Citigroup has proposed a new gold pricing framework, predicting that the gold price will break through the $3000 mark next year

花旗分析師提出新基本面分析框架,認為私人和公共部門投資需求增加將支撐金價,尤其是央行購金的需求,將會榨乾礦山供應,預計 2025 年金價衝上每盎司 2700-3000 美元。

過去一年來,黃金累計漲超 21%。在各類資產中名列前茅。

展望黃金後市的走勢,花旗分析師 Maximilian J Layton 等在本週發佈的報告中提出了一個新的基本面分析框架,他們認為,投資需求佔黃金開採供應的比例是黃金定價的主要驅動因素,過去兩年裏,央行投資需求持續增加,佔據了礦山供應的大頭,推動金價不斷走高,預計後市央行購金可以支撐 25 年金價踩穩 2700-3000 美元。

央行購金需求 Q1 達到礦山供應的 85% 支撐金價上行

分析師指出,投資需求可以視為私人和公共部門財富的分配。這種財富分配決策不僅受實際利率影響,還受地緣因素 (如去美元化) 以及其他資產價格風險的影響。

自 2022 年第三季度以來,黃金價格表現開始與美國實際利率走勢出現顯著背離。從歷史數據來看,金價與美國實際利率通常呈負相關,當實際利率上升,持有黃金的機會成本增加,資金往往會適當減配黃金,增配美債和美元,因此黃金價格通常下跌;反之,黃金價格則上漲。

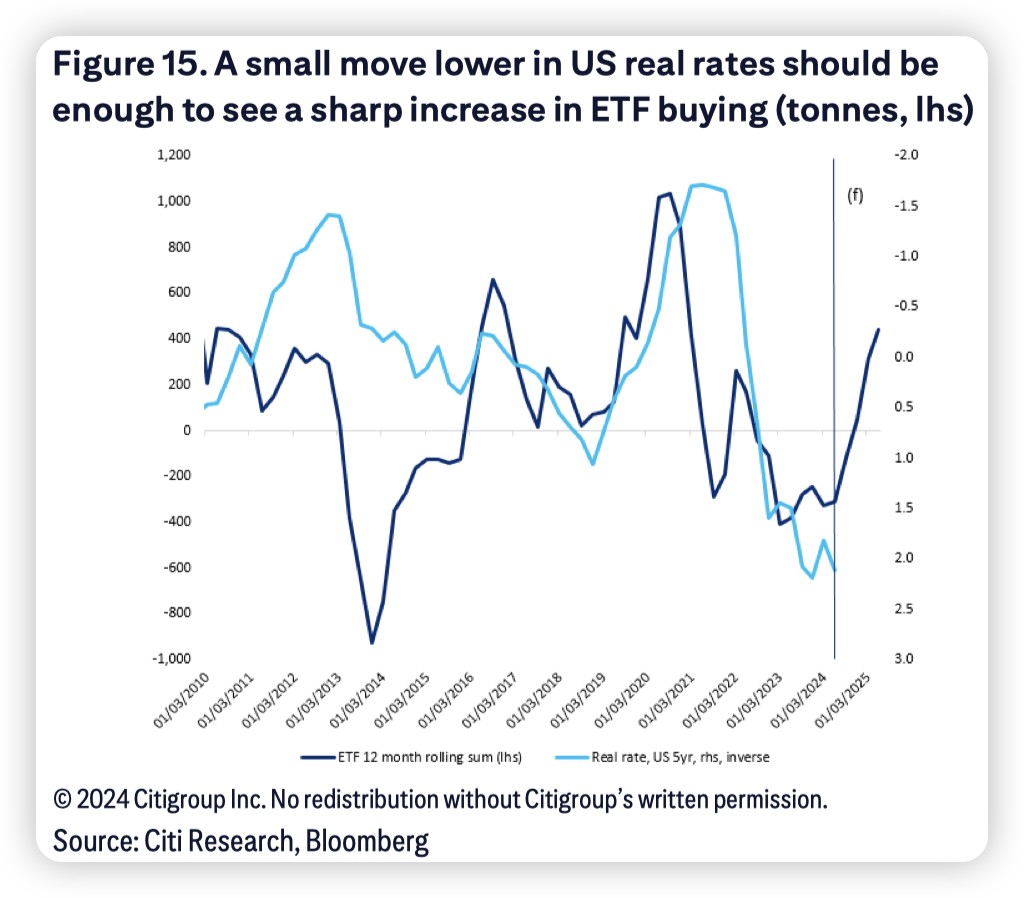

分析師指出,22 年下半年出現的這種背離,是因為實際利率只是全球黃金投資需求的驅動因素之一。事實上,實際利率對黃金投資的負面影響 (主要體現在全球 ETF 實物需求上) 已被自 2022 年中期以來高漲且不斷上升的全球央行投資需求所抵消:

以中國為首的全球央行的黃金投資需求在 24 年第一季度上升至礦山供應的 85%,在過去兩年 (22 年第三季度至 24 年第一季度) 平均超過礦山供應的 70%,而在此前 3 年 (19 年第三季度至 22 年第二季度) 僅佔礦山供應的 25%。全球央行投資需求的增加抵消了美國實際利率上升給金價帶來的負面影響,擠壓了珠寶需求,推動黃金價格升至歷史新高。

私人部門購金熱度也在持續

分析師預計,公共部門強勁的黃金需求可能是一個長達數十年的趨勢,花旗基本假設下,2024 年和 2025 年公共部門黃金需求將創歷史新高,分別為 1100 噸和 1075 噸。在樂觀情景下,2024 年和 2025 年公共部門黃金需求可能分別達到 1240 噸和 1225 噸。

報告指出,黃金價格在強勁投資需求面前上漲幅度將在很大程度上取決於珠寶需求和廢金對價格的彈性。與 2008-2012 年黃金牛市相比,對高價格的反應可能相對温和。自 2022 年以來,儘管價格高企,但珠寶需求已穩定在每年約 2200 噸。

除了央行購金,分析師認為,私人部門黃金投資需求包括全球零售實物金條和金幣需求、全球 ETF 需求和場外交易/其他 (淨) 需求也十分旺盛,尤其是中國。儘管價格在今年迄今為止創下或接近歷史新高,但買入水平仍然很高。2024 年上半年,中國零售黃金需求創下歷史新高。

ETF 方面,分析師預計年底隨着美聯儲開始降息週期,ETF 將轉為買入,並延續至 2025 年上半年。預計 2024 年淨購買量為 50 噸 (四季度較多),2025 年基本情景為 275 噸,樂觀情景為 400-500 噸。

分析師預計,未來 12-18 個月黃金投資需求將上升至幾乎吸收所有開採供應,支撐花旗對金價 2025 年站上每盎司 2700-3000 美元的基準預測。

花旗指出,下一輪投資需求和價格上漲將來自美國利率正常化 (花旗美國經濟團隊認為美聯儲將從 9 月開始連續 8 次降息),特別是推動 ETF 需求上升。而在去美元化等因素支撐下,預計全球央行的購金潮還會繼續。