As the US stock market repeatedly hits new highs, Wall Street cheers "Risk On"! European stocks, mired in political turmoil, have become "abandoned children"

华尔街投资机构降低了对欧洲股票市场的评级,转而看好美国股票市场。华尔街策略师们预计标普 500 指数将不断创下历史新高。全球资管巨头贝莱德表示将继续增持美股。摩根大通预测美国股市在 2024 年将延续强劲势头。花旗集团策略师们下调了对欧洲股市的评级。

智通财经 APP 获悉,法国以及德国政治局势动荡带来的风险促使以花旗集团为代表的华尔街投资机构下调欧洲股票市场的评级,华尔街今年以来持续看涨的以强大基本面蓝筹股为主的低估值欧洲股市,却在近日沦落至华尔街 “弃子”。此外,华尔街策略师们近期更倾向于以大型科技巨头为导向的美国股票市场,表示一些试图进入欧股的资金可能转向美股。高盛、Evercore ISI 等华尔街机构近日纷纷上调美股基准指数——标普 500 指数目标点位,今年标普 500 指数甚至有望冲击 6000 点 (上周收于 5431.6 点)。

自 6 月以来,标普 500 指数屡创新高,美股市场的 Risk On(追逐风险) 动能可谓只增不减,华尔街策略师们近日更是加大力度 Risk On,认为标普 500 指数将不断创下历史新高点位。全球资管巨头贝莱德近日表示,在 11 月美国总统大选之前,该机构对长期美国国债持谨慎态度,由于财政赤字庞大,投资者可能要求更多补偿才愿意持有美债,但是该机构强调在美国大选前将继续增持美股。

摩根大通资产管理部门预测,美国股市在 2024 年的强劲开局势头有望延续至下半年。摩根大通资管部门首席全球策略师戴维·凯利 (David Kelly) 及其团队在年中展望报告中指出,尽管标普 500 指数自 1 月份以来已实现两位数回报,市场增长可能更趋稳健而非迅猛,但得益于坚实的企业盈利基础、美联储宽松预期以及经济增长的强劲表现,美国股市在未来数月仍将得到大幅提振。

欧股惨遭华尔街 “遗弃”

以贝娅塔•曼西 (Beata Manthey ) 为首的花旗集团策略师们将欧洲股市的整体评级从 “增持” 下调至 “中性”,核心逻辑在于 “政治风险加剧”,以及市场宽度缩小和进一步下跌的可能性非常高。与此同时,花旗集团的策略师们将美股评级从 “中性” 上调至 “增持”,强调重点关注大型科技巨头以及工业类股票。

贝娅塔•曼西等花旗策略师在一份报告中写道:“我们选择调高对美国股市的预期回报率以及评级,因为美股的价值增长倾向相比于欧洲市场要高得多,而且在不确定时期更具防御性。”“政治层面上的不确定性可能会暂时冷却美国投资者近期转向欧洲股市的热情。”

法国现任总统马克龙因党派席位压力而在上周出人意料地宣布提前开启选举,引发了法国股市暴跌所引发的欧股基准指数——斯托克 600 指数连续多日暴跌 (法国股票在欧股基准指数斯托克 600 指数中的权重占比非常高),并且导致法国股市的总计市值蒸发约 2580 亿美元。在有关该国财政状况进一步恶化的投资者警告声中,该国的主权债券也遭到剧烈抛售。

投资者们对马克龙所领导的中间派、偏向商业势力的文艺复兴党,将在定于 6 月 30 日和 7 月 7 日期间举行的两轮投票中进一步失去议会席位的前景感到非常不安。

花旗的策略师们写道:“法国议会中极右翼势力占多数席位的前景带来了相当大的经济政策层面不确定性,引发了有关法国财政整顿、为乌克兰提供资金以及欧洲产业政策等方面的众多问题。”

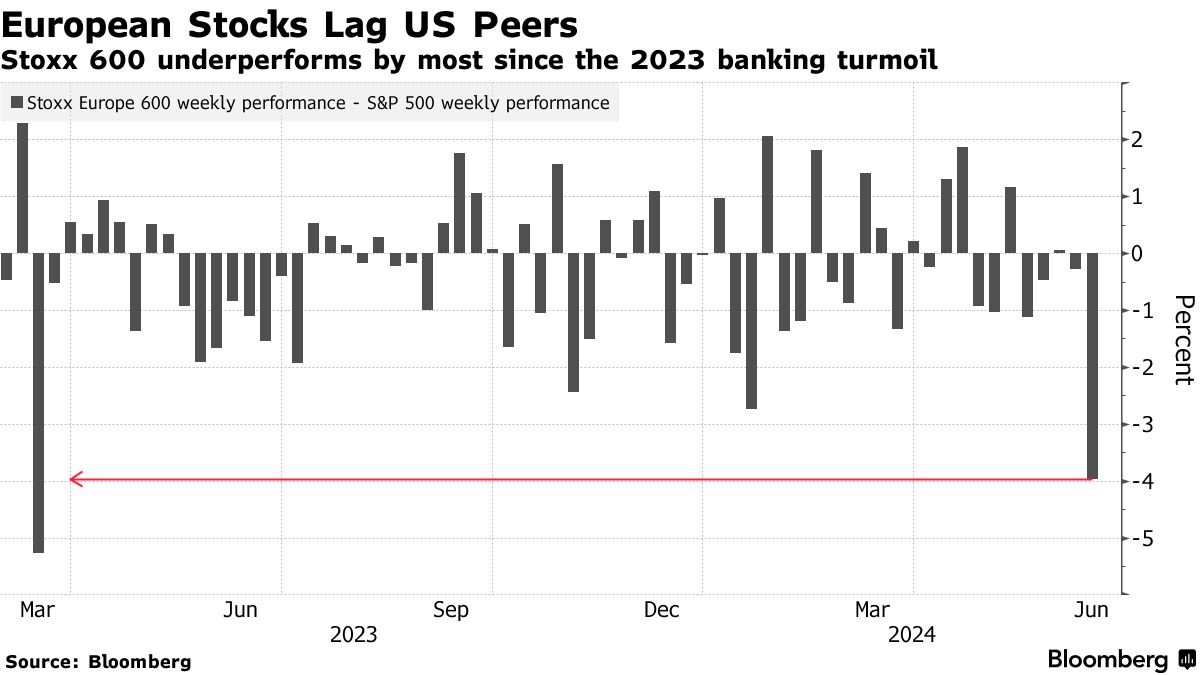

整个欧洲市场都受到了冲击,该地区基准股指在上周下跌近 3%,表现远远落后于美国股市。一周前,花旗策略师们曾预测泛欧斯托克 600 指数将在 2025 年中期左右进一步上涨 14%,进而创下历史新高。

尽管如此,法国市场本周开始显示出一些稳定的迹象,此前极右翼领导人马琳·勒庞承诺,如果她在即将举行的选举中大获全胜,她将与马克龙合作制定政策,而不是抛弃马克龙时代的众多重要政策。

“Magnificent 7” 带领之下,美股有望冲 6000 点

其他华尔街投资机构的策略师们也对美国股市的前景更为乐观。高盛第三次上调对标普 500 指数 (S&P 500 Index) 的年终目标,反映出华尔街对 “美股七大科技巨头”(Magnificent 7) 强劲业绩增速和美国经济增速的乐观前景。以科斯汀 (David Kostin) 为首的高盛股票策略师目前预计,标普 500 指数今年年底将收于 5600 点,高于他们在 2 月份预测的 5200 点。

自美国 CPI 数据公布以来,代表价值股趋势的道琼斯指数意外下跌、小盘股未能实现上涨,而纳斯达克指数则不断创新高。美股市场的 “宽度” 可谓逆袭失败,业绩无比强劲、股票回购弹药充沛且占据标普 500 指数高额权重的 “Magnificent 7” 俨然已然成为美股市场,乃至全球股票市场当下 “最安全的资产选择。

在高盛等华尔街投资机构们看来,美股这轮史诗级涨势并未就此宣告结束,占据标普 500 指数高额权重的 “Magnificent 7” 业绩继续猛增、Magnificent 7 带动之下今年以来持续强劲的标普 500 指数 EPS 增速、美国经济增长前景等积极因素有望推动美股长期稳步上升。华尔街策略师们愈发看涨美股,绝大多数选择上调目标点位 “Risk On”(即 “追逐风险”),而不是 “Risk Off”(即 “风险规避”)。

到目前为止,推动标普 500 指数盈利扩张的因素并没有明显改变,仍然是英伟达与微软所领衔的 “美股七大科技巨头”(Magnificent 7),就像英伟达 (NVDA.US) 在 5 月公布的井喷式季度增长业绩带动纳指与标普 500 指数创新高一样。华尔街策略师们普遍认为,至少到 2024 年底,“Magnificent 7” 强劲的业绩数据带动标普 500 指数整体 EPS 扩张以及带动标普 500 指数续创新高的趋势仍然存在。

“Magnificent 7” 包括:苹果、微软、谷歌、特斯拉、英伟达、亚马逊以及 Meta Platforms。全球投资者们 2023 年以及 2024 年第一季度起持续蜂拥而至七大科技巨头,最主要的原因可谓是他们纷纷押注,由于科技巨头们的庞大市场规模和财务实力,它们处于利用人工智能技术扩展营收的最佳位置。

长期看空美股的 Evercore ISI 近日全面逆转立场,转向强势看涨美股后市。该机构的策略师们预计,到 2024 年底,美国股市将再次出现两位数级别的涨幅,标普 500 指数将创下一个又一个纪录。Evercore ISI 首席股票和量化策略师伊曼纽尔 (Julian Emanuel) 将该机构对标普 500 指数的年底预测大幅上调至 6000 点。

Evercore ISI 强调,通胀消退和科技巨头引领的人工智能热潮将推动美股进一步走高。“如今,人工智能在每项工作和每个行业的潜力都在发生变化。通胀放缓、美联储有意年内降息和经济韧性背景支持着 ‘金发姑娘’ 经济。”

RBC Capital Markets 的策略师们则指出,如果流入欧洲股票型基金的资金因政治不确定性而恶化,股票回购弹药充沛的美股科技巨头可能会从这种另类的 “避险寻求” 中受益。

来自德意志银行的股票策略师们也选择看涨美股后市行情,该机构最近将标普 500 指数的年终目标点位从先前的 5100 点大幅上调至 5500 点,并且他强调该目标存在明显的 “上行动力”。“如果这一共识预期继续走高,并且美国经济今年的增长再次超过预期,一些人认为这可能是美国劳动力生产率在 AI 助力下的繁荣开端,那么不难看到标普 500 指数将达到 6000 点。” 德银策略师们在报告中表示。