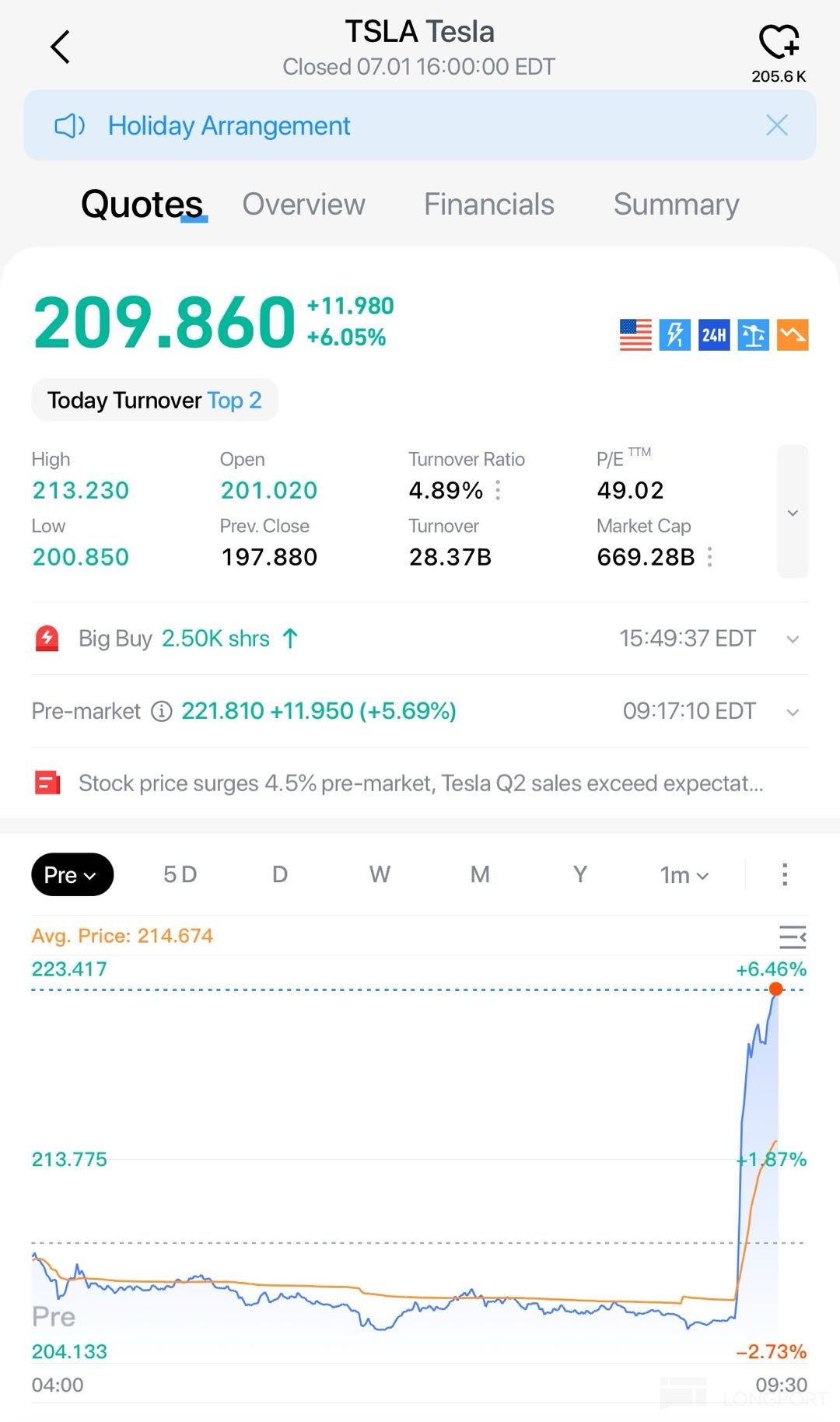

Stock price surges 4.5% pre-market, Tesla Q2 sales exceed expectations

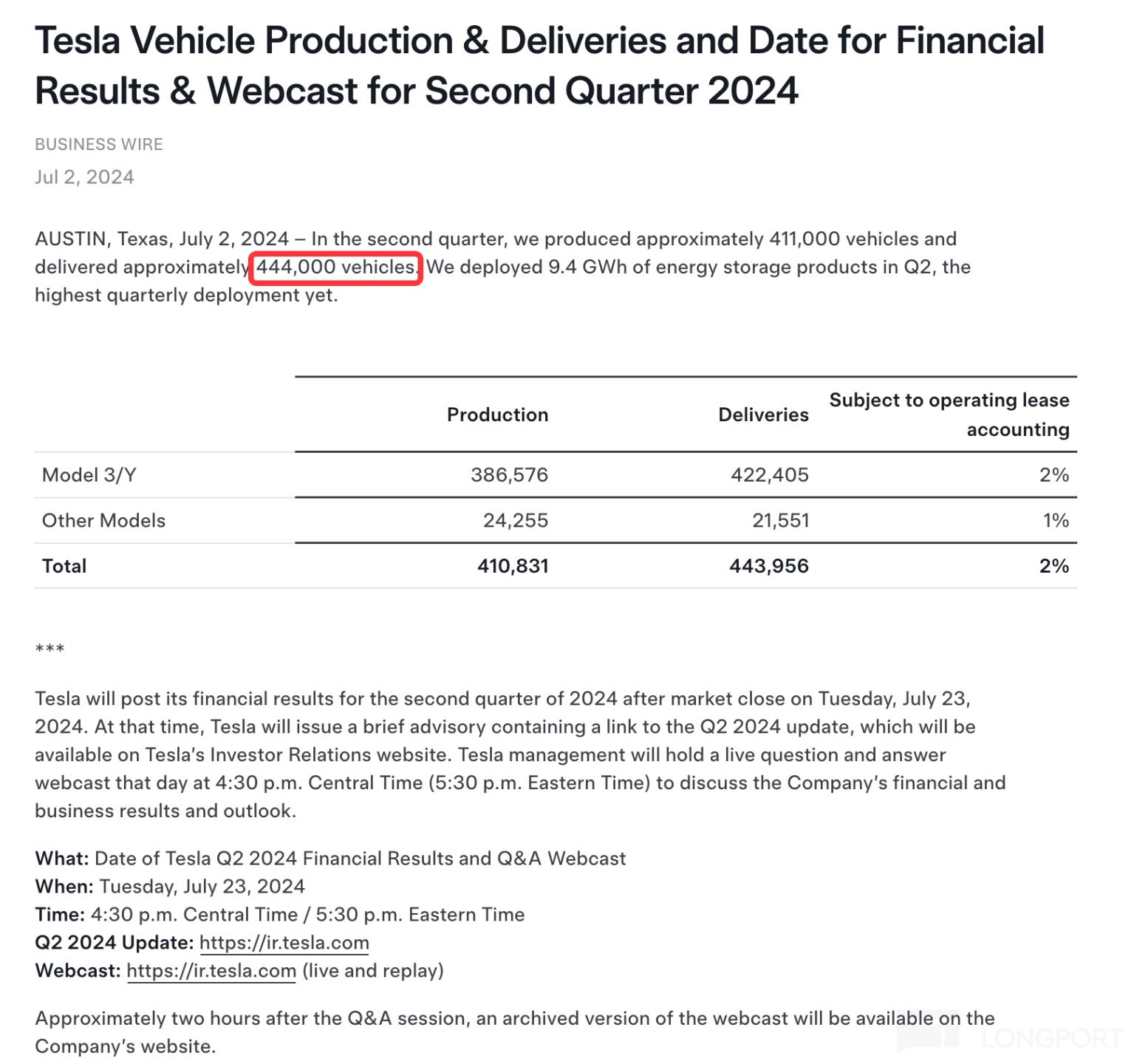

Analysts' consensus forecast for Q2 is 438,019 vehicles, while the actual number is 444,000

Tesla releases Q2 sales data:

Pre-market stock price surged by 4.5%.

Analysts unanimously expected Q2 to be 438,019 vehicles, marking the first consecutive year-on-year decline for the second quarter in history.

This means that Tesla's delivery volume in the first half of this year is less than 1 million vehicles, with many hoping for the first time ever to reach 2 million vehicles.

In the fourth quarter of last year, Tesla set a delivery record of 484,507 vehicles, while the total deliveries in the first quarter of this year were 386,810 vehicles, even lower than the lowest expectations, marking the lowest quarterly delivery volume since the second quarter of 2022.

Recently, Tesla's stock price has performed well. Below are the potential positive expectations in the market:

On July 23rd, Tesla will release its financial report. The report will provide important information about the company's profitability and financial health. With adjustments to analyst expectations, the market's expectations for Tesla's earnings and revenue are also changing.

In August, Tesla's launch of Robotaxi is expected to stimulate some optimism in the short term, but real substantial progress will have to wait until fully autonomous driving technology is achieved and reaches Level 5 autonomous driving. According to other analysts, this will bring incredible financial growth to the company and increase its sales data.

In terms of energy storage business, Morgan Stanley has previously given high praise to Tesla's energy business. Driven by AI, it is predicted that by 2030, Tesla is expected to increase its after-tax net operating profit by $3.95 billion, with earnings per share exceeding $1, and has raised Tesla's target price to $310, maintaining a "buy" rating