GameStop's sharp rise has significantly narrowed, with the "big brother" of the brokerage firm considering banning him, and the US SEC investigation is also on the way

“帶頭大哥” Gill 的券商 E-Trade 考慮禁止他,此外美國 SEC 調查 GME 的某些看漲期權。週一美股收盤後,Gill 又在 Reddit 上更新了持倉截圖——沒有套現。更熱鬧的是,香櫞創始人 Andrew Left 也回到對決舞台,他曾在 2021 年的逼空大戰中遭遇重挫。知名投資人段永平也在雪球上曬出了做空 GME 看漲期權的交易,手法比直接裸空股票要安全不少。

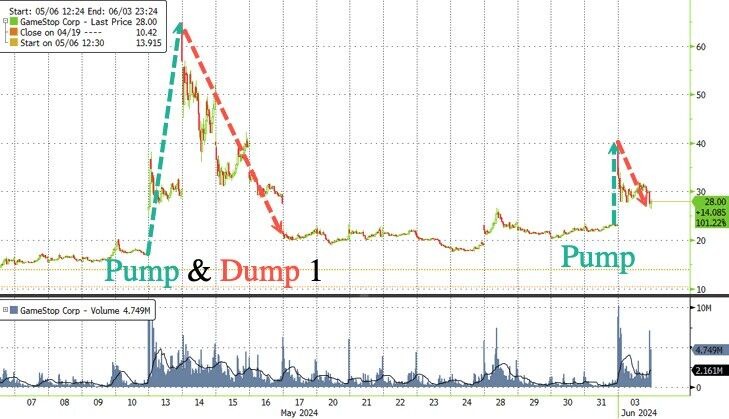

週一美股盤中,遊戲驛站(GME)的漲幅收窄至 14%,刷新日低至 26.40 美元,美股盤前曾翻倍,開盤後的最大漲幅為 75%。截至週一收盤,GME 收漲 21%,收報 28 美元。

推動 GME 週一暴漲的原因是,“散户帶頭大哥” Keith Gill 真的又回來了。Gill 在 Reddit 上的暱稱是 DeepF-Value,在 YouTube 和 X 上的暱稱是咆哮小貓 Roaring Kitty。

“咆哮小貓” 週日在其 Reddit 的賬號 “DeepF-Value” 上,曬出了一張交割單截圖。截圖顯示,他已經以每股 21.27 美元的價格買入了 500 萬股遊戲驛站的股票,總價值高達 1.157 億美元。此外,他還買入了 12 萬份行權價為 20 美元、將於 6 月 21 日到期的看漲期權,這些期權的總價值約為 6570 萬美元。

不過週一美股下午交易時段,兩則消息令 GME 盤中的漲幅大幅收窄,也就是本文開頭提及的股價走勢:

- 據媒體報道,摩根士丹利旗下券商 E-Trade 考慮禁止 “散户帶頭大哥” Keith Gill 使用其平台交易,正在就此進行內部談判,原因是擔心潛在的市場操縱。

- 此外,美國證券交易委員會(SEC)調查該公司的某些看漲期權交易,那些交易發生的時間就在 Gill 於社交媒體平台發帖前後。

雖然 GME 股價經歷了週一過山車,但是 Gill 絲毫沒有動搖。他在週一美股收盤後又在 Reddit 平台上更新了他的持倉,就像 2021 年散户逼空大戰時那樣。截圖顯示,其 GME 股票和期權持倉與週日相同。Gill 這一最新帖子是在媒體報道 E-Trade 考慮禁止其交易後不久發佈的。

截至週一收盤,Gill 的 GME 股票部分的累計浮盈是 3362 萬美元,盈利百分比為 31.62%;GME 期權部分的累計浮盈是 5183 萬美元,盈利百分比為 76.04%。事實上,Gill 早盤的浮盈還要更多許多,不過他並未套現。

這意味着,再加上 2900 萬美元現金,Gill 賬户的持倉價值已經高達 2.89 億美元。

Gill 在週一美股盤後公佈了上述截圖後,GME 美股盤後上漲,漲幅一度達到 4%。

香櫞創始人 Andrew Left 重回做空

同日消息還顯示,重新回到 GME 對決舞台的,除了 “散户帶頭大哥” 本尊,還有知名的香櫞研究公司創始人 Andrew Left。在 2021 年的逼空大戰中,Left 做空 GME 失利,這一次他也重新歸來,再度做空 GME。對於 Gill 在 Reddit 上的發帖,他説,“我看到之後就做空了。”

事實上,5 月時 Left 就宣佈過做空 GME 的股票。他最新表示,“我已經平掉了 5 月的做空倉位,然後今天我又做空了。” Left 還透露,最新的倉位比他之前的倉位要小,但沒有給出具體的倉位大小。

GME 自 5 月開始的狂潮,幾乎完全是受 Gill 所影響。對於 Gill 強大的影響力,Left 感嘆道,“他完全可以當對沖基金經理了。”

2021 年的散户逼空大戰,令香櫞損失倉重,Left 甚至宣佈其公司將不再發布做空研究,結束了長達 20 年的做法。此後,雖然他又回來寫這些研究,但頻率明顯降低了。

Left 表示,“我對這家公司(GME)沒有任何惡意。它甚至不是一家公司,而是一種交易工具。”

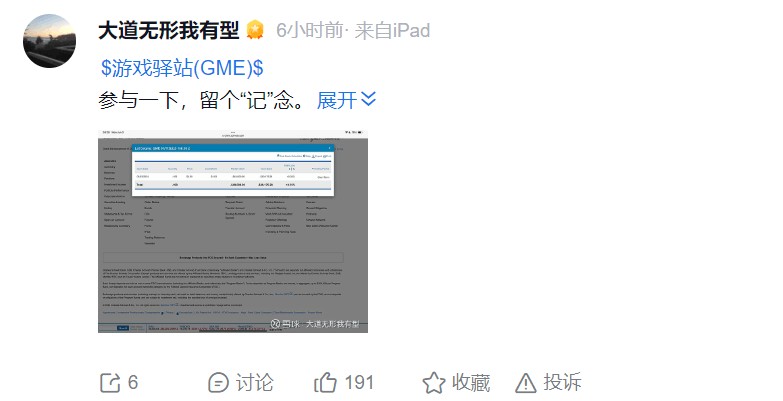

段永平賣 CALL

知名投資人段永平也在雪球上曬出了自己對 GME 本輪交易的參與。

與直接做空正股不同,段永平的交易顯然更加保守和安全,他賣出了行權價高達 100 的 GME 看漲期權,且期權的截止日期拉的很久,為 2025 年 1 月 17 日。

也就是説,GME 的本輪瘋狂要持續或是間歇持續到明年初,並且超過 100 美元,段永平才可能會被行權。GME 要達到大約 105 美元及以上,段永平才會虧損。

目前尚不清楚段永平截圖的做空 100 個看漲期權是其全部倉位,還是部分倉位。數據顯示,GME 250117C100 合約週一有新開倉 656 個合約,另有未平倉合約 1096 個。