Gold and silver hit a new high in a month! Behind this is not only the boost from non-farm payrolls, but also the "buying spree" by the Reserve Bank of India

非農報告釋放了美國勞動力市場降温的顯著信號,美聯儲降息預期升温,美元承壓。印度央行黃金儲備在 6 月份增加了 9 噸以上,為 2022 年 7 月以來的最高水平。

由於非農就業報告不佳,美聯儲降息預期升温,美元承壓,黃金和白銀期貨週五雙雙創下 5 月以來的最高紀錄。此外,印度央行的 “爆買” 也在助推金銀價格近期上漲。

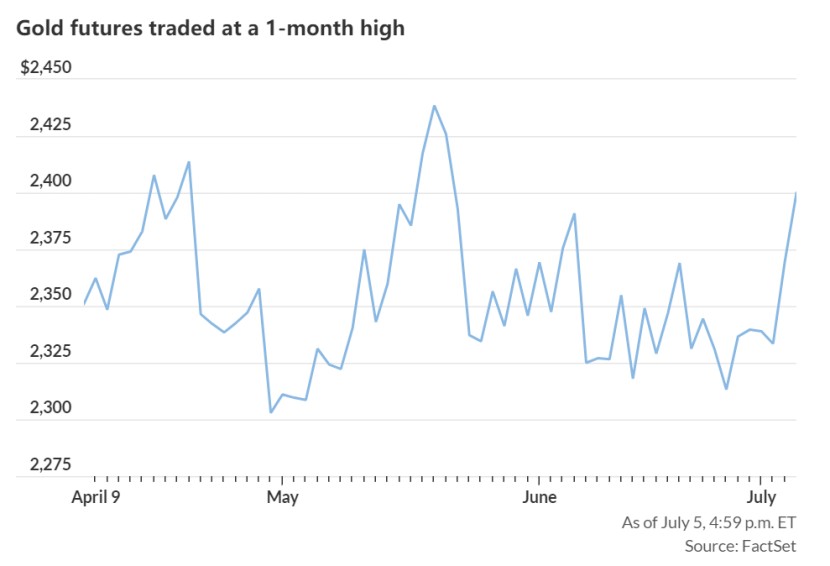

週五收盤,8 月交割的紐交所黃金期貨 GCQ24 和 GC00 結算價為每盎司 2397.70 美元,當日上漲 28.30 美元,漲幅 1.2%。黃金收盤價創下 5 月 21 日以來的最高水平。

根據道瓊斯市場數據,以最活躍的合約計算,黃金期貨本週累計上漲 2.5%,為自 5 月 10 日當週以來最強勁的單週漲幅。

現貨黃金美股尾盤一度漲 1.5% 並上逼 2340 美元整數位,刷新自 5 月 22 日以來新高。本週累漲 2.87%,為近 13 周裏最大周度漲幅。

白銀週五也出現上漲,其 9 月期貨合約 SIU24 和 SI00 價格收漲近 2.8%,至每盎司 31.69 美元,創下 5 月 17 日以來的最高收盤價。本週銀價累計上漲 7.2%,為 5 月 17 日當週以來的最大單週漲幅。

週五公佈的美國非農報告顯示,6 月新增就業 20.6 萬人,高於預期的 19 萬人,但 4 月和 5 月非農新增就業人數大幅下調,抵消了 6 月份超預期的影響。此外,失業率意外升至兩年半來最高水平,工資增長降至三年來最低水平,釋放了美國勞動力市場降温的顯著信號。

實際上,不僅僅非農助推,印度央行的 “爆買” 也在助推金銀價格近期上漲。

當地時間週五,世界黃金協會分析師 KrishanGopaul 在社交媒體平台 X 發帖表示,根據印度儲備銀行每週數據的計算,印度儲備銀行的黃金儲備在 6 月份增加了 9 噸以上,為 2022 年 7 月以來的最高水平。

這也意味着印度的黃金儲備今年增加了 37 噸,達到 841 噸。

5 月份有報道稱,印度央行還將 100 噸黃金從英國移回其國內金庫。

今年,全球央行是推動金價上漲的主要動力,推動金價在 5 月份創下歷史新高。

根據世界黃金協會最近的一項調查,受地緣政治和金融風險加劇的影響,持有黃金更具吸引力,許多央行仍計劃在未來一年購買黃金。調查顯示,約有 20 家央行計劃增持黃金,但並未透露哪些國家預計將購買黃金。