Hawkish! Bank of Japan Governor: Interest rates may be raised in July and bond purchases significantly reduced

日本央行行長表示可能在 7 月加息並大幅縮減購債規模,但具體細節將在與市場參與者討論後決定。日本央行決定以緩慢但穩步的方式退出大規模貨幣刺激政策,開始縮減鉅額債券購買規模。此舉可能在 7 月會議上公佈。日本 10 年期國債收益率上升至 1%。

智通財經獲悉,日本央行行長植田和男在最新的新聞發佈會上表示,在縮減債券購買規模時,重要的是要保持靈活性,以確保市場穩定,同時以可預測的方式這樣做;削減購債的規模可能會很大,但具體的速度、框架和程度將在與市場參與者討論後決定。植田和男還表示,根據經濟數據,有可能在 7 月份會議公佈縮減購債規模的同時宣佈加息。

日本央行週五維持利率不變,但決定開始縮減鉅額債券購買規模,以緩慢但穩步的方式退出大規模貨幣刺激政策。雖然日本央行將繼續以目前每月約 6 萬億日元 (380 億美元) 的速度購買政府債券,但該行決定在 7 月會議上公佈未來一至兩年縮減購債計劃的細節。

在日本央行公佈利率決議前,有媒體援引知情人士透露的消息報道稱,日本央行可能在本次利率會議公佈縮減購債規模。但實際上,日本央行卻採取 “含糊其辭” 的態度,僅表示將縮減購債規模,而將縮減購債的相關問題和具體縮減購債的規模推遲到下次會議。

植田和男提到縮減購債規模時表示:“隨着我們減少債券購買,日本央行的債券持有量將會減少。但我們持有債券的效應將繼續對經濟產生影響。我們沒有一個具體的時間表——即我們需要多長時間才能 (充分) 縮減資產負債表。我們決定從大約一到兩年的時間框架開始。”

對於貨幣政策支持和加息時機問題,植田和男評論稱:“如果潛在通脹加速與我們的預測一致,日本央行將考慮調整貨幣支持的程度。如果經濟和通脹超出我們的預測,這也將成為提高利率的理由。我們將根據經濟和價格的發展情況做出決定。我們當然會考慮如何縮減債券購買規模。”

對於 7 月是否會同時決定加息和縮減債券規模,植田和男的回應稱:“根據當時的經濟和價格情況,我們當然有可能在 7 月份決定提高利率,並調整貨幣支持的程度。”

最近日本 10 年期國債收益率上升至 1% 左右,植田和男對此表示:“我們最近看到長期通脹預期有所上升。因此,實際長期利率水平仍然相當低。我們仍然有一個足夠寬鬆的金融環境。”

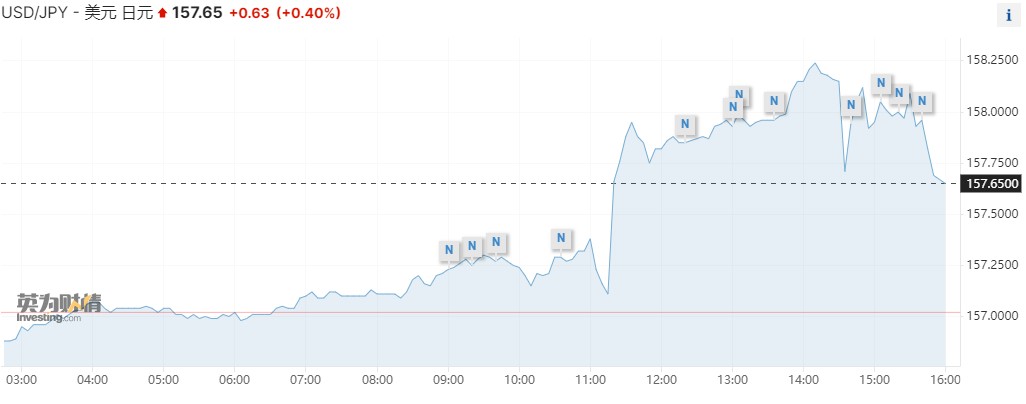

關於日元疲軟,植田和男稱:“匯率變動將對經濟和物價產生重大影響。最近,由於企業工資和價格設定行為的變化,對價格的影響可能會加劇。近期日元貶值對推高物價產生了影響,因此我們正密切關注指導政策的動向。我們正在關注匯率波動、舉措的可持續性,以及它對價格和工資的影響。這是我們每天和每次政策會議都要關注的問題。”

最近有跡象表明,日元疲軟似乎正在促使成本推動型通脹再次加速,植田和男對此表示:“我們的觀點沒有太大變化,即成本推動型通脹正在放緩,而由需求驅動的價格上漲正在逐漸加速。但確實有跡象表明,進口價格正在重新加速上漲,部分原因是日元疲軟。這可能是第二輪成本推動型通脹。這是我們在確定潛在通脹時希望密切關注的問題。”

此外,關於消費,植田和男指出:“我們預計工資將適度上漲,通脹將放緩。因此,我們堅持我們的觀點,即實際家庭收入將逐步增加,並導致更強勁的消費。”