巴菲特公司股價閃崩,網友大呼 “抄底”,有人 185 美元/股買入

由於紐約證券交易所的技術故障,有人在伯克希爾股票短暫停牌之際,以 185.1 美元每股的價格買入原價值超 60 萬美元/股的股票。一旦故障修復,交易生效,每股價值將翻 3400 倍以上。紐交所後決定,取消任何因技術問題出錯期間的所有交易價低於 60.3718 萬美元的伯克希爾個股交易。

北京時間 6 月 3 日晚,因紐交所的技術故障導致伯克希爾哈撒韋公司股價顯示暴跌近 100%,從 62 萬美元/股短暫跌至 185.1 美元/股,股價幾乎跌近 0。

然而出乎意料的是,有人偶然以 185.1 美元的價格 “抄底” 了 51 股,其中最多的一筆是 8 股。這意味着一旦交易生效,故障修復,此人手中的每股價值將瞬間翻 3400 倍以上。網友紛紛猜測是哪個幸運兒買入,又是哪個倒黴蛋不小心賣出。

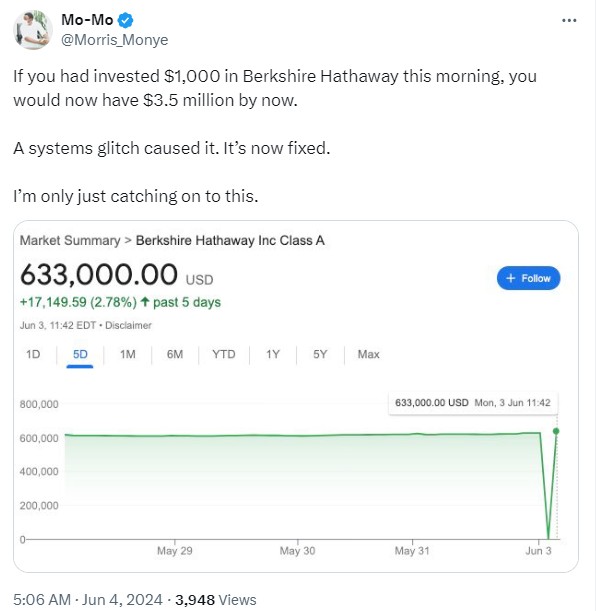

對此,有網友表示:“如果你今天早上在伯克希爾哈撒韋公司投資了 1000 美元,那麼現在你就會擁有 350 萬美元。這是系統故障造成的。現在已經修好了。我剛剛才意識到這一點。”

真有此等 “躺賺” 的好事嗎?

對此,紐約證交所隨後發佈公告宣佈,決定 “取消 “任何美東時間上午 9 點 50 分至 9 點 51 分期間因技術問題而引起的所有錯誤伯克希爾個股交易,與 “CTA SIP” 系統問題相關、任何交易價低於或等於 603718.30 美元的交易都被取消。此外,交易所還明確,交易者無權對這一決定申訴,並暗示可能取消其他個股的交易。

儘管如此,市場市場依然對這一罕見事件反響強烈。有國內媒體提到,市場人士林毅注意到了這個超級 bug 並表示,這種明顯低於正常股價的交易在技術上應被視為正常交易。股價 bug 可能促使量化基金直接賣出,一般正常投資者不會這麼低價格賣出。

此類技術問題並非交易所歷史上的首次,通常可以歸咎於幾個主要原因:數據錯誤、算法交易錯誤、系統升級或維護問題、閃電崩盤以及網絡攻擊等。這些因素都可能導致交易所出現短暫的數據或交易異常。要做到萬無一失,沒有捷徑。

例如,2012 年夏天,Knight Capital 集團在短短 45 分鐘內,因一個軟件錯誤導致鉅虧 4 億,直接從華爾街巨頭淪落為破產企業;2010 年 5 月 6 日,道指無預警瞬間崩盤,高頻交易和市場流動性不足導致道瓊斯工業平均指數 5 分鐘內暴跌 600 多點。

此外,交易所在進行系統升級或維護期間,也可能由於意外問題導致交易功能失效或數據出錯,例如在 2013 年 8 月 22 日,納斯達克交易所經歷了一次重大的技術故障,導致交易暫停了近三個小時。這次暫停影響了數以千計的股票和期權,包括蘋果、谷歌、微軟等大型科技公司的股票交易。此次技術問題被認為是由於交易所的系統升級中出現了故障,特別是與其價格報價分發系統相關的部分。

紐交所的迅速響應和隨後的裁決有效遏制了此次技術故障的影響,但這一事件依然對市場參與者的信心造成了一定的衝擊,同時也再次提醒市場對於現代化交易系統潛在風險的關注。