The S&P Nasdaq Composite Index halted its three-day decline, with NVIDIA rebounding by 6.8%, while Alphabet and Microsoft hit new highs, and oil prices fell by 1%

美联储理事鲍曼鹰派发声,若通胀没有持续改善将支持加息,加拿大 5 月 CPI 重新加速,对加拿大央行 7 月降息构成阻碍。美股走势分化,道指收跌近 300 点且六日里首跌,英伟达市值重上 3.10 万亿美元,芯片股指显著反弹 1.8%,财报利好令联邦快递盘后涨 15%,获德国大众投资令 Rivian 盘后涨 46%。中概指数跌 1.3% 至近十周最低,但小鹏汽车转涨 1%,理想汽车跌超 2% 后小幅转涨。诺和诺德欧股与美股齐创新高,空客欧股跌超 12% 后跌超 9%。美债收益率尾盘基本抹去日内的小幅涨幅,美元走高,日元连续多日下逼 160,离岸人民币徘徊七个月低谷,比特币升穿 6.2 万美元。油价跌 1%,美油失守 81 美元,布油下逼 85 美元脱离八周最高。现货黄金失守 2320 美元至一周低位,伦铜十周最低,纽约可可期货再跌 10%。

FOMC 票委、美联储理事鲍曼鹰派发言称,如果通胀没有持续改善将愿意支持加息,现在还不是开始降息的正确时机,通胀前景存在多重上行风险,预计 2024 年不会有任何降息行动。

有分析称,近期多位美联储官员都称需要等待 “一段时间”、有了更多通胀降温数据才能讨论降息。旧金山联储主席、今年票委戴利拒绝先发制人地降息来对抗劳动力市场恶化和经济放缓。

但另一位票委、美联储理事库克周二称,“在某个时间点” 降息将是适宜的,就业和通胀目标面临的风险更加平衡,预计通胀将在 2025 年更加迅猛地放缓。

美国 6 月咨商会消费者信心、现况和预期指数全线下滑,受访者预计商业条件在未来半年改善的比例跌至 2011 年以来最低。美国 4 月标普 - 凯斯席勒房价指数从高位有所降温。

连续四个月压力缓解之后,加拿大 5 月 CPI 通胀率重新加速至同比 2.9%,对加拿大央行 7 月降息构成阻碍,美元兑加元短线跌超 40 点。此外,市场仍预计美联储今年会降息两次。

联邦快递年度利润展望超预期,得益于深度降成本,股价盘后涨 15%,有分析称,其财报通常是美国经济先行指标。“特斯拉劲敌” Rivian 获得德国大众 50 亿美元投资,股价盘后涨 46%。

标普纳指止步三日连跌,道指六日里首跌,谷歌微软新高,英伟达反弹 6.8%

6 月 25 日周二,美股指数走势继续分化,道指低开低走,盘中最深跌超 410 点或跌 1%,一度失守 3.9 万点整数位,成分股沃尔玛一度跌 3.4%,脱离历史新高并创两个月最大跌幅。费城银行指数跌超 1.2%。标普 500 指数大盘和纳指在英伟达等芯片股反弹的推助下高开高走,纳指和芯片股指都涨超 1%。美股科技股指数 ETF 和生物科技指数 ETF 涨幅居前。

截至收盘,标普 500指数、纳指和纳指 100均止步三日连跌,标普脱离一周低位,纳指脱离两周新低,道指止步五日连涨并脱离近五周高位:

标普 500 指数收涨 21.43 点,涨幅 0.39%,报 5469.30 点。道指收跌 299.05 点,跌幅 0.76%,报 39112.16 点。纳指收涨 220.84 点,涨幅 1.26%,报 17717.65 点。

纳指 100 涨 1.2%,衡量纳指 100 科技业成份股表现的纳斯达克科技市值加权指数(NDXTMC)涨 1.8%,此前均连续三日脱离新高。罗素 2000 小盘股跌 0.4%,“恐慌指数” VIX 跌超 3% 失守 13。

标普纳指止步三日连跌,道指六日里首跌 摩根大通首席市场策略师 Marko Kolanovic 预警称,通胀数据走低在激发人们对降息希望的同时,也在暗示经济增长值得担忧,或为金融市场下阶段面临的主要风险之一。纽约梅隆银行策略师也称,如果经济数据持续疲软,股市涨幅将无法持续,除非 9 月美联储降息的可能性变得更大。

周二美股科技板块反弹一枝独秀

明星科技股齐涨。“元宇宙” Meta 涨 2.3% 至十周多最高,谷歌 A 涨 2.7% 再创历史新高,亚马逊涨 0.4% 逼近六周高位,特斯拉涨 2.6%,奈飞涨 0.5% 脱离一周新低;苹果涨 0.5% 且连涨两日,市值 3.21 万亿美元位居美股第二;微软涨 0.7% 再创历史新高,市值 3.35 万亿美元为美股最大。

芯片股在三日显著回调后反弹。费城半导体指数涨 1.8%,行业 ETF SOXX 涨 1.5%,均脱离两周低位。英伟达涨 6.8%,止步三日连跌脱离三周新低,昨日曾跌 6.7% 创两个月最大跌幅,市值重上 3.10 万亿美元位居美股第三,英伟达两倍做多 ETF 涨近 14%;但博通跌 0.7% 连续五日跌离最高;高通涨 0.7%,ARM 涨超 6%,台积电美股和拉姆研究涨 2.8%,应用材料涨 1.9%,美光科技转涨 1.5%,此前均连续三日脱离新高;英特尔涨 0.6%,AMD 跌 2.4% 后收平。

AI概念股涨多跌少。CrowdStrike 涨 2.3%,此前曾四日脱离新高,甲骨文跌 0.5% 连续四日脱离新高,SoundHound.ai 跌 1.5%,BigBear.ai 涨超 6%,C3.ai 跌超 1%,Snowflake 跌 0.5% 再创 17 个月最低,Palantir 涨 1.7%,Adobe 涨 0.5%,戴尔涨 2%,超微电脑涨约 2%,IBM 跌 1.4%。

消息面上,英伟达蒸发 4300 亿美元市值的抛售暂歇,交易员纷纷看图寻底,Oppenheimer 技术分析主管 Ari Wald 称长期趋势仍然强劲,股价远高于 101 美元的 50 日均线和 92 美元的 100 日均线,美国银行重申英伟达 “买入” 评级并列入最佳股票名单。欧盟指控微软因 “滥用” 捆绑办公协作通讯工具 Teams 和 Office365 中的流行生产力应用程序而违背反垄断规则,高盛重申微软 “买入” 评级,看好投资生成式 AI 的丰厚回报。Evercore ISI 重申苹果 “买入” 评级,看好 iPhone 收入的上涨潜力。富国银行重申特斯拉 “减持” 评级,季度交付或低于 40 万辆电动车,加拿大皇家银行将特斯拉二季度交付预期下调 23% 至 41 万辆。礼来股价创新高,与 OpenAI 达成合作关系。

中概股指回落。ETF KWEB 跌 1.4%,CQQQ 跌 1.9%,纳斯达克金龙中国指数(HXC)跌 1.3% 下逼 5900 点,在七个交易日里第六天下跌,重返近十周最低。

热门个股多数下滑,京东跌 2.8%,百度跌 0.2%,拼多多跌 1%。阿里巴巴跌 1.3%,腾讯 ADR 跌 0.8 %, B 站跌约 3%,蔚来跌 1.6%,小鹏汽车转涨 1%,理想汽车跌超 2% 后转涨 0.1%,法拉第未来跌 33% 后收跌近 19% 至六周新低,董事会批准反向股票分割,比亚迪 ADR 跌近 1%。

消息面上,百度文心旗舰模型首次免费,通义千问公布 OpenAI 用户迁移方案。伯克希尔哈撒韦再度减持比亚迪,持仓比例降至 5.99%。

其他变动较大的个股包括:

嘉年华邮轮涨 8.7% 至近六个月最高,第二财季意外盈利且营收超预期,上调全年利润预测,表示 2025 年的休闲需求将比今年更强劲,行程价格将上涨。

光伏组件电源优化器公司 SolarEdge Technologies 跌超 20% 至七年最低,将私募发行 3 亿美元可转换优先债券,到期日为 2029 年。一位欠公司 1140 万美元的客户已申请破产。

欧股诺和诺德涨 4%,与其美股同创历史最高,司美格鲁肽在中国获批用于长期体重管理,可实现 17% 的体重平均降幅。减肥药概念欧股 Zealand 涨 9.5%,共同带动丹麦股指涨 2.7% 创新高。

欧股空客跌超 12% 后跌超 9%,其美股跌超 6% 后跌 1.8% 至七个月最低,下调 2024 年息税前利润目标和商用飞机交付量预期,面临持续的供应链问题以及空间系统部门的 9 亿欧元额外成本。

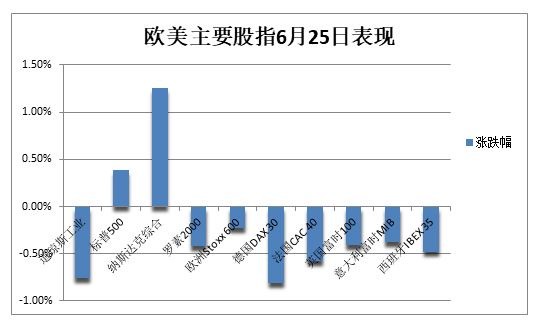

欧股普跌,德国股指跌幅居前,泛欧 Stoxx 600 指数收跌 0.23%,在七天里第三天下跌,科技和工业板块跌超 1% 领跌。Stoxx 欧洲航空航天和国防指数一度 5%,创 2021 年 11 月来最大跌幅。

美债收益率尾盘基本抹去日内的小幅涨幅,短期欧债收益率升幅相对更大

等待周五重磅通胀数据,美债收益率再度小幅走高后转跌。

盘中,美国财政部续发 690 亿美元两年期国债,得标利率 4.706%(5 月 28 日为 4.917%),投标倍数 2.75(前次为 2.41),当时美债收益率仍徘徊日高,有分析称,周三 700 亿美元的五年期美债拍卖将进一步说明潜在需求趋势。

对货币政策更敏感的两年期美债收益率一度上行 2 个基点并上逼 4.76%,美股尾盘基本抹去涨幅。10 年期基债收益率涨超 1 个基点至 4.26%,美股尾盘转跌至 4.24%,一周多前美债收益率都曾跌至 4 月初以来的十周低位。

欧元区基准的 10 年期德债收益率小幅下挫交投 2.41%,两年期收益率小幅上行。10 年期英债收益率微跌,两年期收益率涨超 2 个基点,此前数据显示加拿大通胀意外加速。

油价跌 1%,美油失守 81美元,布油下逼 85美元脱离八周最高

油价冲高回落。WTI 8 月原油期货收跌 0.80 美元,跌幅超过 0.99%,报 80.83 美元/桶,上周曾创 4 月末以来最高。布伦特 8 月原油期货收跌 1 美元,跌幅超过 1.16%,报 85.01 美元/桶,脱离昨日站上 86 美元所创的 4 月 30 日以来八周最高。

美油 WTI 盘中最深跌 0.91 美元或跌超 1%,失守 81 美元整数位,上周曾连续三个交易日收创七周最高。交投更活跃的国际布伦特 9 月期货最深跌超 1 美元或跌 1.2%,失守 85 美元并下逼 84 美元。

有分析称,随着以色列与黎巴嫩边境的紧张局势加剧,中东供应风险再次成为焦点,外加高盛、摩根大通、花旗等主流投行均看好北半球夏季出行高峰和室内降温带来的燃料需求,美油和布油在 6 月份已分别累涨 4.9% 和 4.1%,扭转了 OPEC+ 决定年末增产消息刚发布时的颓势。

有分析师认为,地缘政治风险和看涨基本面相结合,布油突破每桶 85 美元后可能带来进一步上行压力。也有人警告称,若美油跌穿每桶 81 美元,油价涨势可能消退,基金开始清空多头仓位。

欧洲基准的 TTF 荷兰天然气期货一度涨近 3%,脱离近两周低位,ICE 英国期货尾盘也涨超 2%。美国天然气 8 月合约跌 3%,重新下逼两周低位,年内累涨约 11%。美国汽油期货年内涨 19%。

美元走高,日元多日下逼 160,离岸人民币徘徊七个月低谷,比特币升穿 6.2万美元

衡量兑六种主要货币的一篮子美元指数 DXY 最高涨 0.3% 并上逼 105.80,上周五曾升破 105.90 至 5 月 1 日以来的七周多最高,全周累涨 0.2% 且连涨三周。

欧元兑美元跌 0.2% 并一度失守 1.07,重新逼近 4 月末以来的七周多低位,6 月累跌 1%。英镑兑美元微涨仍不足 1.27 关口,小幅脱离 5 月中旬以来的五周最低。离岸人民币兑美元在美股盘初跌至日低,一度失守 7.29 元,随后跌幅收窄,仍徘徊七个月低谷。

日元兑美元一度跌至 159.79,连续多日尝试下逼 160 心理整数位,美股盘中微跌至 159.70,仍徘徊 4 月 29 日以来的近八周最低,也是三十四年来低位。

市场猜测 160 或为日本政府干预汇市的警戒线。日美之间巨大利率差距,令日元 6 月份累跌 1.5%,兑美元年内跌超 10%。周一日元兑欧元曾创历史最低 171.49,兑英镑徘徊十六年最低 202.33。

主流加密货币集体反弹,止步连续多日普跌。市值最大的龙头比特币涨 3% 并重上 6.2 万美元,昨日在美股尾盘曾跌 7%,跌穿 6 万美元心理整数位,还一度失守 5.9 万美元,创 5 月 1 日以来的近八周最低。第二大的以太坊周二涨超 1% 并升破 3400 美元,脱离 5 月中旬以来的五周最低。

现货黄金失守 2320美元至一周低位,伦铜十周最低,纽约可可期货再跌 10%

美元和美债收益率携手走高压低贵金属价格。COMEX 8 月黄金期货尾盘跌 0.6% 至 2330.90 美元/盎司,COMEX 7 月白银期货尾盘跌 2.1% 至 28.905 美元/盎司。

现货黄金日内最深跌近 19 美元或跌 0.8%,失守 2320 美元整数位至一周新低,上周曾逼近 2370 美元创两周最高,但上周五盘中急跌并周内转跌,金价已从 5 月 20 日所创的约 2450 美元历史最高回落超 5%。现货白银盘中最深跌 2.5%,失守 29 美元至六周最低。

美元走高令伦敦工业基本金属多数下跌。经济风向标 “铜博士” 收跌 90 美元或跌 0.9%,失守 9600 美元整数位,创 4 月中旬以来的十周最低。伦铝小幅下跌,不足 2500 美元,依旧徘徊两个月低位。伦锌涨 0.9%,伦铅涨超 1%,伦镍跌 0.9% 刷新 4 月初以来的十二周低位,伦锡跌 1.5%。

纽约可可期货再跌 10%,刷新一个月最低。有分析担心下个月发布的第二季度全球报告显示,创纪录的高价格会破坏需求。今年可可价格累涨 88%,有望创下 1980 年以来最佳表现。