Fed Beige Book: More regions see flat or declining economic activity, weakened consumer purchasing power, maintaining a pessimistic outlook on the prospects

幾個地區的工資增長放緩,物價總體温和上漲且部分地區僅微增,有分析稱,美國經濟展現放緩跡象,消費支出穩定但沒有增長,消費者更為價格敏感,勞動力市場和工資壓力進一步緩解,似乎都在推動美聯儲邁向降息。褐皮書還談到 AI 需求推動數據中心投資擴張,是亮點之一。

7 月 17 日週三,美聯儲發佈了俗稱 “褐皮書”、由 12 個地方聯儲編制的地區經濟現狀調查報告,對美國整體經濟活動的描述保持在 “輕微至小幅增長”(slight to modest pace)不變,但比 5 月份報告新增了三個地區稱 “經濟活動持平或下降”,受訪者預計未來半年的經濟增速會放緩。

褐皮書在美聯儲 FOMC 政策會議前兩週發佈。本次褐皮書由里士滿聯儲編制而成,匯總了截至 7 月 8 日及之前六週內收集的信息,包括 12 個地區聯儲所在區商業狀況的軼事和評論。

在 “總體經濟活動” 層面,褐皮書稱,5 月下旬和 6 月份美國大多數聯儲轄區(in a majority of Districts)的經濟活動保持輕微至小幅增長,其中七個地區的經濟活動有所增加,五個地區的經濟活動持平或下降,5 月份上次報告中稱僅有兩個地區的經濟活動沒有變化。

勞動力市場在 5月和 7月褐皮書中都保持 “輕微增長”(at a slight pace)。大多數地區的就業率持平或 “略有上升”,更多地區提到了就業率持平或下降,僅少數地區的就業 “温和” 增長。由於新訂單放緩,幾個地區(several)彙報了製造業的就業人數減少。

熟練工人稀缺仍是所有地區面臨的挑戰,特別是在建築、維護、零售、醫護和旅遊行業,但也有幾個地區的勞動力供應狀況有所改善,勞動力流失率也在降低,減少了僱傭新工人的需求。幾個地區預計招聘更謹慎,不會填補所有空缺職位。企業繼續轉向自動化和外包,以節省資金和彌補實際或預期的勞動力短缺。

因此,在薪資趨勢方面,大多數(most)地區的工資以 “温和到中等” 速度增長(modest to moderate pace),幾個地區稱工人可得性增強和企業對勞動力的爭奪減少,令工資增長放緩。上述描述比 5 月褐皮書降温,當時工資增速被稱為 “大部分維持中等增速,少數地區增長更温和”。

在物價層面,價格總體温和上漲(have risen modestly),部分地區報告價格僅輕微上漲,這些描述都與 5 月份報告相同。值得注意的是:

“儘管消費者支出普遍報告幾乎沒有變化,但幾乎每個地區都提到零售商打折商品或對價格敏感的消費者只購買必需品、降低質量、購買更少商品或貨比三家尋找最划算的交易。

大多數地區指出,投入成本開始穩定;然而,亞特蘭大聯儲轄區特別指出,銅和電氣用品等產品在此期間出現了顯著增長。

隨着需求減弱,企業在不推走客户的情況下提高價格能力減弱。雖然食品和大宗商品成本基本保持不變,但貨運和一些建築材料的價格上漲。”

具體到消費支出,大多數地區聯儲的統計顯示本季度家庭支出變化不大,而各地區的汽車銷量形勢各不相同,部分地區指出,由於經銷店遭受網絡攻擊和貸款利率居高不下,導致汽車銷量下降。旅行和旅遊業穩步增長,與季節性預期一致。

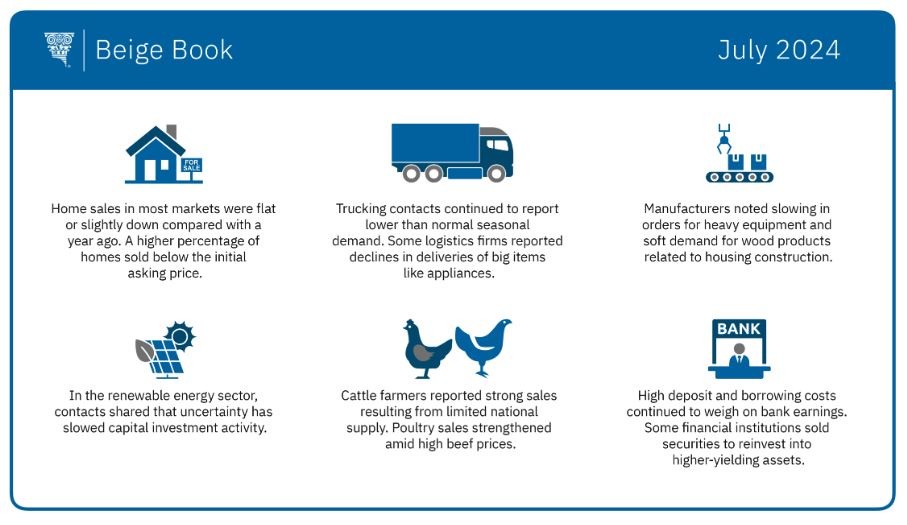

在銀行和金融領域,大多數(most)地區的消費和商業貸款需求疲軟(soft demand),但貸款需求總體保持温和,特定貸款類型(如房屋淨值貸款和二手車貸款)略有增加。存款繼續小幅下降。

住宅和商業房地產市場在最近幾周僅有輕微的變化。住宅房地產市場表現出典型的季節性放緩,庫存逐漸增加。商業房地產活動各不相同,零售租賃回暖,但辦公室租賃仍然疲軟:

“由於房價接近峯值水平且利率仍然居高不下,大多數市場的居民住宅銷售量與去年同期相比持平或略有下降。以低於初始要價的價格售出的房屋比例更高,這表明市場正在向買家轉變。

商業房地產活動喜憂參半。寫字樓和公寓市場活動放緩,導致空置率上升、租金增長持平或下降,以及這些領域的止贖率增加。”

各地區製造業活動好壞參半,描述大相徑庭,從 “急劇下降” 到 “温和增長” 不等(from brisk downturn to moderate growth)。一些地區指出,製造業產品需求疲軟。整體來説,製造業活動自 5 月褐皮書以來略有下降,一些地區的新重型設備訂單放緩,與建房相關的木材產品需求走弱。

農業狀況略有改善(improved slightly),養牛農民報告銷售強勁,牛肉價格走高也令家禽養殖户持樂觀態度。而棉花等一些行種植作物的需求持續疲軟,農業也受到全美偶發的乾旱影響。

此外,零售業補庫存刺激了運輸活動的輕微增長,海運運力緊張導致現貨運費飆升。不過,卡車運輸聯繫人繼續報告季節性需求低於正常水平,一些物流公司稱,批發、零售和家電等大件物品的直面消費者(DTC)交付量下降。倉儲聯繫人稱,配送和倉儲空間需求放緩。

值得注意的是,褐皮書還談到 AI技術投資擴張:

“公用事業聯繫人報告稱,商業和工業領域的電力需求不斷增加,這主要歸因於新建和擴建的數據中心項目,這些項目側重於越來越多地使用人工智能技術。

而可再生能源領域的聯繫人表示,美國總統大選的不確定性已經減緩了資本投資活動。”

總體而言,受訪者的短期展望不夠樂觀:

“由於即將到來的美國總統大選、國內政策、地緣政治衝突和通貨膨脹的不確定性,人們對未來六個月經濟的預期是增長放緩(for slower growth over the next six months)。”

有分析稱,最新褐皮書顯示,美國總體經濟活動仍保持積極態勢,但顯示出放緩跡象。消費支出穩定但沒有增長,消費者對價格更加敏感。經濟仍在增長,但速度緩慢,而且有越來越多的跡象表明增長停滯或下降:

“這可能預示着軟着陸,但請記住,每一次硬着陸都是從軟着陸開始的。”

褐皮書發佈後,美元指數 DXY 日內繼續走低,站穩 3 月下旬以來的近四個月低谷。美股主要指數也維持早前走勢,僅藍籌股匯聚的道指走高,納指和標普科技板塊勢將創 2022 年以來最差表現。兩年期美債收益率也短線走低,交投五個月低點,10 年期基債收益率徘徊四個月最低。