Low prices are always advantageous! Costco's financial report exceeded expectations again, with its stock price hitting a historical high, far outperforming the S&P

在當前消費者追求性價比的大環境下,好市多今年一季度同店銷售同比增長 6.5%。

1976 年成立於西雅圖的好市多(Costco),是會員制倉儲零售商中零售商中歷史最悠久、最著名的一家。隨着通脹壓力有所減輕,消費者重拾對非必需品的開支,好市多在最新一季繼續展現出強勁的增長態勢。

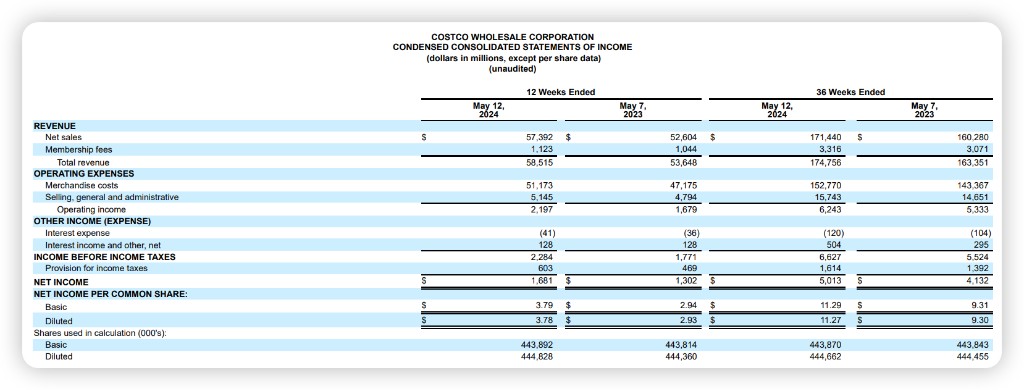

財報數據顯示,好市多第三財季營收達 585.2 億美元,超過市場預期的 579.8 億美元;調整後每股收益 3.78 美元,高於預期的 3.7 美元。

在當前消費者追求性價比的大環境下,好市多的同店銷售同比增長 6.5%,其中國際業務、加拿大市場和美國本土市場分別實現 8.5%、7.4% 和 6% 的兩位數增長。數據顯示,好市多本季度客流量同比有所上升,在同行中拔得頭籌。

目前,好市多的業務版圖目前已擴展至 876 家倉儲式商店,在美國境內就超過 600 家,其餘分佈在加拿大、墨西哥、日本和英國等地。

首席財務官 Gary Millerchip 表示,伴隨通脹降温,消費者在玩具、輪胎、園藝和美容護理等非必需品領域的開支正在復甦。

新任 CEO Ron Vachris 強調,公司在食品和外食等生活必需品領域的競爭力有目共睹,這有助於在通脹高漲時期贏得更多顧客青睞。他表示,與 Target 和沃爾瑪等競爭對手不同,好市多暫時無需採取全面降價等營銷策略,因為公司已做好了商品定價工作。

不過,公司旗下品牌 Kirkland Signature 的部分商品如松子和冷凍蝦串確實調低了價格。

除實體店表現搶眼外,好市多的電商業務同比增長 20.7%,主要得益於黃金白銀、禮品卡和電器等熱門品類線上銷量的增長。新增移動應用下載量更是大漲 32% 至 3500 萬次。此外,公司與 Uber Grocery 在美國和加拿大的合作關係也在不斷加深。

物流和送貨業務同樣是亮點,上季度交付量同比增長 28%,涉及電視、電腦、電器、輪胎和牀墊等多個品類,直接與 Best Buy 等零售商形成競爭。

為了長遠發展並吸引更多年輕顧客,好市多還在嘗試將部分倉庫庫存直接在線上銷售,但 Vachris,表示公司仍將堅持並完善實體店購物體驗。

除商品銷售外,會員服務也是好市多重要的利潤來源。上季度會員費收入達 11.2 億美元,同比增長 7.6%,符合預期。普通黃金會員年費為 60 美元,高級會員則需繳納 120 美元。有分析師預計好市多可能在今年夏天上調會費,但高管目前對此仍守口如瓶。第三季度,公司共有 7450 萬付費會員,其中 3450 萬為高級會員。

展望未來,發展廣告業務被視為好市多的又一潛在增長機會。同業來看,依靠會員龐大的人口數據資源,行業巨頭沃爾瑪的美國媒體業務 Walmart Connect 在最近一季就錄得 26% 的營收增長。

今年迄今,好市多股價累漲超 25%,遠遠跑贏標普 500 指數(10%)