Ghost stories of China Duty Free, cold 618 data

近日市場傳出了關於消費的鬼故事,包括海南離島免税銷售額大跌和今年電商 618 數據冷清等。海南離島免税購物人次和購物金額均同比下滑,中免股價也持續下跌。根據海關數據顯示,今年一季度中免的銷售額同比下跌 30-40%。總體來看,中免的基本面仍未見到拐點,投資人需關注市場預期和利空消息的影響。

在茅台陷入跌價風波後,近日市場再傳出關於消費的鬼故事。一是傳關於中產消費的海南離島免税銷售額大跌,二是今年電商 618 數據冷清,甚至是受關注度最低的一屆活動。

一、股價跌了 80%,鬼故事接連不斷

昨日傳出的鬼故事中提到三點:

1)下半年進入離島免税淡季,下調全年的海南免税銷售預期到 300 億元,同比 2023 年下降 3 成。

2)雅詩蘭黛集團市場投放的緊縮使得新品的表現並不理想。雅詩蘭黛品牌的銷售速度仍在放緩,海藍之謎新品表現一般,免税資源過度傾斜到韓免,對海南免税的影響較大。

3)預計下半年國際客運量恢復度進一步提升的空間有限,機場免税的恢復度低於預期,需要 2-3 年才能恢復到 2019 年水平。

參照海關數據來看,與傳聞差不多。

根據海口海關統計,5 月份海南離島免税購物人次為 41.88 萬人次,同比下滑 16%。購物金額為 19.74 億元,同比下滑 38.3%,人均金額為 4714 元/同比-26.5%。

其中,5 月份香化銷售額為 8.72 億元,同比-38.3%,佔比 44.2%;精品(服裝裝飾、箱包、鞋帽)銷售額 3.49 億元,同比-36.0%,佔比 17.7%。

受此消息影響,中國中免這兩天再跌 6%,較去年 1 月跌去 70%,較歷史高位跌超 80%。

更恐怖的是,即使中免跌了那麼多,基本面仍未見到拐點,投資人還要忍受常出的利空消息,下調市場預期打壓股價。

原本市場預期今年中免會有所恢復,但根據海關數據顯示,今年一季度除了 2 月份,1 月和 3 月的銷售額都同比下跌 30-40%。即使 2 月份銷售額沒下滑,但客單價還是下滑的,1 月客單價為 5831 元,同比下滑 28.5%,2 月客單價為 6650 元,同比下滑 10.6%。

回顧近 3 年多的下跌,與前日提到的邏輯類似,在中免跌 50% 的時候,市場根據原先的盈利預測去看市盈率已跌穿平均水平,當下看好像估值較為便宜,於是有資金開始抄底。

但消費需求並不好預測,代入部分投資者的思維,可能想的是從護城河角度上看,中免是國內規模最大的線下免税平台,只要旅遊消費恢復,肯定是受益最大的一家。

不過,需求端的邊際變化影響了這一邏輯。一是即使規模夠大,但今年去海南旅遊的旅客減少了,並且人均金額較去年繼續下滑。

旅客減少的原因有兩點,根據管理層在交流會上表示,今年海南/三亞的雨季比以往要多,導致原本旅客就變少了。另一點,今年日元貶值速度加快,從消費者的出行性價比上看,出國去日本的消費基本較 5-6 年前的匯率打了 7 折,所以更多旅客願意把出行需求放在日本或是韓國。

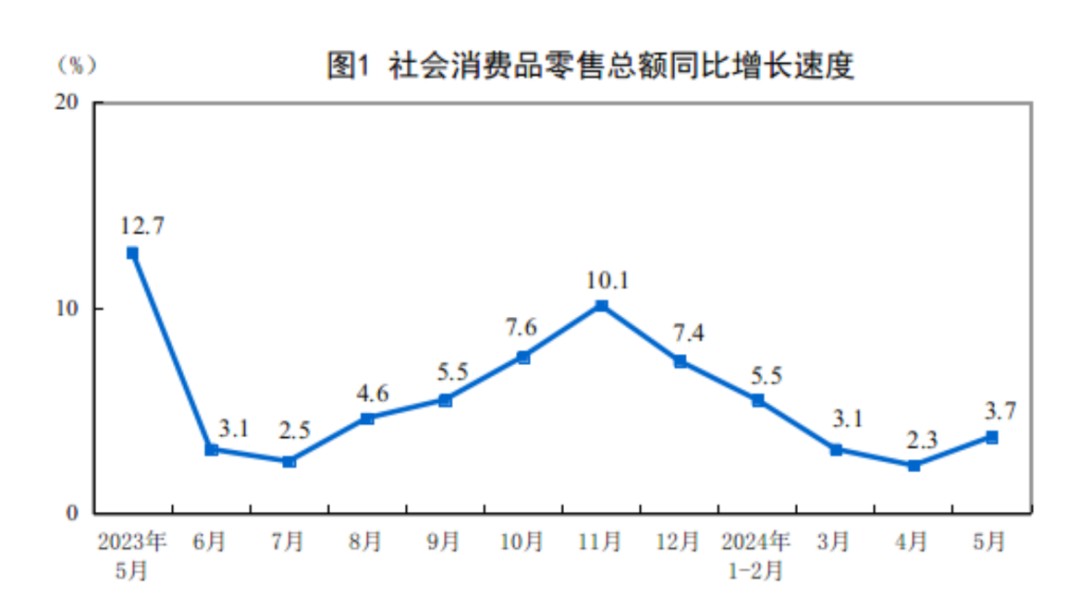

人均金額的減少,根據 CPI 和社零數據就能得知,的確復甦速度不及預期。

此前市場預期着放開後,旅客重回三亞/海南消費,而現實是放開後都把出行選擇放到境外,或許是前幾年出境不方便,導致部分消費者想出行,但國內選擇不多,就選擇海南或是其他城市。而現在免籤國家增多,出行便利給到旅客更多選擇,疊加上匯率端的優勢,中免的競爭力多少受到影響。

這點也比較明顯,5 月份海南離島免税購物人次是 41.88 萬人次。而根據日本旅遊局數據顯示,5 月份中國訪日的遊客數為 54 萬人次,恢復到 19 年同期的 72%。合計日本旅遊局的數據,今年 1-5 月赴日旅遊的人數大約有 358 萬人次左右。

基於上述的邊際變化,現階段的消費需求並不好預測,當中免業績 miss 了,即出現估值越跌越貴的情況。跌到現在仍未見底,另一個原因是 20-21 年基金抱團行情,中免一度炒到 7000 億市值,市盈率超過 80 倍維持了近一年時間,現在是在為之前過度透支估值的行為買單。

截止目前,H 股中免 PE 為 14.5 倍左右,股息率為 5%,而 A 股中免 PE 為 20 倍,股息率為 3.5%,賬面有 360 億出頭,但沒有回購計劃。

與茅台相比起,中免的情況會更差一些,雖然看似有 3.5-% 的股息率,但當營收預期下調,派息金額也會減少。例如今年 Wind 盈利中位數為 79 億元,若市場傳聞營收下調 30% 為真,那盈利數將下滑多少?

所以説,現在股息率來看,這安全墊並不夠厚。往往消費品在下行週期時更難找到安全邊際,疊加上管理層也不回購,賬面現金擺着不懂,任憑股價下跌,現在的估值可能還不是底。

底部可能在哪呢?

目前 H 股 14 倍 PE,最悲觀的情況下,看到 10 倍 PE 為底,那也有不小的下行空間。23 財年公司派息率從 32.9% 提升至 50%,若公司能把利潤的另外 50% 拿出來回購,那股價至少不會像現在跌出一副要退市的樣子。

更何況,公司沒什麼負債壓力,手上還有 360 億現金,只要管理層有意願,執行壓力並不大。

倘若公司不回購,僅靠投資人博弈公司基本面的自身改善的拐點,那誰都預測不準底部在哪,若要抄底的話,等到公司業績真的走出拐點了,確定性提升後再介入也不怕晚,畢竟公司的規模是最大的消費 beta 之一,在走出拐點再考慮入手也不怕晚。

二、最冷清的一屆 618?

若説線下免税店可能受旅客出行選擇的干擾,那再看到電商數據會更全面,今年的 618 也被稱為關注度最低的一次。

因為今年各大電商平台都取消了 “預售” 環節,往年在 618 開始前,消費者都會先參與預售,之後再湊單參與更多優惠活動,而今年取消了之後,對於消費者來説算是優惠來的更直接,沒以前那麼燒腦。不過,根據消費者的反饋來看,都認為今年力度也不如去年。

根據星圖數據統計,2024 年 618 期間(天貓 5 月 20 日 20: 00-6 月 18 日 23: 59;京東 5 月 31 日 20: 00-6 月 18 日 23: 59(其他平台以各平台公佈 618 起始時間截至到 6 月 18 日 23: 59 )),綜合電商平台、直播平台累積銷售額為 7428 億元。

根據星圖數據統計,2023 年 618 銷售額為 7987 億元,意味着今年 618 整體銷售額同比下滑 7%,減少了 559 億元。其中,綜合電商銷售額佔 5717 億元,同比下滑 6.9%,直播銷售額從 1844 億元提升至 2068 億元。

熱門銷售品類中,糧油調味為 110 億元,休閒零食 61 億元,美容護膚 261 億元,香水彩妝 91 億元,洗護清潔 151 億元,營養保健為 92 億元,寵物食品 55 億,家用電器為 756 億元。

由於星圖統計數據是同比下跌,導致今日市場也有受到些影響。有的賣方認為,由於部分場景和場域沒有計入在測算過程中,導致同比數據是下滑了。

根據賣方調研各大平台得出的數據,與星圖數據差距還是比較大的。(數據不一定準確)

·淘天 6197 億元,同比 +13.07%,佔比 50%-60%,倒算全網體量 11800 億元。

·京東 2857.4 億元,同比 +7.3%,佔比 24%-26%。

·拼多多同比 +27%,佔比 15%-17%。

三、結語

值得注意的是,無論各方的統計數據是否有修改,疊加上中免的情況來看,線上線下的消費降級趨勢是明顯的,即使電商快遞數據單量增長 20%,但整體單價是下滑的,消費復甦的仍然疲軟。