Analysis of US Stock IPOs | China's e-sports industry produces its first IPO, can Star Esports tell a new story of success?

中國電競企業星競威武向美國證券交易委員會遞交了招股説明書,預計募資規模達到 2475 萬美元。該企業擁有知名電競俱樂部,背後實控人為商業大亨何猷君。作為國內第一家有望登陸資本市場的電競和數體娛樂企業,其能否獲得資本市場的青睞牽動着整個電競產業的神經。

我們無法預判風什麼時候到來,但需要找準位置,靜待風來。星競威武集團 (NIPG.US) 之於電競和遊戲行業,或許就是從業者苦等的 “新故事”。

近日,星競威武赴美上市迎來新進展。

在北京時間 6 月 12 日首次向美國證券交易委員會 (SEC) 遞交了公開版的招股説明書 (F-1 文件) 後,星競威武於北京時間 7 月 6 日向 SEC 提交了更新後的招股説明書 (F-1/A 文件)。這代表着星競威武的 IPO 進程已進入加速階段,其股價發行區間以及募資規模也隨之披露。

據 F-1/A 文件顯示,星競威武將在此次 IPO 中發行 225 萬股美國存托股份 (即 ADS,每 ADS 對應 2 股普通股),發行區間價為每 ADS 9-11 美元,在行使綠鞋機制前至多募集 2475 萬美元。

按照上述發行區間,若超額配授權未獲行使,那麼 225 萬股 ADS 發行完成後將佔星競威武總股份的 4%,這就意味着星競威武的 IPO 市值將達到 5.06 億美元至 6.19 億美元之間。

星競威武在業內頗具盛名,其擁有着 Ninjas in Pyjamas、eStar 兩大知名電競俱樂部,是全球業務開展最為廣泛、最具影響力的電競組織之一。同時,星競威武背後的實控人為商業大亨何鴻燊之子何猷君,這令星競威武自成立之日起便擁有了較高的關注度。

不過,當下市場最為關心的,還是資本市場對於星競威武的態度,畢竟作為國內第一家有望登陸資本市場的電競和數體娛樂企業,其能否獲得資本市場的青睞,牽動着國內整個電競產業的神經。

通過梳理過往電競企業的上市表現以及剖析星競威武的招股説明書,我們或許可以從中找到答案。

電競企業攔路虎:單一的商業模式和不穩定的收入預期

從全球範圍內來看,已實現上市 (包括已退市) 的電競企業並不在少數。全球首個電競概念股是 Astralis,其成立於 2016 年,是 CS:GO 歷史上第一個 Intel 系列賽大滿貫得主,包攬超 100 萬美元的系列賽獎金,2019 年 12 月,Astralis 于丹麥納斯達克正式掛牌上市。

Astralis 搶先上市後,電競產業迅速發展的風潮讓一眾電競產業公司迎來上市契機。據不完全統計,2020 年後,有超過 20 家電競企業選擇上市,其中便包括了 Faze Clan、ESE Entertainment Group、GameSquare Esports、Guild Esports 等。

但從結果來看,該等電競企業在資本市場的表現不如人意。以 Astralis 以及在北美知名度最高的電競品牌 Faze Clan 為例,Astralis 上市不足 4 年,於 2023 年 8 月正式退市;Faze Clan 則更為慘烈,其於 2022 年 7 月上市,但由於股價跌破 1 美元,於今年 3 月退市,整個上市生命週期不足兩年,股價跌幅超 10 倍。

而 Astralis 及 Faze Clan 在資本市場中的 “大潰敗” 的關鍵原因在於未實現可持續的收入增長且難以走出盈利困境。在已上市的電競企業中,大部分公司營收模式過度單一,戰隊依賴於參賽獎金與商業贊助創收。在這樣的商業模式下,不僅運營開支居高不下,且由於贊助商扎堆湧向頭部戰隊,使戰隊成績已成為影響營收的重要因素,因此電競俱樂部的營收會隨着戰隊成績的變化而出現大幅波動。

以 Astralis 為例,其 2022 財年的營收為 8754.8 萬丹麥克朗,但贊助收入、賽事獎金及其他賽事的相關收入佔比便高達 90.49%,嚴重依賴於電競戰隊運營。單一的商業化模式,讓 Astralis 成長及盈利受限。

Faze Clan 的商業化水平則稍稍好於 Astralis。據 Faze Clan 退市前的最後一份財報 (2023 年三季報) 數據顯示,其 2023 年前三個季度的總收入為 3674.9 萬美元,同比下滑 24%,其中品牌贊助收入為 1461.6 萬美元、內容收入為 965.8 萬美元,消費者產品收入為 85.2 萬,電子競技收入為 1153.7 萬美元。

圖:Faze Clan 2023 年第三季度及前三季度收入數據

雖然 Faze Clan 在品牌贊助與賽事獎金的基礎上開拓了內容以及消費者產品兩大業務挖掘粉絲的變現潛力,但這仍處於電競戰隊運營的範疇之內。且由於運營開支未得到有效控制,Faze Clan 持續嚴重虧損。2023 年前三季度,Faze Clan 僅一般及行政費用這一項,便佔了期內總收入的 107.04%,這致使其虧損率接近 100%。如此的鉅額開支,談何盈利?

圖:Faze Clan 2023 年第三季度及前三季度業績數據

星競威武的解決方案:不單單是 “電競股”

由於已上市電競企業的低迷表現,資本市場對電競企業的熱情一度有所減弱。不過,與 Astralis、Faze Clan 等過度依賴電競戰隊運營的企業不同,此次上市的星競威武則交出了獨特的答卷,向資本市場描繪了不一樣的商業版圖。

研究招股書發現,我們似乎不能單純稱星競威武為 “電競股”,這家即將上市的公司正在向我們講述一個關於 “遊戲娛樂” 的新故事。

星競威武的發軔始於電競。但在通過併購持續加深電競戰隊運營護城河的同時,星競威武開啓了商業變現的多元化,實現了囊括電子競技、賽事活動、人才經紀等多業務並行發展,成為了綜合性的數字體育集團。

早在 2020 年時,星競威武便通過換股合併的方式併購了 2019 年王者榮耀世界冠軍盃的冠軍戰隊 eStarPro,這使其成為國內唯一一家坐擁武漢 KPL 和深圳 LPL 雙主場的俱樂部。此後,星競威武於 2023 年初併購了歐洲老牌電競俱樂部 NIP,這是迄今電競行業規模最大的跨國併購,該交易完善了星競威武對電競項目的覆蓋,充實了其職業選手人才庫,也提升了公司在電競戰隊運營方面的競爭力。

據招股書顯示,星競威武已佈局了包括英雄聯盟、王者榮耀、CS:GO 等在內的眾多主流電競項目,並持有包括 LPL、KPL、FIFA、QQ 飛車職業聯賽和 CODM 職業聯賽等遊戲固定席位。且截至 2023 年 1 月 31 日,星競威武在全球頂級電競賽事 (獎金池排名前十) 中獲得了 19 項冠軍,其中便包括《反恐精英:全球攻勢》、《王者榮耀》、《彩虹六號》和《FIFA》等遊戲,獲得冠軍數量遠超其他電競組織。

對 NIP 俱樂部的收購給了星競威武全球化發展的新機會。目前,星競威武集團業務覆蓋亞洲、歐洲、南美等地區,並在武漢和深圳設有主場,在斯德哥爾摩、上海和聖保羅設有區域辦公室。

電競戰隊的故事之外,人才經紀和賽事活動業務成了星競威武加速奔跑的助推器。人才經紀業務方面,得益於星競威武積累的豐富的電競人才庫,截至 2023 年 12 月 31 日,公司旗下電競選手及藝人在社交媒體擁有約 9900 萬粉絲。

值得注意的是,星競威武不僅簽約了 KPL 電競選手 “諾言”,鬥魚主播 “騷易” 等電競行業內的知名人士,還將觸手伸向了泛體育和娛樂賽道,娛樂圈頂流藝人王嘉爾也以合夥人和實益股東的身份加入了這家公司。

王嘉爾是全球著名的流行偶像之一,也是 Instagram 粉絲最受關注的男藝人之一。截至 2024 年 4 月 30 日,王嘉爾在 Instagram 上擁有約 3300 萬的關注者。

以電競戰隊運營起家的星競威武,似乎已開始從單純的電競公司向綜合的在線遊戲娛樂公司進階,其商業多元化拓展取得的成效也已在收入結構上有明顯體現。

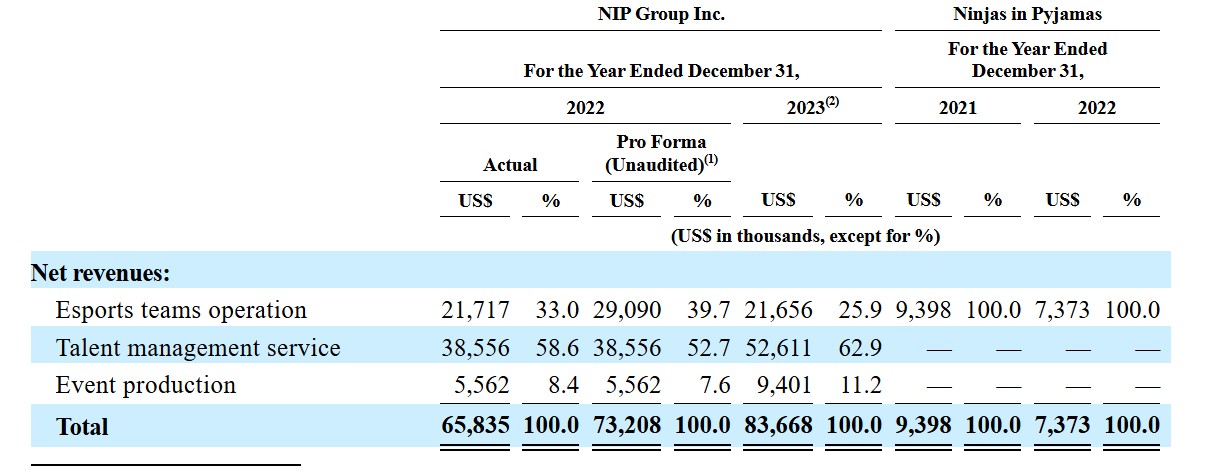

據招股書顯示,2023 年,星競威武核心業務電競俱樂部運營、人才經紀、賽事活動的收入佔比分別為 25.9%、62.9%、11.2%,人才經紀和賽事活動業務已成為星競威武收入的新的增長極。得益於此,星競威武 2023 年的總收入增長 27.09% 至 8366.8 萬美元,人才經紀已成為帶動星競威武收入增長的重要力量。

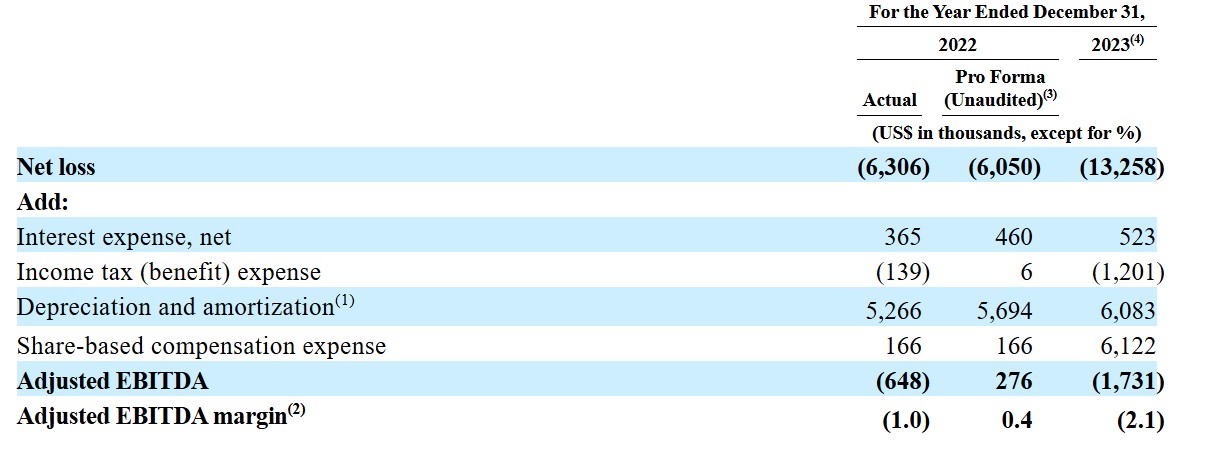

但我們也需要注意,目前星競威武仍處於持續的虧損中,2022、2023 年,其在美國通用會計準則 (GAAP) 下的淨虧損分別為 630.6 萬美元和 1325.8 萬美元,虧損率分別為 9.6% 和 15.9%。但投資者應該注意到兩個關鍵之處:

其一,星競威武的總運營費用佔比有效控制在了一定範圍內。與 Faze Clan 這樣僅一般及行政費用支出一項便超出收入的電競企業不同,星競威武得益於商業的多元化以及穩健的運營管理能力,其總運營費用得到了有效控制,2023 年時,星競威武總運營費用的佔比僅有 26%。

其二,星競威武經調整 EBITDA 已在盈虧平衡的邊緣。眾所周知,與 GAAP 會計準則相比,非 GAAP 會計準下經調整的 EBITDA(税息折舊及攤銷前利潤) 消除了折舊、攤銷等因素的影響,更能反映企業當期的真實盈利水平。2022、2023 年,星競威武經調整的 EBITDA 分別為-64.8 萬美元和-173.1 萬美元,經調整後 EBITDA 利潤率分別為-1.0% 和-2.1%,距離實現盈利僅一步之遙。

可以説,經調整 EBITDA 處於盈虧平衡邊緣在一定程度上指明瞭星競威武未來或可實現盈利的預期,但能否真正實現盈利仍需持續的觀察和跟蹤。

不過,可以確定的是,星競威武確實不同於純電競企業,其不斷破圈成長擴大商業版圖,將公司逐漸升級為全球性的、綜合的在線遊戲娛樂公司,並在業務佈局、收入結構、運營費用控制以及盈利能力等多個維度上有利好體現。

這就意味着,對星競威武的估值不能僵硬的套搬目前已上市的電競企業。鑑於星競威武多元化發展打開成長空間以及比純電競企業更強的盈利能力,那麼星競威武有望獲得更高的估值溢價也相對合理。

試圖講出新故事的星競威武能否讓已被 Astralis、Faze Clan 等電競企業 “傷透心” 的市場資金眼前一亮?隨着星競威武上市進程的推進,答案也將逐漸 “浮出水面”。