRAM 芯片工廠;早盤 Arm 漲逾 8%;AMD 漲逾 3%,高通漲超 2%,英特爾漲近 2%、邁威爾科技漲超 1%,台積電美股盤初曾跌逾 1.39%,盤中一度轉漲至 0.13% 後轉跌,博通幾度轉跌。

熱門中概股總體微幅上漲。納斯達克金龍中國指數(HXC)和相關 ETF Invesco Golden Dragon China ETF(PGJ)早盤曾漲超 0.7%,轉跌後又轉漲至 0.18%。中概 ETF KWEB 和 CQQQ 早盤分別跌逾 0.1% 和 0.5%。

造車新勢力中,理想汽車開盤曾漲逾 3.1%,後回吐大部分漲幅至 0.25%,早盤蔚來汽車漲超 2.6%,小鵬汽車多次短線轉跌後早盤漲超 2.44%,極氪高開低走,早盤曾漲近 3.25%,後轉跌逾 4.75%。其他個股中,拼多多曾跌逾 5.5%,盤中京東跌超 1.2%,阿里巴巴跌超 1%,百度跌近 0.6%,騰訊微漲 0.02%,網易曾跌逾 0.9%。

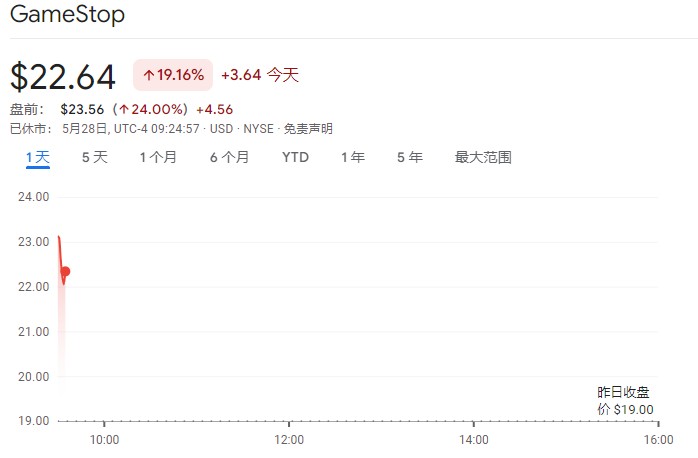

波動較大的個股中,上週五盤後公佈完成按市價增發行動募資逾 9.3 億美元后,遊戲驛站(GME)開盤即漲 21.6%,早盤曾漲約 30%。

以下為北京時間 21:50 發佈內容

週二美股盤初,美股三大指數漲跌不一,納指盤中觸及歷史新高,遊戲驛站暴漲 24%,英偉達一度大漲逾 5%。貴金屬震盪反彈,現貨白銀漲逾 1%,美元疲軟,美油漲 2%。

截止發稿,道指跌 0.3%,標普 500 指數漲 0.5%,納指漲 0.2%。美國股票交易結算週期從 T+2 變成 T+1。

WSB 概念股普漲,遊戲驛站漲約 24%,此前完成了按市價增發(ATM)行動,共計募資約 9.334 億美元。

美股 “七姐妹” 中,蘋果漲 1.1%,數據顯示 4 月份蘋果中國 iPhone 出貨量增長 52%。

英偉達一度漲逾 5%,英偉達上週宣佈將進行 10:1 的加權股票拆分,業界猜測此舉可能是為加入道瓊斯工業指數做準備。

特斯拉跌超 3%,現報 173.67 美元。

此外,微軟、亞馬遜、Meta 小幅下挫。

中概股普漲,法拉第未來漲逾 6%,蔚來、理想漲逾 2%,品多對漲 0.7%。

貴金屬震盪反彈,現貨白銀日內漲 1.1%,現貨黃金漲 0.4%。

美元指數維持跌勢,日內跌 0.16%。

油價漲幅繼續擴大,WTI 原油漲近 2%。

美債漲幅回落,10 年期美債收益率下行 1.4 個基點。