Analysis of New Stocks in the US Stock Market | Seizing the short video marketing dividend for high growth, the big data group with impressive performance still faces hidden risks

大數據集團計劃在美上市,發行 200 萬股普通股,每股價格預計在 4 美元至 6 美元之間,最多募集 1200 萬美元資金。公司實現了快速成長,2023 財年收入為 1.57 億美元,同比增長 324.78%,淨利潤為 445.5 萬美元,同比增長 253.85%。投資者關注大數據集團能否持續成長撐起估值。行業回暖和短視頻趨勢有助於公司拓展客户。中國互聯網廣告市場增長 12.66% 至 5732 億元人民幣。大數據集團上市後市值將達到 7500 萬美元,對應 2023 財年靜態 PE 為 16 倍。

時隔三個月,大數據集團 (OCP.US) 赴美上市迎來新進展。

在 3 月 29 日向 SEC 遞交公開版的招股説明書 (F-1 文件) 後,大數據集團於 6 月 28 日更新了招股説明書 (F-1/A 文件),發行區間及募資規模也隨之公佈。

數據顯示,大數據集團計劃在此次 IPO 中發行 200 萬股普通股,每股價格預計在 4 美元至 6 美元之間,至多募集 1200 萬美元資金。

智通財經 APP 瞭解到,大數據集團通過運營實體廈門曠世聯盟網絡科技有限公司在中國提供移動廣告服務,自 2020 年推出移動廣告業務以來,其已為約 280 家廣告商提供服務。

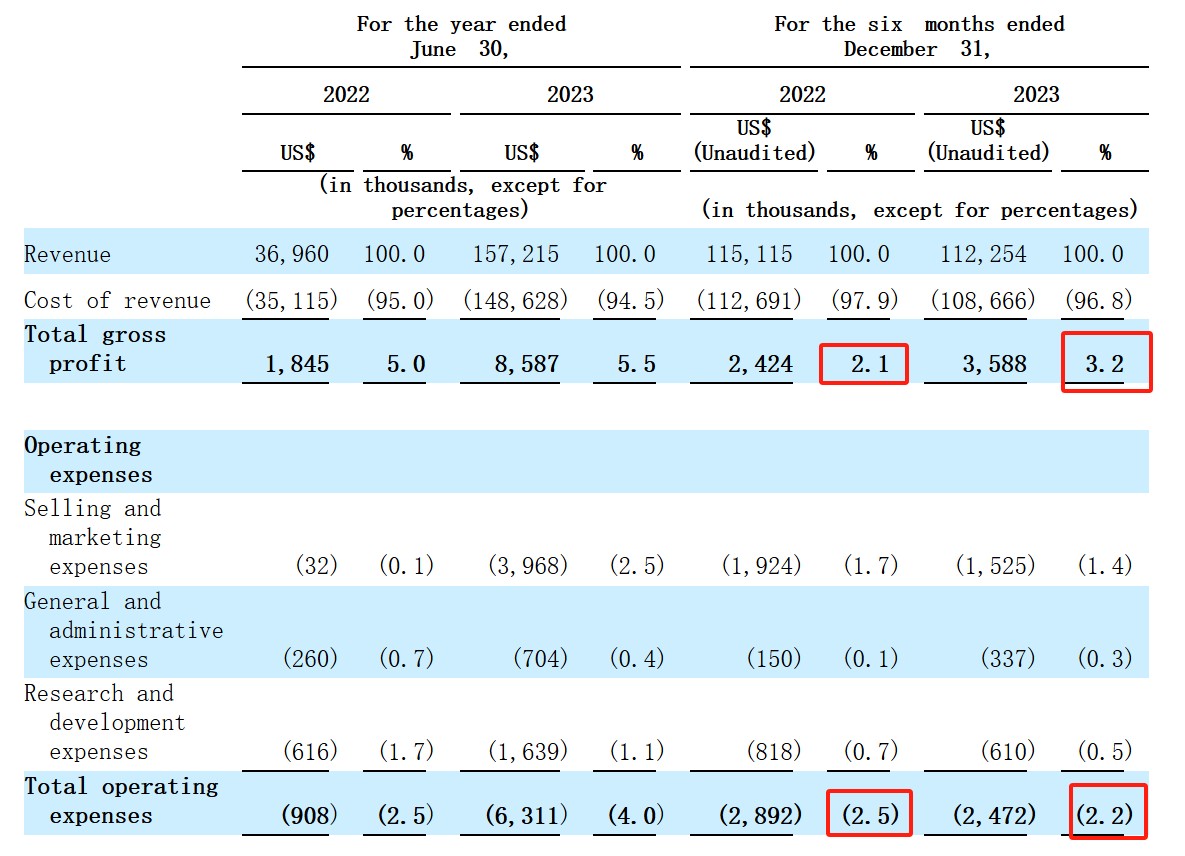

從業績來看,大數據集團實現了快速成長。其 2023 財年 (截至 6 月 30 日止 12 個月) 的收入為 1.57 億美元,同比大增 324.78%,期內的淨利潤為 445.5 萬美元,同比大增 253.85%。至 2024 財年上半年 (截至 2023 年 12 月 30 日止 6 個月) 時,其收入雖微降 2.6% 至 1.12 億美元,但期內淨利潤仍錄得大幅增長,同比升 73.6% 至 126.2 萬美元。

若以此次發行價的中樞價格 5 美元計算,大數據集團此次上市後的市值將達到 7500 萬美元,對應 2023 財年的靜態 PE 為 16 倍。基於此,投資者關心的重點在於,大數據集團能否實現持續成長從而撐起該估值?

緊抓行業回暖及短視頻趨勢實現客户快速拓展

大數據集團之所以能實現業績的持續成長,與行業的回暖有一定關係。據《2023 中國互聯網廣告數據報告》顯示,得益於疫情影響的消除使得經濟商業活動恢復,廣告主投放意願有所上升,在經過 2022 年的結構化調整與資源優化配置後,我國互聯網廣告市場於 2023 年再次呈現增長態勢,同比增長 12.66% 至 5732 億元人民幣。

除了行業回暖外,緊抓短視頻平台崛起的機遇是大數據集團實現業績增速遠超行業增速的關鍵原因。據《2024 中國網絡視聽發展研究報告》顯示,截至 2023 年 12 月,我國網絡視聽用户規模達 10.74 億,網民使用率為 98.3%。其中,短視頻應用的用户黏性最高,人均單日使用時長為 151 分鐘,遙遙領先於其他應用。由於短視頻的風靡,短視頻平台已成為了品牌商家投放廣告的新陣地,營銷行業的格局也由此生變。

基於此行業新趨勢,大數據集團主要為廣告主採用在線短視頻廣告模式,利用中國在線短視頻平台的普及帶來用户的流量和參與度。截至目前,深耕廣告行業數年之久的大數據集團已與抖音和騰訊等中國主流媒體平台建立了廣泛的聯繫,2022、2023 財年以及 2024 財年上半年,其已分別和 48 家、197 家、92 家主流媒體平台及其代理商展開合作。據公司官網顯示,騰訊、新浪、360 等均是曠世聯盟的媒體合作伙伴。

而在客户方面,得益於抓住了短視頻廣告的機會,大數據集團的客户快速增長,其 2022 財年、2023 財年以及 2024 財年上半年的客户數量分別為 64 家、238 家和 120 家,包括騰訊、華為、唯品會等知名企業在內均是大數據集團的客户。

正是由於 2023 財年客户數量的大幅增加,大數據集團於 2023 財年實現了收入和淨利潤暴增的好成績。但值得注意的是,2023 財年的淨利率為 2.8%,較 2022 財年時的 3.4% 有一定下滑,這主要是因為總運營費用隨業務擴張所致。

至 2024 財年上半年,大數據集團的收入微降 2.6% 至 1.12 億美元,這主要是因為匯率的影響,若以人民幣計價,期內收入同比增長 0.4%。在收入微降之際實現了淨利潤的高速增長,這主要是因為大數據集團開始注重高質量發展,公司專注於高價值客户,淘汰了低毛利客户,這使得期內的毛利率提升 1 個百分點至 3.2%,且公司降本增效控制運營費用支出,總營業費用佔比的下降亦提升了公司的盈利能力。雙管齊下後,大數據集團 2024 財年上半年的淨利率為 1.1%,提升 0.5 個百分點。

客户集中度飆升,單一客户收入佔比近三成

從上述的業績分析中不難看出,大數據集團當前的發展穩中向好,公司於 2023 財年迅速拓展客户規模從而實現了快速成長,並於 2024 財年上半年進入高質量發展,追求淨利潤的釋放,這無疑為大數據集團的基本面 “增色” 不少。

且大數據集團在招股書中為投資者描繪了新的商業藍圖,其表示,將探索與谷歌、Meta、TikTok 和 Bing 等海外媒體平台合作的機會,將與該等國際媒體平台的代理商建立合作,以滿足中國廣告客户拓展海外市場的需求,2024 年第三季度開始,大數據集團便將進軍國際移動廣告市場。同時,其將於 2024 年第三季度開始探索東南亞的直播電商市場,迎合當地居民的獨特需求,推廣當地客户喜歡的產品。

近年來,中國民營企業加快 “出海” 步伐,據艾媒諮詢 2023 年 8 月發佈的報告顯示,在已實施 “出海” 佈局的中國企業裏,中、小、微企業佔比分別為 39.4%、17.5% 和 13.6%,中企全球化佈局能力持續提升,且這一趨勢仍將持續。

若大數據集團能成功拓展海外市場,那麼其將抓住除了短視頻之外的第二個行業新趨勢,這或將進一步打開大數據集團的成長天花板,後續還需持續跟蹤其海外業務的拓展情況。

除此之外,大數據集團仍面臨着幾個潛在的風險值得投資者重點關注。首先便是市場競爭加劇的可能,這是大數據集團面臨的最大風險,畢竟公司的淨利率水平僅在低個位數,若市場競爭加劇,必然會影響其盈利水平,而當前已有大量營銷企業湧入短視頻領域,若市場競爭持續加劇,未來不排除有出現價格戰的可能。

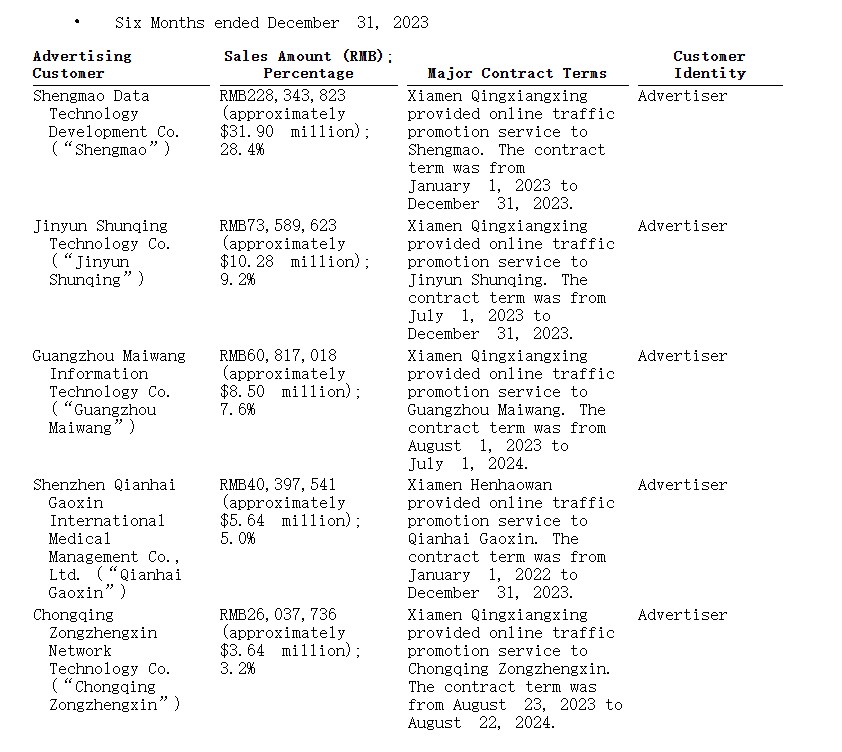

其次,2024 財年上半年的高質量發展也帶來了一定的風險。大數據集團雖然將更多的精力和資源用於擁有更高盈利能力的客户,減少了低毛利的客户數量,但其客户集中度出現了明顯上升。據招股書顯示,截至 2023 年 12 月 31 日止 6 個月,大數據集團的前五大客户收入佔比合計為 53.4%,最大單一客户佔比高達 28.4%,而 2023 財年時的前五大客户收入佔比僅為 25.4%,可見客户集中度短期內大幅飆升。若頭部單一客户廣告投放需求減弱,將會對大數據集團的業績造成明顯影響。

此外,應注意到廣告行業的週期波動性。由於廣告營銷行業與宏觀經濟高度相關,這讓營銷行業也呈現出了一定的波動性,若宏觀經濟走弱,企業便會縮減營銷開支,這將對市場需求造成衝擊,屆時大數據集團或將受影響。

綜合來看,抓住短視頻機遇的大數據集團目前仍處於快速發展期,業績表現較為亮眼,但公司仍面臨着客户集中度短期內大幅飆升、市場競爭加劇等多個潛在挑戰,其業績或會出現大幅波動的可能。