Heavyweight! Top asset management giants support the AI frenzy: "AI leaders" such as NVIDIA will continue to drive the bull market

全球頂級資管機構的市場策略師和基金經理們認為,人工智能仍將繼續推動股市上漲,併成為今年下半年全球股市的重要投資主題之一。英偉達等受益於全球 AI 技術的大型科技公司將繼續領導股市的漲勢,但一些策略師和基金經理也認為人工智能的二級和三級受益者有望嶄露頭角。投資者們預計美國股市在 2025 年有望創下歷史新高。

智通財經 APP 瞭解到,來自全球頂級資管機構的市場策略師以及基金經理們表示,全球股市圍繞人工智能的這股史無前例投資狂潮遠未宣告結束,股價屢創新高的英偉達等 AI 領導者股價經過短暫調整後,將繼續驅動全球股市 “長牛走勢”——即不斷創下歷史新高。甚至有經濟學家預言,基於 AI 技術發展的樂觀情緒推動下的額外多重擴張預期,將推動美股基準指數——標普 500 指數在 2025 年創下 7000 點這一歷史峯值。

據瞭解,全球最大規模資管巨頭貝萊德 (BlackRock Inc.),以及歐洲資管巨頭法國巴黎銀行資產管理機構 (BNP Paribas Asset Management) 等全球大型資管機構的基金經理和市場策略師們紛紛表示,他們預計人工智能將成為今年下半年全球股市的最重要投資主題之一,也是驅動股市創新高的核心驅動力。

雖然大多數策略師預計 AI 芯片霸主英偉達 (NVDA.US) 等受益於全球企業佈局 AI 技術的大型科技公司將繼續走在前列,但也有一些策略師和基金經理認為,包括公用事業和基礎設施提供商在內的人工智能的二級和三級受益者後續有望佔據重要地位。幾乎所有策略師和基金經理一致認為,圍繞 AI 的投資狂潮遠未消退。

來自貝萊德投資研究所的全球首席投資策略師 Wei Li 表示:“我們預計人工智能將成為下半年的最關鍵主題之一。”“這是一次集中式的反彈,這是人工智能轉型的一個顯著特點,而不是市場上的一個漏洞。AI 驅動之下,股票市場的科技股集中度本身並不是我們擔心的原因。”

自 2022 年底以來,美股基準股指——標普 500 指數飆升了 40% 以上,其中英偉達與微軟所領銜的 “美股七大科技巨頭”(Magnificent 7)——被市場是人工智能投資主題的大贏家——為這一漲幅的貢獻力度高達 60%。儘管對一些市場預測者來説,這輪迅速上漲讓人想起了互聯網泡沫時期,但來自全球資管機構的眾多策略師認為,這一輪圍繞 AI 的投資狂潮主要由強勁的實際盈利以及樂觀的盈利前景所支撐。

“Magnificent 7” 包括:蘋果、微軟、谷歌、特斯拉、英偉達、亞馬遜以及 Meta Platforms。全球投資者們 2023 年以及 2024 年上半年持續蜂擁而至七大科技巨頭,最主要的原因可謂是他們紛紛押注,由於科技巨頭們的龐大市場規模和財務實力,它們處於利用人工智能技術擴展營收的最佳位置。

此外,韌性十足的全球經濟增長,加上全球最大規模央行 (即美聯儲) 將降息的押注力度,也提振了市場投資情緒。然而,11 月即將舉行的有爭議的美國總統大選可能會破壞這一反彈。

目前,有基金經理押注,掌握人工智能技術的那些公司,無論是聚焦於 AI 基礎設施領域 (比如英偉達 AI GPU) 還是 AI 軟件領域 (比如 ChatGPT),可能將繼續超越本已很高的業績預期和市場份額預期。他們預計,包括材料、傳統能源、清潔能源和工業在內的傳統行業也將受益於這股全球斥巨資佈局 AI 的熱潮。

來自 Nuveen 資產管理公司的首席投資官 Saira Malik 表示:“毫無疑問,英偉達目前這個領域 (AI) 的最大贏家,基本上無論如何都是如此。” Nuveen 資產管理公司管理着高達 1.3 萬億美元的資產。Saira Malik 領導下的基金將英偉達 (NVDA.US)、蘋果公司 (AAPL.US) 和亞馬遜公司 (AMZN.US) 列為最大持倉,認為這些大型科技巨頭將是 AI 熱潮最大贏家。“每個想要轉向人工智能趨勢的公司基本上都必須使用英偉達的產品。” Malik 表示。

AI,仍將是股市的核心驅動力!有經濟學家高呼:AI 有望推助標普 500 指數明年升至 7000 點

在接受媒體調查的十幾位大型機構投資者中,大多數機構投資者預計未來六個月全球股市基準——MSCI 全球股市指數將上漲 9%,其中佔據 MSCI 全球股市指數最大權重的美國股市最有可能跑贏全球股市基準。

這些投資者認為股市圍繞人工智能的這股史無前例投資狂潮遠未宣告結束,股價屢創新高的英偉達等 AI 領導者股價經過短暫調整後,將繼續驅動全球股市不斷創下歷史新高。在這種背景下,多數投資者表示,即使在如此高的價位,他們也會選擇買入股票或者傾向於逢低買入策略。

來自 Capital Economics 的首席經濟學家 Neil Shearing 認為,AI 可能幫助標普 500 指數在 2025 年達到 7000 點的歷史峯值,儘管他也看到了與之前的 “互聯網泡沫時期” 確實有相似之處。Shearing 在週一的客户報告中寫道:“互聯網泡沫的經驗表明,美國股市估值可以進一步上升——AI 樂觀情緒推動的額外多重擴張預期是我們認為標普 500 指數明年可能達到 7000 點的原因。”

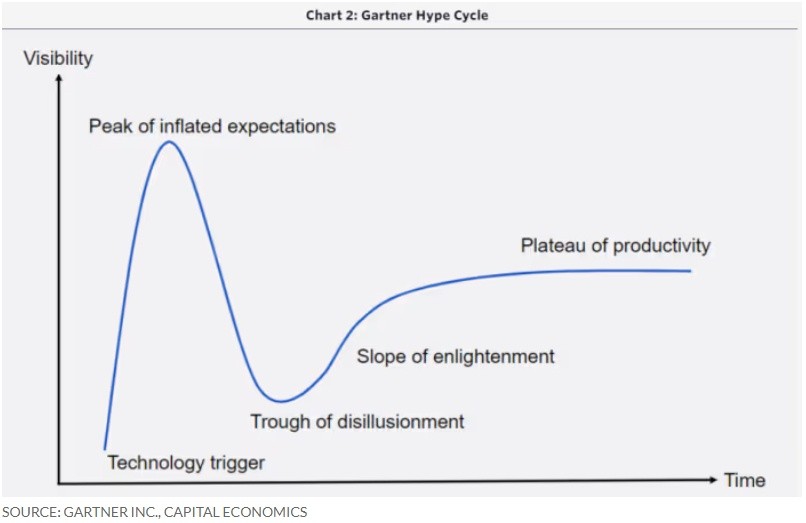

Shearing 表示,目前發生的情況似乎是 AI 正在遵循 “Gartner 炒作週期”(Gartner Hype Cycle),該週期展示了公眾對新技術影響的看法如何隨時間演變 (見下圖)。經濟學家 Shearing 堅持認為,AI 革命將在本十年下半期開始對經濟增長產生積極影響。

來自 Lazard 的首席市場策略師 Ronald Temple 表示:“股票市場在當前水平上還有上行空間。”“如果你回顧過去幾個月,其實跌幅非常小,部分原因是有資金在場外等待投入工作。因此,等待經濟下滑實際上可能是一個糟糕的策略。”

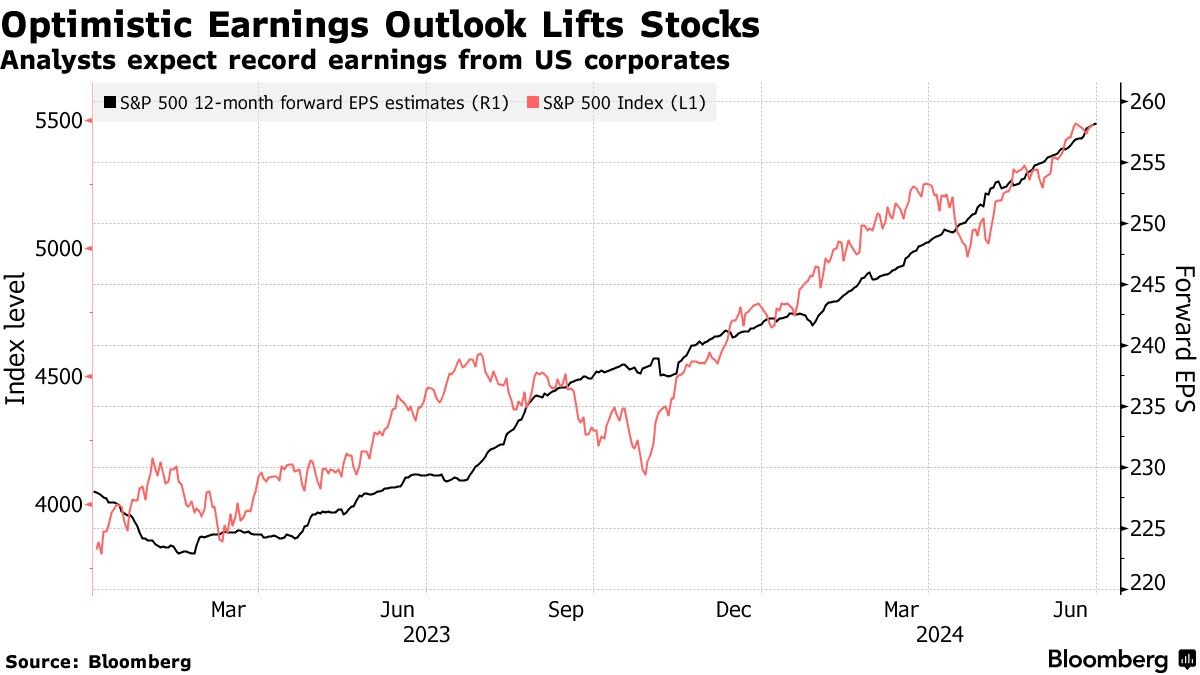

焦點將很快轉移到英偉達等大型科技公司的利潤數據上。市場預期極高,華爾街分析師們普遍預測未來 12 個月標普 500 指數成份公司的整體每股收益將創歷史新高,對於 Q2 美股七大科技巨頭的業績預期也非常高,如果有巨頭業績不及預期,佔據標普 500 指數高權重的這些巨頭可能將引發標普 500 指數回調。即將到來的美股財報季將於 7 月 12 日開始,屆時摩根大通 (JPM.US) 等華爾街大行將率先公佈第二季度業績。

"我整體看好股票市場。” 法國巴黎銀行資產管理機構的資深跨資產策略師 Sophie Huynh 表示。“我們正處於全球抗擊通脹的最後一英里,無論從市盈率還是盈利增長角度來看,這對股市都應該是有利的。”

本季的一大亮點將再次是 AI 領域 “賣鏟人” 英偉達的財報數據——預計將於 8 月下旬公佈,投資者們正在尋找人工智能熱潮是否仍在繼續的證據。到目前為止,這家芯片巨頭實際業績已多個季度遠超華爾街極高的業績預期,但美股科技巨頭們估值普遍大幅上升,使它們面臨着因業績失望而出現更大範圍拋售的風險,促使一些投資者選擇獲利了結。

據瞭解,高盛編制的追蹤人工智能相關股票的一籃子股票整體預期市盈率約為 32x,遠高於標普 500 指數的 21x。

來自 Martin Currie 基金經理 Zehrid Osmani 表示,未來幾年,如果不包括英偉達在內的 AI 領域公司 “不能通過看到盈利升級變得更加積極,顯示出它們可以從人工智能機會中大幅獲利,那麼股價可能會面臨下行壓力”。他強調,“我們的觀點是,堅持持有那些明顯有能力變現的 AI 科技公司,以及那些業績指引上調的公司。”

不過,機構投資者們普遍認為,人工智能對利潤增長的提振,加上即將到來的降息週期和穩健的經濟,將繼續支撐股票市場。

Saturna Capital 的投資組合經理兼高級投資分析師 Dan Kim 表示:“我們正在目睹創新激增浪潮,這一浪潮可能將在未來幾年內大幅推動經濟相對於市場預期的上行。”

全球企業紛紛佈局 AI 的這股熱潮勢不可擋

與此同時,華爾街頂級投行仍然堅持看漲有着 “AI 總龍頭” 稱號的英偉達 12 個月內股價走勢,普遍認為全球企業對於英偉達 H100/H200 AI GPU 需求仍然非常強勁,以及下一代基於 Blackwell 架構的 AI GPU 有望帶來巨大營收貢獻,並且 “CUDA 軟硬件協同平台 + 高性能 AI GPU”,共同構成英偉達無比強大的護城河。

根據知名研究機構 IDC 研報,2022 年全球範圍內覆蓋以人工智能為中心繫統的軟件、硬件和其他相關服務的人工智能 (AI) IT 總投資規模僅僅約為 1324.9 億美元,但是預計在 2027 年有望增長至 5124.2 億美元,年複合增長率 (CAGR) 高達 31.1%,且將全面聚焦類似 ChatGPT 的生成式 AI(Generative AI) 領域。

IDC 最新調查顯示,預計到 2027 年 45% 企業將掌握並使用生成式 AI 工具 來共同開發數字產品和服務,從而力爭營收規模增長比競爭對手翻一番。IDC 還預測,全球生成式 AI 市場年複合增長率或達 85.7%,到 2027 年全球生成式 AI 市場規模將接近 1500 億美元。這些都意味着在 AI 核心基礎設施領域佔據主導地位的英偉達,有望在未來幾年持續受益於這股史無前例的 AI 熱潮。

從更長的時間維度來看,英偉達股價自 2022 年 10 月以來飆升逾 1000%,在上週更是一度成為全球最高市值上市公司,首次榮登 “全球股王” 寶座。在這場暴漲 1000% 的 AI 狂歡盛宴之後,全球資金也許將由狂熱的非理性跟風湧入迴歸至理性思考,可能意味着屢創新高的英偉達股價短期向下調整或橫盤,但很難改變 “AI 賣鏟人” 英偉達在 AI 時代之下的股價 “長牛漲勢”。

看漲英偉達股價的華爾街分析師紛紛強調,英偉達還將繼續上漲,年內可能衝擊 150 美元,甚至 200 美元——意味着英偉達市值將突破 5 萬億美元大關。自今年以來,華爾街分析師們的平均目標價股票同樣遠遠追不上英偉達股價漲勢,迫使所有覆蓋英偉達股票的分析師們不斷上調英偉達目標股價。

美東時間週一,華爾街頂級投行摩根士丹利大幅調高英偉達的業績預期以及目標股價,該機構經最新調研後認為,在無與倫比的需求推動下,英偉達至少今年的業績數據將非常 “強勁”。大摩經調研後將英偉達 12 個月內的目標股價從 116 美元大幅上調至 144 美元,並維持該機構對於英偉達的 “增持” 評級。

華爾街知名投資機構 Rosenblatt 近日發佈一份重磅研報,核心內容在於:基於英偉達以 CUDA 為核心的軟件業務潛在繁榮預期,即使 AI 芯片霸主英偉達股價在一年股價暴漲,但未來 12 個月該芯片巨頭的股價仍將繼續攀升。除了 CUDA 牢牢綁定英偉達 AI GPU 所帶來的鉅額 GPU 硬件營收,以及 CUDA 企業級的大規模應用帶來創收,以 CUDA 為核心衍生出的軟件業務同樣是英偉達 CUDA 實現鉅額創收的引擎。

以上是來自 Rosenblatt 芯片行業分析師 Hans Mosesmann 的看法,他在這份研報中將該機構對英偉達的 12 個月內目標股價從 140 美元大幅上調至每股 200 美元的驚人水平,位列華爾街對於英偉達的最高目標價。