Oppenheimer: There is no bubble in US growth stocks, sector rotation prefers equal-weight NASDAQ-100 Index

目前成長股並沒有被高估,而是非成長股處於落後地位,當兩者差距縮小時,可能是非成長股出現反彈,而不是成長股暴跌。Oppenheimer 技術分析師 Ari Wald 認為等權重納斯達克 100 指數是一個板塊輪動首選,具有吸引力的平衡。

智通財經 APP 獲悉,Oppenheimer 技術分析師 Ari Wald 在研究納斯達克 100 指數是否處於泡沫區域時表示,目前成長股並沒有被高估,而是非成長股按歷史衡量處於落後地位,當兩者之間差距縮小時,可能是非成長股出現反彈,而不是成長股暴跌。

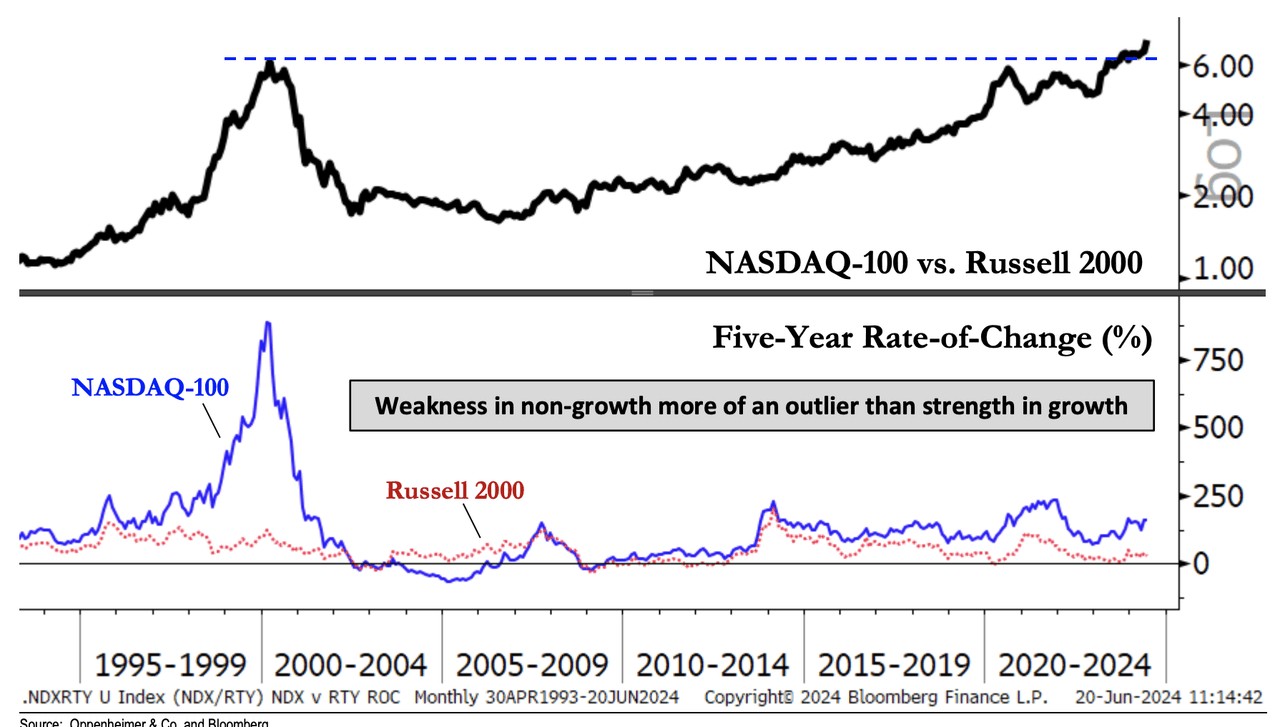

Wald 在一份報告中寫道:“我們仍然認為,市場分化,尤其是成長股和非成長股之間的差距,可能是自上世紀 90 年代以來最大的。我們的不同看法仍然是,推動這一差距的主要因素是非成長股領域的疲弱,而不是成長股領域的強勁。”

他表示:“我們可以把納斯達克 100 指數和羅素 2000 指數看作這種關係的代表。雖然這一比率已經突破了 2000 年的峯值,但各個部分的五年變化率顯示出現在和當時之間的顯著差異。”

“從我們的角度來看,一個異常值是,羅素指數正從個位數 (2023 年第四季度為 5%) 回落,這更符合主要市場低點而不是市場高點。這就是為什麼我們認為,未來幾年的收斂更可能由追趕效應催化。”

“藴藏火力”

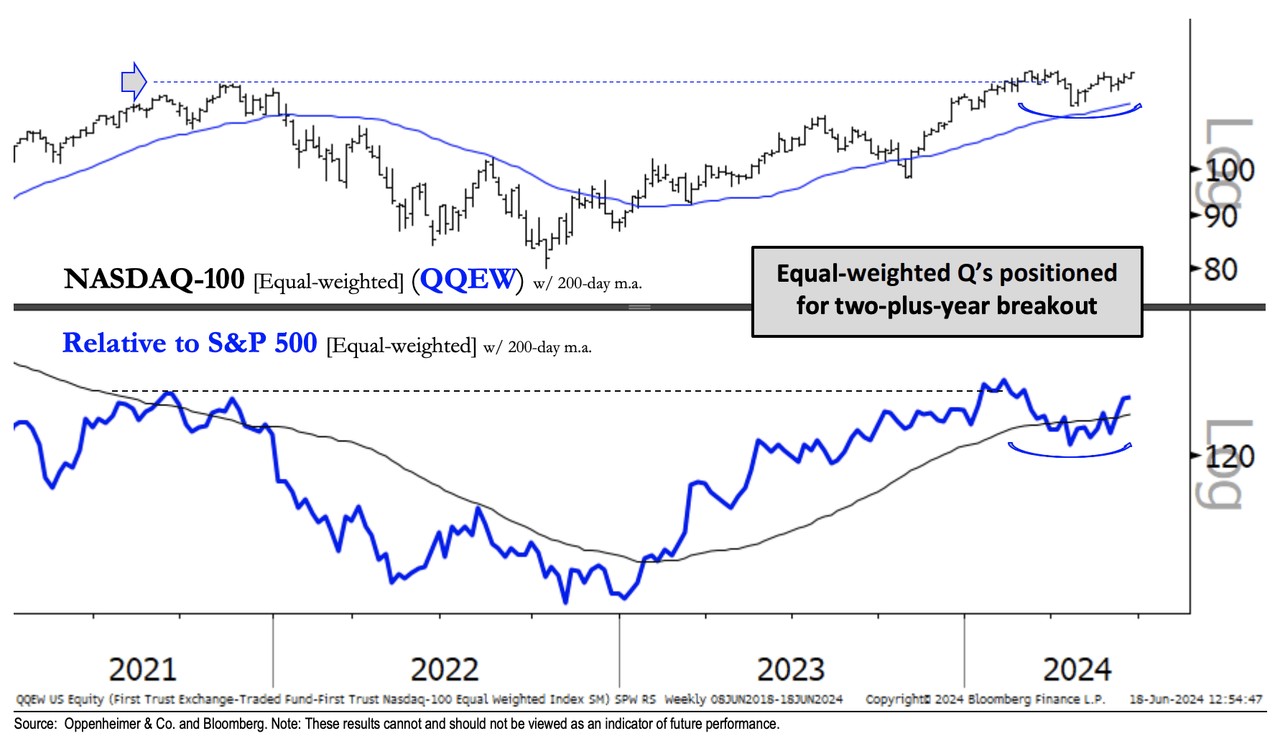

Wald 還看好等權重納斯達克 100 指數的走勢。

他表示:“作為中型成長股的代表,我們認為等權重指數 First Trust NASDAQ-100 Equal Weighted Index Fund(QQEW.US) 是一個板塊輪動首選,因為我們認為它在長期增長的領導地位和較低市值的中期輪動潛力之間達到了有吸引力的平衡。”

“該指數在今年 3 月反彈至 2021 年 11 月的峯值,此後一直在這一關鍵阻力點附近盤整。我們認為,這種盤整使超買行為在我們預計的多年趨勢突破之前有所緩解。”

他表示:“與我們對標普等權重、羅素 2000 指數、羅素價值指數和標普高貝塔指數的看法類似,我們認為這是牛市週期下一階段的藴藏火力。”