How long will it take for US inflation to return to 2%? Cleveland Fed economist: If the economy does not go into recession, it will take another 3 years

如果供應鏈改善不再推動通脹下降,那麼唯一能帶來下行壓力的就是經濟衰退。而如果沒有衰退,那就需要更多耐心,等待通脹回到 2% 需要一段時間。

抗通脹 “最後一英里” 路途漫漫,需要的時間可能超出市場預期。

據媒體週三報道,美聯儲克利夫蘭分行高級經濟學家 Randal Verbrugge 表示,由於通脹的內在特性,落至 2% 目標可能需要數年時間。

Verbrugge 的模型顯示:

到 2025 年第二季度,通脹率仍將高於目標,達到 2.7%;到 2027 年年中,通脹率將接近但仍略高於 2%。

Verbrugge 解釋通脹"最後半英里"為何如此頑固時指出:

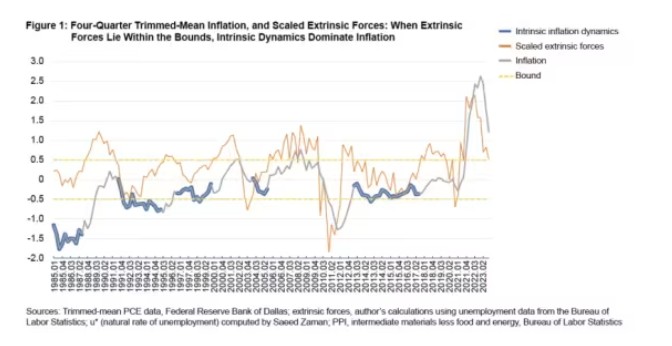

推動通脹的三大力量有:經濟衰退、經濟過熱和供應鏈壓力。在缺乏這些外部因素的情況下,通脹通常具有持久的 “內在特性”,在沒有外力推動時回落至 2% 將是緩慢的。

本週五將公佈美聯儲 “最青睞” 的核心指標——核心 PCE 指標,今年以來藍籌經濟指標反映出的頂級分析師的一致預測是,PCE 通脹率將在 2025 年接近 2%,遠早於 Verbrugge 的模型預測結果。不過,鮑威爾本月初承認,將通脹率降至 2% 可能需要更長的時間。

Verbrugge 解釋了為什麼企業可能會在預期通脹下降的情況下繼續提高價格:

通脹的內在持續性基於人們對未來的預期形成方式以及經濟中的價格設定方式。

自 2023 年 4 月以來,通脹一直在相對快速下降,但由於通脹仍為正值,大多數調整也是正向的,所以問題是還會上漲多少?

工資是其中一部分,如果企業突然要支付更高的工資,那會就會削減利潤率,企業可能會試圖提高價格,以免被壓縮利潤。

因此,Verbrugge 認為,除非有外部力量或非常規的內在力量推動,否則通脹不會很快回到 2%,而是緩慢地拖着腳步回落。

歷史經驗也證明情況確實如此,尤其是從 2012 年到 2019 年,PCE 通脹率 12 個月的截尾均值僅變化了半個百分點,這花了大約六年時間。截尾均值是觀察核心通脹率的另一種方式,剔除每月增長最快和最慢的成分。

總的來看,Verbrugge 的模型意味着,如果供應鏈改善不再推動通脹下降,那麼唯一能帶來下行壓力的就是經濟衰退。而如果沒有經濟衰退,那就要有耐心,通脹回落需要至少 3 年。

此外,Verbrugge 補充成,經濟衰退將幫助企業決定。它們可以隨着時間的推移慢慢地提高價格或工資,而不是今年提高 4% 或 3.5%。