Nasdaq weakened, NVIDIA plunged more than 6.5% and fell for three consecutive days, chip and AI stocks generally declined, while Chinese concept stocks outperformed

美國三大指數走勢分化,道指標普上漲,納指下跌。芯片股領跌大盤,英偉達跳水並一度跌超 6.5%,英偉達兩倍做多 ETF 跌超 12%;AI 概念股多數下跌,戴爾科技曾跌超 5%,超微電腦跌超 8.1%;熱門個股普漲,新能源車齊漲,蔚來曾漲超 4.6%,中概指數漲 1.8%。

6 月 24 日週一,美國三大指數走勢分化,納指脱離新高跳水,標普 500 雖低開轉漲,道指維持漲勢。

高開 34 點的道指一路走強,曾漲超 1%;科技股為主的納指早盤跳水,一度跌約 126 點或 0.7%,納指 100 在開盤半小時一度轉漲,隨後重新回落;標普 500 大盤轉漲,曾漲近 0.48%,後小幅回吐部分漲幅。

明星科技股漲跌不一。微軟跌 0.75% 後轉漲 0.66%,現漲幅幾近持平;蘋果一路上揚,一度漲超 1.5%;谷歌 A 漲超 0.5% 又跌超 0.45%,現小幅下跌;亞馬遜漲約 1% 後加速下跌,曾跌約 1.15%;Meta 和特斯拉維持漲勢,曾一度漲超 2.6% 和 2.9%,但又雙雙回吐多數漲幅;而奈飛維持跌勢,一度跌近 2.6%。

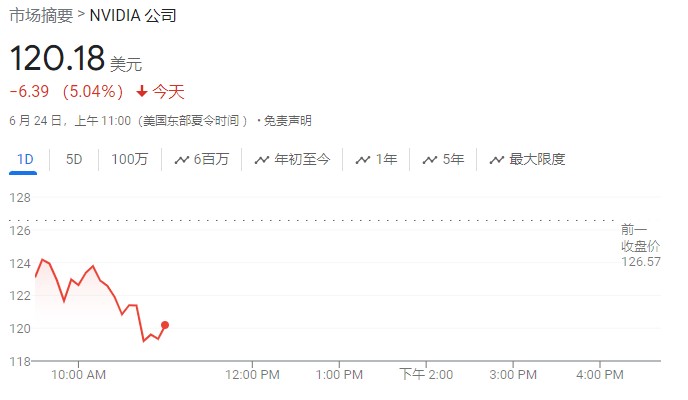

芯片股跌幅居前。費城半導體指數和行業 ETF SOXX 均曾跌超 1.8%。英偉達跳水並一度跌超 6.5%,勢將連跌三天;英偉達兩倍做多 ETF 跌超 12%;Arm Holdings 跌超 5.7%;高通跌超 4%;而美光科技曾漲近 2.4% 後又跌超 1%。

消息面上,上週五 “三巫日” 時英偉達高管頻頻減持,部分資金獲利了結均重挫英偉達股價。SEC 文件顯示,黃仁勳於美東時間 6 月 21 日出售 12 萬股英偉達股票,6 月 13 日至今,黃仁勳合計減持英偉達股份 72 萬股,套現總金額近 9500 萬美元(約合人民幣約 6.9 億元)。

AI 概念股多數下跌。戴爾科技曾跌超 5%,超微電腦跌超 8.1%。SoundHound.ai 曾跌超 3%。

中概股指強勢跑贏美股大盤。ETF KWEB 漲超 1.2%,CQQQ 維持跌勢,曾跌約 0.9%,納斯達克金龍中國指數(HXC)曾漲約 1.8%。

熱門個股普漲,阿里巴巴漲超 3%,騰訊控股漲約 1.3%,京東漲超 2.8%,新能源車齊漲,蔚來曾漲超 4.6%,理想汽車曾漲約 3.9%,小鵬汽車曾漲超 4%,而極氪多次短線轉跌。

以下是北京時間 21:50 之前更新內容

6 月 24 日週一,美股盤初,三大股指漲跌不一,道指漲 0.22%,納指跌 0.18%,標普 500 指數跌 0.02%。

半導體股跌幅居前,Arm Holdings 跌超 3%,超微電腦跌超 4%;英偉達一度下跌 3.2%,現跌超 2%,連續第三個交易日走低,恐蒸發逾 3000 億美元的市值。

英偉達市值已低於微軟和蘋果,上週五英偉達市值約為 3.1 萬億美元,低於蘋果的 3.2 萬億美元和微軟的 3.3 萬億美元。然而,該公司股價開年以來至最近一日收盤的漲幅仍有 156%,是以科技股為主的納斯達克 100 指數中表現最佳的個股。

蘋果股價微跌。消息面上,反壟斷風暴再起,歐盟委員會週一發佈公告稱,根據初步調查結果,指控蘋果應用商店規則違反《數字市場法案》。

比特幣今日大跌,日內跌超 4%,跌至 61000 美元附近,受此影響,區塊鏈概念股普跌,嘉楠科技跌超 5%,Coinbase Global 跌約 4%。

納斯達克中國金龍指數迅速拉昇,現漲超 1%。蔚來漲超 3%,理想汽車、小鵬汽車、阿里巴巴漲超 2%。

本週投資者最關注的事件是週五的個人消費支出 (PCE) 價格指數報告,這是美聯儲首選的通脹衡量指標,預計將顯示價格壓力温和。根據 LSEG 的 FedWatch 數據,市場參與者仍預計美聯儲今年將降息兩次,其中 9 月降息 25 個基點的可能性為 60.4%。

本週的其他重要事件還包括耐用品訂單、每週失業救濟金申請人數和最終的第一季度 GDP 數據。

歐股集體走高

歐洲斯托克 50 指數漲 0.70%,德國 DAX30 指數漲 0.62%,英國富時 100 指數漲 0.53%,法國 CAC 40 指數漲 0.72%。

比特幣跌至 61000 美元附近

比特幣日內跌 4.34%,現報 61313.8 美元/枚。