September's first decline, US stocks up another 5% this year... Powell's "brave" second day on Capitol Hill! Survey shows the market's future direction

美聯儲主席鮑威爾在國會山發表半年度貨幣政策證詞,投資者普遍預計 9 月將首次降息,預計美股到年底可能再漲 5%。鮑威爾警告稱,過早或過度降息可能阻礙通脹下降,而行動太遲或太少可能削弱經濟與就業。他表示,更多良好數據將增強對通脹正朝着 2% 目標移動的信心。根據調查,多數受訪者預計第一次降息將在 9 月份發生。

智通財經獲悉,美聯儲主席鮑威爾 “勇闖” 國會山進入第二天。在第一天的證詞發言之後,投資者目前普遍定價 9 月首次降息,預計美股到年底很有可能再漲 5%。

鮑威爾週二在參議院發表半年度貨幣政策證詞後,北京時間週三 22:00 將在眾議院金融服務委員會發表半年度貨幣政策證詞。投資者將密切關注他在利率、當前環境和未來政策線索方面的每一句話。

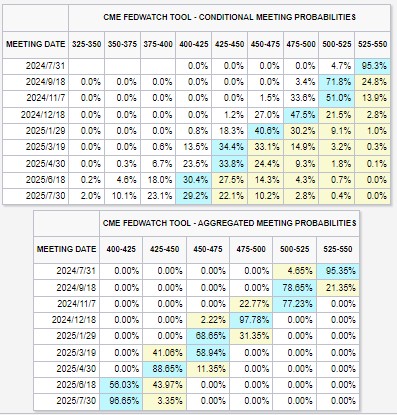

就鮑威爾週二的證詞來看,由於在抑制通脹方面取得了 “適度的進一步進展”,美聯儲無疑離降息更近了一步。然而,政策制定者仍然需要確信,通脹正在持續向 2% 的目標邁進,這意味着本月晚些時候降息的可能性不大。考慮到美聯儲在過去一年的大部分時間裏都在發表類似的言論,這對市場來説並無新意。根據 CME 美聯儲觀察工具,市場目前預計美聯儲 7 月份降息的概率僅為 4.7%,而 9 月降息的概率超過 75%。

週二,鮑威爾警告稱,過早或過度降息可能阻礙甚至逆轉通脹下降,而行動太遲或太少可能過度削弱經濟與就業。他在為期兩天的國會證詞的第一天對立法者説:“高通脹不是我們面臨的唯一風險。過晚或過少地減少政策約束可能會過度削弱經濟活動和就業。過早或過多地降息可能會阻礙或逆轉通脹進展。更多的良好數據將增強我們對通脹正朝着 2% 可持續移動的信心。”

美聯儲官員們的目標是將通脹恢復到 2% 的目標,此前新冠疫情後價格飆升。儘管勞動力市場在高利率壓力下保持了韌性,失業率的上升增加了對美聯儲官員降低借貸成本的政治壓力。

鮑威爾也指出,“更多的良好數據” 將增強對通脹正在向美聯儲 2% 目標移動的信心。因此,根據 SA Sentiment Survey最新的 7 月情緒調查,大多數受訪者 (45%) 預計第一次降息將在 9 月份發生,高於 6 月份調查的 37%。

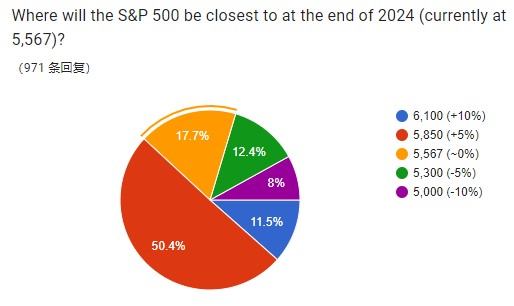

鮑威爾在美國國會的評論也被市場解讀為偏向中性,沒有出現鷹派信號,進而推動標普 500 指數週二創下新的收盤新高,創下該指數 2024 年以來的第 36 個紀錄。根據 Seeking Alpha 最新的 7 月情緒調查,超過六成的受訪者認為到 2024 年年底將上漲,其中近 50% 的受訪者認為將上漲 5%。

半年一次的貨幣政策更新報告還包含了美聯儲對整體經濟的展望。此前,美國 6 月份非農新增就業人口為 20.6 萬,失業率上升至 4.1%;與此同時,美國經濟增速有所放緩。鮑威爾補充説,就供需動態而言,勞動力市場 “幾乎” 處於疫情前的水平,但如果出現意外的疲軟,聯邦公開市場委員會將做出回應。鮑威爾稱:“我們已經看到,從很多方面來看,勞動力市場已經明顯降温……這不是目前經濟普遍通脹壓力的來源。”

對此,投資者也不在普遍認為通脹 (15.3%) 是最大的投資組合風險,轉而認為美國政府飆升的債務和財政赤字是最大的投資風險 (33.7%)。此外,投資者普遍 (49.5%) 認為未來 12 個月美國衰退的概率為 25%;僅有 3.7% 的受訪者認為美國未來一年 100% 陷入衰退。