Expectations of interest rate cuts are rising, and US real estate stocks surged to achieve the best single-day performance of the year

美國房地產股票在降息預期升温的影響下,週四迎來了顯著上漲。最新的通脹報告低於預期,市場押注美聯儲可能在九月份開始降息。這一預期為房地產板塊注入了活力,推動房地產成為標普 500 指數中表現最佳的板塊。消費者價格指數的住房成本部分上漲最低,對住宅建築商股價產生了積極影響。同時,房地產投資信託基金 (REITs) 也迎來了上漲,漲幅達到 3%。

智通財經 APP 獲悉,由於美國最新通脹報告低於預期,市場押注美聯儲可能在九月份開始降息,這一預期為此前表現疲軟的房地產板塊注入了活力,帶來了顯著的上漲。週四,房地產公司股價迎來顯著上漲,漲幅達到 2.7%,創下 2024 年單日最佳表現,並攀升至 3 月份以來的最高點。投資者紛紛湧入住宅建築商、數字和商業房地產股票,推動房地產成為標普 500 指數中表現最佳的板塊,成交量比 30 天平均水平高出約 30%。

消費者價格指數的住房成本部分尤為引人注目,僅上漲 0.2%,為三年來最低的月度漲幅。這一數據的下降,對今年以來已經上漲 7.1% 的住宅建築商股價產生了積極影響,當日股價飆升 7.3%,創下 2022 年以來的最大漲幅。霍頓房屋 (DHI.US),一家即將在下週四公佈業績的公司,其股價也上漲了 7.3%。

晨星公司的首席美國經濟學家普雷斯頓·考德威爾在給客户的報告中指出:“住房市場是抗擊高通脹的關鍵戰場。前沿數據已經強烈表明,住房通脹正在下降。”

房地產股的上漲對於那些大量賣空該類股票的投資者來説是個壞消息,因為房地產股是今年標普 500 指數中表現最差的股票之一。據 S3 Partners 的數據,本週初,SPDR Homebuilders ETF 的賣空持倉佔流通股的比例高達 49%,創下自 2 月份以來的最高水平。

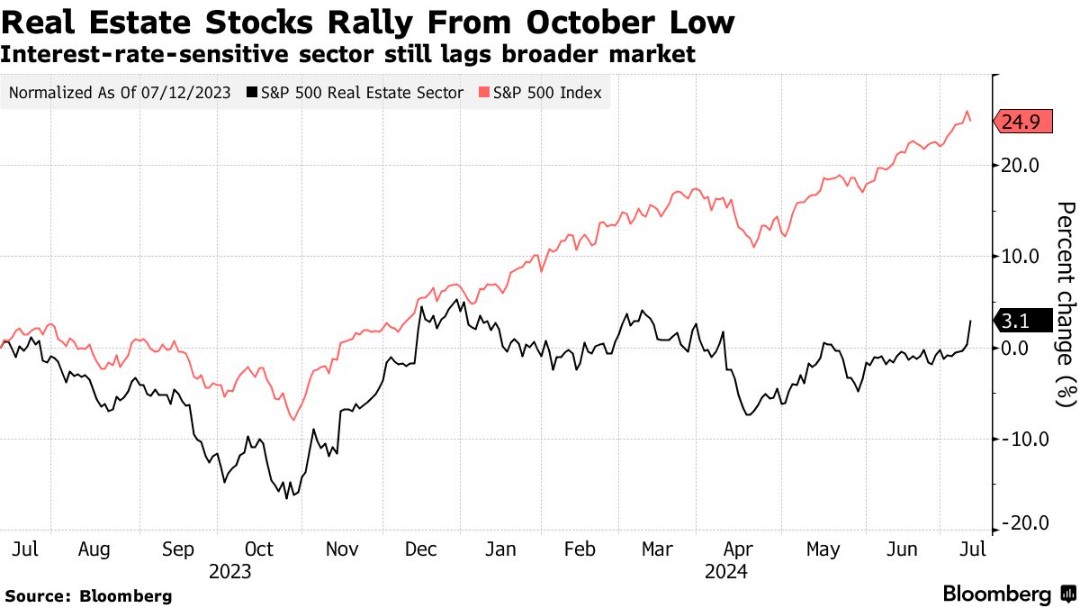

值得一提的是,房地產投資信託基金 (REITs) 也迎來了上漲,漲幅達到 3%。這些基金在借貸成本連續兩年上漲期間遭受了重創。Cohen & Steers Capital Management 的高級副總裁兼房地產戰略和研究主管裏奇·希爾表示,房地產投資信託基金的前景似乎正在轉好。他引用最新的通脹數據和利率前景稱:“如果通脹降温且利率繼續下降,那麼自 2023 年 10 月開始的反彈勢頭有望持續,這將為上市房地產投資信託基金帶來超過 20% 的回報。”

工業房地產投資信託公司安博 (PLD.US) 在公佈第二季度業績後,股價上漲 3.3%,達到 4 月份以來的最高水平。同時,美國國債收益率大幅下跌,10 年期國債收益率降至 4.2%,而對政策更為敏感的兩年期國債收益率跌至 4.5%。

整體來看,低於預期的通脹報告為市場帶來了積極的信號,投資者對房地產板塊的前景重新評估,推動了相關股票的強勁表現。隨着通脹的降温和利率的潛在下降,房地產行業可能會迎來更多的投資機會。