The Fed's rate cut dilemma: Too early in July, too late in September?

I'm PortAI, I can summarize articles.

有觀點認為,美聯儲等到 9 月再降息的考量是出於程序上的,而不是經濟上的。部分市場人士擔心,如果美聯儲將降息拖得太久,美國經濟可能會面臨衰退的風險。

美國 6 月 CPI 數據意外疲軟,市場的降息預期愈發強烈,加大押注美聯儲將在 9 月降息。

數據顯示,6 月核心 CPI 同比增速降至 3.3%,創下三年多來的最低增速——通脹持續穩步下行的趨勢意味着降息必須儘快提上日程。

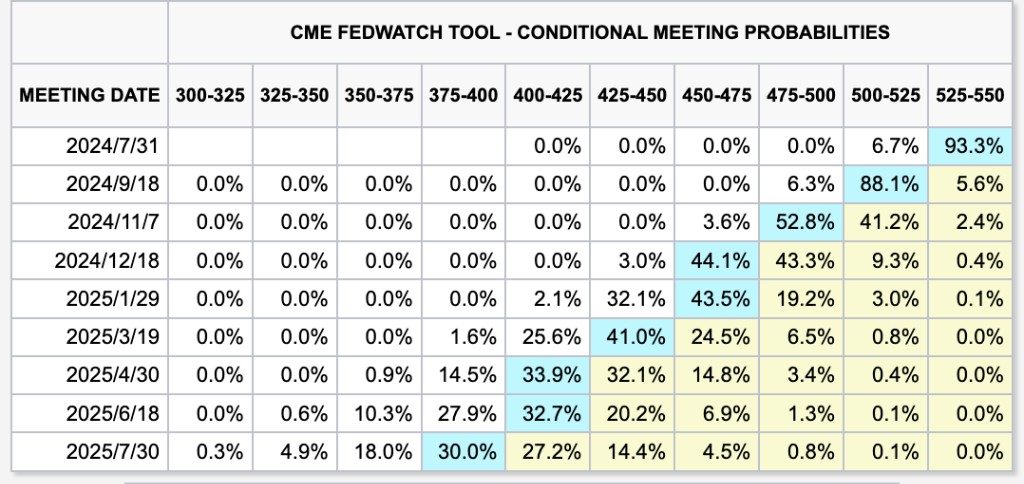

實際上,在 9 月 18 日之前,美聯儲在 7 月 31 日也有一場議息會議。而根據 Fedwatch,市場押注美聯儲降息在 7 月降息的可能僅為 6.7%。

既然降息的理由如此充分,為何還要等到 9 月?

有觀點認為,美聯儲等到 9 月再降息的考量是出於程序上的,而不是經濟上的。

目前距離 7 月底的會議還有不到三週的時間,這意味着美聯儲幾乎沒有時間有條不紊地為降息做準備。但如果美聯儲等到 9 月再降息,美國的經濟可能面臨更多下行風險。

部分市場分析人士擔心,如果美聯儲將降息拖得太久,美國經濟可能會面臨衰退的風險。隔夜美股市場對 CPI 數據反應不佳就是一個例證。

美聯儲主席鮑威爾在本週的國會聽證會上也表示,勞動力市場正在降温,這一方面削弱了通脹的上升動力,另一方面也為經濟前景帶來了不確定性。

還有跡象表明,高利率環境正在不斷壓制消費對經濟的驅動作用。

根據此前的報道,美國消費企業正不斷髮出警告,稱美國消費者的購買力已經接近極限,消費巨頭百事公司甚至將銷售疲軟歸咎於長期的通脹累積和高昂的借貸成本。

因此,有觀點推測,從現在到 9 月,美聯儲可能會頻頻 “放鴿”,對債市而言是利好。